Elliott Wave Theory (EWT) is a market principle coined by an accountant named Ralph Nelson Elliott. The crypto market is volatile, but the cyclical movements of the crypto market always follow certain predictable patterns and trends. This is the reference in EWT, that the price of an asset can be predicted based on these patterns.

It is important for us to predict market cycles and trends before we decide to enter the market because we have to enter at the right time and exit at the right time as well. Based on the predictions, we also need to determine the stop loss point to prevent losses. Therefore, we need to make a prediction based on various analyzes before entering the market, and one of them is doing analysis-predictions based on EWT.

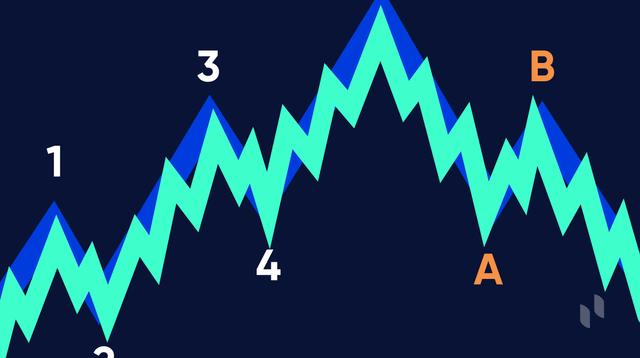

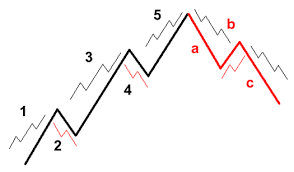

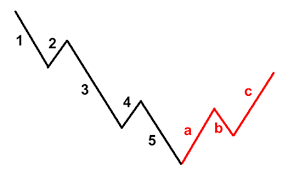

There are two types of waves that can be distinguished based on the EWT principle, namely corrective wave and impulse wave. In addition, there are also two market trends that we need to know, namely a bullish trend or an uptrend and a bearish trend or a downtrend. To observe corrective waves and impulse waves in both trends, EWT distinguishes them using the concept of market cycles based on 8 main currents that occur in the market, as in the following pictures. The impulse waves tend to follow the market trend seen in the first to the fifth currents, while the sixth, seventh and eighth currents are corrective waves which tend to start in the opposite direction of the previous trend.

- Impulse Wave

This wave consists of the first current to the fifth current. The first current represents the initial cycle when an uptrend starts and a number of traders start buying assets at low prices. However, the second current suffered a slight setback as a number of traders sold assets for a small profit. In the third current, the price chart starts to rise significantly more quickly because many traders are starting to buy assets at that time and keep in mind that the third current is the longest current on the impulse wave. Then comes the fourth current which is the same as the condition that happened before in the second current because traders started to take profits here. The last is the fifth current, here there is an increase in prices that is not too significant and this increase occurs because there are a few traders who make purchases in this condition, but it is not recommended to buy in this current because this is the right current to sell assets.

- Corrective Wave

This wave consists of the sixth, seventh and eighth currents, and this wave is present after the impulse wave. A corrective wave occurs because many traders have sold their assets during an impulse wave so that the market experiences lower demand than supply. The sixth and eighth currents are the main currents in this wave and the seventh currents only act as transitional currents. The sixth, seventh and eighth currents are differentiated based on three formations, namely zigzag, flat and triangle. In zigzag formation, the seventh currents are usually shorter than sixth currents & eighth current. Whereas sixth, seventh and eighth currents in flat formations have almost the same length. The last formation is a triangle formation, the sixth, seventh and eighth currents in this formation looks up and down like forming a triangle.

Note: The impulse and corrective waves that I have described are in conditions of a bullish trend, while what occurs in conditions of a bearish trend is the opposite of the explanation I have given. Below is a picture of a bearish trend.

Actually EWT is new knowledge for me and I just learned it in this class. In general, EWT is a good analytical choice to use and can also be combined with various other analyzes, such as technical analysis, fundamental analysis or sentimental analysis to make it more accurate.

The concept of EWT analysis is carried out based on cycles that often occur in the market and this pattern is a good reference in analysis because it is referenced based on movements in market conditions that have occurred before so that we can reflect on previous conditions to predict conditions that may occur in the future. Based on the EWT we can also determine when is the right time to enter and exit a trade.

To do a good EWT analysis, of course, we need to properly identify the impulse & corrective waves on the chart. But the fact is we don't always find this pattern (first current to eighth current). Therefore, good observations are needed in carrying out this analysis and should be combined with various other analyzes to obtain better results. And don't forget to use a stop loss for every trade you do.

In addition, in my opinion, the EWT concept is also more suitable for trading with a time span that is not short and is not suitable for trading with a very short time span because this analysis is carried out based on market cycles with significant chart changes (especially in the third current) and this concept too refers to the 8 main currents contained in impulse & corrective waves. Overall, this analysis is very suitable to be combined with various other analyzes.

In the lessons that have been shared by professors, professors have provided two main tips to remember to use this theory properly. The length of the second and fourth currents must not exceed the starting point of the first current and the length of the third current must be longer than the first and fifth currents.

Here is an example.

In the first current it can be seen that the price is starting to move up and a number of traders are starting to take part in this trade. However, as the price crawled upwards some traders also started selling some of the assets for a small profit, causing a slight decline in the second current. Then comes the third current which becomes the main current of the impulse wave. In the third current the price starts to rise significantly and traders who are still holding out and not selling their assets in the previous current will make a lot of profit here and in analysis this is the right time to sell some of the assets and sell the rest in the fifth current.

After reaching the top point of the fifth current, the price starts to move down and that is what usually happens in the market because demand starts to disproportionate to supply. The impulse wave has turned into a corrective wave, the decline in the price of this wave starts at the sixth current, then undergoes a slight transition in the seventh current and finally moves down on the eighth current. A smart trader will buy the asset at the low of the first current and sell 20% of the asset at the peak of the first current then sell the remaining 40% of the asset at the peak of the third current and sell the remaining 40% at the peak of the fifth current, a price close to the initial purchase price can be used as a reference for stop loss point.

Whatever trade you are going to do, you should always do analysis and predictions before starting because our goal is to seek profit, not loss. Apart from considering various other things, of course you can use EWT as one of your references before starting it and it's even better if you combine it with several other analyzes. In closing, I would like to thank the professor for this study because I have acquired new knowledge about EWT.

I'm sorry! You were late submitting your work, they were accepted till 22nd March 2021, 23.59 UTC Time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I know that I turned in my assignment at the end of the time and I think I was only 5 minutes late from the deadline based on Argentina local time. Please consider my duties and my efforts. Thank you Professor @fendit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If I do that with you, I should do it with everyone else. I wouldn't be fair with the others if not.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Alright then.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit