Hello to everyone out there, I would love to join Prof. @reminiscence01 to welcome each and everyone to the seventh week of this season. The topic for this week is DeFi Products and I'll try my best to give detailed answers to the test questions listed. If you reach the requirements, you could join me to do same my reading up the lesson on this link.

1.)

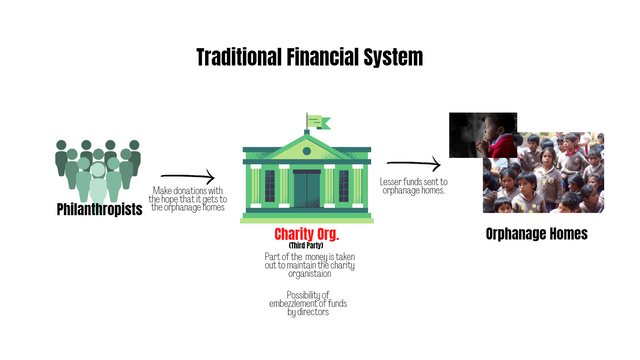

A financial system is a network of institutions facilitating all money operations; loans, savings, allowing transfers or exchange of assets between two parties. Today, the systems we use for the movement, investment and storage of our cash is centralised. That is, it is owned or controlled by central authorities.

Having talked about the financial system today, if we should be honest with ourselves, visualizing our experiences with people and projects directed by them, there is always that tendency of mismanagement, greed and even corruption. There will always be those policies shaped to help the owners make more money. Due to all these negative characteristics of the centralised system of the financial system, there was need for the introduction of the decentralised financial system in 2017.

DeFi Products

DeFi, also known as decentralised finance are monetary services that can't be controlled by the banks or any government policy. From this we can say that the DeFi products are simply tools or applications that are used to engage in all real world financial services without the involvement of the government, banks or any intermediaries.

Mechanism of the DeFi Products

Like I said, this DeFi products are decentralised and can't run like other traditional centralised applications. They can only be created on a platform that can support its program. Well, with platforms like Ethereum, this is made possible. Ethereum is a Do It Yourself (DIY) platform that can be used in making decentralised applications. Programmers of the DeFi products can use solidity (a programming languange understood on the ethereum platform) to write automatic codes or smart contracts.

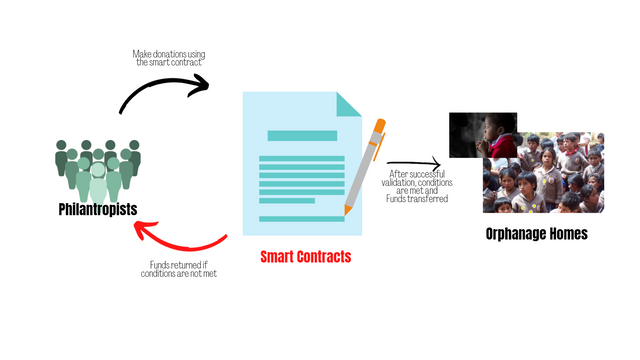

Without a central authority, the operations of this DeFi products can only be made possible with the use of smart contracts. Smart contracts here are simply just like real life contacts. Difference is that they are digital. They are programs built inside a blockchain, bounded by some rules. Once initiated on a dApp by a programmer, they are fixed and can't be changed. Smart contracts are enforced by all nodes in a network and ensures safe transactions on the blockchain without the need of third parties or intermediaries. There is always an assurance that with or without familiarity between participants in a transaction if conditions are not met, their funds will be returned to them.

How the DeFi products shape today's Finance

Today, there are a lot of DeFi applications out there, all created to facilitate faster and cheaper transactions without the need of intermediaries. Users enjoy smooth and continuous transactions with no form of restrictions from any intermediary. With the introduction of Defi, banks, insurance companies etc all ran by an entrepreneur or the government have been replaced with some cool decentralised applications.

- Real life assets normally preserved in commercial banks that can one day close (you never know) can now be made digital and stored in form of cryptocurrencies in decentralised wallets.

- There are now possibility to take loans from DeFi products like AAVE and bZx

- Cryptocurrencies can be swapped on decentralised exchanges like Justswap and Uniswap

- Insurance DeFi products like Opyn and Nexus Mutual

With this cool dApps, life has been made easier and users are guaranteed of the safety of their digital assets. . Although, I must say DeFi is still in its infancy but recently there has increase in the marketcap value of these DeFi projects and this means that people are gradually drifting from the centralised financial systems to decentralised financial system. Intermediaries are eliminated and this is a good thing.

Benefits of DeFi Products

Reduced Cost: The centralised system of finance are normally owned by an individual or a group of investors and these group of people are determined to make the highest obtainable profit. Higher profit are reflected as there is increase in their transaction fees and this makes the Defi better and less expensive to transact with.

Higher Security: DeFi products are decentralised, meaning there isn't a central server and this makes it impossible for the products to be hacked. Also products like the decentralised wallets are created in a manner to ensure that the owner of the wallet is in total control of all operations that go on with his assets. All private keys are vested in the hands of the owner of the wallets, he is the one that manages the keys unlike the CEX where the keys are controlled by the exchange.

Immutability: The Defi products are coded in a rigid manner. They are created with a tool called the smart contract which makes it impossible for its featured to be changed, even by the developers of this product once it is lauched on the network smart chain. Also, it's transactions are stored or registered on a digitalised ledger called the blockchain which can not be edited or revised by anyone.

Transparency: The DeFi products are created as open source tools and this allows users the opportunity to analyse each tool and understand what they do or how authentic these products can be. Aside that, transactions are all stored on the blockchain whic is easy to access by all users on the platform. The same way the Professors know how much we've been powering upm and how much we've been cashing out.

2.)

Pancake swap is a decentralised exchange built on the binance smart chain. It was invention in September 2020. Unfortunately, the developers of this beautiful exchange are said to be anonymous. Unlike the centralised exchanges where orderbooks and market makers are used to provide liquidity for transactions, the pancakeswap is known as an automatic market maker which uses liquidity pools to provide liquidity and volume in these liquidity pools to determine prices.

The token on the Pancake swap is called CAKE

.png)

Well, currently the cake token has a circulating supply of 237,155,995.18 units of cake and unfortunately, there is a max supply for the coin. It has a marketcap of $4,270,677,663

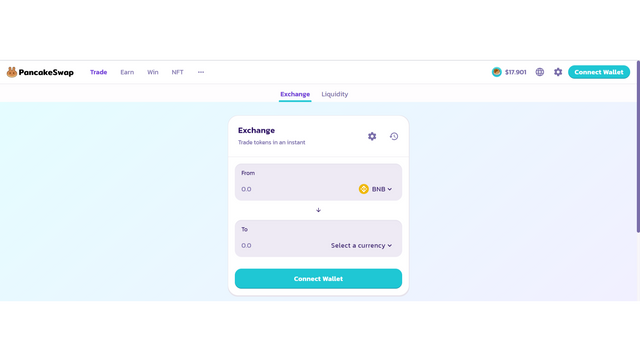

The Exchange

The exchange is where BEP20 tokens are traded

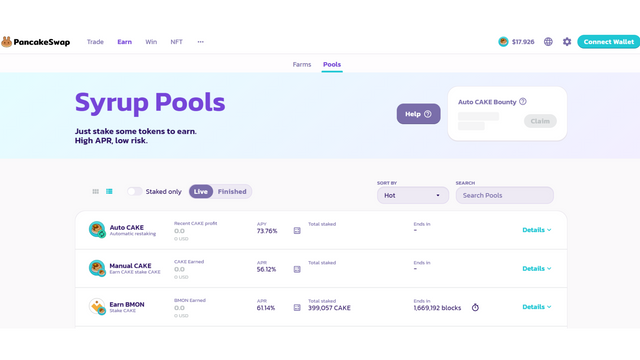

The Liquidity Pool

On Pancakeswap, its liquidity pool is called Syrup Pools. Here BEP20 are given off to the pools by users in order to add liquidity to the exchange. Overtime these users are being rewarded with the cake token.

The pancakswap has its special characteristics and features which makes it different from other decentralised exchanges like UNISWAP

Since the Pancake swap is built on the binance smart chain, it is very fast and offers cheaper transaction fees compared to the UNISWAP.

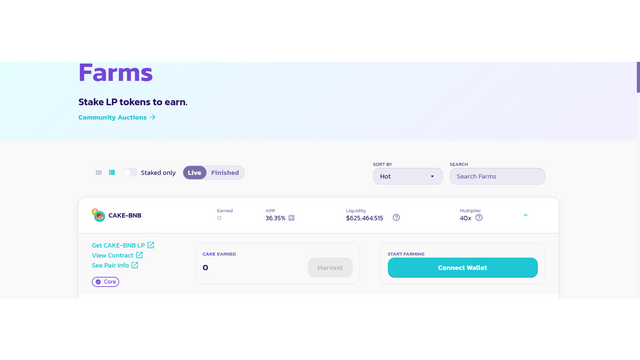

Pancake has another feature called farming where you can stake Liquidity Provider tokens to be rewarded or to harvest cake. Currently, cake is worth 17.92 USDT for a unit.

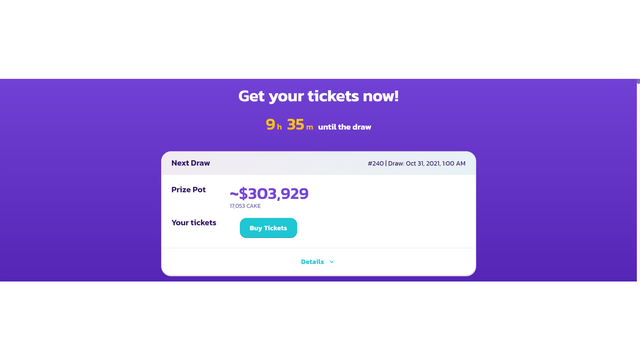

- There is also a lottery feature that lets you gamble. You buy a ticket worth 10 Cake. Each lottery has a duration of 6 hours, once the lottery is over, if the number on any of your ticket matches the numbers on a winning ticket to receive rewards of 50% of the total cakes staked in the lottery. What I mean by that is if you have a ticket with 5-8-6-14 and the winning ticket has the same digits you win the lottery. There are also some rewards given to users with two or three numbers on the winning ticket. Let's say another user got 5-10-7-14, then he still get some rewards.

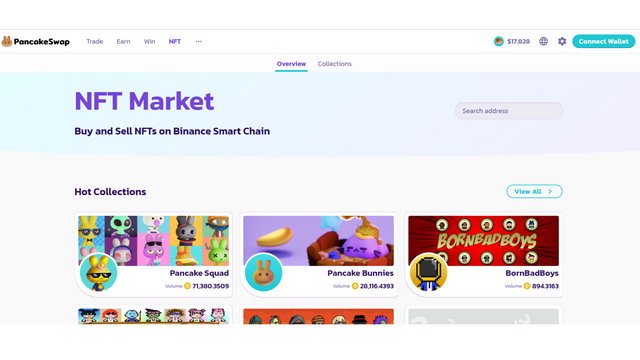

NFT markets

NFTs can be bought and sold here

Overview

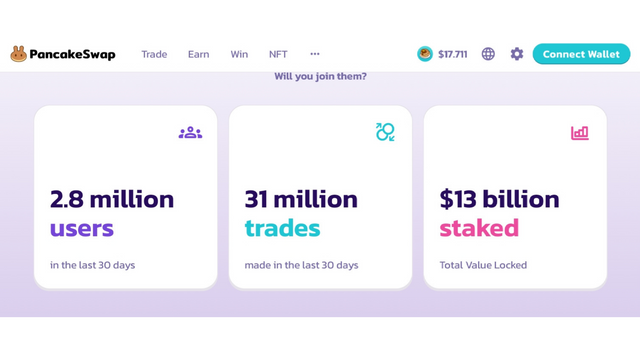

The growth of Pancakeswap is massive, it currently has the highest number of users of all decentralized exchanges. There has been 31 million trades on the platform and the total value staked in the syrup pools are up to 13 billion USD.

.png)

From the image above you can see that the pancakeswap has liquidity of 6.12 billion dollars and a 24 hours trading volume of 1.03 billion dollars. This means the pancakeswap platform has a lot of users and high liquidity for a decentralised exchange. Herby greasing and improving the exchange with faster transactions.

.png)

The pancakeswap platform is a very popular exchange especially in these meme token days. Currently it is ranked 1st right above the UNISWAP and from the stats I've seen, it is surely the best. The devs also did a superb job on the interface, It has special features like the lottery which lends to lure more investors into the platform. everybody loves a good gamble.

Justswap is a decentralised exchange on the tron blockchain. It was created to displace UNISWAP which is on the ethereum blockchain. Justswap was created by Justin Sun in August 2020 to displace Ethereum's UNISWAP. Over the few months of its existence, it has displayed reasons for its high necessity on the Tron Blockchain because of its liquidity pool.

Investors can provide any amount of TRC20 tokens pairs to be used in transactions and the platform rewards them with some rewards overtime. They get rewarded with 0.3% of the worth of any transaction on the justswap exchange.

The Justswap token is called TRX

.png)

From the picture above we can see that TRX has a market cap of $7,197,003,919 and a circulating volume of 71.66 billion units of TRX. Just like the CAKE token, there isn't a max supply for the TRX token.

.png)

The exchange for the Justswap platform is called Swap, here you can trade any TRC20 token. On the image above, you can see the TVL, Total Locked Value which is $1,613,644,477.

.png)

Above is the Liquidity pool, we talked about that earlier. Here investors can provide any amount of TRC token pair. Overtime, they receive some rewards according to how much they staked.

.png)

Above is the WTRX Exchange, here the native TRX tokens can be exchanged to WTRX tokens. They have the same value.

.png)

**

This is the WBTT exchange, native BTT can be changed here to WBTT. They are also of the same value.

.png)

Above is the SUN redomination plan page above on the Justswap platform, the plan was to redominate the SUN token, increasing the former supply by 1000. Now the former SUN tokens are called SUNOLD and the new SUN. Here is the page to exchange them.

.png)

The value for Liquidity above is the TVL I explained above. It is the amount of tokens in dollars that can be found in the liquidity pool. On the right hand side, the 24hr trading volume is $192,989,028. The trading volume on the pancakeswap is higher by far.

The Justswap platform is also a nice DEX platform, it is ranked 16 on coingecko.

.png)

On Justswap, its feature of rewarding liquidators with 0.3% of every transaction is nice one. I know it may find its way up the chart in future but to me, I would prefer the pancakeswap DEX to the Justswap. The developers really put in enough work.

3.)

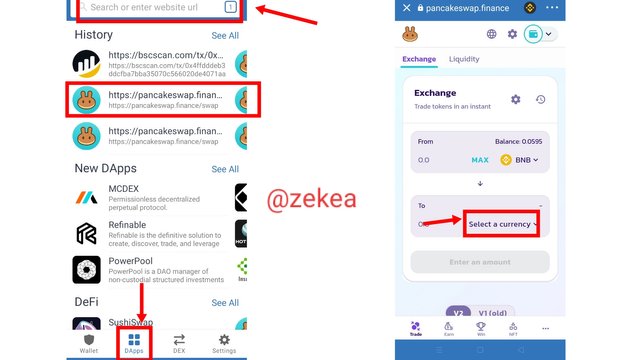

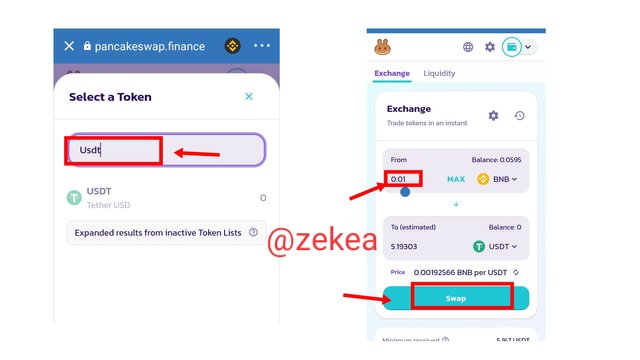

- Sign into your trust wallet

Click on dApps then search for pancakeswap on the search bar

Click on pancake swap

On the pancake swap exchange page, click on select a currency

- Click on USDT then input the amount of BNB you want to swap

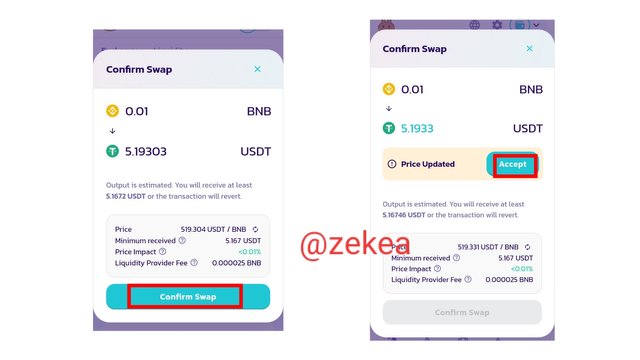

- Click on confirm swap

- On the next page, click on accept

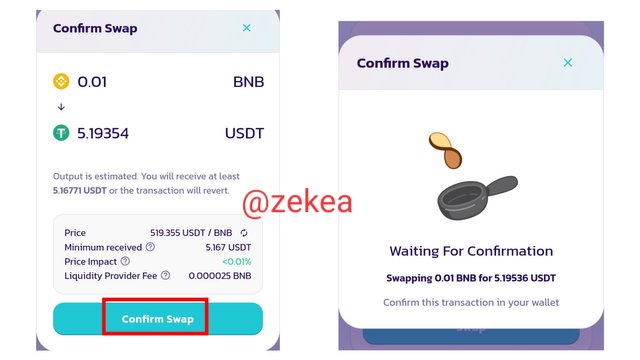

- From the pop up menu, click on confirm swap

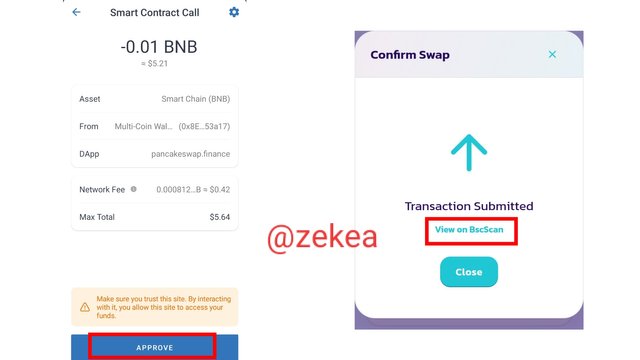

- Approve the transaction from the prompt menu

Transaction complete!!

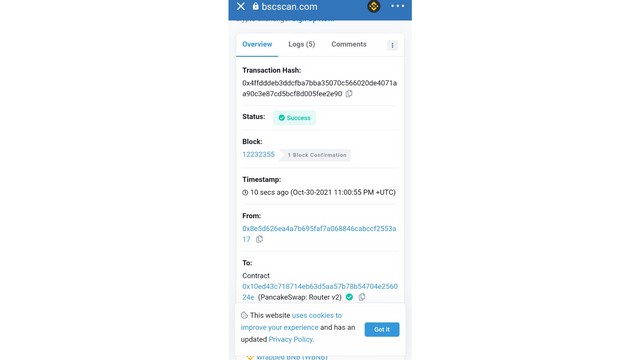

Proof Of Transaction From Block Explorer

- On the "successfull" pop up menu, click on view on BSCscan

- Above is the proof!

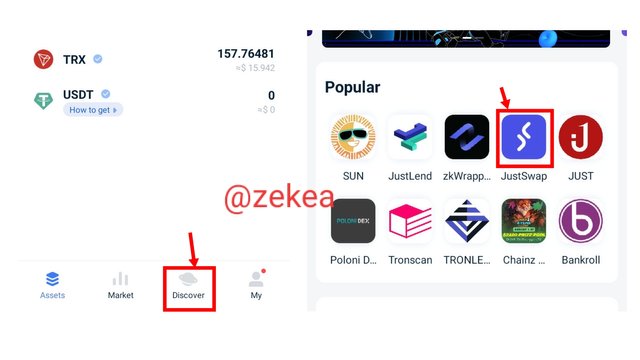

- Log in to your account on the tron Tronlink application

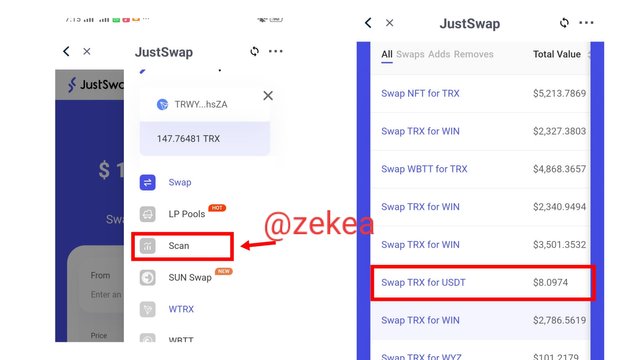

- On the home page, click on Discover, then click on the Justswap icon on the next screen

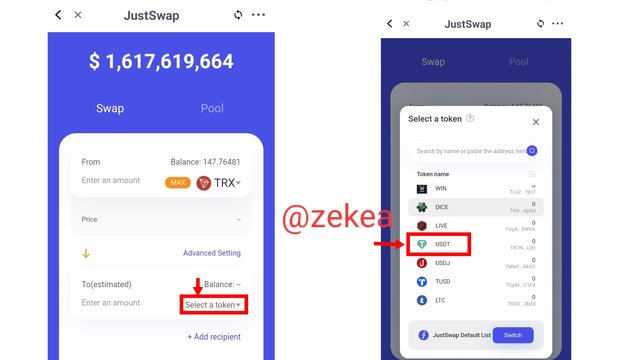

I am trading TRX for USDT. TRX is already selected so I'll have to move to the next option. Click on the highlighted select a token* on the Justswap Swap screen.

Select USDT on the pop up screen.

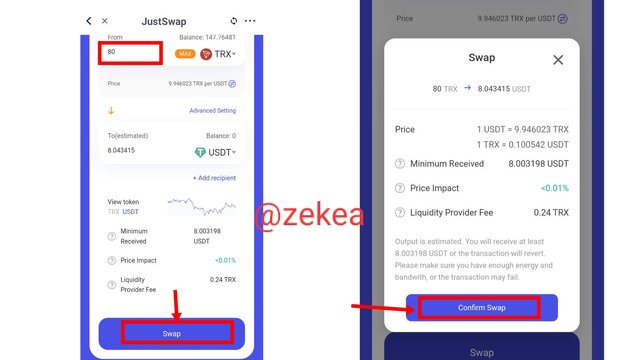

Insert the amounts of tokens you want to swap, then click on swap.

On the pop up screen, click on Confirm Swap

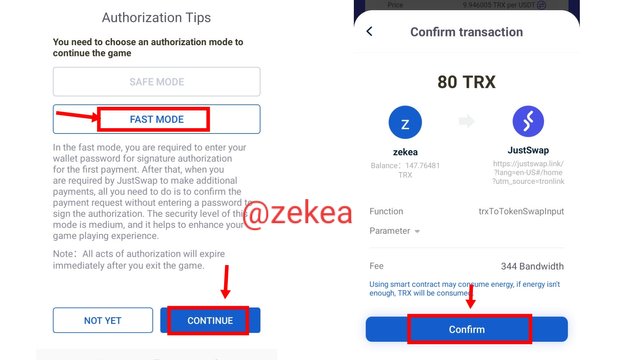

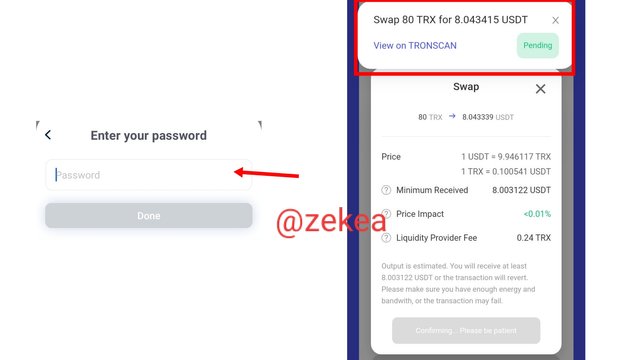

Select Fast Mode then click on Continue

On the pop up sctreen, click Confirm.

Insert your password and click on Done

On the next screen you can see that the transaction was successful.

Proof Of Transaction From Block Explorer

.png)

- Load up tronscan.org and paste your public key in the search bar

_LI.jpg)

- Click on transactions below, then select the hash of the justswap transaction

.png)

- Here is the hash link

From what I noticed in the transactions, they were so fast and that is because of the liquidity pools. Decentralised exchanges are the future of the financial system, they provide users with opportunities to make more cash of the liquidity pools.

DEXs like the pancakeswap even provide users with the opportunity to participate in making more cash off the lottery platform. I just can't wait to for a time were banks will be closed and the DEFi products are officially allowed in countries.

Thank you for the wonderful lesson Prof. @reminiscence01

I received 11.368 SBD, changed it to steem and decided to power up 100% of my payouts this week, 138 steem

.png)

Here is the link to my steemit wallet.