Designed by @zeebhutta Using Canva

Hello guys!

First of all, I would like to pay my respect to @sachin08 for teaching this community the most important crypto chart patterns and how we can identify and trade using them. Now in this homework post, I will be sharing details about the rectangle pattern that I have learned from the 2nd post from the professor. So, let’s start with the homework:

1. Explain Rectangle Pattern in your own word.

1. Explain Rectangle Pattern in your own word.

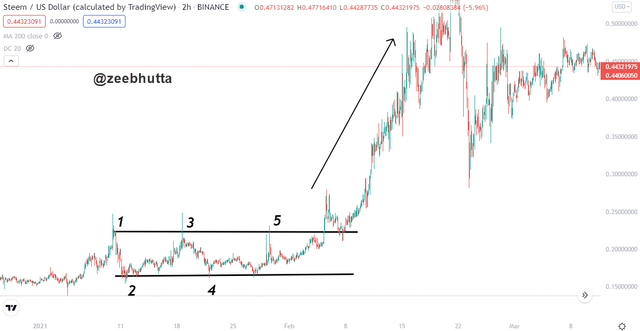

In the financial market, there are several chart patterns like head & shoulder, double bottom/top, symmetrical triangle, bull flag, bear flag, and a lot more. The rectangle is also one of the renowned patterns that give a signal about the future price action of the commodity. Just like the name represents, it is similar to rectangle in which the price consolidates.

Unlike other patterns, rectangles can’t be easily found in the market. Additionally, there are some criteria that one has to follow in order to make sure that it is valid. The most important thing to consider is the lines. This pattern is made up of a top trendline that works as a resistance and a bottom trendline that is a potential support. The price has to consolidate between these lines and must touch each line at least 2 times to make the pattern valid.

Once the pattern is identified in the market, we have to wait for the breakout in any direction. Once the price closes the candle above any trendline, we can enter the trade. As you can see from the example from the chart of STEEM/USDT the price formed a rectangle and started a strong bullish trend after breaking out the top trendline.

2. How to identify Rectangles. Explain with Screenshots.

2. How to identify Rectangles. Explain with Screenshots.

It can be difficult to identify rectangles in the market but there are some factors to consider and it will be effortless to find them. I will share each of them along with an example so that you can fully understand the concept and use it for trading.

Horizontal Trendlines

One of the primary elements that form a rectangle is horizontal trendlines. If you find the price moving in a horizontal range, then you have to draw a top and bottom trendline that will work as a support and resistance to price and keeps on consolidating in a range. As you can observe from the below-mentioned image that I have drawn a top trendline and bottom trendline and the price is moving between the lines.

Finding Undershoot & Overshoot

Undershoot refers to the strong price movement to the downward direction before forming a bottom triangle and the same goes for overshoot as the price makes a bullish structure and ends up making a top rectangle. It is said that these scenarios occur in order to confuse the amateur trader.

Double Taps

Once the rectangle pattern is formed, we have to look out for at least 2 taps in the upper trendline and bottom trendline. That shows that trendlines are truly working as a support and resistance. Further, it is important to understand that the pattern won’t be valid if it doesn’t touch the trendline 2 or more times. The below-mentioned chart of DOT/USDT is the best example as you can see the price has tapped the trendline twice which makes the pattern valid.

The summary of this answer is that we have to consider overshoot, undershoot, price taps, and horizontal trendlines to make sure that pattern is valid. Otherwise, if we force the chart to make a rectangle and open trade without the aforementioned confluence, then it won’t be a wise decision.

3. Can we use indicators with this pattern to get accurate results? Explain with Screenshots.

3. Can we use indicators with this pattern to get accurate results? Explain with Screenshots.

If you want to trade in the financial market, then the technical analysis is the best option to get maximum profits but is essential to understand that you need a great grip on price action and indicators. The bottom line is that you need to add as much confluence as possible. It will help you to predict the future price with confidence and keep your bias strong.

That’s the key reason due to which I would prefer to use technical indicators with rectangle patterns. I use several indicators like RSI, MACD, MA, Donchian Channel, and Stochastic Oscillator. Further, I will show you how they can help while trading rectangle patterns.

As you can see from the following chart of DOT/USDT that it has formed a rectangle pattern. Now that we know that price can manipulate us sometimes through a breakout so how would someone recognize whether it's fake or not? It’s simply with the help of indicators. Just observe that price broke the lower trendline and I have used RSI which shows that price is oversold which adds more confluence to the downward trend. So, I can open a short position without worrying about the fake breakout.

4. Explain Rectangle Tops and Rectangle Bottoms in your own words with Screenshots of both patterns.

4. Explain Rectangle Tops and Rectangle Bottoms in your own words with Screenshots of both patterns.

Rectangle chart patterns can be classified into further 2 patterns that are known as rectangle tops and rectangle bottoms. Let’s discuss each one:

Rectangle Tops

Rectangle tops are formed when the price makes a strong bullish move and then consolidates for a while in a range that will form a rectangle. It is formed at the top of the market due to which it is called rectangle tops. However, the outcome of this pattern is bearish.

From the below-mentioned chart pattern of TRX/USDT, you can find out the that price was in a strong uptrend and then it formed a rectangle. Later, the price broke the support trendline and started a bearish trend.

Rectangle Bottoms

Rectangle bottoms are the complete opposite of rectangle tops. This pattern is formed at the bottom of the chart. So, it can be found after a strong downtrend and indicates that price will make a bullish move after breaking out from the upper trendline.

The KSM/USDT chart is the perfect example as you can see that price made a bearish move and formed a rectangle bottom. After breaking out from the rectangle, it started a strong bullish move.

5. Show full trade setup using this pattern for both trends. (Entry Point, Take Profit, Stop Loss, Breakout)

5. Show full trade setup using this pattern for both trends. (Entry Point, Take Profit, Stop Loss, Breakout)

Rectangle Top

The rectangle top is formed at the top of the market. As you can see from the chart of RSR/USDT that it started with a bullish trend and then the price formed a rectangle top pattern which predicts a bearish move. As soon as the price broke the lower resistance line, I opened my short position with a tight stop loss above the resistance line. My risk to reward ratio was 1:5 and you can see that my TP was successfully hit.

Rectangle Bottom

Rectangle bottom is formed after the price makes a bearish move. Similarly, OMG/USDT made a rectangle after a strong downtrend which means that price has the potential to start a bullish move after breaking out. So, when the price broke the resistance line, I opened my long position by putting my stop loss below the support line with a risk to reward ratio of 1:5. You can observe that the price successfully reached the TP area.

6. Conclusion

I have learned about several chart patterns but what makes rectangle so essential is that it gives traders clear insight about future price action after. This pattern not only gives a clear prediction about future price action but it can provide huge profit if a trader can recognize top and bottom rectangles.

Thanks For Visiting My Post And Your Appreciation

Cc:

@sachin08