Designed by @zeebhutta Using Canva

THEORY

Explain and define in your own words what the “VWAP” indicator is and how it is calculated (Nothing taken from the internet)?

Explain in your own words how the “Strategy with the VWAP indicator should be applied correctly (Show at least 2 examples of possible inputs with the indicator, only own charts)?

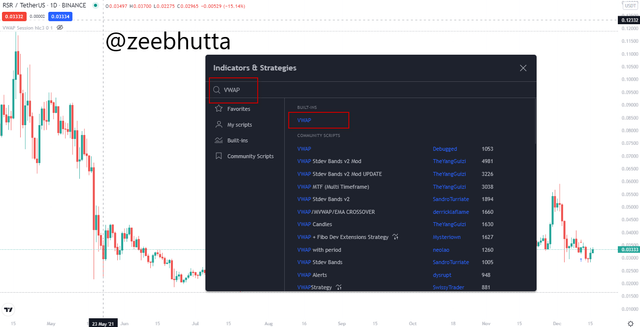

- The first step is to open any chart pattern of crypto and click on the “INDICATOR” on the top bar that I have highlighted.

- Once clicked, write “VWAP” on the search bar and it will show you the indicator and you have to click on it to apply the indicator on the chart.

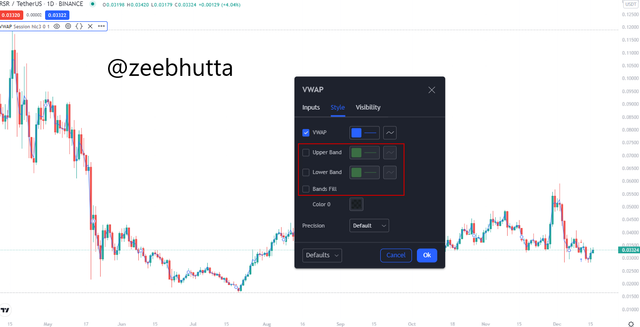

- The VWAP will be applied on the chart but we have to remove the upper band, lower band, and band fill from the settings. I have marked them on the mentioned image. I will increase the thickness and change the color to black for better representation.

- That’s how easy it is to apply the VWAP on the chart.

Break of Structure

Applying Fibonacci Retracement

Trade Management

Explain in detail the trade entry and exit criteria to take into account to correctly apply the strategy with the VWAP indicator?

We have to be sure about the break of the market structure and VWAP so that we can enter the trade. It shouldn’t be a breakout but a complete change of structure with great volume so that the first criteria can be met. So, the bottom line is that the previous high or low must be broken for trend reversal.

Once the market structure is broken, we have to wait for the price to retrace back and touch the VWAP along with the golden ratio of a Fibonacci retracement so that we can enter the trade. If it doesn’t retrace to our target point, then we have to consider it invalid.

Risk management is very important for every trader due to which stop loss must be placed below the 50% or 61.8% of Fibonacci retracement.

The risk to reward ratio should be around 1:5 or 1:2.

PRACTICAL

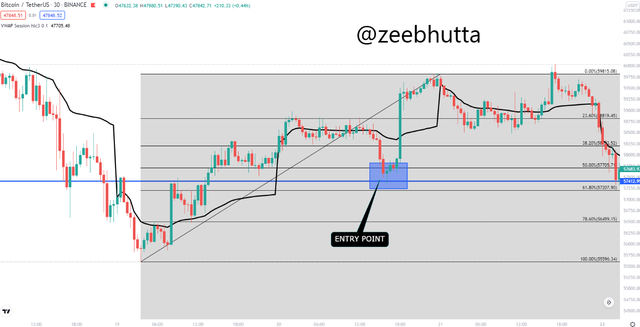

PRACTICAL Make 2 entries (One bullish and one bearish), using the strategy with the “VWAP” indicator. These entries must be made in a demo account, keep in mind that it is not enough just to place the images of the entry, you must place additional images to observe their development in order to be correctly evaluated.Bullish Demo TradeIn order to show you a bullish example of the VWAP strategy, I have used a chart of ANT/USDT. The price was in a complete downtrend but the price broke the previous low along with the VWAP line which is the sign of a break of market structure. So, the first criteria were fully met.The next thing is to apply the Fibonacci retracement so that I can enter the trade when the price retraces between the golden ratio. The price successfully came to my entry point and I opened a long position by placing a stop loss below 61.8% while the TP was according to the RR of 1:5.You can see that price is bullish which means the prediction was perfect and the price easily hit the TP.

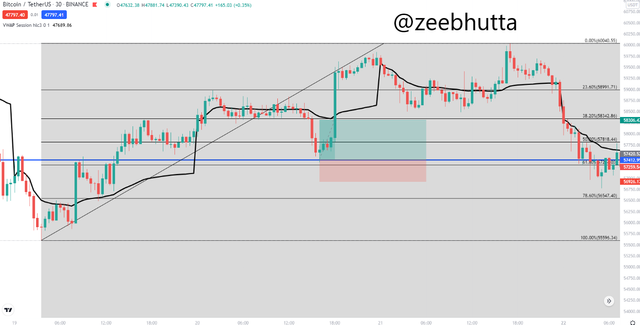

Make 2 entries (One bullish and one bearish), using the strategy with the “VWAP” indicator. These entries must be made in a demo account, keep in mind that it is not enough just to place the images of the entry, you must place additional images to observe their development in order to be correctly evaluated.Bullish Demo TradeIn order to show you a bullish example of the VWAP strategy, I have used a chart of ANT/USDT. The price was in a complete downtrend but the price broke the previous low along with the VWAP line which is the sign of a break of market structure. So, the first criteria were fully met.The next thing is to apply the Fibonacci retracement so that I can enter the trade when the price retraces between the golden ratio. The price successfully came to my entry point and I opened a long position by placing a stop loss below 61.8% while the TP was according to the RR of 1:5.You can see that price is bullish which means the prediction was perfect and the price easily hit the TP. Bearish Demo TradeNow I will represent a bearish example of this strategy on the chart of BAND/USDT. Observe that price was making a series of high but it broke the previous high which is the sign of break of market structure. So, our first criteria were fully met and we can move to the next step.I applied a Fibonacci retracement on an impulse move of the price and waited for the price to come between the golden ratio. Once it did, I entered the trade and shorted the asset with a risk to return ratio of 1:5 while the stop loss was above 61.8%.You can see that the price was bearish which makes my trade valid.

Bearish Demo TradeNow I will represent a bearish example of this strategy on the chart of BAND/USDT. Observe that price was making a series of high but it broke the previous high which is the sign of break of market structure. So, our first criteria were fully met and we can move to the next step.I applied a Fibonacci retracement on an impulse move of the price and waited for the price to come between the golden ratio. Once it did, I entered the trade and shorted the asset with a risk to return ratio of 1:5 while the stop loss was above 61.8%.You can see that the price was bearish which makes my trade valid. ConclusionThe conclusion of this homework is that VWAP is one of the best indicators that can provide great signals based on the present data of the asset. Plus, the strategy provided by the professor can give us huge profit if the criteria are fully met.

ConclusionThe conclusion of this homework is that VWAP is one of the best indicators that can provide great signals based on the present data of the asset. Plus, the strategy provided by the professor can give us huge profit if the criteria are fully met.

Thanks For Visiting My Post And Your Appreciation

Cc:

@lenonmc21