Define the Order Book and explain its components with Screenshots from Binance

In our everyday activities, we monitor the price of things we wish to purchase and place orders on them because they’re not currently sold or bought at prices we want. The same happens in the crypto world in exchanges and this is why we have order books.

The order book is a record of the order activity or history of an asset. It contains buy and sell orders arranged by price. Buy orders are instructions that a trader gives to buy an asset. They’re called bids. Sell orders are those that a trader use to instruct their broker to sell an asset. Those are normally called asks. The order book therefore contains buy and sell orders at any given time in the market.

In the order book, bids and asks that match or fill each other are paired up. This is how trades happen. When a bid and an ask fulfill each other. Let’s talk about the components of the order book

- Bid side: This is the green part of the order book. It contains all the information on buy orders of an assert in the market, from bid prices, amount of asset bought at said bid price, and the total cost.

- Ask side; This is the red part of the order book. It contains information on ask orders of an asset in the market, from ask price, amount of asset bought at said ask price, and total cost.

Who are Market Makers and Market Takers?

In the market, assets do not always trade at prices we want to enter or exit the market. Because the market value is not at the price we want, certain traders make their own order different from the current market value so that when price gets to this price, their order is filled. These kind of traders are called market makers. They do not settle for the price available and place orders called limit orders to buy assets at prices they want.

Market takers: This group normally buy and sell instantly at whatever price the asset is currently trading. They take the asset at the price it is currently trading. This group normally is not so bothered about making higher bids or asks and are okay with just accepting prices that are already preset or predetermined by market makers. They trade using market orders which are instant and quickly gets filled. Market takers are normally inexperienced traders or traders who just really need to sell or buy an assert instantly.

What is a Market Order and a Limit order?

Market orders are buy or sell orders at the best available market price. These orders are instantly filled and so very quick. They’re used by market takers. Most traders who are just beginning their crypto trading journey use this order because they don’t fully understand the order types and are not really so concerned about setting higher bids or asks.

Limit orders are instructions a trader gives their broker to buy or sell an asset at specific price or better. These orders take some time to fill and are not filled until the market trades to the set price. They’re set by market makers. After placing limit orders, a trader has to wait until a buy or ask matches this price.

Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

A trade happens when a bid and ask fulfill each other. When a bid and ask price match, thy fulfill each other and a trade happens. A trade will therefore require market makers and market traders, as the relationship between them is symbiotic.

Market makers create liquidity by placing several limit orders in the market. The limit orders created at some point become market orders when market price trades to the limit price.

At this point, market takers come in with their market orders, take or accept the liquidity created by the limit orders of market makers and fulfills them causing a trade to occur.

Place an order of at least 1 SBD for Steem on the Steemit Market place by

Accepting the Lowest ask. Was it instant? Why?

To access the steemit marker place, I logged into my steemit wallet by clicking wallet from my profile. In the wallet, I clicked SBD, and market. The. It opened up the steem internal market.

.png)

The above screenshot is from the steem internal market. As can be seen from the screenshot, I placed a bid for 1 SBD worth of STEEM with the lowest ask of 0.082800 . I accepted the lowest price and placed a bid of 1 SBD for Steem. My order got filled instantly in some minutes.

.png)

My order was a market order and it was quickly fulfilled by existing orders.

Changing the lowest ask. Explain what happens

.png)

In the screenshot above from the steem market place, I changed the ask to my own price. My order will therefore only get filled when the lowest ask reaches my set price, because my set price is lower than the current lowest ask.

After changing the lowest ask to my own desired price, my order becomes a limit order and I have to wait until someone is willing to sell at my limit price. The order therefore doesn’t instantly execute like it did when used the lowest ask.

.png)

Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

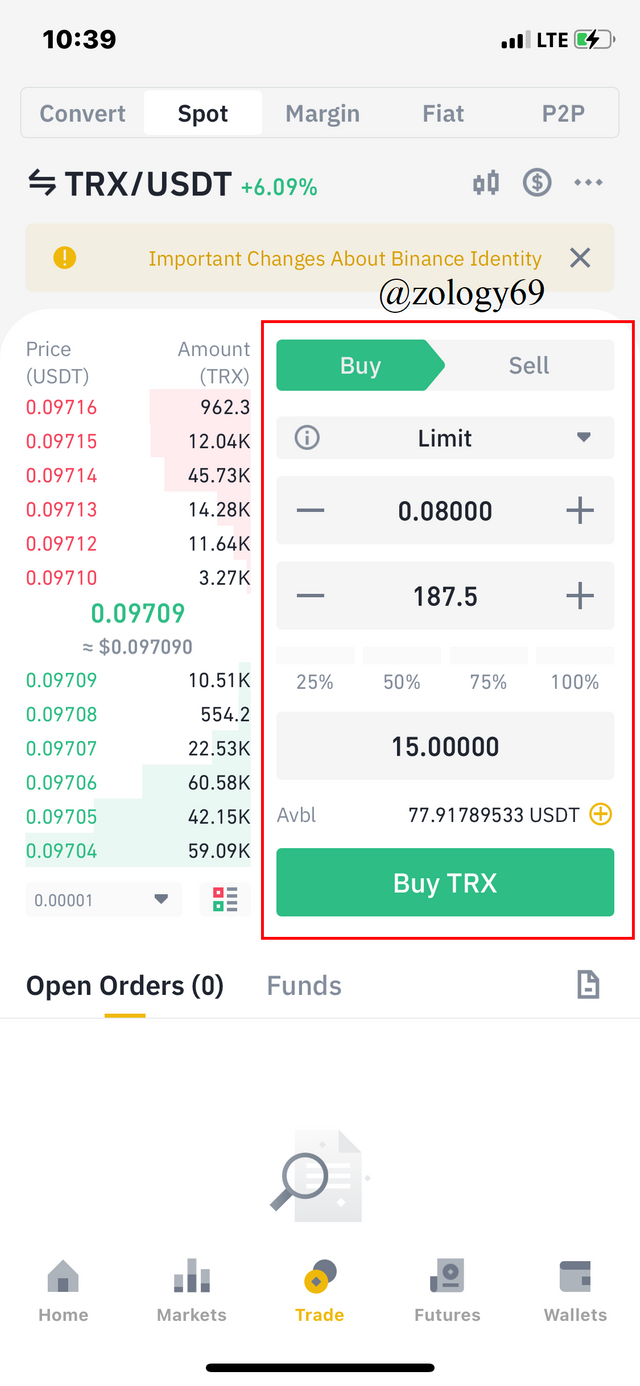

Step 1: Place TRX/USDT Buy Limit Order

I opened my verified binance account and launched the TRX/USDT trading page. From the trading page, I changed my order type from market order to Limit order. I entered my limit price(price I wanted to buy at which was below current market level). I am using this class as an opportunity to buy $15 TRX as I planned to buy some TRX already. I therefore enter my limit price(0.08) and amount as $15 and I click buy. The screenshot below explains my procedure.

A screenshot of my placed TRX/USDT limit order is below.

.png)

Impact of my order in the market

After placing my order, the order didn’t immediately get executed but was added to my open orders and was added to the bid prices in the order book. Placing this order(limit order) makes me a market maker as I have contributed to the increase liquidity. I will therefore have to wait for a market taker who will accept to sell at my bid price in order for my order to get filled.

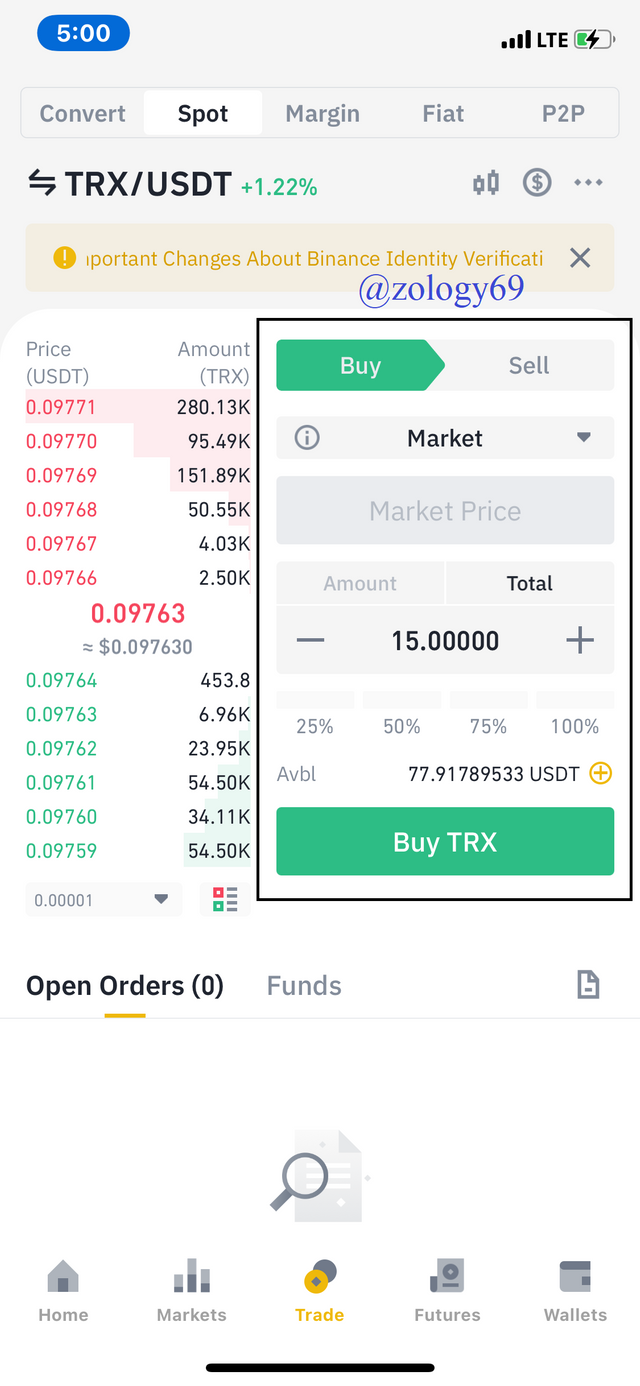

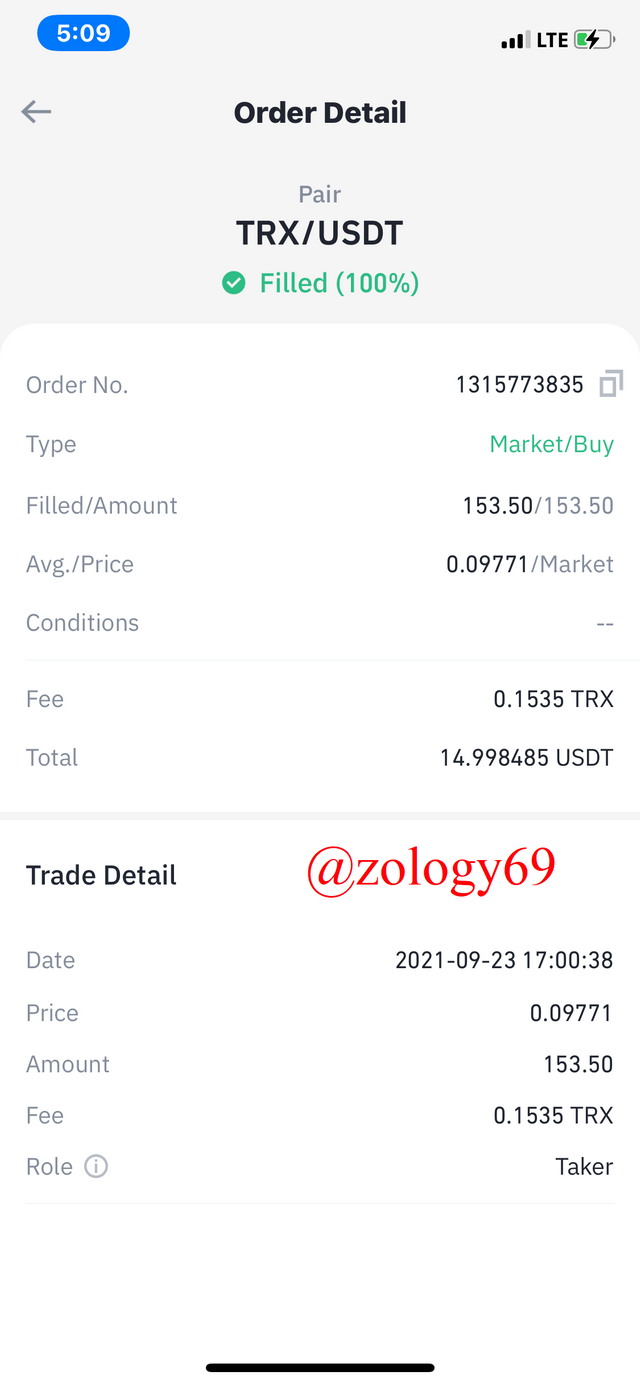

1 Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

Steps

Again, I log into my verified binance account, launch my TRX/USDT trade page. This time however, I change my order type to market order, enter my purchase amount($15) and I click buy.

My order instantly gets filled as it is a market order

#Impact of my order in the market

By placing, a market order, I seek liquidity and I am therefore a market taker in this case. My market order is me accepting liquidity provided by market makers who have already set their predetermined prices. My order is instantly executed at the best available ask price of the market.

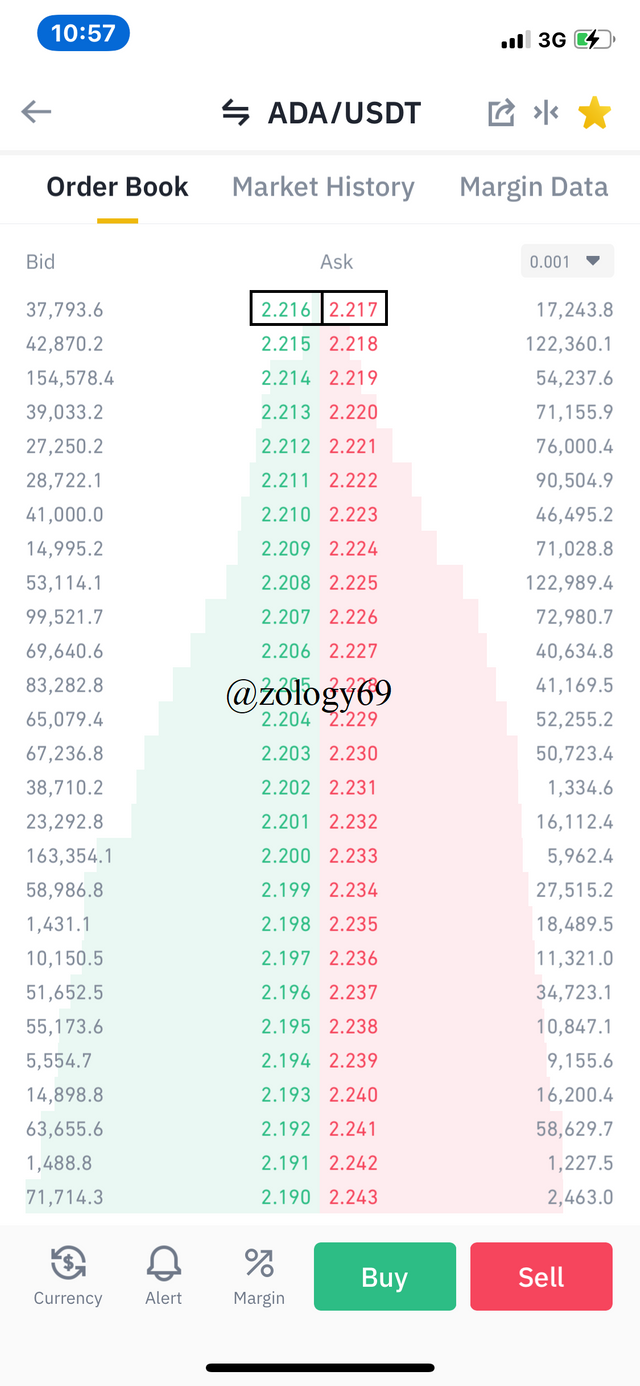

Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices:

a) Calculate the Bid-Ask.

Bid-Ask = Ask Price - Bid Price

Using the highest bid and lowest ask from my screenshot :

Ask = 2.217

Bid = 2.216

Therefore Bid-Ask = 2.217-2.216 = 0.001USDT

b) Calculate the Mid-Market Price.

Mid-Market Price = (Bid Price + Ask Price)/ 2

Still using the same set of Ask and Bid Price;

Mid-Market value = (2.217 + 2.216) / 2

= 4.433/2

= 2.2165USDT

Just like we have record books in businesses, we have the order book to record buy and sell order transactions. It could show us the potential direction of the direct depending on the direction we see more orders placed towards.

Also understanding the order book will allow newbie traders understand the relation between market makers and takers and to understand the concept of market and limit orders. This will help them be in control of their trades and help them place orders that’ll maximize their profits.

CC: prof @awesononso