Hello steemians, I would love to join Prof. @shemul21 to welcome each and everyone of us to week one of the crypto academy trading competition. Today, I will be trading XRP/BUSD pairs on spots trading to make some good profits. If you reach the requirements, you could join me to do same by reading up the competition rules on this link.

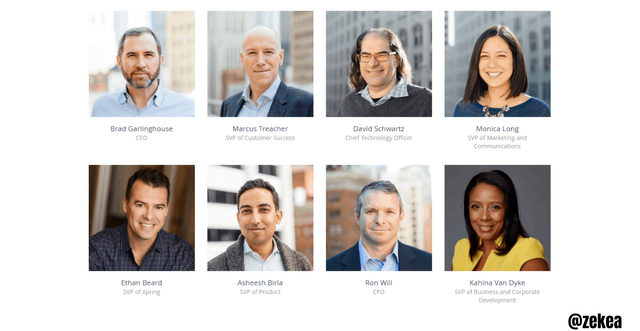

Introduction to XRP

XRP is the native token of the ripple protocol. Ripple is a blockchain based platform which aids in the transfer of funds globally. So we can see it was actually built to be a faster decentralized bank for global transactions. This was exactly the initial use case of the Bitcoin but with the increase of users on the blockchain, the network became slower. This is what Ripple tends to solve, it has network throughput of 1500 transactions per second with an average transaction fee of $0.0002. The ripple network has a transaction completion time of 5 secs. This is higher that that of Bitcoin which could take up to 60 mins.

Ripple was introduced by ripple labs in 2012 and their ability to produced such a high throughput is because of the consensus mechanism used on the blockchain. Ripple protocol uses the Unique Node List which is a group of validator selected by Ripple labs to verify transactions and make decisions on updates that should happen on the network. The voting process is done through the majority rule and not by stake.

Since these nodes are selected, it brings an opinion that the blockchain may not be as decentralized as we think coupled up with the fact that there are no block rewards given to nodes who validate transactions.

Ripple is still used vastly in the world today and is utilized as a payment system by more that 50 banks and institutions across the world, American Express included. This is because of Ripple’s technology to detect fraud transactions and money laundering.

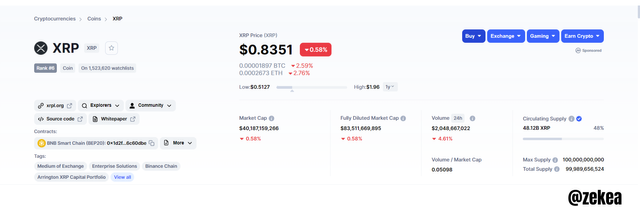

XRP is ranked 6th with a market cap of $40,187,159,266 and a circulating supply of 48.12 billion XRP. It’s current price is $0.8351 and if we look at the above image, in the last year, XRP has attained a high of $1.96 and a low of $0.5127.

Since XRP has been around for a long time now and is among the top ten coins in the world, it will be traded on a lot of exchanges.

- Binance

- Bitfinex

- Kucoin

- Gate.io

- Huobi

- OkeX

- Coinbase

- Kraken

- CoinEX

- BitMEX etc.

Well, I'm not so optimistic about the XRP token but I had some in an old wallet. I did some analysis and figured out the price may go into a downtrend so I decided to make a sell order.

From my analysis chart above, I used the rising wedge price action technique and the RSI indicator on a 5 mins chart.

A rising wedge usually signifies that the market may go into a downtrend. It uses normal support and resistance break out principles. Once the price breaks out at the support line, its a good time to sell off the tokens.

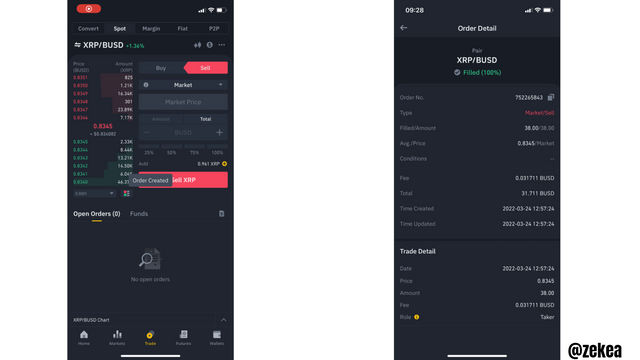

- First, I made a sell trade at the market price on spot trading XRP/BUSD.

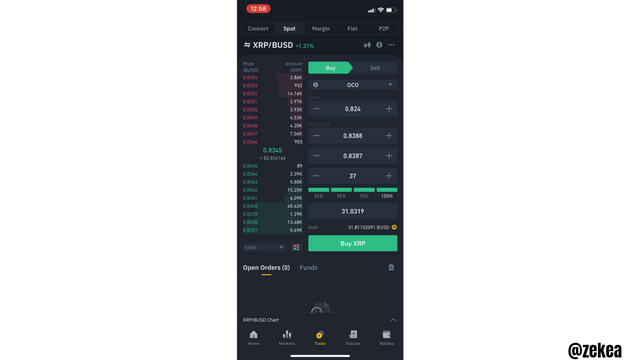

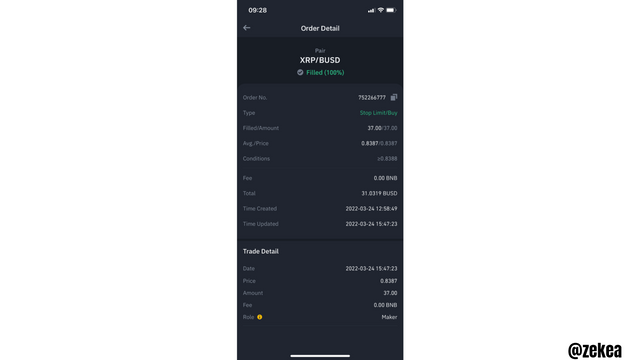

- I changed the trade type to an OCO trade in order to include my take profit price and stop loss. We should all note that, when using the OCO feature, for buy trades, you trade on the sell side and for sell trades, you trade on the buy side.

On the trade,

Entry: $0.8345

Take profit: $0.824

Stop loss: $0.8388

If you look at the chart above, price broke the support level and almost hit my take profit but it reversed. It later bought at my stop loss level. You can see the Binance order receipts to see my confirmation that the trade got filled at the stop loss.

I don't recommend anyone to hodl XRP, this is my reason.

Its consensus mechanism: The point of cryptocurrencies were to ensure a safe and decentralized environment for its users. Ripple protocol uses the unique node list consensus mechanism. This makes it a bit centralised because ripple labs are the ones that select people to be nodes. There is no staking on the platform so this nodes will not be threatened with a slash on their stake if they perform malicious or false transactions on the network. This makes ripple not so safe and centralised. Also, there are no block rewards on the network, this means there is no incentive provided for being a node. It's either the nodes are employed and paid privately or probably have hidden reasons which may not be beneficial to the ripple community.

SEC threats: Because of the theories behind the fact that ripple may be centralised, the U.S. Securities and Exchange Commission have claims the XRP may not be a coin but a secuirty (stock) and should be treated with certain taxes and restrictions like stocks. This has been on for a while but is a serious threat to the future of XRP.

Today, I made a buy trade on XRP/BUSD trading pairs and I learnt a lot while doing that. I so much thank all the Profs for teaching me all I know

CC: @shemul21