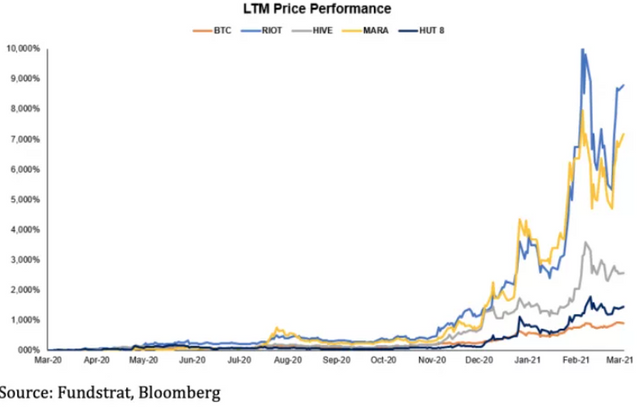

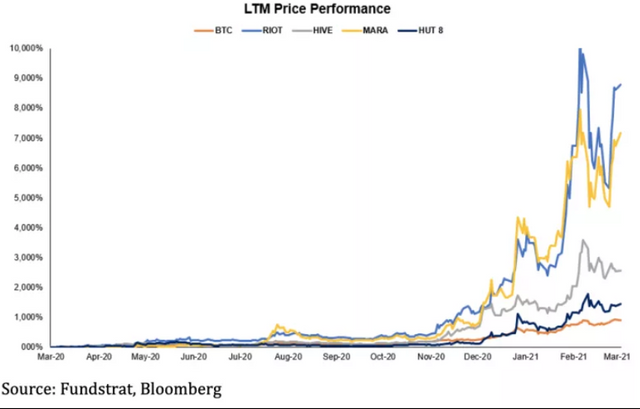

Crypto mining stocks could deliver amplified returns during a bitcoin bull market, according to FundStrat research.

Over the past year, crypto mining stocks have outperformed bitcoin (BTC, +1.36%) (BTC), and the trend has accelerated since the cryptocurrency climbed past $20,000 a few months ago, according to the financial research firm FundStrat. The dynamic might hold if bitcoin stays in a bull market, the firm predicts.

“Bitcoin and the wider crypto market are the modern-age digital gold rush,” wrote FundStrat, which means crypto mining stocks could see further upside.

Because "miners play such a critical role in ensuring the Bitcoin network functions properly, investors have sought opportunities to gain exposure to mining companies,” which generate revenue in the form of mined bitcoin.

The largest publicly listed mining companies include Riot Blockchain (NASDAQ: RIOT), Hive Blockchain (OTCMKTS: HVBTF), and Marathon Patent Group (NASDAQ: MARA).

As the bitcoin price increases, miners spin up new rigs or upgrade hardware in pursuit of higher block rewards. And FundStrat expects more-efficient mining machines will help some firms remain competitive, which could boost profit margins.

But buyer beware: “Mining company equities may serve as a high-beta play on bitcoin … [and when the cryptocurrency] enters a bear cycle, we would expect mining equities to have greater downside volatility than bitcoin,” according to FundStrat.

Chart shows crypto-mining stocks performance over the last 12 months.

Source: FundStrat

Thanks for sharing news crypto @yahoofinancelive

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit