Hi everyone, top of the day to you all. This is my fourth entry in the ongoing season 6 week 1 SCA trading competition. I still maintain my entry route which is Team fredquantumkouba. I will be making my entry on the Moonriver coin (MOVR).

Overview of the Moonriver (MOVR)

The MOVR is a decentralized Smart chain Parachain on Kusama that runs on the Ethereum network. Parachain in the sense that it works with the moonbeam where it provides an incentivized canary network. These dual platforms work in a manner that new codes received in the network are processed in the Moonriver before they are tested and verified and hence pushed to the moonbeam for completion.

This process observed in the Parachain does all this through the EVM implementation which is like a bridge that interconnects the Moonriver to the Ethereum. With this connectivity, existing Smart contracts (dApps) can now be easily deployed to the Moonriver with low fees. This is in addition to the other functionalities observed in the use of her native coin MOVR which include active support of smart contract execution, execution of network gas fees, and participating in governance and voting activities in the Blockchain.

Asset Analysis - MOVR

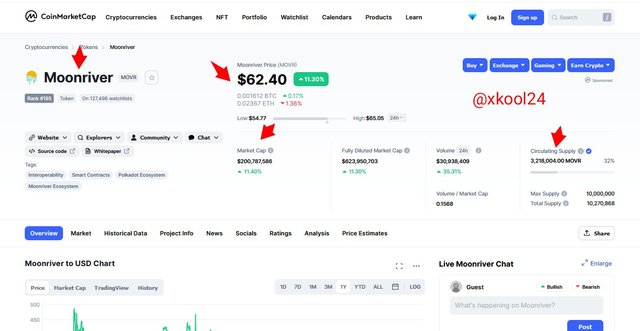

MOVR, over the last one year, the value of MOVR peaked sometime on 11th September 2021 with a value worth $481.97 and volume traded as $148.70M. Also, a Low peak level at $55.91 and volume traded as $26.87M.

The MOVR is currently valued at $62.40 at the time of writing of this post with a Market Cap of $200,787,586 and a Circulation Supply of 3,218,004.00 MOVR.

Under the same period, we observed a 24h Low of $54.77 and a 24h high of $65.05. Market dominance of 0.01% and market ranking of #195 of total volume traded using the coinmarketcap.

Trade Analysis for MOVR/USDT pair

I will be using the double EMA indicator where the short period and long period are both monitored relative to their positions to trend line and crossovers.

From the chart analysis where a 30Mins time frame was selected, the short period indicator line (blue) was observed crossing over the long indicator line (red) and this was supported with a thick bullish candlestick to make valid trade positions. There was also a confirmatory position with the RSI indicator also showing a bullish trend position.

Since I came into trade with such signals ongoing and with the short period line acting as dynamic support to the price trend, I will be making a buy setup position immediately using the SPOT trading strategy in the Binance exchange.

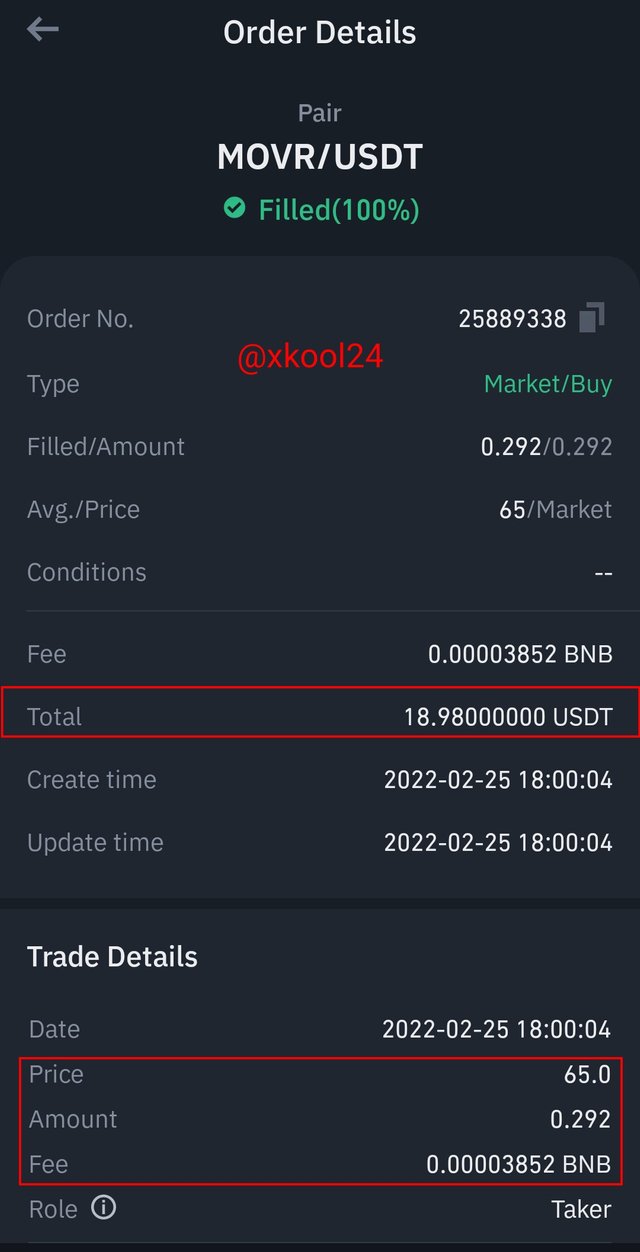

Buy Set-up Scenario

Market Price - $65.00

Fee charges - 0.00003852 BNB

Total Investment (USDT) - 18.98000000 USDT

Filled/Amount - 0.292 MOVR

The Sell Set-up strategy was executed after several minutes when the buy order was taken. This was to allow for the time frame selected as well as ensure positive price changes that maximize profit.

See the image below to see chart analysis on the tradingview site.

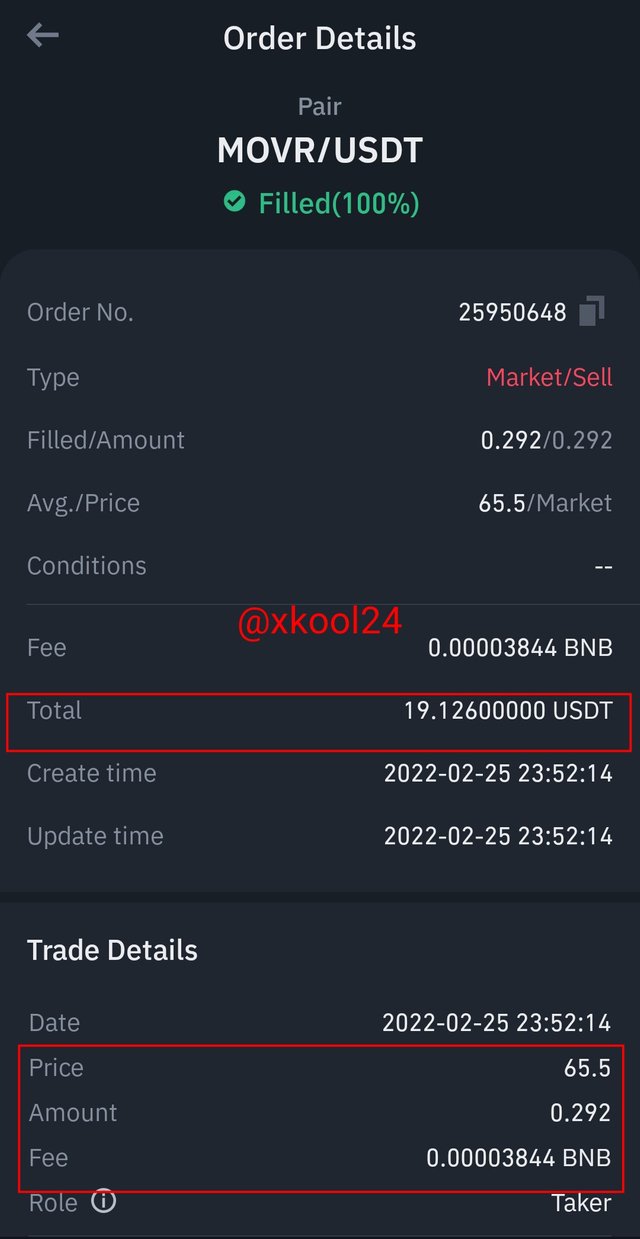

Sell Set-up Scenario

Market Price - $65.5

Fee charges - 0.00003844 BNB

Total Investment (Initial filled/amount) - 0.292 MOVR

Filled/Amount - $19.12600000 USDT

PROFIT GENERATED- $0.146

The MOVR coin is a native coin in the Cardano Blockchain with potential given to the structure of its project which is developmental and innovative in its modus-operandi. Though it is at its low levels for a given time now because of the downward trend observed in the cryptocurrency coins, the MOVR has attained over $400 price value which makes potential more evident for a rebound. A more reasonable quantity of this coin can as well be HODL for future use and also traded for profitability.

Thank you professor@kouba01, this is my fourth trade entry for the week.