Designed by @zeebhutta Using Canva

Greeting Everyone,

I hope you guys are doing well. In the 5th season of the Crypto Academy, we have learned a lot about crypto trading which includes strategies and chart patterns but professor

@reminiscence01 has provided us with the most important lecture for every trader which is risk management. I will be sharing details about this essential topic in my homework post.

What do you understand by "Risk Management"? What is the importance of risk management in Crypto Trading?

Risk Management

There are countless trading strategies that are recommended by people but all of them are not going to be effective in making a profit unless the risk is managed by the trader. Greed can affect everyone and it can seriously harm the sentiment and portfolio. It’s a fact that a trader wants to make a maximum profit without loss but this is the inevitable part that is faced throughout the trading career. There’s no way to avoid it but there’s a viable solution and that is to control your risk which can be done through good management skills.

You can open trade with any strategy but if the risk is not managed properly, then it has the ability to liquidate your position. Such scenarios can affect the trading mindset and make a person question its skills. However, if the profit is taken at the right time and stop-loss is placed accordingly, then not only it can improve the chance of winning streak but put the loss to minimal. So, to lead a successful career in crypto trading, it is essential for everyone to consider the risk to reward ratio, stop-loss and take profit according to the strategy to make profit. Even if your trade is going against your prediction, risk management can reduce the total loss.

Importance of Risk Management

No one advises to start trading in the crypto market without learning risk management first. The core reason is that market is very volatile due to which a single trade can get a person liquidated in no time. I also believe that trading strategies are worth nothing without risk management because if it is not applied, then it can give profit at some point but take out the entire portfolio as well.

There’s nothing except risk management that can help in sustaining the profit and minimizing the loss. It is sort of difficult to understand its importance by reading so I will demonstrate an example so that you can find out why it is important for everyone to implement it while trading crypto.

Suppose that you have a capital of $1000 and took a trade by risking 1% of your portfolio which would be a total of $10. On the other hand, your risk to reward ratio is 1:5 which means that if the TP gets hit, then you will get a total profit of $15.

Now consider that 5 of your trade hits the stop loss so it means that your portfolio will stand at $950 which gives you enough margin to recover the loss amount in the future.

But if you would have risk around 3-5% person of capital per trade, then a few failed setups would have seriously affected the portfolio and it won’t be long that it swipes the entire capital.

So, risk management is all about risking a limited portion of your portfolio and booking such profit that can recover at least the loss of previously failed setups. Further, it can give you confidence while trading and help you to control your emotions which is one of the most inevitable things for traders.

Explain the following Risk Management tools and give an illustrative example of each of them.

a) 1% Rule.

One of the most common mistakes that every trader makes in the crypto market is that they don’t manage their capital while opening a position. Not doing so can seriously affect the profits that have been made in the previous setups and that’s why everyone should follow the 1% rule. It is a concept in which a trader must use only 1% of capital so it can minimize the loss in case the stop loss gets hit.

It totally depends upon the traders to choose how much they want to invest per trade. The majority prefers 1% while there are some who prefer 2-3%. However, it is advised to start with a minimum percentage and keep it that way to sustain the profit because if you are trading with a high percentage of capital per trade, then a single stop loss hit can take down the profit of multiple trades.

Illustrative Example of 1% Rule

Now I will give you an example of the 1% rule through the CHZ/USDT chart so that you can understand how you can leverage this concept while trading in the crypto market. I opened a demo account on tradingview with $1000. As you can see that the price was in a downtrend but broke the resistance which is a long signal.

Since I had a capital of $1000, I will be only risking $10 according to the 1% rule per trade in case the stop loss hits. The take profit was 1.5x the stop loss which means that I will gain $15 once the TP hits.

Screenshot Source

Now let’s do some calculations here to understand why the 1% rule is essential. Suppose that 5 of my trades hit the stop loss which will decrease the capital by $50 making it a total of $950. I can still recover loss through a few setups but if I would have opted for a high percentage, then it would become difficult to recover the lost capital.

b) Risk-reward ratio.

A risk-reward ratio is an important tool which is also referred to as RR. It is the process in which you decide how much profit you have decided to book as compared to the risk you were taking. Most of the traders who don’t pay attention to risk management and never realize how much they are making or risking. Suppose that some of your trades hit the TP, but if you don’t manage the risk of another setup, then a single trade will be taking out the entire profit. That’s why it is always advised that reward should be greater than the risk.

The professional traders recommend that the reward should be around 1.5x or 2x the risk so that a single profitable trade can cover twice the failed setup.

Illustrative Example of Risk-reward ratio

You can see that ROSE/USDT made a falling wedge and broke out with great volume which is a long signal. I opened the trade by risking 1% of my capital which was $10 while the RR of 2:2. So, when the TP hits, I will be able to get a profit of $20 which is twice the amount I was risking in this trade.

The reason to opt for a good reward ratio is that it can cover the previous loss but trading with 1:1 is risky as it can bring no profit and barely covers the loss.

Screenshot Source

c) Stoploss and take profit.

Stoploss and take profit are major tools in risk management. It is the act of booking profit when the price reaches the TP and closing the position when the price retraces to the opposite direction in order to save funds from liquidation. Amateur traders don’t place stop loss and take profit on their trades and that’s why the loss occurs and doesn’t get to book the profit right on time. I will explain each of them with complete details with an example as well for a better understanding of this tool.

Take profit is the tool that helps us to book the profit when the price reaches the desired area of the chart. You can not observe the price action 24/7 due to which this tool is applied so that it can automatically book the profit. Plus, you might have observed that the majority of the time the price reaches the TP and goes back to its previous structure. So, it is essential to make sure that you get the profit even if you are observing the chart or not.

As for the stop loss, it helps the trader to minimize the loss as it closes the position right away when the price goes in the opposite direction of the setup. It is of great importance because it saves from liquidity and secures the capital from great loss.

Illustrative Example of Stoploss and take profit

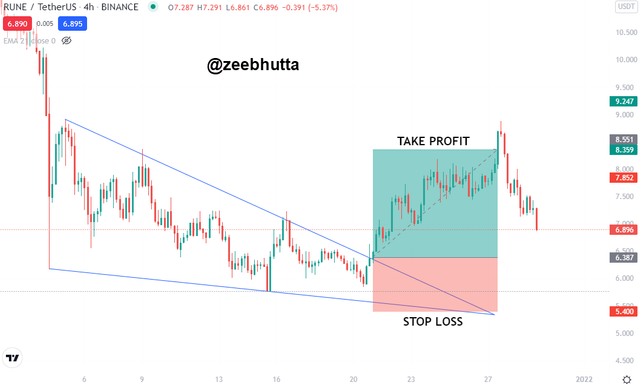

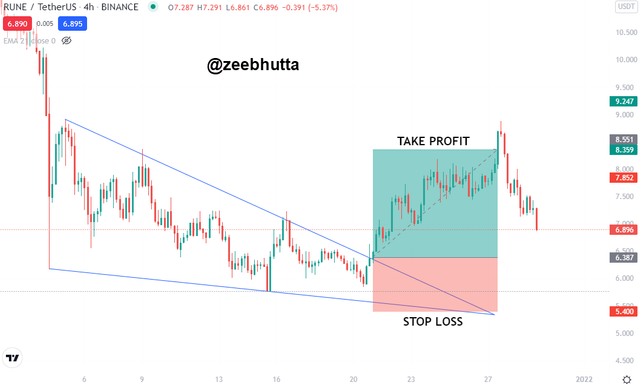

Now I will show you an example of placing stop loss and take profit in a live chart so that you can understand its importance while trading in the crypto market.

Observe the mentioned chart and you can see that a falling wedge was formed. I opened a long position with a risk-reward ratio of 2. I placed stop loss below the major support zone so if the price starts a strong downtrend, then the position can be automatically closed with minor loss. The TP was placed according to RR so that profit can be booked when it reaches the expected price.

Screenshot Source

Open a demo account with $100 and place two demo trades on the following;(Original Screenshots on Crypto pair required).

a) Trend Reversal using Market Structure.

b) Trend Continuation using Market Structure.

The following are expected from the trade.

1. Explain the trade criteria.

2. Explain how much you are risking on the $100 account using the 1% rule

3. Calculate the risk-reward ratio for the trade to determine stop loss and take profit positions.

4. Place your stop loss and take a profit position using the exit criteria for market structure.

(Show demo account balance and proof of trade execution)

This is the practical question of my homework post in which I will make 2 demo trades which will be done through simple price action of trend reversal and trend continuation using market structure. My trades will represent the understanding of risk management and it will also clear the concept of using tools like risk-reward ratio, stop loss, and much more.

Trend Reversal using Market Structure

I will demonstrate the first demo trade that will be done when the price will reverse the trend which will be identified through the market structure. I have opted for the MATIC/USDT chart to explain everything about risk management including entry and exit criteria.

Entry Criteria

The entry criteria of my setup were that the price was making a series of lower lows and lower highs which is the sign of a downtrend. However, it failed to sustain the trend and broke the previous low which indicates a break of market structure and change in trend.

Next thing was to wait for the price to retest the broken high to make sure that it has become potential support to the price. Once the retest is successfully done, we have to wait for the bullish engulfing candle which is a confluence to uptrend, then we can open long position on the asset.

Screenshot Source

Exit Criteria

- The best way in my opinion to exit is to set your TP at the previous high. Sometimes, it won’t give enough RR but you can sell assets at various TP according to the risk-reward ratio. You can see that I have marked the resistance with a blue line and that was TP.

Screenshot Source

Calculating RR to Find Out the Stop Loss and Take Profit

I opened a demo account on tradingview with the capital of $100,000 to execute the setup. I decided to risk 0.5% on each trade. Let’s calculate the total amount that I can risk per trade.

Risk Amount = $100,000 X 0.5 / 100

Risk Amount = $500

I will risk $500 in this trade. As for the reward, I opened the trade with the ratio of 1:5 which means that if the setup hits the stop loss, then the total loss amount will be $500 and in case the asset hits the TP, then the profit will be $1000.

Considering the risk-reward ratio, I placed the stop loss on 2.580 and take profit on 2.618.

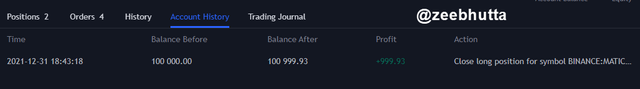

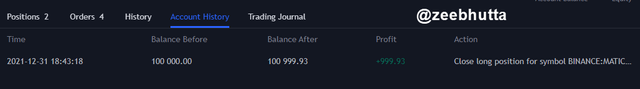

Proof of Trade Execution

The price hits my TP easily and I have attached the screenshot of the tradingview which shows the total profit made from this setup. So, I was successful in executing the trade with proper risk management.

Screenshot Source

Trend Continuation using Market Structure

I will open a demo trade on MANA/USDT chart through a simple price action strategy that is trend continuation through the market structure. I have explained everything like entry criteria, exit criteria, risk-reward ratio, and much more in the following sections:

Entry Criteria

The first criteria were to observe the market structure and make sure that it is in a clear direction. You can see from the mentioned chart that I have marked the series of higher lows and higher highs which simply indicates that the price is in a bullish trend.

The second criteria were to find a perfect entry point which I did when the price was retraced to the previous high as marked by the blue line because it works as a support in bullish trends.

The third entry criteria were a bullish engulfing candle and when it was formed, I opened a long position.

Screenshot Source

Exit Criteria

- My exit criteria were that when the asset reaches my reward price, then I will simply exit the trade with profit. Otherwise, closing position when the price touches resistance is also a good idea but the risk-reward ratio was fulfilled before the resistance zone so it wasn’t necessary for my setup.

Calculating RR to Find Out the Stop Loss and Take Profit

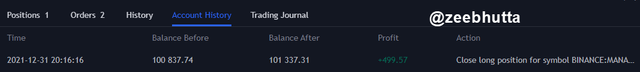

I will be risking 0.25% on this trade as well which is a total of $250 according to the $100,000 capital of my demo account. So, my risk-reward ratio was around 1:5 and which means that the stop loss will be 3.3517 and take profit is 3.4094 which will get me total gain of $500.

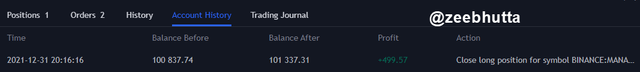

Proof of Trade Execution

You can see from the below-mentioned 2 images that the TP was finally hit and profit was booked right away making my trade successful.

Screenshot Source

Screenshot Source

Conclusion

After attempting the entire homework, I would like to conclude that risk management is very important for every trade as it can incredibly reduce the chances of loss to a great extent and boost the confidence of a trader as well. The demo trades also helped me to practice the risk management tools and It will be also assist me in real-time trades.

Thanks For Visiting My Post And Your Appreciation

Cc:

@reminiscence01

Hello @zeebhutta, I’m glad you participated in the 7th week Season 5 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

That's correct.

yes, Traders are required to pay attention to their risk to reward ratios.

Recommendation / Feedback:

Thank you for submitting your homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank You Professor

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit