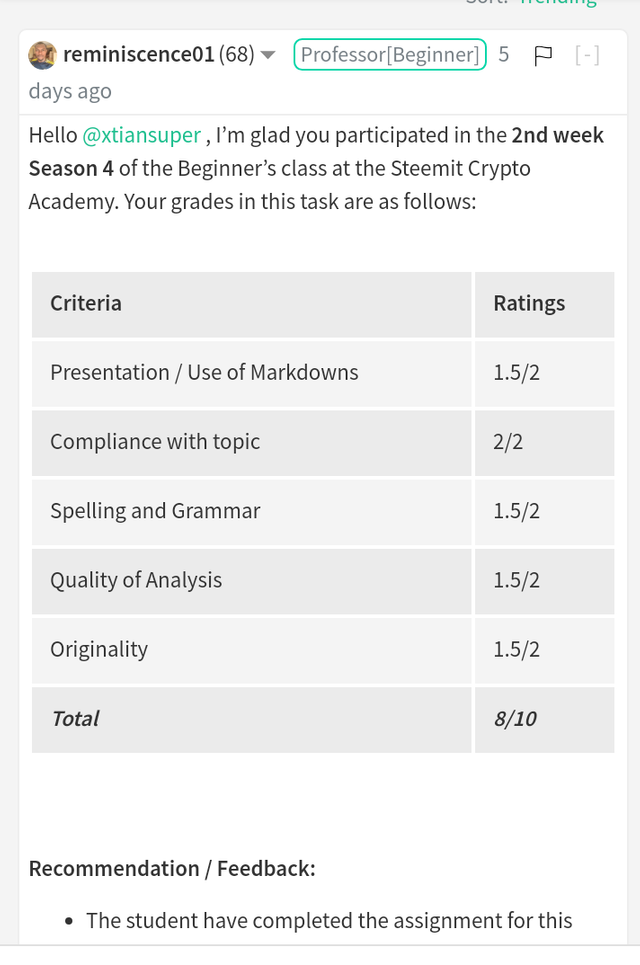

Please this is a repost of my week 2 task that was not voted. Below is the screenshot of the review that was done by professor @reminiscence01

Introduction

In every investment program, there are some dangers and risks associated with them. In fact, the chances of finding a risk free investment is very minimal especially in the cryptocurrency space. This is why it is very important to study the movement of the market before making any investment. One of the tools used in analysing the market in order to reduce the risks of incurring losses is the technical indicators. It is very crucial to know in detail what this is, in order to be in a good position to use it to the advantage of the trader.

Technical Indicators

In simple terms, we could refer to technical indicators as a tool that uses past data like trading volume, price, demand, etc to determine what will happen in the future. It is a type of technical analysis tool that uses historical market performance and statistical trends of price, volume of trade, demand and supply to predict future performance in order to reduce the risk of going against the market. Active traders of any market often use technical indications for different purposes especially to identify their entry and exit positions; and also to reduce stoploss.

Why Technical indicators is a good technical analysis tool

Technical indicators is a good technical analysis tool because it involves all that a trader needs to make decisions. First, with technical indicator, a trader can predict what will happen in the future and use these predictions to set a support / resistance levels for his investments.

In a case where there are two or more technical analysis tools, the signals gotten from technical indicator will confirm the signals of other technical analysis tools which will make the investor more certain about his investments. In addition technical indicators keep a trader on alert on when to take profit to enter the market based on the signal received.

In a nutshell, an investor using technical indicator as a technical analysis tool will be on the winning side because such trader will understand the current condition of the market which will consequently help in the management of his or her investment.

1B. Are Technical Indicators good for Cryptocurrency Analysis?

Technical indicator is a good technical analysis tool for cryptocurrency following the various purposes it serves. First and foremost, technical indicators enable a trader to know his or her entry position. This is very important in cryptocurrency trading. It is non-debatable that knowing the time to enter and exit the market is the most crucial thing in crypto trading.

With technical indicator, one can follow the entry and exit alert to minimise costs and maximize profits. Also technical indicators help identify a weak/strong trend of any chosen crypto-assets. The knowledge of these to a trader beforehand will also help the trader to know the next action to take.

Technical indicators as a good analysis tool does not only give traders insight on when to enter or exit a volatile market, it also provide price movements which will enable investors to take profit when the time is right. Although they are heuristic in nature which means it is not absolutely safe, they are of essence and they provide basic information that could be termed as the basis of trading.

1C. How to Add an Indicator to a Chart and How to Configure

In order to add an indicator to my chart;

Step 1.

I logged in to the Tradingview Website.

Step 2:

On opening of the site, I clicked on the menu icon and select chart.

Step 3:

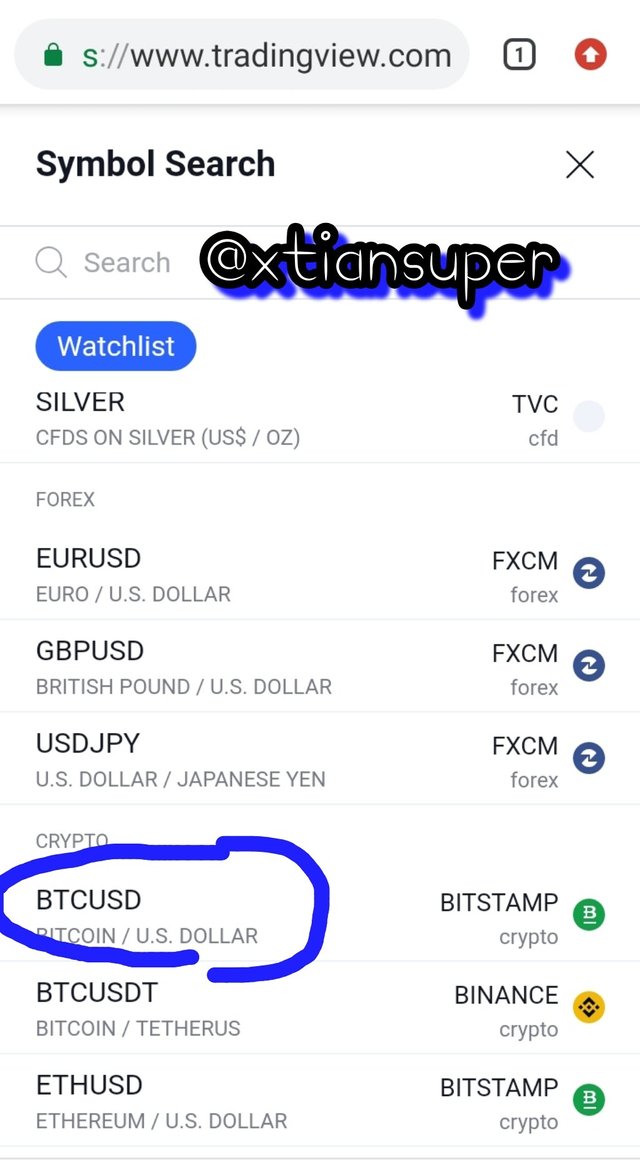

I selected the trading pair to be BTC/USD.

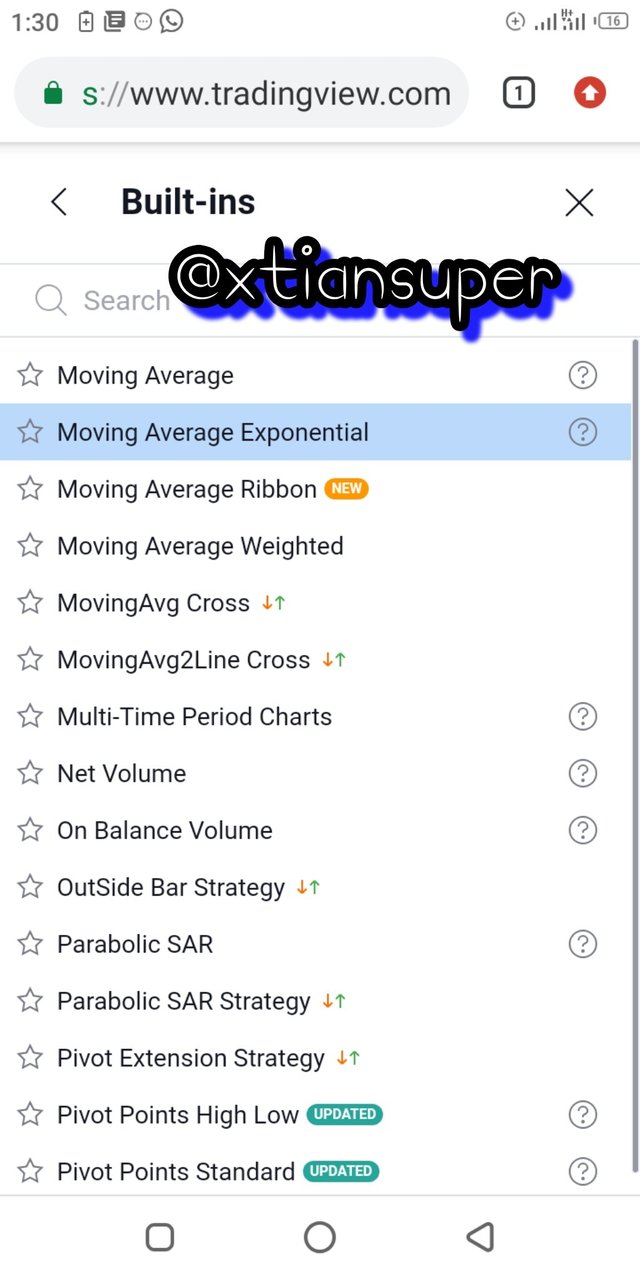

My chart appeared, and on the up row, I clicked on indicators and selected built-in indicators.

Step 4:

A list appeared where there were numerous indicators to select from. I selected the Moving average indicator.

Step 5:

Moving average was added to my chart as shown below.

Configuration

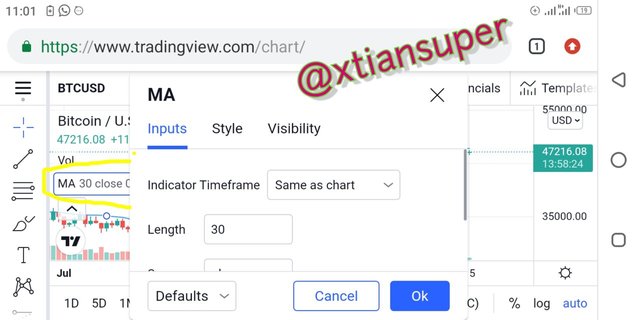

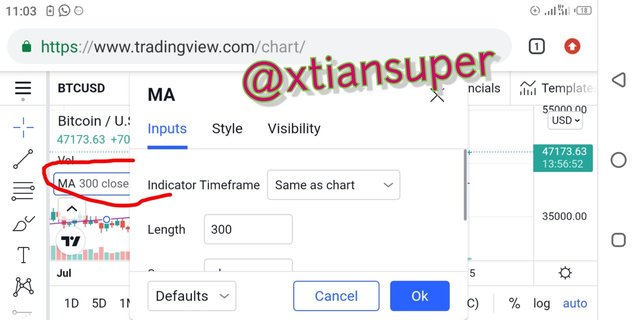

¶ In order to configure the indicator, I tapped on the MA icon twice and a dialog box was opened. I had to change the settings to my preferences.

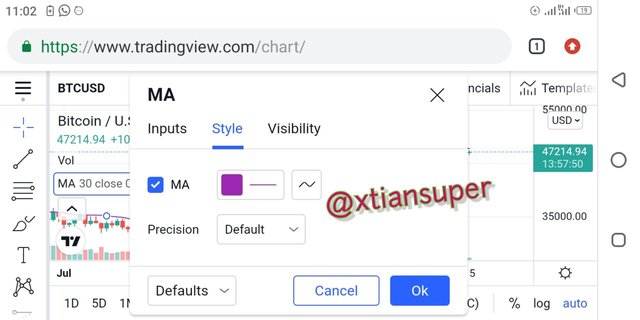

¶ I clicked on input where I changed the length to 30 for short. And then I clicked on style where I reset the color to purple.

¶ The MA was configured and it showed on the chart below.

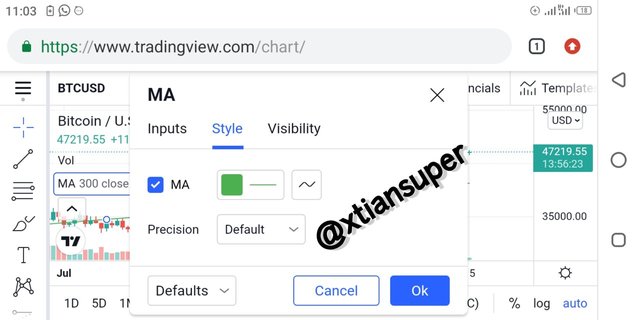

¶ I also repeated the same process for long where I set the length to 300 and color to green.

My indicator was configured as shown below.

2A. The categories of technical indicators

There are basically four categories of indicators available for an investor when doing technical analysis. They are explained below:

1. Trend indicators:

Trend indicators are indicators which point out the direction of cryptocurrency pairs. Asset pairs may be trending or ranging. Trend indicators works in two ways; first, it will point out if there exist a trend at all, and also if the trend is weak or strong. Traders use these indicators to establish whether there is an upward or downward trend in order to make major investment decisions. This is in line with the phrase, "The trend is your friend."An example of trend indicator

An example of trend indicator is the moving average. Moving average is a technical analysis tool that shows an average price of an asset overtime. It ranges from simple to exponential. Other trend indicators are the ADX indicator and Ichimoku indicator.

.jpeg) moving average indicator chart

moving average indicator chart

2. Oscillator Indicators:

Oscillator is an umbrella name for indicators that show the movements of prices. Prices might fly upward or downward. An oscillator indicator moves in the same direction with price. An Oscillator may reach an extreme either or downward indicating an overbought or oversold. Traders also use this to know when to buy or sell.

Examples of oscillator / momentum trend include;

Relative strength index, commodity channel index, moving average divergence/convergence, stochastics.

RSI chart

RSI chart

Volatility Indicators:

These are indicators that measure how volatile the market is, that is, how frequently the prices change. A highly volatile crypto pair is one in which prices fluctuate very frequently. On the other hand, a less volatile market is one in which prices are more steady.

Example

An example of volatile indicator is the Bollinger bands indicator.

Bollinger Band indicator chart

Bollinger Band indicator chart

Support and Resistance Indicators:

These indicators show the price level which serve as limitations to price movements. In simpler terms, support and resistance are the level in a chart in which prices are expected to fall to or rise to in an extreme case. These indicators enable a trader to know when to initiate a buy/ sell order.

Examples

Examples of support and resistance indicators are the Pivot points and Donchain channels.

Donchain channels indicator chart

Donchain channels indicator chart

2B) Why Technical Indicators Are Not Fit To Be Used As Standalone Analysis Tool

Technical indicators are not really fit to be used as standalone tool for analysis. This is because they are heuristic in nature. They are not absolutely safe and hence, they often faill when the future of a market is quite different from the past. The prices of assets are greatly determined by the forces of demand and supply. Once demand or supply drops, prices will move accordingly. And in trading, there is no 100% assurance of what will happen in the next minutes.

2C. Ways Through Which a Trader Can Improve the Success Rate of an Indicator Signal

Traders can improve the success rate of an indicator signal in different ways depending on the kind of indicators they use. But in general, some of the requirements for these improvements include;

1. Availability:

A trader must always be available to monitor the movements of the charts. With this, he will know the kind of indicator that will best suit that market or trading pair. Availability will also help the trailer to identify a signal and act accordingly. This will make such indicator effective.

2. Understanding market conditions:

A trader that understands a prevailing market condition will know exactly the kind of signal and the kind of alert to set at one point to the other. Traders who are new in the markets will barely know what signal suits prevailing market conditions.

- They should combine indicators with other technical analysis tools.

This way signals cotton will be in line with other technical analysis tools.

4. Selection of proper technical indicators:

Traders should try as much to not just select any indicator, but should pick the ones in which configuration terms are simple and easy to interprete in order not to make mistakes.

Conclusion

Technical analysis is an important aspect of every investment activity. Technical indicators being tools of technical analysis go a long way in helping investors understand the movements of the market in order to take major decisions. In order to improve the use of technical indicators, investors should study the functions and the way each of the indicators work in order to choose the one that is appropriate. Also, investors should combine indicators with other tools of analysis as indicators work better as confirmation tools.

Thank you so much for your time.

Note: All screenshots were taken by me on Tradingview