How many times has "halving" been done in Bitcoin? When is the next one expected? What is the current amount that Bitcoin miners receive? Mention at least 2 cryptocurrencies that perform or have performed "halving".

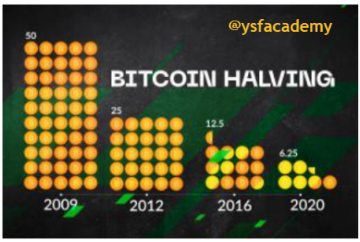

By definition, Bitcoin halving is when the miners’ rewards for bitcoin transactions are cut in half. Initially, for each block that was successfully produced, a miner was rewarded with 50 BTCs. However, BTC has a fixed supply of 21 million that can be in circulation as stated by Satoshi Nakamoto in his Whitepaper.

With an average creation of new Bitcoins every ten minutes, to maintain the fixed supply of 21 million, the idea of halving was birthed so that the maximum amount isn’t reached in the shortest time. Halving has therefore been taking place every time a threshold of 210,000 blocks is reached.

Satoshi Nakamoto is known to have mined the first Bitcoin at the beginning of 2009. Later on, in 2012, around November, the first halving took place. That is to say, the reward for each block mined was cut by 50%.

Close to four years later, the price of BTC took another drift, whereby the reward for each successfully mined Bitcoin that was initially at 50 BTCs and reduced to 25 BTCs between 2009 and 2012, further dropped to 12.5 BTCs in 2016. The most recent halving took place last year (May 11, 2020), the price was reduced to 6.25 BTCs for every successful Bitcoin mined.

Therefore, the halving has been done three times with an average periodic trend of four years. With that said, the next halving is expected to take place in 2023. The current amount that Bitcoin miners receive is 6.25 BTCs per successful Bitcoin mined.

Image source

It can also be noted that other cryptocurrencies have performed halving and to mention a few, these include:

Tomochain (TOMO): It experienced halving in February 2021. We saw it reduce from a price of 2 million to 1 million.

Verge (XVG): The reward in January 2021 was 100XVG which was later reduced to 50 XVG in September 2021.

What are consensus mechanisms? How do Proof-of-Work and Proof-of-Staking differ?

A consensus mechanism can be referred to as a combination of methodologies used to achieve contract terms, confidence, and safety across a distributed computer network. Professor states in the recent course that they seek various objectives by applying different technical solutions to the problems they seek to solve thus implementing mining systems other than Bitcoin. He highlights out two consensus mechanisms, i.e., PoW algorithm and various alternative systems based on PoS

Proof-of-work is the mechanism in which the decentralized Ethereum network comes to a consensus securing users from "double spending" their coins and ensures the safety of the Ethereum chain. An audit to find and eliminate any pitfalls for a block is done and the validated ones are added to the chain.

On the other hand, POS miners validate block transactions based on the number of coins a miner possesses. Miners are seen to have less potential to attack the network since its compensation is structured in a way that leaves the miners less advantaged.

Log in to the Bitcoin explorer and indicate the hash corresponding to the last transaction. Show Screenshot.

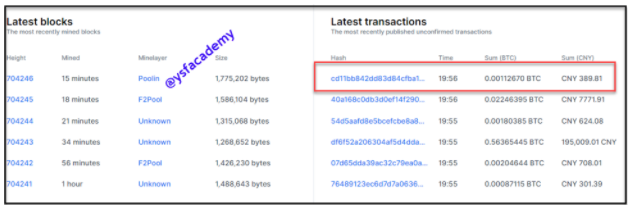

I will look at the hash of the last transaction generated by block number 704246

Image source

Below are the details of the hash of that transaction:

Hash: 44a2b9126dd1c3e7b4f5f63d0cab098cc2416d8f23c881f82640640a98a64cb4

Creation time: 2021-10-09 19:40

What is meant by Altcoin Season? Are we currently in Altcoin Season? When was the last Altcoin Season? Mention and display 2 charts of Altcoins followed by their growth in the most recent Season. Reason your answer.

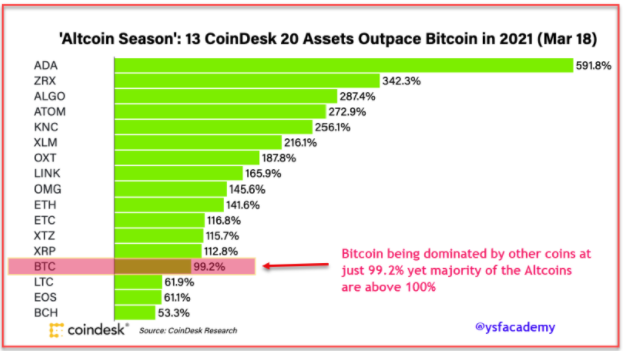

Altcoin season is a time in the crypto market where any cryptocurrency that isn't Bitcoin tends to dominate Bitcoin in terms of performance. To be specific, it is when 3 quarters of the Top 50 coins performed better than Bitcoin over the last 90 days. Of course, one of the reasons why this may happen is the transaction. Due to speculations of more profits, if one invested in altcoins, holders of Btcoin shift their investments into altcoins by selling Bitcoins to get great profits.

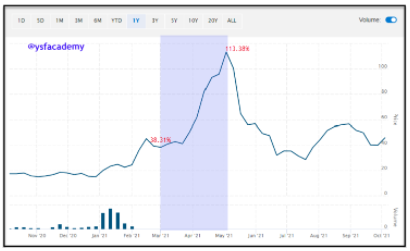

The image below shows an example of the Altcoin season that happened on 18th March 2021.

Image source

The figure above is a good illustration to explain what Altcoin season is from a pictorial perspective.

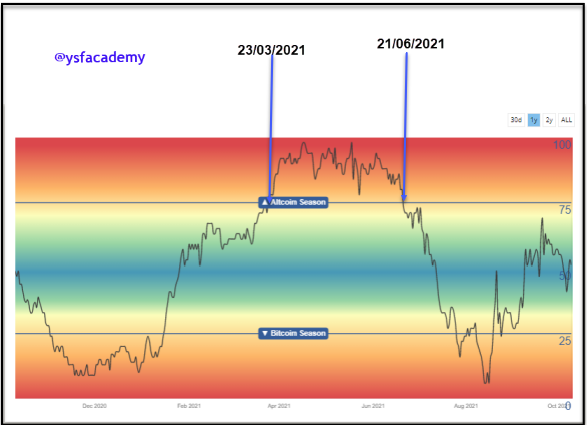

I looked at the trend over the past year to be able to identify when the last Altcoin season was experienced.

The figure below is extracted to show evidence of when it did last happen.

Image source

Evidence from the graph above shows that the last Altcoin season was between the 23rd March 2021 and the 21st of June 2021.

Below are 2 Altcoins followed by their growth in the most recent Season.

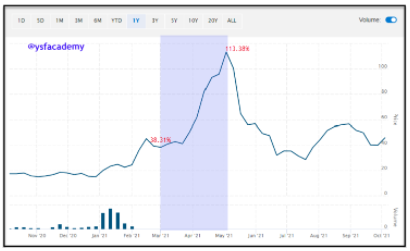

(1) Neo (NEO-USD)

Neo is the oldest Chinese blockchain protocol, founded in 2013. In the most recent season, Neo increased from 38.3% to 113. 38%. Currently, the coin is overlooked but it is one of those that has silently flowered since the beginning of 2021. Below is a chart to shows its growth rate during the previous Altcoin season. It is one of those coins that one would have to look at and invest over time.

Image source

(2) Stellar (XLM-USD)

XLM-USD is gaining popularity as a payments network. This has fueled the rise of XLM cryptocurrency.

We are seeing this because its goal is to simply transfers global money using its blockchain platform. Its desire to attain the world’s “unbanked” to permit money to transit overboard, linking banks, payment systems, and individuals with reliability and time responsiveness. In the last Altcoin season, the coin grew from 463.3% to 825.38%. This is shown in the figure below.

Image source

Make a purchase from your verified account of the exchange of your choice of at least 15 USD in some currency that is not the top 25 coin market (SBD, tron or steem are not allowed). Why did you choose this coin? What is the goal or purpose behind this project? Who are its founders/developers? Indicate ATH of the currency and its current price. Reason your answers. Show Screenshots.

Anton Bukov and Sergej Kunz are the founders of the coin. This was founded during a hackathon program that was held in New York and at the moment Anton Bukov serves as the project's CTO. One of the goals of the 1inch coins is to aim at restructuring how management controls decentralized networks

The coin has no max supply available thus a possibility that it may not yet be affected by the halving effect. A greener pasture one would want to explore, thus one of the reasons I picked on it. It a liquidity that is worth $30 billion from which users can tap.

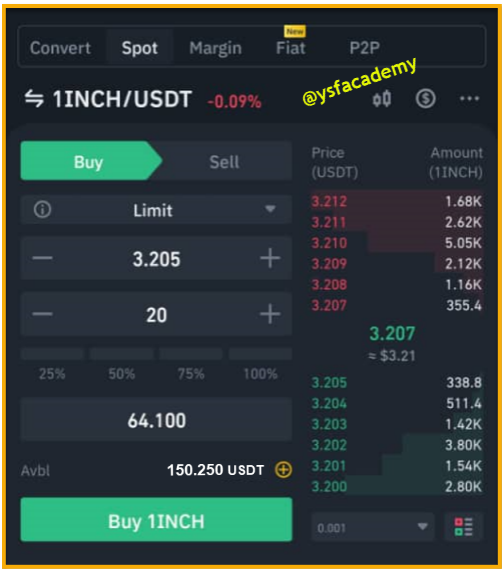

Summary details of 1inch coin:

Current price:$3.22

Market rank: 126

All-time high: $7.87

All-time low: $0.4933

Market cap: $582,899,850.34

Circulating supply: 180,362,122 1INCH

Screenshot from Binance Mobile

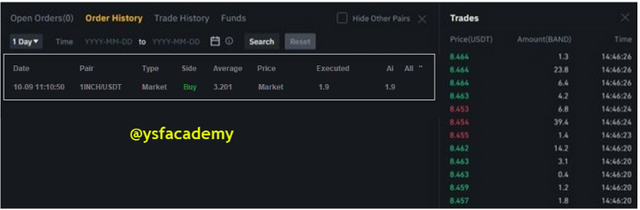

The above screenshot shows a transaction made of 20 1 inch coins from my Binance account. The total cost of the coins is 64.100 each was valued at $3.205 current market price at the time of the transaction.

Below is an image of the transaction

screenshot from Binance mobile

Conclusions:

Bitcoin, the leading cryptocurrency has had 3 halvings whereby halving refers to splitting the rewards miners receive into half. And the reason for doing so is to ensure that the fixed supply of 21 million isn’t reached quickly. The halving doesn’t only affect Bitcoin but extends even to the other coins.

I also had discussions on a few consensus mechanisms, i.e. PoW and Pos. PoW is the safest security-wise compare to PoS and in that regard, it is important to note that Bitcoin uses the PoW algorithm.

I further explored the Altcoin season which is simply when the other coins dominate Bitcoin in performance at a threshold of 75% share being taken up by the other coins. Finally, I purchased 1inch coin which I transacted with the sale of USDT which in my opinion came with profits.

My appreciation to professor @imagen. More knowledge was acquired from the course. I was compelled to even look for more. Thank you so much.

Gracias por participar en la Cuarta Temporada de la Steemit Crypto Academy.

Continua esforzandote, espero seguir corrigiendo tus asignaciones.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Gracias, profesor, me aseguraré de que mi texto esté justificado la próxima vez. También mejoraré aquellas áreas destacadas que necesitan mejoras.

Gracias por los comentarios.

Estoy humillado

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have been curated by @yohan2on, a country representative (Uganda). We are curating using the steemcurator04 curator account to support steemians in Africa.

Keep creating good content on Steemit.

Always follow @ steemitblog for updates on steemit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit