Hello to everyone out there, I would love to join Prof. @imagen to welcome each and everyone to the first week of this season. The topic for this week is Exchange Coins and I'll try my best to give detailed answers to the test questions listed. If you reach the requirements, you could join me to do same my reading up the lesson on this link.

1.)

Some exchanges, whether centralised or decentralised have a certain digital asset native to the platform. These tokens are called exchange coins. They are developed by these exchanges and are utilized greatly for various purposes; allocating rewards to users who hold them and providing holders the right to make decisions on the growth of the platform.

Well, this is a wonderful lesson and I would select these two tokens:

- the HT token and

- the UNUS SED LEO token.

HT is a native coin of the Huobi exchange.

Short History Of Huobi

Huobi was developed in 2013 by a graduate of the Tsinghua in China. The founder is called Leon Li who was a former engineer for Oracle.

The exchange began to grow on a website called huobi.com before it experienced a massive capital of $10 million from a fund (the Dai Zhikang and Zhen fund in China).

Due to China's great economy and high population, the exchange reached great heights in its daily trading volume of 30 billion Yuan in Dec 2016. Unfortunately for Huobi, in Sept 2017, the China government banned cryptocurrency trading and this was an uneasy time. This made the exchange experience a crash in its daily trading volume hereby prompting its developers to expand internationally, placing its headquarters in South Korea.

.png)

In 2018, Huobi was launched in the US and today is ranked as the 6th best cryptocurrency exchange in the world with an exchange score of 7.7, at this time a 24 hour trading volume of $4,984,594,149 with 1031 markets.

Like I said above, its native coin is HT

Quick Analysis on the HT token

.png)

HT is a token launched on the Ethereum blockchain. It is ranked 83rd with a current price of $9.94 and currently has a market cap of $1,583,763,195. That's really huge. It has a circulating supply of 159,308,566.25 HT.

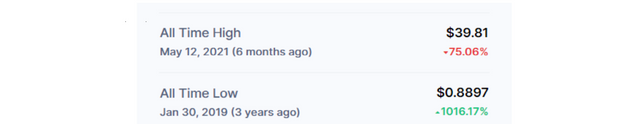

The HT token has an all time high of $39.81 early this year and an all time low of $0.8897 in Jan 2019. This shows that the HT token stands a chance of getting back up to $39.81 sometime in the future.

It can be acquired on Huobi Global, gate.io, finexbox. Generally, there are lots of exchanges to get the coin from.

.png)

The HT token is a good long investment token with an ROI of 564.51%. It is backed with the fact that it is used on the Huobi exchange to reward users in the loyalty program and HT holders also receive some substantial amount of coins according to their holdings during listings. HT holders also have the rights and privileges to vote and make decisions on the growth of the Huobi exchange.

Well, all of these advantages of holding the coin makes HT in high demand on the Huobi platform and with the massive growth over the years having weekly visits of 1,781,764, I believe the HT coins stands a chance of moving up the chart to top 20.

The UNUS SED LEO token is a native token of the Bitfinex exchange

Short History of Bitfinex

Bitfinex is a cryptocurrency exchange founded in late 2012 by Giancarlo Devacini and Raphael Nicholle. It is currently owned by iFinex. The bitfinex platform was first introduced as a P2P (Peer to Peer) exchange platform where users can transact with BTC amongst themselves with no intermediaries. It later expanded and gave support to exchange other tokens.

The Bitfinex is one of America's leading bitcoin exchange platforms which was known to be the reason for more than half the increase of the bitcoin price in late 2018. This was because the bitfinex exchange added BTC/USDT pairs and 80% of the bitcoin volume was traded with those pairs. A high percentage of the USDT holders where seen to be converting them to BTC and from the law of demand, this skyrocketed the BTC price and reduced the USDT price from $1 to $0.88.

.png)

Bitfinex is a very popular exchange and although it has experienced a lot of hacks in the past with poor banking relationships. It is ranked 8th on coinmarketcap with an exchange score of 7.5 and currently has a 24h trading volume of $1,484,556,212.

Like I said above, its native coin is UNUS SED LEO

Quick Analysis on the LEO token

The LEO tokens are unique tokens, they were launched on two different blockchains. 64% of the supply was issued on the Ethereum blockchain while 36% was issued on the EOS.

LEO has a mechanism which burns unutilised tokens at a rate. The coins are bought back and disposed monthly. The burning is said to stop once 100% of the tokens have been redeemed.

.png)

Well, the LEO token is ranked #55 with a current price of $3.20 and a current market cap of $3,075,578,573. It has a circulating supply of 953,954,130.00 LEO.

.png)

The LEO token has an all time high of $3.92 in May 2021 and an all time low of $0.8036 in late 2019.

It can be purchased on Bitfinex, Gate.io etc, with trading pairs of BTC, ETH and USDT.

The LEO token is a utility token of this bitfinex exchange and helps traders to cut down cost in transaction fees according to how much holdings of LEO the trader has.

2.)

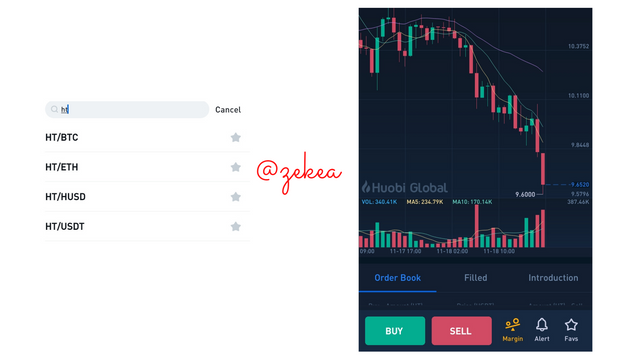

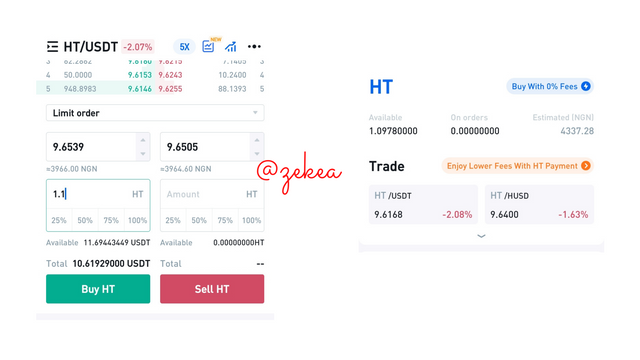

I transferred some USDT to the huobi exchange and went on to make a trade.

All Images in this section taken from Huobi mobile unless otherwise stated

- I searched for HT/USDT pair on the left

- Then I Clicked on buy.

- I filled in my order and purchased 1.1 HT

For the trade I made

I converted my HT to HUSD stable coin when I noticed that the price movements on the HT/USDT chart where in a downtrend.

.jpg)

I sold the coin at $9.7561 to get $10.71 and set a limit order to buy HT at the support level. Making my limit price $9.6350.

Although, I forgot to take I screenshot of the chart when I did my analysis, I can still explain further with the current chart.

From the chart, you can see that my analysis were correct once the price fell from $9.7561 to $9.6350 my order was placed and I made a small profit of an additional 0.0216 HT making my current amount of HT 1.1194.

3.)

0 hours

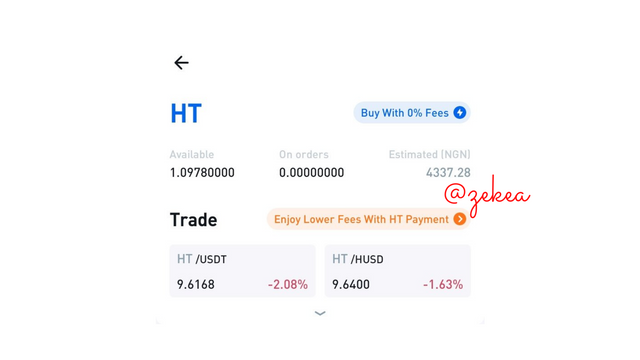

On the first day, I bought the HT tokens and the value of the coin was at $9.6168 USDT. My estimated value of my 1.0978 HT coins was 4337.28 NGN.

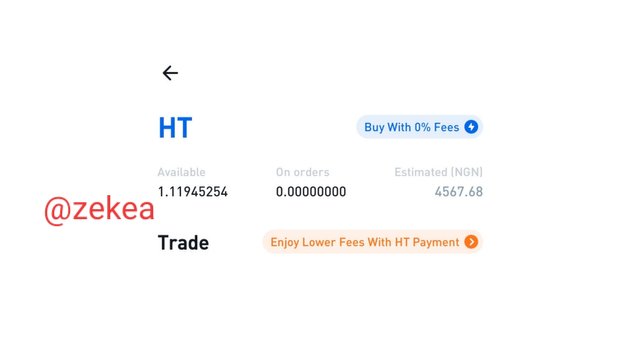

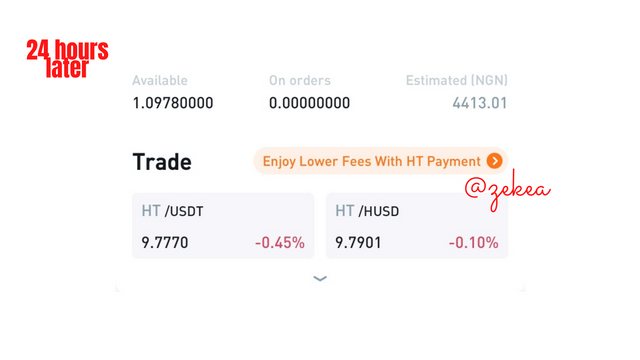

24 hours

The next day, the price of the HT coins got to $9.777 and my estimated value became 4,413.01 NGN.

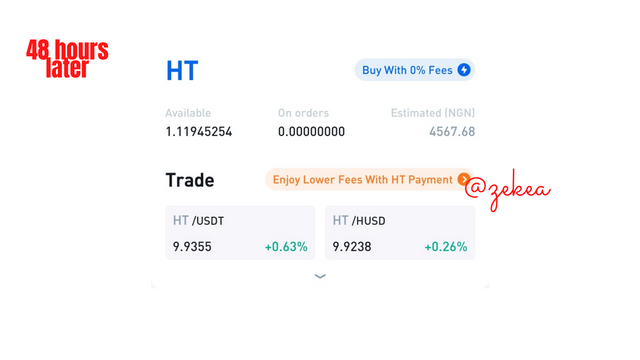

48 hours

After the trade I made which made my HT coins become 1.1194 HT, my estimated value after 48 hours became 4,567.68 NGN.

3.1)

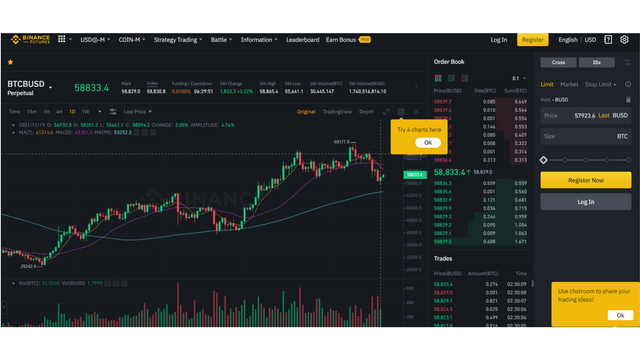

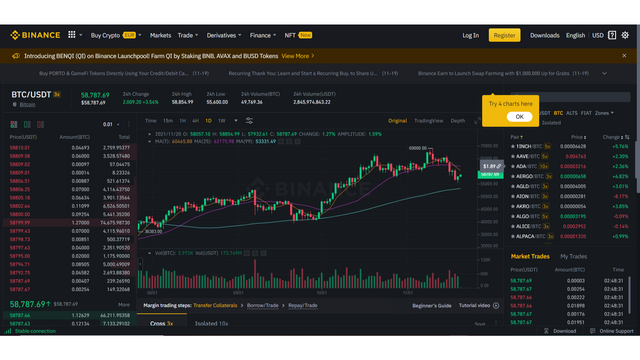

The price didn't act independently, it was largely affected by the price movements in the BTC/USDT chart.

I have marked the regions carefully in the chart above for the first 24 hours of the HT/USDT pair and the BTC/USDT pair. In the charts above, the HT/USDT pair started a downtrend and got into the oversold region on the stochastic indicator just like the BTC/USDT pair. From that moment on the both charts had a price action in the downward direction (downtrend) hereby displaying the HT token's dependence on the price movements of BTC.

For the next 48 hours, the HT/USDT price action was still in correlation with the BTC/USDT price action. At the same time, the stochastic indicator displayed that the HT and the BTC price was about to go into an uptrend. The movements are similar and this explains HT's dependence on the price movements of BTC.

4)

Futures trading is a trade that is placed with an agreement to buy or sell certain crytocurrencies at a certain price in the future. It is simply the placement of a trade to take place at a later time in the future.

Let's take a short example, John wants to start a nut oil factory in three months time but before he can make that possible, he needs to find a supplier for the nuts. John then goes to a supplier and makes a deal (the futures contract) to buy a sack of nuts currently sold at $50 at the price of $55 in 3 months time. The supplier then accepts the deal and in 3 months time, he must sell the sack of nuts at the price of $55.

The trick about the futures trading is that if there is a famine or scarcity of the nuts in three months time and the price of the nuts go up to $100 by that time, John will be making really high profits but if it goes the other way and the prices of the sack of nuts goes down to $40 the supplier will be making a lot of profit.

This is a typical explanation of the futures trading market, the difference is that on the cryptocurrency futures trading the trader is given leverages of 2x, 10x or even 100x to purchase a coin worth $120 with $12 with the 10x leverage. This helps the trader make large profits and also adversely make servere losses.

5)

Margin trading is almost like the futures trading, it is a market where the trader can make a lot of profit by borrowing a substantial amount of assets from investors or even the exchange its self. He then uses this grant to make a lot of money and makes returns to the investors.

The Margin trading market also has the leverage features which also the trader to multiply his staked assets by 10x, 20x, 100x etc. They vary on different platforms. The Margin trading feature is available to help traders expand their portfolio increasing their staking amount from let's say $500 to a $1,000

The problem with this trading market is that in event of high losses where the trader doesn't meet up with margin trading requirements given by the investors, the investors would make a margin call to the trader to invest more of his assets from his portfolio and if he's unable to do that the investors will initiate a forced sale to liquidate his possessions .

6.)

As long as a system is dealing cash, there will be a lot of people around the world looking for loop holes to steal some cash. This happenings also occurs in exchanges today, mainly the centralised ones and it is kind of possible for these hackers because CEXs with hold the private keys of the users on a central server which can be compromised .

These happenings are called exchange hacks and they are sudden happenings that can't be tracked down or prosecuted legally.

Here are two instances:

- The Binance Security Breach and

- The Bitfinex hack

i.) The Binance Security Breach

On the 7th of May, 2019, the world's leading cryptocurrency exchange, Binance was hacked using viruses, phishing and some other techniques unknown to the company. API keys were stolen and there was still possibility of other infos unknown to binance to be stolen.

The Binance CEXs realised the sad happening late and in no time the hackers withdrew 7000 BTC from the hot wallet. 2% of their BTC holdings worth $40,000,000. Their methods were so structured and this is why they were able to beat the security checks of Binance.

The company immediately closed all withdrawals and deposit actions for a week through out the platform to contain and control this severe damage. Trading actions were still open.

Luckily for the company, they were able to cover all losses of the event with a SAFU Fund and no user was affected. They security protocols were changed and made stronger. Since then, no such actions have taken place on the Binance exchange.

ii.) The Bitfinex hack

The bitfinex multibillion dollar exchange had experienced two series of hacks in its time. Such tragic experience that could bring the exchange down to shambles but they still found a way to reimburse losses and are in operation today.

In May 2015, Bitfinex was hacked with methods unstated and a total of 1500 BTC worth $400,000 at the time was lost. The company changed its methods of security and employed Bitgo to handle its security operations.

In August 2016, Bitfinex was hacked again with techniques unspecified by the exchange. Lots of keys were stolen and the hackers were able to cart away with about 119,756 units of BTC at a value of $72,000,000 at the time.

The exchange realised late and immediately shut down all withdrawal and trading operations to control the damages. Users affected lost 36% of the account value and were reimbursed in form of BTX tokens. This also resulted Bitfinex serious difficulties in its banking relationships.

Exchange coins are coins native to an exchange and they are highly utilised on these platforms. This makes the coins a substantial investment opportunity all depending on the nature and level of trading volume experienced on the exchange daily. Of course, a high trading volume means high level of users trading on the platform. Such high usage of an exchange can increase the value of its native coin.

Coins like the BNB which is the native coin of the best exchange in the world has skyrocketed in value in the past year, from a low of $26.54 to a high of $690.93. This is a massive improvement on the price of the coin.

Well, we talked about exchange hacks and these are very tragic experiences to these exchanges resulting in massive losses and reduction in its trading volume due to distrust.

This was a nice lesson. I must say it's my first time learning from you Prof. @imagen and I had fun.