Hello steemians !

I hope you are doing well in your life. I hope you are keeping your health in this pandemic as first priority. So this is my homework post for @reddileep The topic today is an In-depth Study of the Market Maker Concept, so let's get started.

Question 1

Define the concept of Market Making in your own words.

What is the function of the market or what is market-making? !.When someone wants to buy or sell cryptocurrencies, they must go to an exchange where buyers and sellers meet. The price they pay is determined by supply and demand at the time, which is translated into the bid price for buying and the asking price for selling. The bid-to-ask spread is the difference between the bid and asks prices. If there are few counterparties to trade with, it may be impossible to buy or sell, and the market is now considered illiquid. New exchanges or newly listed coins that have just completed their initial coin offering (ICO) or initial coin offering (ICO) often lack liquidity and have a widespread to ensure liquidity. Professionals are asked to report a bid-ask spread to the market on a regular basis by exchanges.

In other words, market makers create markets, which is why they are known as market makers. Market makers often do not trade based on market movements, but rather benefit from the spread (the difference between the ask and the bid). A market maker would typically place an order at the top of the order book and try to sell it as soon as possible. The profit they make is made up of the spread and transaction fees. The danger for market makers is that markets may fall so fast that they will be unable to sell the freshly purchased asset for a profit.

Question No 2:-

Explain the psychology behind Market Maker. (Screenshot Required)?

Crypto trading is highly volatile and risky. The sole reason behind this is the psychology behind it. As we already know that the market moves according to the buy and sell orders, and this movement of the market is not just random but the market itself is moving that way. The buy and sell orders are pre-planned by the people behind it and are called market makers.

Market makers provide liquidity to the market by placing major buy and sell orders and the small traders' orders lie in between the ask and bid price of the market makers.

The market always moves in the way that the money flows from small traders/investors like us to big traders/investors/whales. How is it possible?

Well, the reason being market manipulation and the psychology of small traders plays an important role in this migrating of money. The whales contribute to the market segment hugely and place higher selling liquidity which results in a huge dip in the market so that the small traders/investors will sell at lower prices and they will buy that asset at lower prices in the dip. This is called market manipulation and contributes largely to the market-making concept and psychology of the market.

Question 3 No:-

Explain the benefits of the Market Maker Concept?

The benefits of market makers are given under as follows;

Other market shareholders can be boosted since market makers might enhance the worth of a price to a greater level. This indicates that using this approach can result in more people participate in a coin trade.

Because the market offers many purchasing and selling possibilities, a highly liquid asset can generate a huge flow of activities.

It frequently advocates for maintaining market liquidity. It implies that by offering Bids and Ask prices, they actively help to sustain the value of a new currency.

One of the advantages of the concept is that market makers might choose to shift the market. You may employ little traders to entice them in and then place a stop-loss order before going in the direction they desire.

We may generate enormous profits with rapid market entrance and exit if we can pinpoint the exact moment when the market maker is active.

Question NO 4:-

Explain the disadvantages of the Market Maker Concept?

The notion of a market maker causes a conflict of interest. The action of various bid and ask prices produced by different market makers causes the conflict of interest.

Many market makers in the crypto realm are unregulated. It indicates they're simply supplying fake liquidity to the market for a brief period of time.

A large amount of liquidity they inject into the market has an obvious impact on an asset, which they may utilise in either a good or negative way, posing a significant danger to a currency's value.

There is always the issue of unjust profits to consider. With the unjust gains, we can see that market makers are renowned for keeping information secret from the broader public, a practice known as insider trading.

If the market makers' mechanism is not correctly detected, all of the small traders' capital might end up in their hands. Leveraged trading is a prime example of this type of behavior.

Question No 5

Explain any two indicators that are used in the Market Maker Concept and explore them through charts. (Screenshot Required)

In this portion of the course, I'll go over two indicators that are used in the market maker concept. The two indicators I'll cover in this portion of the course are the relative strength index(RSI) and moving averages.

RSI:-

The Relative Strength Index (RSI) measures price variance and movement. The RSI is a scale that goes from 0 to 100. The RSI is regarded as overbought when it reaches 70, and it is considered oversold when it falls below 30. Turbulence and unsuccessful swings can be used to generate false signals.

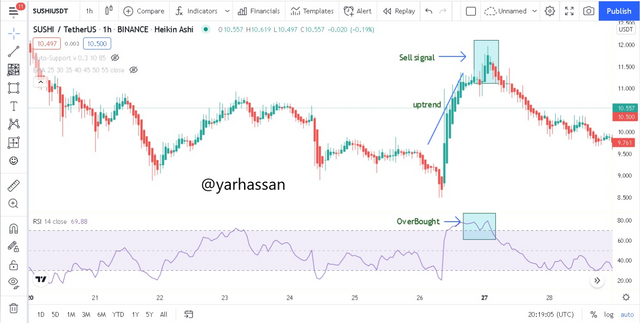

As you can see in the above picture that is how the market makers have set the market. I have chosen sushi usdt coin, you can see that at 10.52 value it was oversold as indicated by the rsi indicator. The Rsi has fallen below the 30 levels. It was created as an entry point by the market makers. After that, you can see that the downtrend came and boom after it the uptrend came and traders book their profits.

- the Same strategy implies here, as you can see that at 11.8 usdt the coin was overbought as indicated by the rsi indicator. So it was the sell signal.

Moving averages:-

- Moving averages are a trend-based indicator. It's made up of two moving average lines. One of the moving averages is set higher, while the other is set lower. It is an uptrend and a buy indication when the lower line crosses the higher line facing up, and it is a sell signal when the higher line crosses the lower line facing down.

- In the above image you can see that I chose the coin sxp usdt and you can see that the lower MA 9 crosses the higher MA 21 facing upward so it is buying signal and entry point and when the higher 21 MA crosses the MA 9 facing downward at 2.4 it is a sell signal.

Conclusion:-

Finally, I'll say that this was a really thorough and concise explanation of market-making and market makers. This professor's assignment post will be extremely beneficial to me in real-life trading. With this, I learned about the advantages and disadvantages of the market maker idea. I'm looking forward to hearing more from the professor.

Thank you.