Hello class, I know we are all doing well so far? I will be making my entries immediately to participate in today's entry by respected Prof @kouba01

Discuss your understanding of the ADX indicator and how it is calculated? Give an example of a calculation. (Screenshot required)

The ADX Indicator

The ADX indicator which simply means the Average Directional Index Indicator has been an age-long trading indicator that came into emergence in 1978 by Wilder Welles a man whose popularity has been evident in trading indicators especially the Resistance and Support Indicator. The essence of this indicator is a little divergent from the usual indicators that we commonly use to identify the actual movement of market price from bullish to bearish and sometimes sideways. The ADX is specifically designed to function in a way that relates the capacity of the strength of trends at every given time.

Just as we know that the trend is the trader's friend, the ability to dictate the strength of this given trend is another added advantage given to the trader to know when to engage in train de and make entry and exit positions. In this case, the ADX measures the strength of trends which guides the trade to avoid entering the market when trends are weak. There this would also see that issues of fake signals or Fakeouts are eliminated using the ADX indicator given to its trend readings. In all of it is a single line indicator that can exist independently as an entity or with other indicators for better results.

(The ADX indicator)

The ADX indicator can be measured within the 0 -100 readings which all signify the different trend strengths of a given market price. These are some of the indicator range below for our view;

| Range | Trend Strength |

|---|---|

| 0-25 | Very weak Trend |

| 25-50 | Presence of Trend in Trade |

| 50-75 | Very Strong Trend |

| 75-100 | Extremely Strong Trend |

Just as simply mentioned above, the Average Directional Index Indicator can as well function with the introduction of other indicators to it which further makes for a better result. These indicators are the Positive Directional Indicators and Negative Directional Indicators. These are independent indicators that help to give the ADX a direction of its trend. Remember we mentioned that the ADX only measures the strength of Trends in a trend which can be weak, present, very strong and extremely very strong, hence the +DI and -DI are Directional Indicators that give this a sense of direction in the market. It is seen to capture the high and lows of trends with a given period of 14.

(ADX with the +DI & -DI)

How to Calculate ADX & with an Example

1.We have to derive the DMI's which is a factor of +Di and -Di

+Di = current high - Previous High

-Di = Current low - Previous Low

2.We will derive the Range and the highest value is termed the true range of the asset. So we will be using, either way, to determine the true range by this activity in the trend;

Current high - Current Low = A

Current high - Current Close = B

Current Low - Previous close = C

TR = The highest value from A,B,C

Therefore;

+Di = +Dm/TR

-Di = -Dm/TR

Since ADX is a moving Average of a Directional Movement Index:

DX = 100 * ((DI +) - (DI-)) / ((DI +) + (DI-))

And ADX = Sum of n [((DI +) - (DI-)) / ((DI +) + (DI-))] / n

Given that the following has these values;

Current High - 51

Current low - 42

Price of the day (CC) - 49

Previous high - 48

Previous Low - 45

Previous Close - 41

therefore;

+Di = current high - Previous High (51 - 48) = 3

-Di = Current low - Previous Low (42 -45)= -3

Then for True Range

A ; Current high - Current Low = (51-42) = 9

B; Current high - Current Close = (51 - 49) = 2

C; Current Low - Previous close = (42 - 41) = 1

So; TR = A,B,C = 9,2,1

The TR = 9

So my:

+Di = 3/9 = 0.333

-Di = -3/9 = -0.333

Now to calculate for DX;

DX = 100 * ((0.333) - (-0.333)) / ((0.333) + (-0.333)) = 100

So let us get more ADX calculation for DX (we will use 80 and 50 periods)

ADX = Sum of n [((DI +) - (DI-)) / ((DI +) + (DI-))] / n

n = (100+80+50)/3 = 76.7

Therefore ADX = 76.7 (Extremely Very strong Trend)

How to add ADX, DI+ and DI- indicators to the chart, what are its best settings? And why? (Screenshot required)

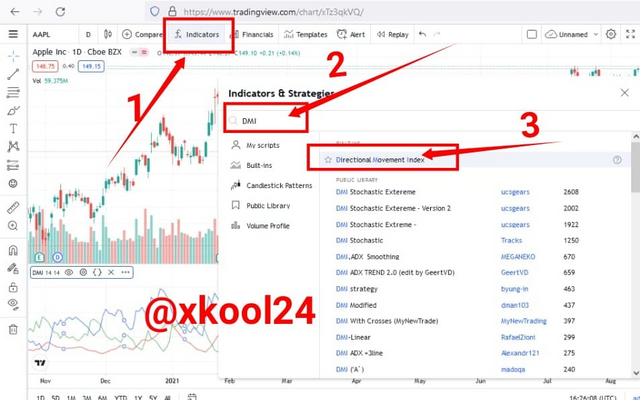

STEP:1

I will be using the TradingView Site to perform this process.

- First of all, launch the Chart from the site

- Click on the Fx indicator tab on your top screen

- Then Search for the word DMI, click on it when it pops up

- As soon as that is done, it sends this indicator to the chart screen

- This has successfully added the DMI indicator to the screen. We can see the ADX (Red), +DI (Blue) & -DI (Green) lines.

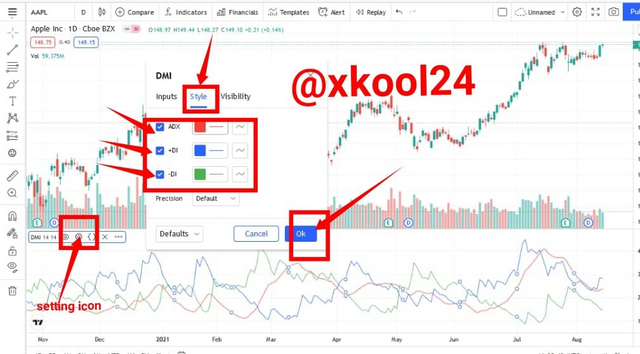

STEP:2

To configure the DMI to allow for easy identification of the different lines with styles as well as Inputs (Periods/Lengths)

- Goto the added indicator on the chart screen

- Got to Style Options

ADX is on RED (You can click on the colour to change it to your preferred colour base)

+Di is on BLUE (You can click on the colour to change it to your preferred colour base)

-Di is on Green (You can click on the colour to change it to your preferred colour base) - Click on OK to effect settings

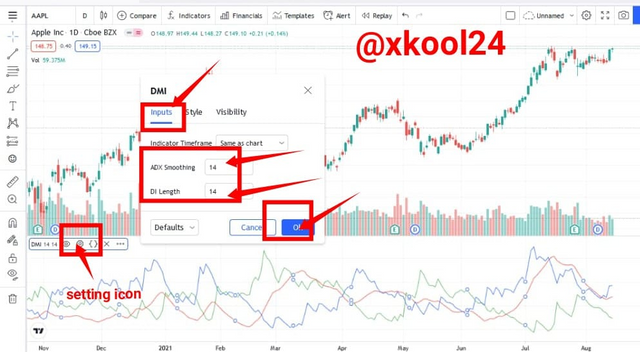

The Next is to see what we have in the Input Option.

- Click on the Input Option

- We have the Length and Period all on default settings (14)-

(Note, this can be changed either upwards or downwards depending on the user's preference).

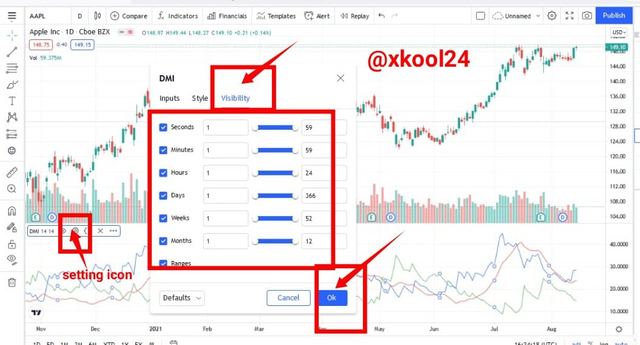

We also have the visibility option which shows us the different time preferences to view the trend.

*This is a clear representation of the DMI indicator with the ADX, +Di and the -Di

The best settings in the DMI are usually periods and lengths that are higher than what we saw in the default settings of 14. The Higher the periods, the better the coverage rate and ability of the market to establish very strong market trends. There are higher incidences of error occurrence in the short period lengths seen from false signals and fakeouts trends and if allowed, traders may be wrongly directed to engage and make improper trade positions that would bring about losses. Therefore the higher the periods, the better the market trend and behaviour captured over a given period.

Do you need to add DI+ and DI- indicators to be able to trade with ADX? How can we take advantage of this indicator? (Screenshot required)

Just as mentioned above, the ADX can be used independently as an indicator and also be used with the +Di and -Di indicators. This simply means that the ADX can be traded with on its own but let us be quick to remember that the ADX can only be used to identify the strength of trends in a given market with no other function. Strength in the market can be categorized as listed above (Weak trend<25, Presence of Trend>25, Very Strong Trend >50 and Extremely very strong Trend >75)

Therefore, the +Di and -Di indicators help to smoother the results and directions are seen from the ADX. They give Directional Movement to the ADX which only gives the strength of Trend. That is to say, with the Additional indicators to the ADX, traders should be able to identify trend strength as well as also determine the direction of trends which may either be bullish (Upward), bearish (downward) or sideways.

From the screenshot we can when +Di is above and the market trend was strong and bullish. We can also identify where -Di was above with market trend bearish.

What are the different trends detected using the ADX? And how do you filter out the false signals? (Screenshot required)

Just as I tabulated earlier in my explanation on what ADX above, it is deeply categorized by the strength levels which include;

| Range | Trend Strength |

|---|---|

| 0-25 | Very weak Trend |

| 25-50 | Presence of Trend in Trade (Strong Trend) |

| 50-75 | Very Strong Trend |

| 75-100 | Extremely Strong Trend |

Trends that falls with this cycle are vividly seen to be categorized based on their strength status.

For the Very Week Trend, there are little or no trends or most especially very recognizable trends moving o a sideways movement. The market is usually seen to almost been at equilibrium where buy positions equal Sell positions or Demand equals Supply positions. There are no activities of the composite man or bigger institutions to drive market trends at this level. See Screenshot below;

The Strong Trend level is the next after the Very weak trend level. This is seen to be greater than 25 but less than 50 in its strength level. There is market volatility with trends seen to follow a bullish and bearish movement.

See Screenshot for more illustrations;

The Very strong Trend is this scenario shows the presence of high trading activities with buyers/sellers having a field day. There is full adoption of market strategies and indicators given to the high market volatility and presence of Trend Support and Resistances. See screenshot below

The *Extremely very strong Trend is mainly the highest of the market trend with the full trading expertise deployed. It is important traders know their risk aversion level as well as follow their trading strategy tenaciously before engaging this level of market trend. It is highly volatile and required experienced traders to deploy their expertise.

How do you filter out the false signals

There are two ways I can filter false signals and also deliberately avoid them.

By the use of the appropriate Periods for trades. Logically, we should use the appropriate and long periods why setting our DMI indicators on our charts as this helps remove all false and fakeouts. Smaller periods are known to have all of these signals (both the real and false signals) where longer period settings mostly showcase the real and shade of the false signals.

False signals can also be filtered by the use of trading strategies. Strategies like the Break Retest Break which allows for a valid break out of price either in the bullish or bearish trend gives the trader a clearer view of the market trend. Another strategy that can filter these false trends is the Market Structure Break (MSB) strategy. In all of this, there is clearer higher high trends or lower low trends seen which gives a valid market trend.

Explain what a breakout is. And How do you use the ADX filter to determine a valid breakout? (Screenshot required)

What is Breakout

A breakout in trade is simply that point where forces of the market break through the last Support level or Resistance levels. This breakout point may be due to the ongoing market positions taken by buyers and sellers in the trade. When the presence of the composite man of bigger financial institutions comes to influence the market with the whale capital, they may alter the present support or resistance points to make their profits and exit markets. So, this point where trends retest and break through the last swing high points or Swing low points are known to be trade breakouts.

On the other hand, they are temporary and sharp price movements that happen in the opposite trend which still retest and continue in their initial trend. This mostly gets traders in many trade positions thinking they are valid breakouts and hence funds are lost in these open positions.

Breakouts may be seen tcocontinuein their new trend direction making them a valid breakout but when there are reversals, this entails it is a false breakout.

See screenshot to demonstrate this below;

How do you use the ADX filter to determine a valid breakout

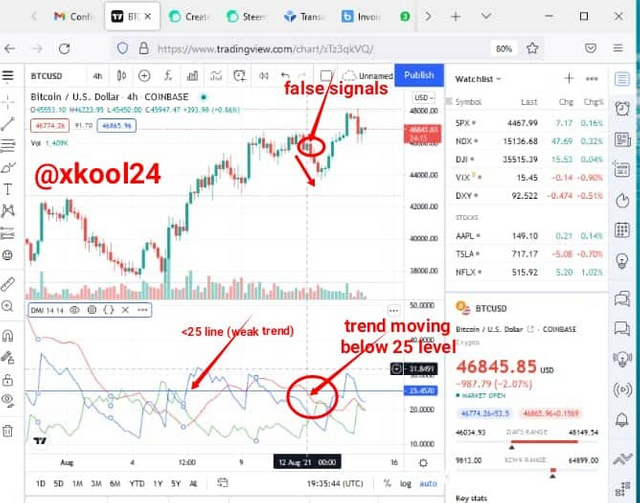

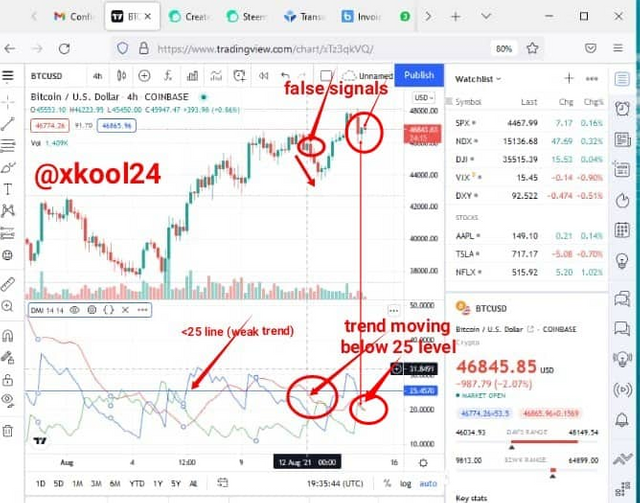

I will be showing us a clear screenshot to demonstrate how ADX filters trends determine a valid breakout. Most times when we look at the trend charts without the ADX, we may see some trends we would ordinarily feel are strong trends but unfortunately all happening below 25 which is a weak one. Most times, the market trend still returns to its old direction making a false move initially.

From the screenshots above, we can see that market made a bullish trend but that was below the 25 level line which showed a weak trend. The later trend continued on the bearish trend and more down to the weak zone. With the presence of ADX, we should be able to know when the trend is strong and when valid breakouts occur too. We can see both occurrences of false signals all happening below the strong signal point.

- What is the difference between using the ADX indicator for scalping and swing trading? What do you prefer between them? And why?

| Scalping Trading | Swing Trading |

|---|---|

| Presence of many Trading Indicators while scalping | Presence of only two (2) trading Indicators |

| Good trading strategies for 1 minute and % minutes time frames | Good trading strategy for medium and daily (4H) time frames |

| The period can be set on 100 to overlook fake signals as well identify strong trends | Has lower period set value which makes the occurrence of different trend signals. |

| Identifies important resistance and support levels in the market more easily. | There is a longer time frame to identify this index in its strategy given to its best time frames. |

My Preference

My risk aversion is that of the medium term which is distributed over a longer period. So I won't be going for the Scalping which happens to be a fast and quick trade decider with a higher risk aversion level. The Swing trade is more suitable to my risk level as I can place trades and monitor is across longer time frames with the possibility of taking a trade when the market goes in my direction as well as a stop loss when against my direction

Conclusion

The mainstay of the ADX which is to identify stronger trends signals as well as a spot on or to remove fakeouts/fake signals are veritable indicators traders has used over time to determine the trend level of their asset at every given time. It also in extension uses other indicators which smoother its results by giving it a directional movement. This is to say it also supports the use of other indicators for better performance.

Thank you Respected prof @kouba01 for participating in your classes.

Written by @xkool24

Hello @xkool24,

Thank you for participating in the 7th Week Crypto Course in its third season and for your efforts to complete the suggested tasks, you deserve an 8/10 rating, according to the following scale:

My review :

An article with good content in which you answered all the questions effectively and with a clear methodology, but certain points must be mentioned.

An understandable explanation of the indicator and its use.

Your explanation for changing the settings wasn't deep, just you gave the general idea without going into details.

A superficial explanation of two ways to trade with ADX indicator, as you confined to stating generalities without going into more details.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @xkool24,

Thank you for participating in the 7th Week Crypto Course in its third season and for your efforts to complete the suggested tasks, you deserve an 8/10 rating, according to the following scale:

My review :

An article with good content in which you answered all the questions effectively and with a clear methodology, but certain points must be mentioned.

An understandable explanation of the indicator and its use.

Your explanation for changing the settings wasn't deep, just you gave the general idea without going into details.

A superficial explanation of two ways to trade with ADX indicator, as you confined to stating generalities without going into more details.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you Prof for your review.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit