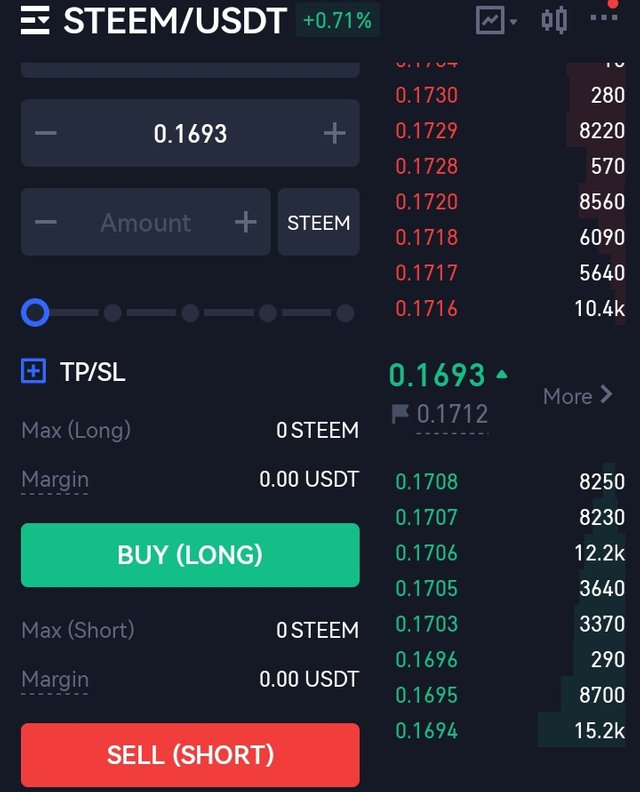

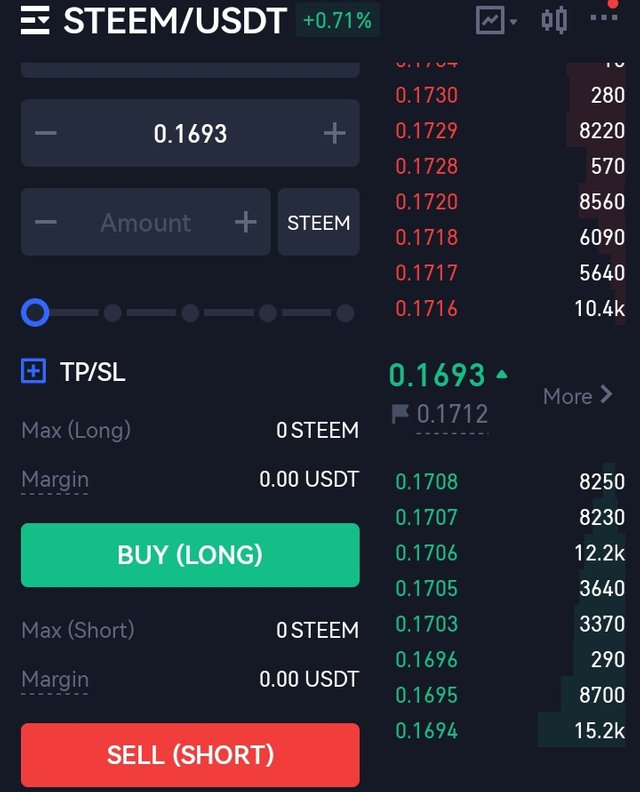

A shot from Bybit Exchange

Hi Steemians and welcome to an interesting topic of discourse that adds or increase our knowledge on trading. In the crypto market, there is the existence of those who wants to buy and sell crypto assets on daily, weekly, or monthly bases or timeframes. The market is volatile and prices of crypto assets fluctuates. This volatility and fluctuations makes trading in the market very risky as knowing the measures that could be put in place, could reduce the risk exposure in trading. Traders may not be opportuned or have time to always monitor the market movements or the direction that prices may take hence, the need to put up a measusre that automatically takes you out of the market at the price you are satisfied with, or reduces your risk of loss when the market goes against you. Now to reduce the risk of loss when the market might be going against you, the measure to take to put in place is the STOP LOSS ORDER. Now what is

A shot from Bybit Exchange

Stop loss order(SL) is the placement of an automatic instruction to sell your crypto at a certain price level when the market falls. This is a risk management technique. The traders use it to reduce the risk of the loses they incure if the market falls, as they would not be always there to monitor the movement or direction of prices.

A shot from Bybit Exchange

The automatic order or instruction to stop your losses is done by taking the following steps:

- Open the trading platform or exchange and select your trading pair, example STEEM/USDT

Start to click the subtraction or minus icon (–) on the steem column till you reach the price at which you are satisfied or comfortable with.

As soon as you have selected the price at which you are satisfied with, then proceed to the “sell” and click on “sell short”. Automatically your SL order is placed.

Pleas note that this is steem/Usdt derivatives.

The importance of stop loss order while trading includes:

It helps to prevent traders from losing in the market.

You are prepared in advance to make your selling decisions

It is an effective way to reduce your risk exposure as you would be always there to monitor the movement of the market.

In the market, determining the highest and lowest prices can not be easily calculated. so setting the SL order helps traders to close their positions before the market reaches its low positions that could result to losses.

The stop loss order is a useful risk management trading tool that traders use. Since traders may not always be there to monitor the movement or direction of prices, placing the stop loss order takes care any adverse events that could result to more losses that traders could bear.

If you want to be a trader, or you have not been making use of the stop loss order, I recommend you should learn how to use the stop loss order and apply it. It is an essential trading tool to prevent unbearable losses in the market.