Good day, Prof @allbert and students. Good to be back as well joining the first week lessons of the season 4 series in the SteemitCryptoAcademy community. Without wasting much time, I will be attempting Prof's homework straight to the point.

Graphically, explain the difference between Weak and Strong Levels. (Screenshots required) Explain what happens in the market for these differences to occur.

STRONGER LEVELS

Strong Support Level

Strong Resistance Level

The screenshot above clearly shows the different Strong points both at the Support and resistance levels. These strong levels simply indicate the market price activities as it affects buy and sell at a given point and periods. At these strong levels, there are larger volumes of trades awaiting to be triggered each time price gets close to its zone, hence it re-bounces prince trends in the opposite direction.

For the Strong Support level, larger buy positions are waiting to be triggered when the price gets to this strong point whereas, in the Strong Resistance level, there are volumes of trade awaiting sell positions as soon as the price gets to its level.

In both scenarios, there are these imaginary horizontal lines that keep interacting with price trends which may be termed dynamic support or resistance levels.

WEAK LEVELS

Just as explained for the Strong Levels, this is a typical scenario for the weak levels. There is a presence of pending orders at the different weak levels (Support or Resistance levels ) but these volumes of trades waiting to be activated or triggered are not voluminous enough to keep the price trend in the opposite direction for a longer time. what we see here is that these pending trades push the price temporarily in the opposite direction but we see price retesting and making a breakthrough in either the support or resistance levels which we call weak levels.

Key Points that differentiate Both Levels (as demonstrated from screenshot)

| Strong Levels | Weak Levels |

|---|---|

| Presence of several support or Resistance points to show sign of strength | Presence of one or two resistance or support points that shows weakness |

| The price trend is usually seen to follow the opposite direction for a longer period | There are temporary trend reversals after following an initial opposite direction |

| Larger activities of pending buy/sell orders awaiting activation | Fewer pending buy/sell orders |

Explain what a Gap is. (Required Screenshots) What happens in the market to cause It

In my early days in the cryptoacademy lessons, I keep coming across candlesticks that skip some reasonable and notable spaces before the proceeding candlestick which just clearly tells us the presence of gaps. These are largely caused by the trading behaviour as buy/sell positions keep becoming largely voluminous. When we have the institutional/Composite Man who makes a large entry into the trade, there is more likelihood of the presence of Gaps which simply allows the market not to position itself in line with the proceeding candlestick rather skips and start a new trend.

When we have this scenario in occurrence either in the Bullish or Bearish trend, it simply also represents the stronger Resistance and Support levels for possible trade positions. This may be seen to proceed with a longer candlestick which rives the point of a larger volume of trade positions made.

Explain the types of Gap (Screenshots required, it is not allowed to use the same images of the class).

Having explained the scenarios whereby we can experience the presence f Gap in a chart/trade, there are three (3) different types of Gaps as explained by our respected Prof @allbert;

a. Breakaway Gap

Just as the name entails, it is a complete breakout of the previous trend seen from a given price trend which shows an entire bearish or bullish move depending on the last recorded trend in the trade. As we know, this is usually caused by the heavy activities of buy and sell which made an entry into the trade and hence causes a shift from the existing market trend as witnessed in the trade.

b. Runaway Gap

Unlike the breakaway where we have a new beginning of an entire trend to stir the course of a given trend, in the Runaway Gap we have a continuation of the previous trend. This usually occurs because the trend which was previously in place is still young and just initializing and when this heavy buy/sell position happens in favour of the prevailing trend, trade continuous in the same direction and maintain a more valid break position. This kind of scenario may be hard to identify in a trade but wherever they are dictated, it shows stronger support or resistance levels to make adequate trade positions.

c. Exhaustion Gap

This is another scenario that is difficult to dictate when in occurrence because it is already at its finishing point before we can dictate this gap. Unlike what we say of the Runaway which happens when the trend is still young, the exhaustion happens when the trend is almost in its conclusive stage. But funnily each time we have such a scenario make a Gap due to thtradingde behaviour, the trend is seen to come back to fill up this gap in the sideways direction. Price trend would always retest to make up for the omitted levels which should also guide us on how best to make trade positions.

Through a Demo account, perform the (buy/sell) through Strong Supports and resistances. Explain the procedure (Required Screenshots)

XRPUSDT Chart for 1H Time frame (Sell order)

For the XRPUSDT chart for the 1H time-frame, we could see the introduction of the RSI indicator which is a clear indicator to show us the Strong Points where the trend is strong with possible retest/reversals. When RSI >70, there is a likelihood of a possible trend change (bearish) which was captured when the asset price was 1.39162817. This trend reversal stopped after reaching a strong support level which was also the breakout point at 1.31461016. This point is also the Stop loss endpoint where it was placed at an R: R ratio of 1:1.

My Entry order was placed immediately after the green candlestick crossed the last bearish red candlestick at 1.36009146 and my take profit was between 1.36009146 to 1.40321445.

XRPUSDT chart for 1H time frame (BUY ORDER)

We also have the same scenario for the buy position.

Through a Demo account, perform the (buy/sell) through Gaps levels. Explain the procedure (Required Screenshots).

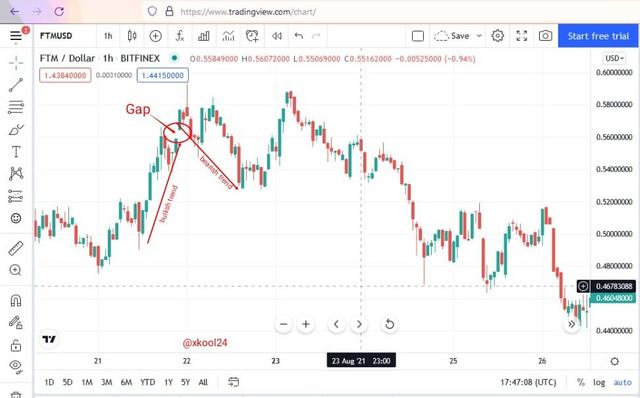

FTMUSD Chart of 1H Time Frame

We already know that the Presence of the Gap in our chart simply connotes strong Support or Resistance levels at the point of occurrence. From the Chart, we can see this scenario which also formed strong support at points 0.24181000 where price trends keep rebounding each time it gets to that certain level.

My preferred place of entry was after another long green candlestick was observed at 0.24754218. And just as shown, my preferred place of Taking Profit is at 0.26294012 at a Risk/Reward ratio of 1:2.

Conclusion

Strong and Weak levels are also better TA that allows traders to make an informed trade position during trading. They are can be applicable knowing full well that price trends have high tendencies of rebounding on stronger levels as well as breaking out on weak levels.

The occurrence of gaps is heavily influenced by the sharp movement of price trends made from buy/sell behaviors through the injection of large volumes of trade positions into the market. Their occurrence indicates places of strong supports and resistance and if dictated earlier, traders can also make quick trade positions for profiteering.

Thank you Prof @allbert for putting us through this practical and resourceful task.

Written by @xkool24

(All images used are screenshots from the tradingview site and all done via my device)

Your Post has been manually Supported/Up-voted by @steemingdiaries which is a Community & Curation account for Steeming Diaries Community.

Comments, Votes are performed an important role for Community, hence involved with your innovative Comments & Votes on other active users posts.

Community Latest Update: Steeming Diaries CONTEST Of The Month (September 2021) | Steemit FAQ

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit