- a) Explain CoinGecko and why it is a good cryptocurrency investment tool.

It is a mobile app and a website that is used for aggregating information as regards the performance of more than half of all available cryptocurrencies. CoinGecko uses real-time data feeds to show trading volume, price information, as well as price fluctuations over a length n of time from one hour, to one week, to as far back as the readily obtainable information will allow. In addition, crypto assets are ranked by market capitalization, having the largest ranked highest.

CoinGecko was founded in 2014 by TM Lee and Bobby Ong and is a Singapore-based company. The team has given orations at worldwide conferences, and have gotten support from the Malaysian government agency (MaGIC). The duo was sponsored by MaGIC for a program that lasted for two weeks to learn from some experts at Silicon Valley. In addition, there has been a partnership between CoinGecko and Humboldt University of Berlin and Western University of Canada, for research on cryptocurrency. Ever since, findings and results have been published in various books which includes Digital Finance & Regulation, The Handbook of Digital Currency and Handbook of Blockchain.

Being in operating since 2014, CoinGecko is among the many go-to sites for live listings of crypto prices. Together with this, CoinGecko gladly or willingly accepts fresh crypto users to the community with yield gain calculations, educational material, and interactive giveaways. Bitcoin defaults as the top cryptocurrency when first landing on CoinGecko and have the largest network and market cap. Nevertheless, there are thousands of coins out there to explore. Sans the correct tools for refining one's search, sifting through project after the project can be irksome. For this reason, has CoinGecko placed or sorted all the various characteristics of tokens to allow users to observe a wealth of distinct data points and information is relative to the crypto markets.

CoinGecko is considered one of the most useful tools readily obtainable to crypto traders and investors. CoinGecko functions as a hub for trustworthy information relating to more than 600+ crypto assets. Similar to the Swiss Army knife for cryptocurrency analysis, CoinGecko makes attainable useful links to official websites, blog posts, and social media accounts.

Also, the contract addresses for crypto assets are displayed by CoinGecko. This is specifically useful when making purchases of ERC-20 tokens from decentralized exchanges (DEXs) like Uniswap reason being that one can speedily import the contract address for freshly purchased tokens into a MetaMask wallet. This also assists to guarantee that one is making use of the error-free contract address when purchasing lesser-known tokens, assisting to avoid scams.

A good number of crypto investors rest with confidence in CoinGecko as an online sponsor of true shop information to assist make known trading decisions. Additionally, CoinGecko is to an extreme degree useful for keeping up with the most recent tokens and hottest trends in crypto. Furthermore, CoinGecko keeps an eye on on-chain metrics, open-source code development, as well as future events within the industry.

Another great characteristic is that CoinGecko allows for filtering and refining searches making use of different criteria to discover precisely what one needs to know and fast. For instance, with a single click, one can have a look at the top-performing coins of the day. Another click, and you’ll see the biggest losers!

b) Explore CoinGecko and explain at least 5 unique features of the platform (Take a screenshot of the page).

2 a) Give a brief explanation of the Tradingview platform.

TradingView is a social-networking software and charting based on the cloud which is for both newly started and professional active investment traders. Fundamental charting, research, and analysis information are readily attainable with a free account. It is online stock-picking software and screener for beginners and experienced active traders alike. It blends widespread cloud-based charting equipment for study and presents users the capability to share and work together with other active traders online. The disadvantageous aspect is that most great brokerages are not yet in a direct manner integrated with TradingView, to that effect one will have to place trades separately with one's brokerage of choice.

It goes on to be a famous choice amongst active traders as well as financial software companies for the reason of its versatility.

Users can acquire new concepts, study market fluctuations, possible chart outcomes, work with other traders, chat, make inquiries, and exercise trades with the TradingView platform on any device.

TradingView has in it a detailed market information just on the homepage before the free sign up of the account. There is a ticker at the top for the currency pairs of EUR/USD, BTC/USD and ETH/USD, including the Dow, Nasdaq and S&P 500 markets.

Just below that, on the TradingView social media section, one will find the recently made stories by top authors, up-to-date market summaries, an economic calendar, the most recent stock news, and trending charts. One can also read what other users, as well as high-profile traders, have to say, and share your trading notion. TradingView's social media aspect annexes huge educational value.

b) Explain the steps involved in adding indicators on the Tradingview chart. You can add an indicator of your choice ex forced the moving average. (Screenshots required)

c) With relevant screenshots, illustrate how to modify the indicator you have added to your chart.

3 a) In your own words, explain cryptocurrency Portfolio and Watchlist.

This is software that controls or manages the inventory of one's online currency investments. It assists you to monitor the performance of each coin as well as make provision of analytical tools. A good number of portfolio management systems makes attainable live feeds as well as pricing updates from cryptocurrency exchanges. They can in addition give an alert about notable market activities.

A cryptocurrency portfolio can also be said to be is a description of all the coins and tokens on one's ownership. It delineates one's total investment across all types of cryptocurrency. For instance, if one has 10 different kinds of coins and tokens in possession, then the portfolio is made up of 10 cryptocurrencies. The value of every cryptocurrency in one's portfolio is equivalent to the portfolio worth.

As one start to invest in more cryptocurrencies, the portfolio will become very heterogeneous. At some point, one may have trouble monitoring all investments. In this case, the download of the portfolio tracker is worthwhile. The tracker, which may be an app or desktop software, allows for seeing at a glance how all of one's investments are performing.

One's portfolio can be as heterogeneous as it is wanted to be. For instance, fresh investors can have a small portfolio holding only a few tokens. More experienced investors may have a very heterogeneous portfolio, comprising of numerically large cryptocurrencies for trading purposes.

This is a set of securities that are tracked for potential trading or investing opportunities.

A good number of brokerage and financial platforms permits easy construction and viewing of watchlists. A watchlist that is properly organized may assist in identifying trading opportunities, monitoring portfolio performance, or tracking hot or famous stocks.

it is a list of stocks that an investor keeps an eye on to take advantage of supposing prices fall enough to make an interesting undervalued situation.

As a prevalent rule, the watchlists made readily attainable by brokerage platforms may have room for the range of 25 to 75 names about space taken up by charts, news tickers, scanners and market depth windows. A longer watchlist of takes, for instance, 200 stocks are probable to be too broad for nearly any investor to track or maintain. An investor should refresh this list at most a couple of times in a month.

b) Explain the need for Portfolio management

Portfolio management is needful in the following ways:

- Makes Right Investment Choice

Portfolio management is an implementation that assists the investor to choose the right portfolio of assets. It gives the ability to make more informed decisions as regards investment plans in harmony with the goals and objectives.

- Maximizes Return

Maximizing the return is one of the very important roles portfolio investment plays. It makes readily attainable a structured framework for analyses as well as making a selection of the best class of assets. Investors can earn high returns with limited funds.

- Avoids Disaster

Portfolio management is needful for avoiding the disaster of coming face-to-face with huge risks by investors. It guides in making investments among various classes of assets rather than making investments only in one type of asset. If an investor invests in only one type of security and if it fails, then the investor will go through huge losses that could be avoided supposing he might have invested among various assets.

- Track Performance

Portfolio management assists in the management of monitoring the performance of a portfolio of investments. An investment that is made stronger or more solid held within the portfolio can be assessed in a better way and any of its failures can easily be detected.

- Improves Financial Understanding

It assists to make better the financial knowledge of investors. During the same that investors manage their portfolio, they came across many financial concepts and acquire knowledge on how a financial market functions which improves the overall financial understanding.

- Avoids Risk

It is quite risky to make investments in securities for the reason of the volatility of the security market that raises the chance of losses. Portfolio management aids in mitigating the risk using diversification of risk amongst large peoples.

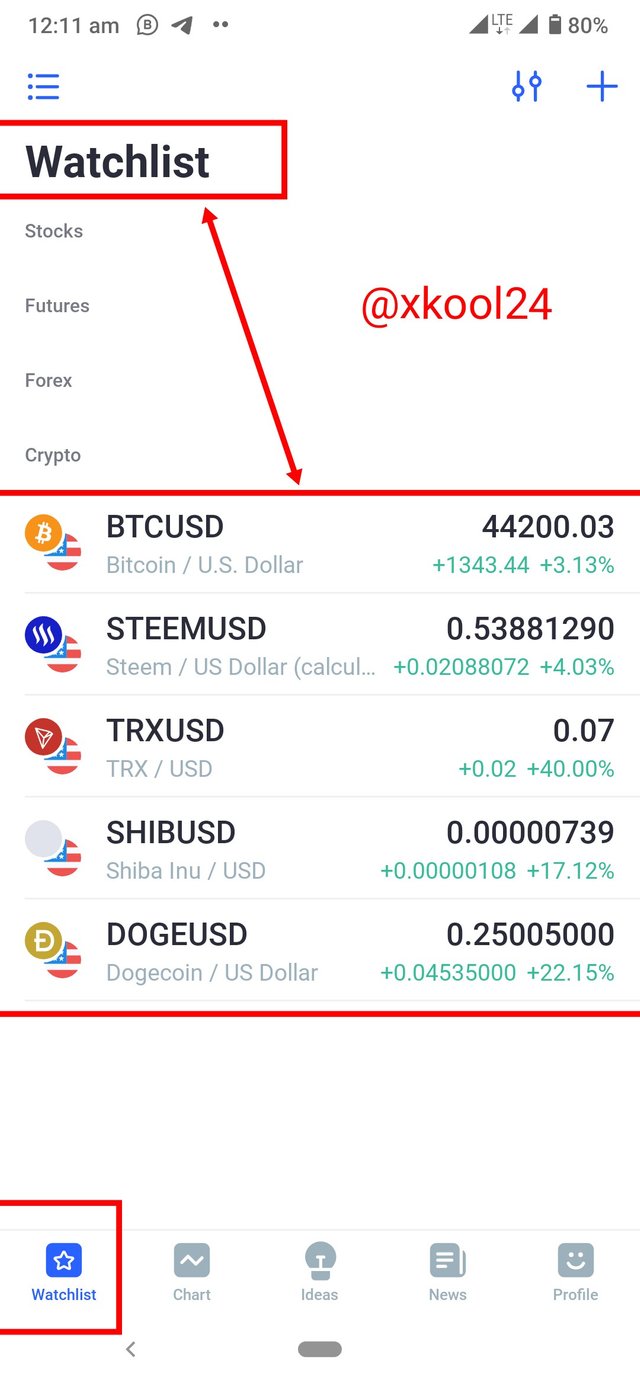

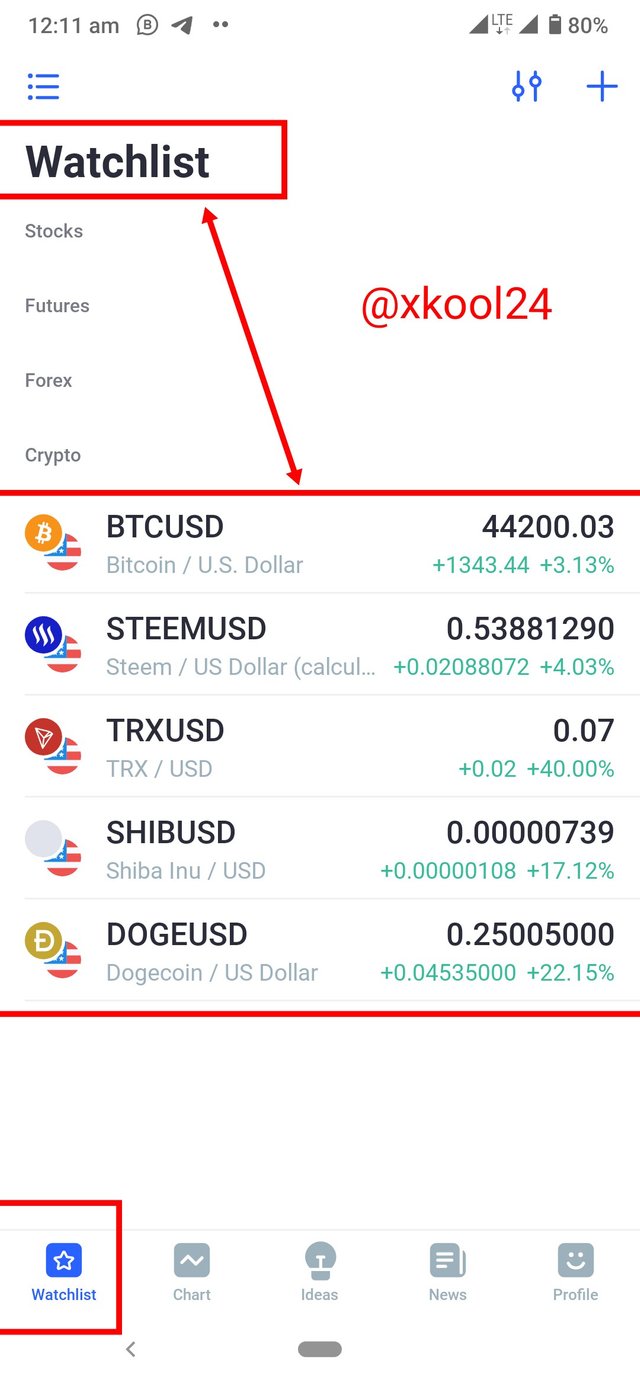

c) Select 5 cryptocurrency assets you wish to add to your Watchlist and explain your reason for selecting each of them. (Show screenshot of your Watchlist. It can be any platform).

Each of the cryptocurrency assets where choose by me based on personal ground which primarily deals on how much I trade this assets vis-a-vis their potentials too.

For the Bitcoin, this is Large Capital market with long term investment plan for traders who wish to get relatively stable market and gradual residual income. My basis for the Bitcoin.

For Steem and TRX, this is primarily because of my daily engagement with this assets in the steem Blockchain as well as the potentials therein in this penny Cryptocurrencies.

The SHIB and Doge are also assets I've done little fundamental analysis and found out about the potentials in the future and decided to leave some amount of values in them.

Thank you for Reading

Hello @xkool24 , I’m glad you participated in the 6th Week of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for submitting your homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit