Hi friends, this is my second entry and competition in this week's lessons. I will be participating through the Investors team anchored by prof @pelon53 and my analysis would be on the COS token (Contentos Network).

Introduction/Overview of Contentos Network

This is a Network that tends to hold the foundation of decentralized digital content with the ability to reward all participants (creators, advertisers, and consumers) for their contribution. This is a protocol that one may relate to having the same resemblance with the Ethereum network where dApps are built and supported from. It has positioned itself to be the future Ethereum of digital content where it can receive massive deployment of dApps on its protocol.

Before now we observed most content creators which run on centralized systems are pressured to release contents that are advertisers driven rather than content owner driven. This is observed to skew earnings more to cooperate platforms who are beneficiaries of this content than the creators/influencers whose content is seen to sustain the platform. Therefore, both the creators and consumers of this content are at a negative variance and hence leave the tech giants who are the advertisers better off.

This is where the Contentos protocol comes in and makes all participants in the process of digital content equal beneficiaries of the system with skewing earnings to either side. The tokenization that is used in blockchain technology, the Contentos Network brings about the democratic content platform that is enjoyed.

The Contentos is made up of 45 members which encompass the Development Team, the Management Team and the Marketing Team with the development Team having a makeup of 56% of its membership. The Contentos system has consistently removed concerns from frequent infringement of rights to digital contents and as well floats an Untampered Credit System that makes cyber-attacks on credit systems more impossible.

The Contentos Network which we already observe as a decentralized platform has developed an infrastructure capable of keeping it afloat which involves the Decentralized Digital Content System, Credit System as well as the Social network. Most importantly, the Contentos system reaches its consensus in seconds with a zero transaction fee through the Self-Adaptive Byzantine Fault Tolerant.

The Contentos Team

Just as briefly mentioned above, the team of 45 members has more than 50% in its development unit which makes it development driven. The Co-founded and CEO Mick Tsai who is a software engineer from the state's university of California with a prerequisite experience of over 15years as a Senior product Director and Senior Development manager at Trend Micro.

Also in the team is the VP of Engineering, Peter Wei who with o er 13 years as a software developer and prerequisite experience in Mobile Application Technology with HTC and Cheetah Mobile.

Contentos Network also has Zac Nien as its VP for Product who has a masters in Information System and Application and with prerequisite experience of over 10 years in IT security as a Senior Engineer, I trend Micro.

Lastly, is Avan Wen is the VP of Marketing with years of experience in the entertainment and digital content industries.

The COS Token, Development and Existence

The COS token is the utility token and driver of the Contentos Network. It launched its ICO between the 25th of May to the 10th of June 2019 which gave it a 17th-day ICO trading that saw a whopping 3 billion of the COS Token sold through this channel out of the 10 billion Total supply of the same token. It was valued at $0.016 per COS Token which gave the network about $30million. They are supported by the ERC-20 standard token before the launch of the COS manner.

Not long after the ICO, prices of the COS Token went up as high as $0.085396 in July 2019 though it had its all-time of about 0.015. For some time, it has existed on only the Binance exchange which made COS liquidity monotonous. But of recent, we can find the COS with trading pairs found in other exchanges like the Bithumb, Coinine, Gate.io, WazirX, CoinEx, Bitrue, Pionex, Hotbit, CoinDCX, Nominex, BitGlobal, etc. Therefore, the sell, buy, and exchange of the COS coin can be found in these various exchanges.

Going with the details from the Contentos block explorer, the coin has been a busy one since its launch into the public domain with the execution of various commits. There are other different milestones already completed in the network which include the v.1.0 to 1.5 Testnet that entails the use of the consensus mechanism (SABET), use of the photo creator and game live streaming, block producer for election stage, reputation and Copywrite authorization system respectively for the versions in sequence. These all gave birth to the v.1.0 Mainnet system that saw the onboarding of live users in the network.

Trade Analysis of COS Token

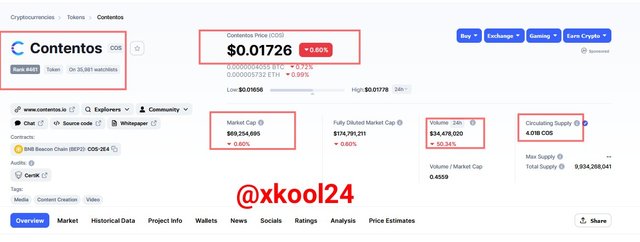

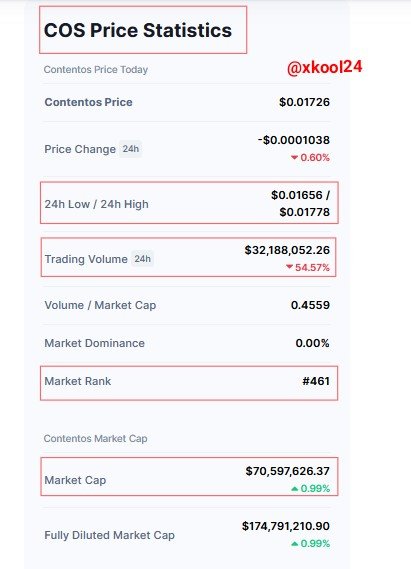

The COS Token is currently valued at $0.01726 as of the time of this report and with a Market Cap of &69,254,695. A Circulating supply of 4.01B already observed as at this time of the report with $34,478,020 as volume traded under 24H. Price changes under the same period depreciated with a 0.60% with its peak as $0.01778 and Low as $0.01656. The COS is currently ranked as #461 in the coinmarketcap site based on the volume traded.

From the price Historical chart, we can observe that peak and low price indices as indicated. Just after the ICO, the price peaked at $0.08237 with volume traded at $209,809.82 on 7th July 2019. Its all-time low was also captured around 14th march 2020 with a value of $0.00573 and volume traded as $3.81M. Sometime in December 2021, the price peaked to as high as 0.05 before the bear run which saw all crypto assets crashing in 2022.

Technical Analysis of COS Token

I will be using the COS/USDT pair with the Chart analysis represented on the tradingview site showcasing the different time frames for the selected indicators. The EMA was used and in this case, it was a short and long period EMA to help give a clear signal during the crossover scenario. This was also confirmed with the use of the RSI Indicator that helps give the strength of the trend in the Overbought or Oversold levels or as well above or below the midpoint 50 band levels.

When I observed the blue short EMA indicator line cross above the red long EMA indicator, I should anticipate an Uptrend and the reverse is for a Downtrend. This is confirmed by the RSI indicator line.

(15M time frame)

I checked the three-time frame to really get the price action and its signals, and this gave me some mixed signals. For the 15M time frame, there was a crossover to signify an uptrend which was also confirmed by the RSI Indicator, but there was a Retracement just as seen in the chart analysis. This particular signal would only be advisable for a short-time buy and sell position.

(30M time frame)

For the 30M time frame, there was no crossover instead both indicator lines were observed close. The RSI was slightly seen in the Overbought region before reversals.

(1HM time frame)

The same scenario was observed for 45M and 1H time frames where both indicator lines were observed close but no crossover identified. The RSI Indicator line was observed above the midpoint line but not in the overbought region.

Therefore, I will be using signals from the 15M time frame with the short EMA indicator line still found above and above the Long EMA indicator line. The RSI Indicator line is still above the midpoint showing strength in the price trend.

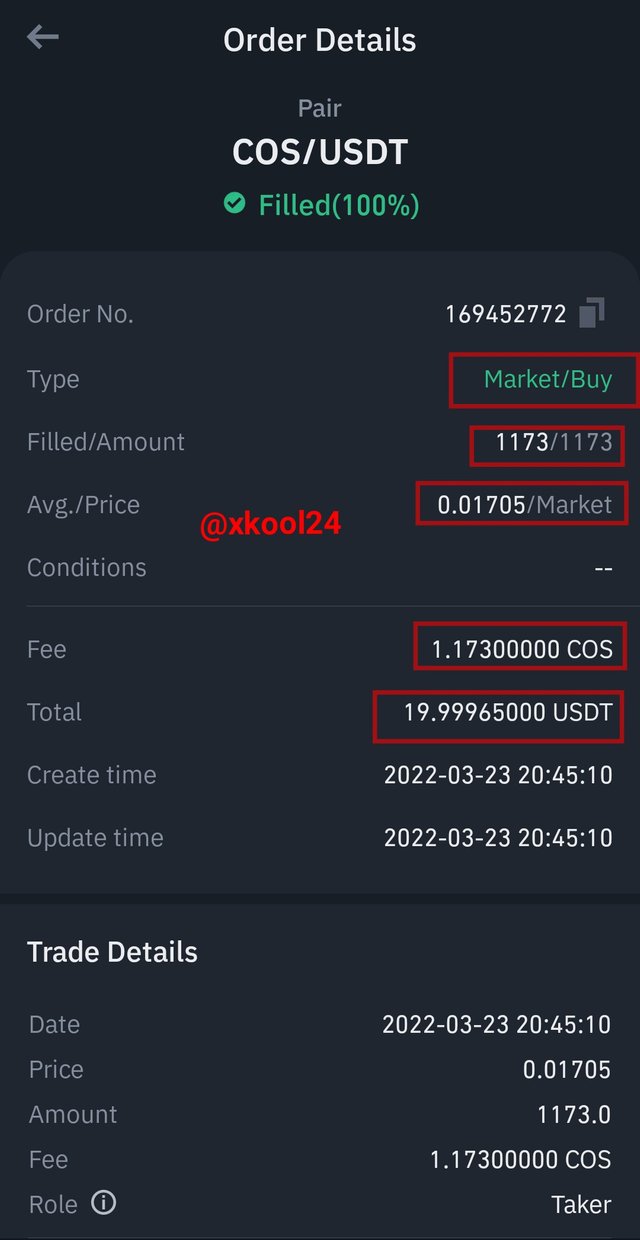

The following Buy position details were executed with Risk Reward ratio set at 1:2;

Market Buy Price: 0.01705

Total asset used: 19.99965000USDT

Amount filled: 1173

Fee charge: 1.17300000COS

Stoploss: 0.01688

Take profit: 0.01734

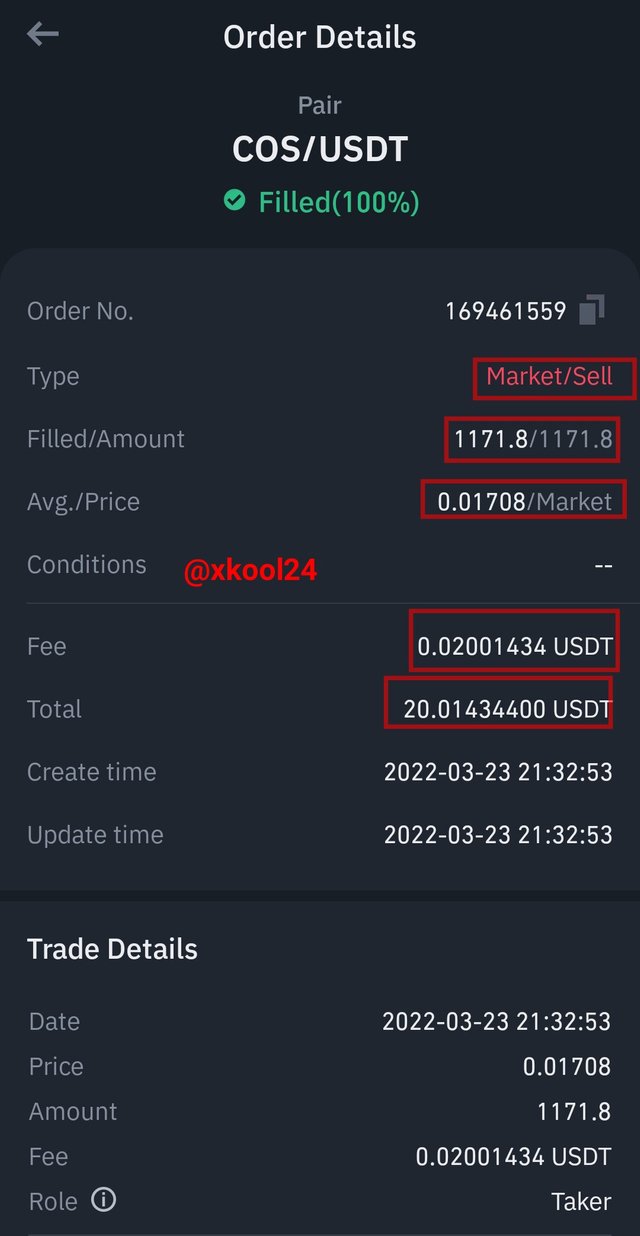

After the time frame period, a sell setup was executed to take profit. These were the details from the take profit;

Market Sell Price: 0.01708

Total asset used: 20.01434400 USDT

Amount filled: 1171.8

Fee charge: 0.02001434 USDT

PROFIT/LOSS: +$0.014694

Recommendation/Conclusion

It is most important to note that Contentos is a new project with about two years down its line, it has continued to be stronger given to the backing of Binance and its Chinese allies. The Contentos has been following and improving on the drawbacks inherent in the existing social network systems which the Steem Blockchain an older social network Blockchain in this regard.

Contentos sees that it could handle most of these drawbacks with the use of the saBFT consensus mechanism with its credit system wired in such a way that all participants of the system are guided accordingly.

The future of this project is not in doubt given to the over 2 billion participants in China alone and various commits and investments a going concern. It is a penny cryptocurrency with a value below the $1 threshold, hence investors can HODL enough quantity of this coin for long-term investment so as to leverage on price changes.

Thank you professor @pelon53, this is my second entry into the competition.

https://steemit.com/hive-108451/@xkool24/cos-usdt-spot-trading-crypto-academy-trading-competition-s6q3-or-homework-post-for-prof-pelon53

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit