Hello all, it's my pleasure to participate in this weeks homework task presented by prof @sapwood on On-chain Metrics (Part 3).

(1) How do you calculate Relative Unrealized Profit/Loss & SOPR? Examples? How are they different from MVRV Ratio(For MVRV, please refer to this POST)?

A. The Relative Unrealized Profit/Loss

Just as learned from the previous On-chain metric (Part 2) on Realized Cap and Market Cap, this gives us a cue on this Relative Unrealized Profit/Loss. The Market Cap as we know is simply the asset value as at the time required multiplied by the circulating supply whereas the Realized Cap is the individual UTXOs of a given asset vis-a-vis when it was last moved or spent.

Therefore, the RUPL is another important leading indicator of on-chain Metrics that takes into cognizance the difference between market Capitalization and Realized Capitalization Relative to the total asset supply at a given period. The Unrealized Profit & Loss simple takes into account the profit or loss that would have been incurred if the Last UTXO is moved at a given time. That is when we subtract the Realized price from the Realized Price which either gives us a positive or negative value.

Unrealized Profit/Loss = Market Cap - Realized Cap

It can as well be calculated by checking when an asset was last moved from its current value;

Unrealized Profit/Loss = Current Price - Realized Price

Just as slightly mentioned above about having a positive or negative value, Unrealized Positive Value is observed when the Current asset value is higher than the Realized asset value (Unrealized Profit) whereas the Unrealized Negative Value is observed when the current value is less than the Realized value (Unrealized Loss).

(screenshots from lookintobitcoin.com)

Having known that the Relative Unrealized Profit/Loss takes into cognizance the profit and loss in relative to Market Cap. This is observed to be represented with Cycle Tops and Bottoms. It has readings that indicate different levels of trend. 0.75 (75%) bands and above clearly indicates price asset peak and possible profit-taking. We may likely have more selling pressure at this level as traders may observe the Current price as higher than Realized price.

Bands between 0 - 0.75 either indicate the bullish and bearish cycles while bands level below 0 simply indicates accumulation zone.

Relative Unrealized Profit/Loss = (Market Cap - Realized Cap)/Market Cap

For example, if the Market Cap of BTC is $950B and Realized Cap is $750B. To calculate the Relative unrealized Profit/Loss;

= ($950 - $750)/$950

= $200/$950

RUPL = 0.21 (21%)

This shows that the BTC RUPL falls within the 0 - 75% band levels that represent being in a given cycle (Bearish or Bullish).

B. Spent Output Price Ratio (SOPR)

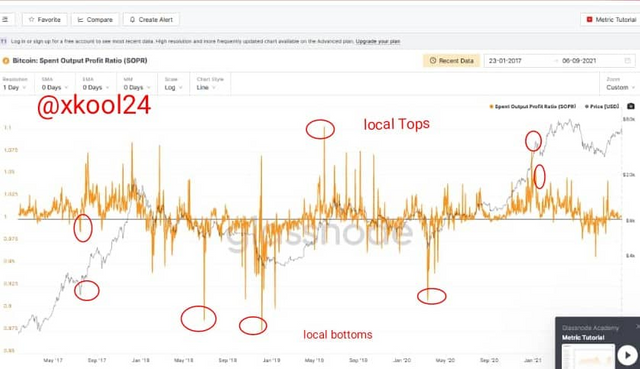

Just like the SUPL, the Spent Output Price Ratio ( SOPR ) is also another On-Chian metric that has representations of local Tops and Bottoms just the cycle tops is to the SUPL. It is the Ratio sum of the spent value vis-a-vis the created value of UTXOs. It helps identifies interim Tops or Bottoms in a given cycle which may be Bullish or Bearish.

When we use the term ratio, we divide the given values. The SOPR is the ratio of Sold Price to the paid price of a given asset in a given cycle. If I buy 2BTC at $20 and sold the same volume at $6, the SOPR here is 3 ($6/$2).

(screenshots from Glassnodes)

The SOPR = Sold Price of an Asset/Bought Price of an Asset

For example, if the created value of a given 10 BTC is $26,000 and were sold for $54,000, the SOPR will be;

Bought Price = 10 x $26,000

Sold Price = 10 x $54,000

therefore SOPR = $540,000/$260,000

SOPR = 2.07

This shows a positive value and hence indicated a Profit in trade.

Difference Between RUPL, SOPR & MVRV Ratio

| RUPL | SOPL | MVRV |

|---|---|---|

| RUPL simply takes into cognizance the profit and loss relative to Market Cap. It shows the anticipated Profit or loss a holder may incur if he transacts | SOPL takes into cognizance the profit and loss incurred already for spending the UTXOs relative to current market price | Gives the trader's average profit and loss value incurred in a market. It also indicates when an asset is overvalued or undervalued relative to market anticipation. |

(2) Consider the on-chain metrics-- Relative Unrealized Profit/Loss & SOPR, from any reliable source(Santiment, Glassnode, LookintoBitcoin, Coinmetrics, etc), and create a fundamental analysis model for any UTXO based crypto, e.g. BTC, LTC [create a model to identify the cycle top & bottom and/or local top & bottom] and determine the price trend/predict the market (or correlate the data with the price trend)w.r.t. the on-chain metrics? Examples/Analysis/Screenshot?

The Relative Unrealized Profit /Loss (RUPL)

The Relative Unrelaized Profi/Loss is an On-Chain Metric and a leading indicator that tells us the Unrealized Profit or Loss of UTXOs of given assets relative to Marlet cap over a given period. It indicates the Cycle Tops and Cycle Bottoms which have representations of profit-taking at the Tops and accumulation level at the Bottoms.

(screenshots from lookintobitcoin.com)

Analysis of BTC RUPL (9 years)

The chart above clearly shows us the different holders behaviour in the market vis-a-vis asset value/price, and this site was able to identify each of these price/holder behaviour with colours. From the Tops to Bottom we have the Euphoria, Greed, Optimism/Denial, Hope/Fear and Capitulation.

On the 8th June 2011, RUPL was seen at the tops at 88% which clearly shows that the asset price is at its peak and there is a possibility of holders taking profit as they anticipate market correction/Reversals with price at $17k. Just as anticipated, the price corrected to $400 which showed the selling pressure and stronger resistance at Cycle Tops with RUPL at -19% on 10th Sept 2021 (which is in the Capitayilation zone).

also on 18th Nov 2013, the price was observed to be at the Tops where the RUPL trend line moved to 86% with a price value of $18k. Just as we know that asset holders would take profit at tops, the price corrected to $1k as RUPL line declined to 19% on the 11th April 2014.

Lastly, we can also observe this top trend of RUPL on the 17th December 2017 where it is at 78% with rice at $17k but corrected thereafter to Hope/Fear Zone of 13% RUPL with price at $1k

Observations

I observed that in all of the Tops and Bottoms signal, the RUPL cycle tops line has continued to meet strong resistance levels when at bands 75% and above and prices are corrected as anticipated downwards to the capitulation zone. Therefore, RUPL has a good and direct interaction with price trends without trend divergence.

Spent Output Price Ratio (SOPR)

This is a leading indicator that takes into cognizance the ratio of assets spent vis-a-vis their created value when they were bought. This helps to represent the profit or loss a holder incurs when UTXO is moved.

(screenshots from Glassnodes)

Analysis of BTC SOPL (4 years)

On the 16th of July 2017, the SOPR line was observed at 0.98 with a price tag of $1,914 which means that traders who engaged in moving their UTXO did at a loss trade which represents the SOPR at the Bottom.

Also on 13th Sept 2017, SOPR was at 0.99 with a price value of $3,867 which all indicated a local bottom with a negative SOPL value. At the Bottom, there are usually ongoing accumulation activities and hence observed within the bullish cycle.

On the other hand, on 16th December 2020, the SOPR was observed to be at 1.02 with a price value of $21k showing a positive SOPR value. This simply means that most traders sold at a current price higher than that of the created value (Bought price).

Observations

I was able to know that SOPR also has a direct interaction with Price trends which are also observed from the presence of local Tops and Bottoms. When the price was seen to hit the local bottom, the market is anticipated to correct with a bullish trend which indicates stronger support. This scenario is also seen at local Tops with anticipated market correction with a bearish trend which indicates stronger resistance.

(3) Write down the specific use of Relative Unrealized Profit/Loss(RUPL), SOPR, and MVRV in the context of identifying top & bottom?

Just as we know the all of the listed leading indicators are all On-chain metrics with Top and Bottom bans representing Price trends.

Relative Unrealized Profit/Loss

The Relative Unrealized Profit/Loss (RUPL) helps in identifying Cycle Tops and Bottoms in a market. This is done relative to the Market Cap. That is to say, Unrealised Profit/Loss is divided by the Market Cap. When this is done a positive value of 75% and above is realized, it shows the Cycle Tops but whereas when the outcome is less than 0, it tells us that RUPL is at Cycle Bottom.

Spent Output Price Ratio

Just like the RUPL that are used in identifying cycle tops and bottoms, the SOPR are used in identifying Local tops and local bottoms. This is evaluated by a ratio between the Paid value and the created value. When the current price is higher than the Realized value (>1), it is observed s local Top but when this outcome is less than 1 (<1) we can identify it as the local bottom.

MVRV

This gives an average ratio and a fair evaluation of a coin. Due to the buy/sell activities in the market, price trends are usually seen at an all-time peak or low. The MVRV helps in identifying overvalued and undervalued assets in the market. When it is above the 200 bands, we can say asset price is at the Top (Overvalued) and when it is below band 100, we can say an asset is at the bottom (Undervalued).

Conclusion

The On-Chain metric especially the SOPR and RUPL are key and leading indicators that aids in identifying Local and Cycle Top and Bottoms respectively. Unrealized Profit/Loss of a given holder asset can be easily determined when they are spent relative to their Realized price. Whereas the MVRV which gives an average profit and loss value of a given asset is a fair valuation of that given asset.

Thank you Prof @sapwood for the lessons/Homework task.

@tipu curate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted 👌 (Mana: 5/6) Get profit votes with @tipU :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit