Hello friends, I welcome you all to my blog as I participate in this week's advanced course presented by Prof @sapwood on Onchain Metrics. Let's get started

What is a HODL wave, how do you calculate the age of a coin(BTC, LTC) in a UTXO accounting structure? How do you interpret a HODL wave in Bull cycles?

What is HODL Wave

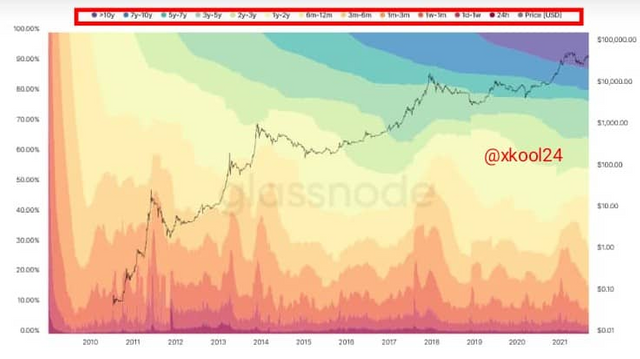

HODL wave is an On-chain metric that determines how long a coin has been kept or held up in a particular wallet address over a given period. HODL wave simply tells us the time duration a coin has moved by the use of different colours. These colours in use differentiate the various period captured by the decade long coin (BTC) vis-a-vis how long it has moved or held up.

The HODL Wave colour representations are seen to be either Warm or Colder when in use. Warm colours like Yellow, Orange and Red are used to represent how a coin (BTC) has recently been transacted whereas the Colder colour like Light Yellow, Blue and Green represents how this coin has not been transacted for a longer period. We should be aware that each time this coin is transacted, there are perceived migration of coin from one address to another.

How to calculate the age of coin

Just as I earlier said, the age of coins is determined through the HODL wave which simply represents the different bands sing the colour scheme approach. From the colour scheme, our ability to detect the warm and colder colours makes this calculation a lot easier for us. From the screenshot below, we can see a combination of all colours which represent the different classes of coinages.

a. Warm Colors

The warm colours are yellow, red and orange which represent coins that have witnessed some level of recent coin transaction. These are seen under bandages of 6m-12m, 3m-6m, 1m-3m, 1w-1m, 1D-1W and 24H.

b. Colder Colors

This colour band helps to calculate coinages that are yet to receive relative recent transactions and hence can be detected with the different colour bands. Colours captured in this category include Light Yellow, Green and Blue with bandages between 1y-2y, 2y-3y, 3y-5y, 5y-7y, 7y-1oy and 10y-above.

How do you interpret a HODL wave in Bull cycles?

In interpreting the HODL wave in Bull cycles, we know that the HODL wave explains the ratio between transacted and UN-transacted coins over a given period. Having known that coins with age band in warm colours are usually seen to be transacted on in recent times which are classified between days, weeks or months but lesser than a year. They also tend to migrate into the older age bands which causes a reduction in the UTXO and spikes seen below or at the bottom with recent ages.

Therefore in subsequent time, a reasonable percentage of these new-age bands which make up the base or bottom activity is seen to enter the Colder colour or older age bands which hence makes these age bands grow much bigger. In all of this analysis, when there are lesser transaction activities and limited UTXO in the relatively newer bands due to continuous expansion seen in the older age bands, supply tends to exceed demand. And when supply > demand, the price of the coin increases which translates into a bullish trend.

Consider the on-chain metrics-- Daily Active Addresses, Transaction Volume, NVT, Exchange Flow Balance & Supply on Exchanges as a percentage of Total Supply, etc, from any reliable source(Santiment, Coinmetrics, etc), and create a fundamental analysis model for any crypto[create a model for both short-term(up to 3 months) & long-term(more than a year) & compare] and determine the price trend (or correlate the data with the price trend)w.r.t. the on-chain metrics? Examples/Analysis/Screenshot?

Daily Active Addresses

This is simply the number of addresses captured in correlation with the movement of prices. They can be determined either in the short term or long term but they are all factors of the number of participants addresses vis-a-vis how it affects price action.

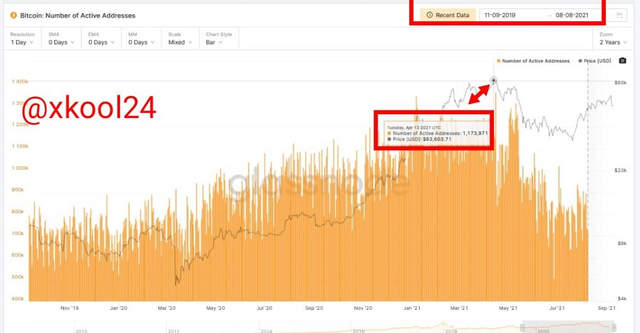

Short term Basis - 6 months

In this scenario, we can see that on July 20, 2021, there was a decline in the price of BTC which was valued at $29k with a correspondingly low number of active addresses of 823k whereas, on April 13, 2021, the BTC price was valued at $63k with an active address of 1.7m. This tells us that for every high inactive address, there is always a corresponding increase in the price action of the given coin. It implies more demand than supply in the trade activity.

Long term Basis - 2years

In this scenario on March 12, 2021, BTC was priced at $4k with a correspondingly low number of active addresses of 917k which shows the participating addresses which represent individual users dropped hence the value of the price BTC coin declined. Also on April 12, 2021, when BTC price went to an ATH of $64k the corresponding Active address also went up to about 1.7m. There is a typical correlation between this duo as a decline in user participation (which represent active addresses on Chain) entails a drop in price action of BTC at that given time.

Transaction Volume

From the Active addresses where we saw that the number of participating addresses or users leads t a corresponding increase in the price action of the coin, in the Transaction Volume an increase in the transaction volume may not necessarily mean an increase in the price action of the given coin. It may only be a signal towards a potential increase or decrease of price action or rather the level of participation ongoing which isn't a direct correlation to a price spike.

Short Term Basis - 6 months

From the short term scenario, on April 14 2021, the transaction volume was 49B and the BTC price was valued at $63k whereas on May 14 2021, the transaction volume was 56B and BTC was priced at $50k. This just shows that even at an increased transaction volume, the price still dropped. Also on March 14 2021, the transaction volume was 23B but the BTC price was valued at $60k. Transaction Volume may not be directly impacting the price action of coins.

Long term basis - 1 year

On April 14th 2021 the transaction volume was 49B and BTC price at $64k while on April 17 2021 just days after, the transaction dropped to 21B which is over 100% drop in volume but the price action of BTC saw a little decline to $61k which ordinarily we would have expected to see half of that value dropped.

Network Value to Transaction (NVT)Ratio

NVT ratio is an indicator that signals an overvalued or undervalued assets at different levels. It is a lagging indicator if used as a single entity. NVT ratio is the resultant output when we divide Market capitalization by the Transaction volume. All this occurs in the On-chain tends to give us the network value. The higher the NVT ratio signifies an overvalued asset whereas a lower NVT signifies undervalued assets. We tend to have the best of the NVT results when calculated in the long term than when done in short term.

Short term Basis - 3 months

In this scenario, we can see the readings from the short as been distorted as it does not truly reflect the situation of price action on the coin. Nevertheless, from the peak price on August 7 2021, the BTC price was $44k with an NVT ratio of 71NVT ratio. Also on July 20 2021, BTC price stood at $29k with a 44NVT ratio. This clearly shows that a higher NVT ratio means a higher price value for a coin but with an expected dip signal in its trend. BTC coin is always overvalued each time when the NVT is higher and vice versa.

Long term Basis - 1 year

We can see that each time we have a spike in the NVT ratio, there is a corresponding price increase in the Price of the coin but that does not mean when prices are high it does increase the NVT ratio. It is not a two-way thing where either increment affects the other. This would be demonstrated in the screenshot where both spikes would be considered and values are taken.

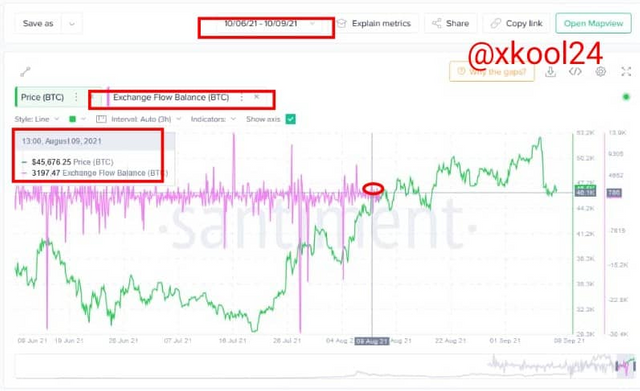

Exchange Flow Balance

This is where the inflow and outflow balances are taking into consideration because when it is tilted on a particular side it determines the bullish or bearish status of a coin trend. Each time a coin is moved from an exchange to a decentralized wallet or from the decentralized wallet into an exchange, this simply tells us when we need the Supply and Demand of that given coin.

When an asset moves from the decentralized wallet to an exchange, what we have is a SUPPLY need and hence there is a more likelihood of price decline due to excess supply in circulation. But when we have assets moving from the exchange back into the decentralized wallets, there is a DEMAND need and hence prices tend to go up given to the excess DEMAND need in the market.

Short term - 3 Months

In this scenario, on August 7 2021, the value of BTC was priced at $43k with a 748 Exchange Flow balance and on August 8 2021, the BTC price was $45k with a 3197 Exchange Flow Balance. This sparingly shows that when we have a higher positive Exchange Flow Balance, the coin price also increases but at the same incremental rate as seen with the exchange flow balance.

Long term - 1 year

This scenario on April 13 2021 saw the BTC price with an ATH of about $64k and the exchange Flow Balance at 4503. But with the huge outflow observed on July 20 2021, there was a decline in the price of BTC to $29k and with a -3461 exchange flow balance.

My General Observation

My overall observation entails that the On-chain metrics is a key contributor to the value of any given coin. We saw the correlations and little divergence of some of the On-chain metrics with the Price action of the coin. Just like the Active address which have a corresponding increment to price action, transaction volume does not have this direct effect as it acts as an indicator for possible bullish or bearish trend anticipated. This majorly depends on the principles of demand and supply also which alter the effects on Price action. Long term projections are more reliable and efficient in their result output than the short term projections marred with distorted results.

Are the on-chain metrics that you have chosen helpful for short-term or medium-term or long term(or all)? Are they explicit w.r.t price action? What are its limitations? Examples/Screenshot?

On-chain Metrics Preference

On-Chain, Metrics were observed to give clearer results when use3d on the long term scale of not less than one year period. Just as mentioned earlier they are far more detailed and filters wrong signals than other periods used. We all know from our little technical analysis that short term projections are usually marred with blurred or inconsistent output signals. This does not remove the fact that they can also be read with facts but they always come with wrong signals will limit their accuracy when compared with the long term periods.

From the lessons, we were also made to know that we can integrate other indicators with the On-chain metrics just like the overbought and undervalued assets which the RSI can quickly help us indicate positions with such levels.

On-chain Metric w.r.t Price Action

On the chain, the metrics are quite explicit to Price action from our screenshots. It directly correlates with the unit price of the BTC coin. This draws its effect from the forces of Demand and supply where buy and sell activities determine the price action of that given asset. Just like we saw in the Active Addresses which gives a scenario of when the Number of active addresses goes high, the unit price also goes high. This indicates that there are huge or increased trade activities that see demand, not at the level of supply.

Limitations of the On-chain metrics

One of the major limitations of the On-chain metric is that it does not give accurate signals when used in short term projections. There is evidence of wrong signals occurrence that does not give the true picture of Price action vis-a-vis the on-chain metrics.

Secondly is the absence of enough data to persecute the on-chain metric of other coins except for Bitcoin. This is given to the fact that other coins are still infantry in their stages with less than a decade of emergence and existence.

Thank you respected Prof @sapwood for putting up this task, it was not just exhaustive and tiring but at least impactful.