Cryptocurrency Pair Analysis by @danish578

| I want to clarify that I am not assuming responsibility for anyone here, and this is not a signal. I am simply sharing my market perspective. |

|---|

.jpeg)

SOLUSDT

Multiple Timeframe Analysis

M5, M15, H1, H4

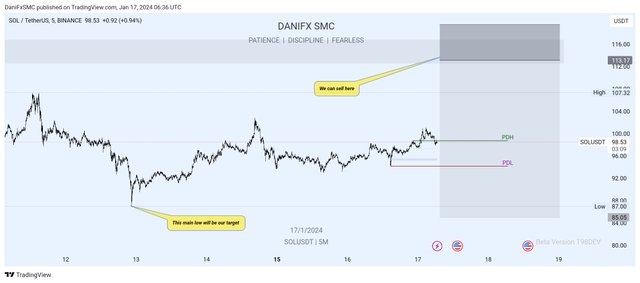

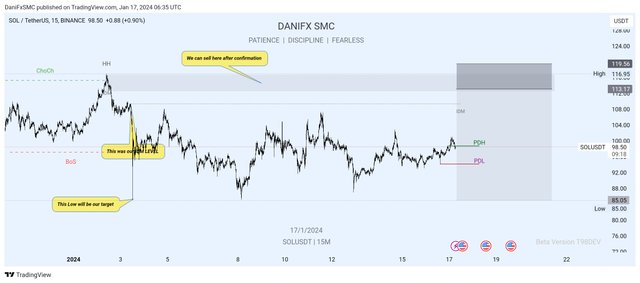

M5

𝙸𝚗 𝚝𝚑𝚎 𝙼5 𝚝𝚒𝚖𝚎 𝚏𝚛𝚊𝚖𝚎, 𝚠𝚑𝚒𝚌𝚑 𝚒𝚜 𝚊 𝚠𝚊𝚢 𝚘𝚏 𝚕𝚘𝚘𝚔𝚒𝚗𝚐 𝚊𝚝 𝚜𝚑𝚘𝚛𝚝-𝚝𝚎𝚛𝚖 𝚖𝚊𝚛𝚔𝚎𝚝 𝚖𝚘𝚟𝚎𝚖𝚎𝚗𝚝𝚜, 𝚠𝚎 𝚘𝚋𝚜𝚎𝚛𝚟𝚎 𝚝𝚑𝚊𝚝 𝚂𝙾𝙻𝚄𝚂𝙳𝚃 𝚒𝚜 𝚌𝚞𝚛𝚛𝚎𝚗𝚝𝚕𝚢 𝚒𝚗 𝚊 𝚙𝚑𝚊𝚜𝚎 𝚠𝚑𝚎𝚛𝚎 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚒𝚜 𝚑𝚊𝚙𝚙𝚎𝚗𝚒𝚗𝚐 𝚖𝚘𝚛𝚎 𝚝𝚑𝚊𝚗 𝚋𝚞𝚢𝚒𝚗𝚐. 𝚃𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝 𝚑𝚊𝚜 𝚛𝚎𝚊𝚌𝚑𝚎𝚍 𝚊 𝚕𝚎𝚟𝚎𝚕 𝚝𝚑𝚊𝚝 𝚝𝚢𝚙𝚒𝚌𝚊𝚕𝚕𝚢 𝚝𝚛𝚒𝚐𝚐𝚎𝚛𝚜 𝚜𝚎𝚕𝚕𝚒𝚗𝚐, 𝚔𝚗𝚘𝚠𝚗 𝚊𝚜 𝚝𝚑𝚎 𝚒𝚗𝚍𝚞𝚌𝚎𝚖𝚎𝚗𝚝 𝚕𝚎𝚟𝚎𝚕. 𝙰𝚍𝚍𝚒𝚝𝚒𝚘𝚗𝚊𝚕𝚕𝚢, 𝚝𝚑𝚎 𝚕𝚘𝚠𝚎𝚜𝚝 𝚙𝚘𝚒𝚗𝚝 𝚝𝚑𝚊𝚝 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝 𝚒𝚜 𝚕𝚒𝚔𝚎𝚕𝚢 𝚝𝚘 𝚛𝚎𝚊𝚌𝚑 𝚑𝚊𝚜 𝚋𝚎𝚎𝚗 𝚌𝚘𝚗𝚏𝚒𝚛𝚖𝚎𝚍.

𝙽𝚘𝚠, 𝚠𝚎 𝚊𝚛𝚎 𝚙𝚕𝚊𝚗𝚗𝚒𝚗𝚐 𝚝𝚘 𝚝𝚊𝚔𝚎 𝚊𝚍𝚟𝚊𝚗𝚝𝚊𝚐𝚎 𝚘𝚏 𝚝𝚑𝚒𝚜 𝚜𝚒𝚝𝚞𝚊𝚝𝚒𝚘𝚗 𝚋𝚢 𝚜𝚎𝚕𝚕𝚒𝚗𝚐. 𝚃𝚘 𝚍𝚘 𝚝𝚑𝚒𝚜, 𝚠𝚎 𝚊𝚛𝚎 𝚞𝚜𝚒𝚗𝚐 𝚊 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢 𝚌𝚊𝚕𝚕𝚎𝚍 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸 (𝙿𝚘𝚒𝚗𝚝 𝚘𝚏 𝙸𝚗𝚝𝚎𝚛𝚎𝚜𝚝). 𝙾𝚞𝚛 𝚐𝚘𝚊𝚕 𝚒𝚗 𝚝𝚑𝚒𝚜 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚙𝚛𝚘𝚌𝚎𝚜𝚜 𝚒𝚜 𝚝𝚘 𝚛𝚎𝚊𝚌𝚑 𝚝𝚑𝚎 𝚕𝚘𝚠𝚎𝚜𝚝 𝚙𝚘𝚒𝚗𝚝 𝚘𝚏 𝙼5, 𝚠𝚑𝚒𝚌𝚑 𝚒𝚜 𝚊 𝚜𝚒𝚐𝚗𝚒𝚏𝚒𝚌𝚊𝚗𝚝 𝚕𝚎𝚟𝚎𝚕 𝚒𝚗 𝚝𝚑𝚎 𝚜𝚑𝚘𝚛𝚝-𝚝𝚎𝚛𝚖 𝚖𝚊𝚛𝚔𝚎𝚝 𝚊𝚗𝚊𝚕𝚢𝚜𝚒𝚜. 𝙷𝚘𝚠𝚎𝚟𝚎𝚛, 𝚋𝚎𝚏𝚘𝚛𝚎 𝚙𝚛𝚘𝚌𝚎𝚎𝚍𝚒𝚗𝚐, 𝚠𝚎 𝚊𝚛𝚎 𝚠𝚊𝚒𝚝𝚒𝚗𝚐 𝚏𝚘𝚛 𝚏𝚞𝚛𝚝𝚑𝚎𝚛 𝚌𝚘𝚗𝚏𝚒𝚛𝚖𝚊𝚝𝚒𝚘𝚗 𝚝𝚘 𝚎𝚗𝚜𝚞𝚛𝚎 𝚝𝚑𝚎 𝚌𝚘𝚗𝚍𝚒𝚝𝚒𝚘𝚗𝚜 𝚊𝚛𝚎 𝚏𝚊𝚟𝚘𝚛𝚊𝚋𝚕𝚎 𝚏𝚘𝚛 𝚘𝚞𝚛 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢.

𝙸𝚗 𝚜𝚞𝚖𝚖𝚊𝚛𝚢, 𝚠𝚎 𝚊𝚛𝚎 𝚍𝚒𝚜𝚌𝚞𝚜𝚜𝚒𝚗𝚐 𝚝𝚑𝚎 𝚌𝚞𝚛𝚛𝚎𝚗𝚝 𝚜𝚝𝚊𝚝𝚎 𝚘𝚏 𝚂𝙾𝙻𝚄𝚂𝙳𝚃 𝚒𝚗 𝚝𝚑𝚎 𝙼5 𝚝𝚒𝚖𝚎 𝚏𝚛𝚊𝚖𝚎, 𝚑𝚒𝚐𝚑𝚕𝚒𝚐𝚑𝚝𝚒𝚗𝚐 𝚝𝚑𝚎 𝚒𝚗𝚍𝚞𝚌𝚎𝚖𝚎𝚗𝚝 𝚕𝚎𝚟𝚎𝚕 𝚊𝚗𝚍 𝚝𝚑𝚎 𝚌𝚘𝚗𝚏𝚒𝚛𝚖𝚎𝚍 𝚕𝚘𝚠𝚎𝚜𝚝 𝚖𝚊𝚛𝚔𝚎𝚝 𝚙𝚘𝚒𝚗𝚝. 𝙾𝚞𝚛 𝚙𝚕𝚊𝚗 𝚒𝚜 𝚝𝚘 𝚜𝚎𝚕𝚕 𝚞𝚜𝚒𝚗𝚐 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸 𝚖𝚎𝚝𝚑𝚘𝚍, 𝚠𝚒𝚝𝚑 𝚝𝚑𝚎 𝚝𝚊𝚛𝚐𝚎𝚝 𝚋𝚎𝚒𝚗𝚐 𝚝𝚑𝚎 𝚖𝚊𝚒𝚗 𝚕𝚘𝚠 𝚘𝚏 𝙼5, 𝚊𝚗𝚍 𝚠𝚎 𝚊𝚛𝚎 𝚋𝚎𝚒𝚗𝚐 𝚌𝚊𝚞𝚝𝚒𝚘𝚞𝚜 𝚋𝚢 𝚠𝚊𝚒𝚝𝚒𝚗𝚐 𝚏𝚘𝚛 𝚌𝚘𝚗𝚏𝚒𝚛𝚖𝚊𝚝𝚒𝚘𝚗 𝚋𝚎𝚏𝚘𝚛𝚎 𝚖𝚊𝚔𝚒𝚗𝚐 𝚊𝚗𝚢 𝚖𝚘𝚟𝚎𝚜.

.png)

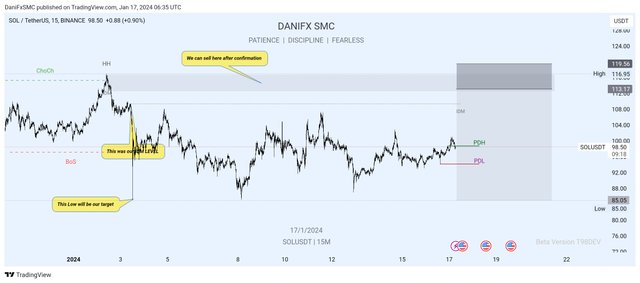

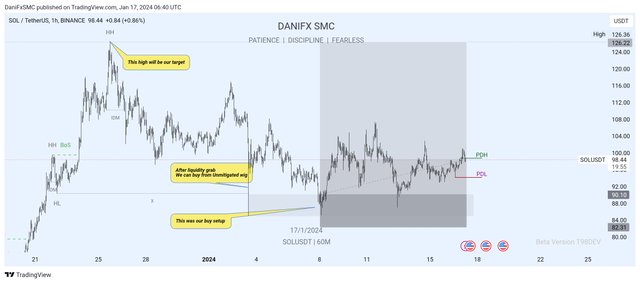

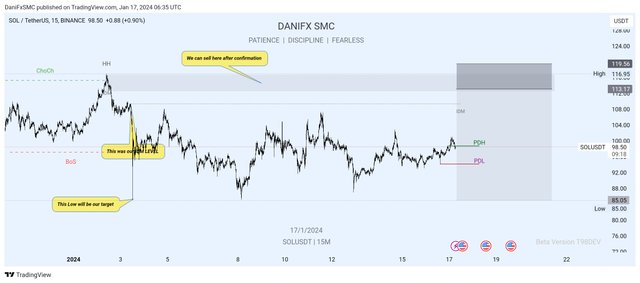

M15

𝙽𝚘𝚠, 𝚕𝚎𝚝'𝚜 𝚍𝚎𝚕𝚟𝚎 𝚒𝚗𝚝𝚘 𝚂𝙾𝙻𝚄𝚂𝙳𝚃'𝚜 𝙼15 𝚝𝚒𝚖𝚎 𝚏𝚛𝚊𝚖𝚎. 𝙲𝚞𝚛𝚛𝚎𝚗𝚝𝚕𝚢, 𝚂𝚘𝚕 𝚄𝚂𝙳𝚃 𝚒𝚜 𝚒𝚗 𝚊𝚗 𝚘𝚟𝚎𝚛𝚊𝚕𝚕 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚝𝚛𝚎𝚗𝚍 𝚘𝚗 𝚝𝚑𝚒𝚜 15-𝚖𝚒𝚗𝚞𝚝𝚎 𝚌𝚑𝚊𝚛𝚝. 𝚆𝚎'𝚛𝚎 𝚙𝚊𝚝𝚒𝚎𝚗𝚝𝚕𝚢 𝚠𝚊𝚒𝚝𝚒𝚗𝚐 𝚏𝚘𝚛 𝚊 𝚝𝚛𝚒𝚐𝚐𝚎𝚛𝚒𝚗𝚐 𝚎𝚟𝚎𝚗𝚝, 𝚌𝚊𝚕𝚕𝚎𝚍 𝚝𝚑𝚎 𝚒𝚗𝚍𝚞𝚌𝚎𝚖𝚎𝚗𝚝 𝚕𝚎𝚟𝚎𝚕, 𝚝𝚘 𝚘𝚌𝚌𝚞𝚛 𝚊𝚕𝚘𝚗𝚐 𝚠𝚒𝚝𝚑 𝚊 𝚜𝚙𝚎𝚌𝚒𝚏𝚒𝚌 𝚜𝚒𝚗𝚐𝚕𝚎 𝚌𝚊𝚗𝚍𝚕𝚎.

𝙾𝚗𝚌𝚎 𝚝𝚑𝚎 𝚘𝚛𝚍𝚎𝚛 𝚋𝚕𝚘𝚌𝚔, 𝚊 𝚜𝚒𝚐𝚗𝚒𝚏𝚒𝚌𝚊𝚗𝚝 𝚖𝚊𝚛𝚔𝚎𝚝 𝚜𝚝𝚛𝚞𝚌𝚝𝚞𝚛𝚎, 𝚒𝚜 𝚒𝚍𝚎𝚗𝚝𝚒𝚏𝚒𝚎𝚍, 𝙸'𝚟𝚎 𝚙𝚕𝚊𝚌𝚎𝚍 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸 𝚘𝚗 𝚒𝚝. 𝚆𝚎'𝚕𝚕 𝚌𝚕𝚘𝚜𝚎𝚕𝚢 𝚖𝚘𝚗𝚒𝚝𝚘𝚛 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝, 𝚜𝚎𝚎𝚔𝚒𝚗𝚐 𝚌𝚘𝚗𝚏𝚒𝚛𝚖𝚊𝚝𝚒𝚘𝚗 𝚊𝚝 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸 𝚏𝚘𝚛 𝚊 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚘𝚙𝚙𝚘𝚛𝚝𝚞𝚗𝚒𝚝𝚢. 𝙾𝚞𝚛 𝚙𝚕𝚊𝚗 𝚒𝚜 𝚝𝚘 𝚜𝚎𝚕𝚕 𝚏𝚛𝚘𝚖 𝚝𝚑𝚒𝚜 𝚙𝚘𝚒𝚗𝚝, 𝚝𝚊𝚛𝚐𝚎𝚝𝚒𝚗𝚐 𝚝𝚑𝚎 𝙼15 𝚖𝚊𝚒𝚗 𝚕𝚘𝚠. 𝙳𝚞𝚛𝚒𝚗𝚐 𝚝𝚑𝚒𝚜 𝚝𝚛𝚊𝚍𝚎, 𝚠𝚎 𝚖𝚊𝚢 𝚌𝚑𝚘𝚘𝚜𝚎 𝚝𝚘 𝚝𝚊𝚔𝚎 𝚜𝚘𝚖𝚎 𝚙𝚛𝚘𝚏𝚒𝚝 𝚖𝚒𝚍𝚠𝚊𝚢 𝚘𝚛 𝚜𝚎𝚌𝚞𝚛𝚎 𝚘𝚞𝚛 𝚒𝚗𝚟𝚎𝚜𝚝𝚖𝚎𝚗𝚝 𝚋𝚢 𝚜𝚎𝚝𝚝𝚒𝚗𝚐 𝚊 𝚜𝚝𝚘𝚙 𝚕𝚘𝚜𝚜 𝚊𝚝 𝚝𝚑𝚎 𝚎𝚗𝚝𝚛𝚢 𝚙𝚘𝚒𝚗𝚝, 𝚠𝚑𝚒𝚌𝚑 𝚒𝚜 𝚌𝚘𝚖𝚖𝚘𝚗𝚕𝚢 𝚛𝚎𝚏𝚎𝚛𝚛𝚎𝚍 𝚝𝚘 𝚊𝚜 𝚋𝚛𝚎𝚊𝚔 𝚎𝚟𝚎𝚗. 𝚃𝚑𝚒𝚜 𝚌𝚊𝚞𝚝𝚒𝚘𝚞𝚜 𝚊𝚙𝚙𝚛𝚘𝚊𝚌𝚑 𝚎𝚗𝚜𝚞𝚛𝚎𝚜 𝚠𝚎 𝚖𝚊𝚗𝚊𝚐𝚎 𝚛𝚒𝚜𝚔𝚜 𝚎𝚏𝚏𝚎𝚌𝚝𝚒𝚟𝚎𝚕𝚢 𝚍𝚞𝚛𝚒𝚗𝚐 𝚝𝚑𝚎 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚙𝚛𝚘𝚌𝚎𝚜𝚜.

.png)

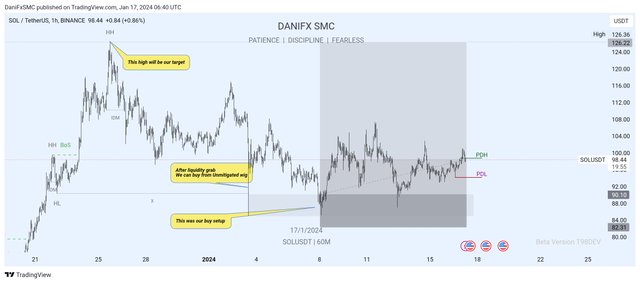

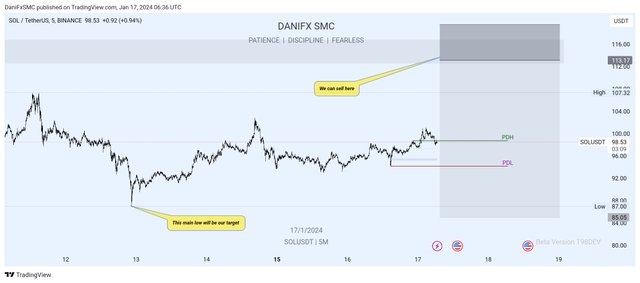

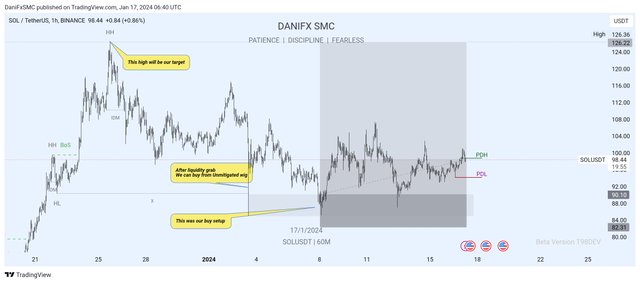

H1

𝙽𝚘𝚠, 𝚕𝚎𝚝'𝚜 𝚏𝚘𝚌𝚞𝚜 𝚘𝚗 𝚂𝙾𝙻𝚄𝚂𝙳𝚃, 𝚊 𝚌𝚛𝚢𝚙𝚝𝚘𝚌𝚞𝚛𝚛𝚎𝚗𝚌𝚢 𝚙𝚊𝚒𝚛, 𝚒𝚗 𝚝𝚑𝚎 𝙷1 𝚝𝚒𝚖𝚎 𝚏𝚛𝚊𝚖𝚎. 𝙲𝚞𝚛𝚛𝚎𝚗𝚝𝚕𝚢, 𝚂𝚘𝚕 𝚄𝚂𝙳𝚃 𝚒𝚜 𝚒𝚗 𝚊𝚗 𝚘𝚟𝚎𝚛𝚊𝚕𝚕 𝚙𝚘𝚜𝚒𝚝𝚒𝚟𝚎 𝚝𝚛𝚎𝚗𝚍 𝚊𝚜 𝚖𝚎𝚗𝚝𝚒𝚘𝚗𝚎𝚍 𝚒𝚗 𝚙𝚛𝚎𝚟𝚒𝚘𝚞𝚜 𝚊𝚗𝚊𝚕𝚢𝚜𝚎𝚜 𝚊𝚗𝚍 𝚋𝚕𝚘𝚐𝚜. 𝚆𝚎 𝚑𝚊𝚟𝚎 𝚊 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢 𝚝𝚘 𝚋𝚞𝚢 𝚠𝚑𝚎𝚗 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝 𝚍𝚒𝚜𝚙𝚕𝚊𝚢𝚜 𝚊𝚗 𝚄𝚗𝚖𝚒𝚝𝚒𝚐𝚊𝚝𝚎𝚍 𝚠𝚒𝚐, 𝚒𝚗𝚍𝚒𝚌𝚊𝚝𝚒𝚗𝚐 𝚊 𝚜𝚠𝚎𝚎𝚙 𝚘𝚏 𝚕𝚒𝚚𝚞𝚒𝚍𝚒𝚝𝚢. 𝙵𝚘𝚕𝚕𝚘𝚠𝚒𝚗𝚐 𝚝𝚑𝚒𝚜 𝚕𝚒𝚚𝚞𝚒𝚍𝚒𝚝𝚢 𝚜𝚠𝚎𝚎𝚙, 𝚠𝚎 𝚙𝚛𝚘𝚌𝚎𝚎𝚍 𝚠𝚒𝚝𝚑 𝚘𝚞𝚛 𝚋𝚞𝚢 𝚎𝚗𝚝𝚛𝚢, 𝚌𝚘𝚗𝚜𝚒𝚍𝚎𝚛𝚒𝚗𝚐 𝚝𝚑𝚎 𝚖𝚒𝚝𝚒𝚐𝚊𝚝𝚎𝚍 𝚠𝚒𝚐𝚜 𝚊𝚗𝚍 𝚘𝚞𝚛 𝚙𝚛𝚒𝚖𝚊𝚛𝚢 𝚑𝚒𝚐𝚑 𝚝𝚊𝚛𝚐𝚎𝚝.

𝙸𝚗 𝚝𝚑𝚎 𝚘𝚗𝚐𝚘𝚒𝚗𝚐 𝚖𝚊𝚛𝚔𝚎𝚝 𝚜𝚌𝚎𝚗𝚊𝚛𝚒𝚘, 𝚝𝚑𝚎 𝚙𝚛𝚒𝚌𝚎 𝚑𝚊𝚜 𝚛𝚒𝚜𝚎𝚗 𝚏𝚛𝚘𝚖 𝚝𝚑𝚎 𝚄𝚗𝚖𝚒𝚝𝚒𝚐𝚊𝚝𝚎𝚍 𝚠𝚒𝚐, 𝚊𝚕𝚒𝚐𝚗𝚒𝚗𝚐 𝚠𝚒𝚝𝚑 𝚘𝚞𝚛 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢. 𝙾𝚞𝚛 𝚐𝚘𝚊𝚕 𝚛𝚎𝚖𝚊𝚒𝚗𝚜 𝚝𝚊𝚛𝚐𝚎𝚝𝚒𝚗𝚐 𝚝𝚑𝚎 𝚖𝚊𝚒𝚗 𝚑𝚒𝚐𝚑 𝚊𝚗𝚍 𝚊𝚌𝚑𝚒𝚎𝚟𝚒𝚗𝚐 𝚘𝚞𝚛 𝚃𝚊𝚔𝚎 𝙿𝚛𝚘𝚏𝚒𝚝 (𝚃𝙿). 𝙳𝚞𝚛𝚒𝚗𝚐 𝚝𝚑𝚒𝚜 𝚙𝚛𝚘𝚌𝚎𝚜𝚜, 𝚠𝚎 𝚖𝚊𝚢 𝚜𝚎𝚌𝚞𝚛𝚎 𝚜𝚘𝚖𝚎 𝚙𝚊𝚛𝚝𝚒𝚊𝚕 𝚙𝚛𝚘𝚏𝚒𝚝𝚜 𝚋𝚎𝚏𝚘𝚛𝚎 𝚛𝚎𝚊𝚌𝚑𝚒𝚗𝚐 𝚝𝚑𝚎 𝚖𝚊𝚒𝚗 𝚃𝙿. 𝙰𝚕𝚝𝚎𝚛𝚗𝚊𝚝𝚒𝚟𝚎𝚕𝚢, 𝚠𝚎 𝚑𝚊𝚟𝚎 𝚝𝚑𝚎 𝚘𝚙𝚝𝚒𝚘𝚗 𝚝𝚘 𝚊𝚍𝚓𝚞𝚜𝚝 𝚘𝚞𝚛 𝚜𝚝𝚘𝚙 𝚕𝚘𝚜𝚜 𝚎𝚗𝚝𝚛𝚢 𝚙𝚘𝚒𝚗𝚝 𝚝𝚘 𝚖𝚊𝚗𝚊𝚐𝚎 𝚝𝚑𝚎 𝚝𝚛𝚊𝚍𝚎 𝚎𝚏𝚏𝚎𝚌𝚝𝚒𝚟𝚎𝚕𝚢. 𝚃𝚑𝚒𝚜 𝚊𝚙𝚙𝚛𝚘𝚊𝚌𝚑 𝚊𝚕𝚕𝚘𝚠𝚜 𝚞𝚜 𝚝𝚘 𝚊𝚍𝚊𝚙𝚝 𝚝𝚘 𝚝𝚑𝚎 𝚎𝚟𝚘𝚕𝚟𝚒𝚗𝚐 𝚖𝚊𝚛𝚔𝚎𝚝 𝚌𝚘𝚗𝚍𝚒𝚝𝚒𝚘𝚗𝚜 𝚠𝚑𝚒𝚕𝚎 𝚊𝚒𝚖𝚒𝚗𝚐 𝚏𝚘𝚛 𝚘𝚞𝚛 𝚜𝚎𝚝 𝚝𝚊𝚛𝚐𝚎𝚝𝚜.

.png)

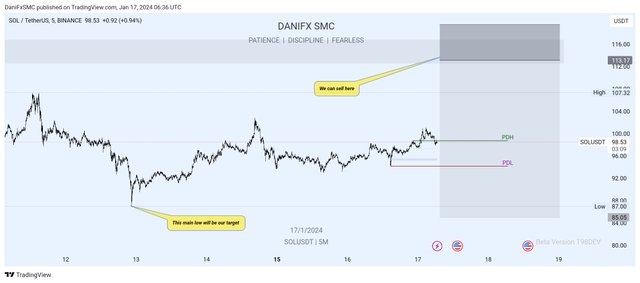

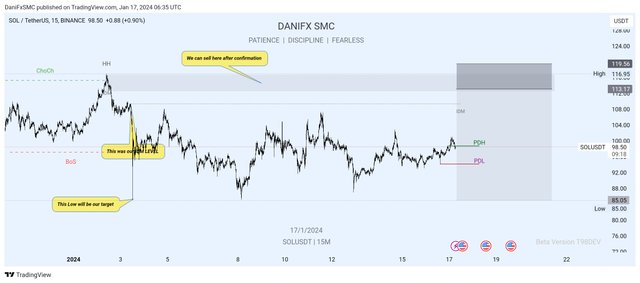

H4

𝙽𝚘𝚠, 𝚝𝚞𝚛𝚗𝚒𝚗𝚐 𝚘𝚞𝚛 𝚊𝚝𝚝𝚎𝚗𝚝𝚒𝚘𝚗 𝚝𝚘 𝚝𝚑𝚎 𝙷4 𝚝𝚒𝚖𝚎 𝚏𝚛𝚊𝚖𝚎, 𝚠𝚎 𝚘𝚋𝚜𝚎𝚛𝚟𝚎 𝚊𝚗 𝚘𝚟𝚎𝚛𝚊𝚕𝚕 𝚋𝚞𝚕𝚕𝚒𝚜𝚑 𝚝𝚛𝚎𝚗𝚍 𝚒𝚗 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝. 𝙷𝚘𝚠𝚎𝚟𝚎𝚛, 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝚘𝚒𝚗𝚝 𝚘𝚏 𝙸𝚗𝚝𝚎𝚛𝚎𝚜𝚝 (𝙿𝙾𝙸) 𝚒𝚜 𝚗𝚘𝚝𝚊𝚋𝚕𝚢 𝚕𝚘𝚠. 𝚂𝚘, 𝚘𝚞𝚛 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢 𝚒𝚗𝚟𝚘𝚕𝚟𝚎𝚜 𝚠𝚊𝚒𝚝𝚒𝚗𝚐 𝚏𝚘𝚛 𝚊 𝚖𝚊𝚛𝚔𝚎𝚝 𝚜𝚑𝚒𝚏𝚝 𝚋𝚢 𝚜𝚞𝚛𝚙𝚊𝚜𝚜𝚒𝚗𝚐 𝚘𝚞𝚛 𝚙𝚛𝚎𝚟𝚒𝚘𝚞𝚜 𝚑𝚒𝚐𝚑.

𝙾𝚗𝚌𝚎 𝚠𝚎 𝚒𝚍𝚎𝚗𝚝𝚒𝚏𝚢 𝚊 𝚜𝚒𝚗𝚐𝚕𝚎 𝚌𝚊𝚗𝚍𝚕𝚎 𝚘𝚛𝚍𝚎𝚛 𝚋𝚕𝚘𝚌𝚔, 𝚖𝚊𝚛𝚔𝚎𝚍 𝚋𝚢 𝚊 𝚜𝚙𝚎𝚌𝚒𝚏𝚒𝚌 𝚣𝚘𝚗𝚎, 𝚍𝚎𝚛𝚒𝚟𝚎𝚍 𝚏𝚛𝚘𝚖 𝚝𝚑𝚒𝚜 𝚘𝚛𝚍𝚎𝚛 𝚋𝚕𝚘𝚌𝚔, 𝚠𝚎 𝚙𝚕𝚊𝚗 𝚝𝚘 𝚒𝚗𝚒𝚝𝚒𝚊𝚝𝚎 𝚊 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚎𝚗𝚝𝚛𝚢. 𝙾𝚞𝚛 𝚃𝚊𝚔𝚎 𝙿𝚛𝚘𝚏𝚒𝚝 (𝚃𝙿) 𝚠𝚒𝚕𝚕 𝚋𝚎 𝚜𝚎𝚝 𝚊𝚝 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸 𝚘𝚏 𝙷4. 𝙰𝚏𝚝𝚎𝚛 𝚘𝚋𝚝𝚊𝚒𝚗𝚒𝚗𝚐 𝚌𝚘𝚗𝚏𝚒𝚛𝚖𝚊𝚝𝚒𝚘𝚗 𝚏𝚛𝚘𝚖 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸, 𝚠𝚎 𝚠𝚒𝚕𝚕 𝚙𝚛𝚘𝚌𝚎𝚎𝚍 𝚠𝚒𝚝𝚑 𝚊 𝚋𝚞𝚢𝚒𝚗𝚐 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢, 𝚝𝚊𝚛𝚐𝚎𝚝𝚒𝚗𝚐 𝚘𝚞𝚛 𝚖𝚊𝚒𝚗 𝚑𝚒𝚐𝚑 𝚏𝚘𝚛 𝚃𝙿, 𝚠𝚑𝚒𝚌𝚑 𝚒𝚜 𝚊 𝚕𝚎𝚟𝚎𝚕 𝚎𝚜𝚝𝚊𝚋𝚕𝚒𝚜𝚑𝚎𝚍 𝚒𝚗 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝. 𝚃𝚑𝚒𝚜 𝚊𝚙𝚙𝚛𝚘𝚊𝚌𝚑 𝚒𝚗𝚟𝚘𝚕𝚟𝚎𝚜 𝚊𝚍𝚊𝚙𝚝𝚒𝚗𝚐 𝚝𝚘 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝 𝚍𝚢𝚗𝚊𝚖𝚒𝚌𝚜, 𝚊𝚕𝚕𝚘𝚠𝚒𝚗𝚐 𝚞𝚜 𝚝𝚘 𝚖𝚊𝚔𝚎 𝚒𝚗𝚏𝚘𝚛𝚖𝚎𝚍 𝚍𝚎𝚌𝚒𝚜𝚒𝚘𝚗𝚜 𝚠𝚑𝚒𝚕𝚎 𝚊𝚒𝚖𝚒𝚗𝚐 𝚏𝚘𝚛 𝚜𝚙𝚎𝚌𝚒𝚏𝚒𝚌 𝚙𝚛𝚒𝚌𝚎 𝚙𝚘𝚒𝚗𝚝𝚜.

Thank you for visiting my post

Analyzed by @danish578 Source Trading view Pairs SOL/USDT Community Steem4Bloggers Beneficiaries 25% @null Thanks For Voting My Post

.jpeg)

SOLUSDT

Multiple Timeframe Analysis

M5

𝙸𝚗 𝚝𝚑𝚎 𝙼5 𝚝𝚒𝚖𝚎 𝚏𝚛𝚊𝚖𝚎, 𝚠𝚑𝚒𝚌𝚑 𝚒𝚜 𝚊 𝚠𝚊𝚢 𝚘𝚏 𝚕𝚘𝚘𝚔𝚒𝚗𝚐 𝚊𝚝 𝚜𝚑𝚘𝚛𝚝-𝚝𝚎𝚛𝚖 𝚖𝚊𝚛𝚔𝚎𝚝 𝚖𝚘𝚟𝚎𝚖𝚎𝚗𝚝𝚜, 𝚠𝚎 𝚘𝚋𝚜𝚎𝚛𝚟𝚎 𝚝𝚑𝚊𝚝 𝚂𝙾𝙻𝚄𝚂𝙳𝚃 𝚒𝚜 𝚌𝚞𝚛𝚛𝚎𝚗𝚝𝚕𝚢 𝚒𝚗 𝚊 𝚙𝚑𝚊𝚜𝚎 𝚠𝚑𝚎𝚛𝚎 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚒𝚜 𝚑𝚊𝚙𝚙𝚎𝚗𝚒𝚗𝚐 𝚖𝚘𝚛𝚎 𝚝𝚑𝚊𝚗 𝚋𝚞𝚢𝚒𝚗𝚐. 𝚃𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝 𝚑𝚊𝚜 𝚛𝚎𝚊𝚌𝚑𝚎𝚍 𝚊 𝚕𝚎𝚟𝚎𝚕 𝚝𝚑𝚊𝚝 𝚝𝚢𝚙𝚒𝚌𝚊𝚕𝚕𝚢 𝚝𝚛𝚒𝚐𝚐𝚎𝚛𝚜 𝚜𝚎𝚕𝚕𝚒𝚗𝚐, 𝚔𝚗𝚘𝚠𝚗 𝚊𝚜 𝚝𝚑𝚎 𝚒𝚗𝚍𝚞𝚌𝚎𝚖𝚎𝚗𝚝 𝚕𝚎𝚟𝚎𝚕. 𝙰𝚍𝚍𝚒𝚝𝚒𝚘𝚗𝚊𝚕𝚕𝚢, 𝚝𝚑𝚎 𝚕𝚘𝚠𝚎𝚜𝚝 𝚙𝚘𝚒𝚗𝚝 𝚝𝚑𝚊𝚝 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝 𝚒𝚜 𝚕𝚒𝚔𝚎𝚕𝚢 𝚝𝚘 𝚛𝚎𝚊𝚌𝚑 𝚑𝚊𝚜 𝚋𝚎𝚎𝚗 𝚌𝚘𝚗𝚏𝚒𝚛𝚖𝚎𝚍.

𝙽𝚘𝚠, 𝚠𝚎 𝚊𝚛𝚎 𝚙𝚕𝚊𝚗𝚗𝚒𝚗𝚐 𝚝𝚘 𝚝𝚊𝚔𝚎 𝚊𝚍𝚟𝚊𝚗𝚝𝚊𝚐𝚎 𝚘𝚏 𝚝𝚑𝚒𝚜 𝚜𝚒𝚝𝚞𝚊𝚝𝚒𝚘𝚗 𝚋𝚢 𝚜𝚎𝚕𝚕𝚒𝚗𝚐. 𝚃𝚘 𝚍𝚘 𝚝𝚑𝚒𝚜, 𝚠𝚎 𝚊𝚛𝚎 𝚞𝚜𝚒𝚗𝚐 𝚊 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢 𝚌𝚊𝚕𝚕𝚎𝚍 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸 (𝙿𝚘𝚒𝚗𝚝 𝚘𝚏 𝙸𝚗𝚝𝚎𝚛𝚎𝚜𝚝). 𝙾𝚞𝚛 𝚐𝚘𝚊𝚕 𝚒𝚗 𝚝𝚑𝚒𝚜 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚙𝚛𝚘𝚌𝚎𝚜𝚜 𝚒𝚜 𝚝𝚘 𝚛𝚎𝚊𝚌𝚑 𝚝𝚑𝚎 𝚕𝚘𝚠𝚎𝚜𝚝 𝚙𝚘𝚒𝚗𝚝 𝚘𝚏 𝙼5, 𝚠𝚑𝚒𝚌𝚑 𝚒𝚜 𝚊 𝚜𝚒𝚐𝚗𝚒𝚏𝚒𝚌𝚊𝚗𝚝 𝚕𝚎𝚟𝚎𝚕 𝚒𝚗 𝚝𝚑𝚎 𝚜𝚑𝚘𝚛𝚝-𝚝𝚎𝚛𝚖 𝚖𝚊𝚛𝚔𝚎𝚝 𝚊𝚗𝚊𝚕𝚢𝚜𝚒𝚜. 𝙷𝚘𝚠𝚎𝚟𝚎𝚛, 𝚋𝚎𝚏𝚘𝚛𝚎 𝚙𝚛𝚘𝚌𝚎𝚎𝚍𝚒𝚗𝚐, 𝚠𝚎 𝚊𝚛𝚎 𝚠𝚊𝚒𝚝𝚒𝚗𝚐 𝚏𝚘𝚛 𝚏𝚞𝚛𝚝𝚑𝚎𝚛 𝚌𝚘𝚗𝚏𝚒𝚛𝚖𝚊𝚝𝚒𝚘𝚗 𝚝𝚘 𝚎𝚗𝚜𝚞𝚛𝚎 𝚝𝚑𝚎 𝚌𝚘𝚗𝚍𝚒𝚝𝚒𝚘𝚗𝚜 𝚊𝚛𝚎 𝚏𝚊𝚟𝚘𝚛𝚊𝚋𝚕𝚎 𝚏𝚘𝚛 𝚘𝚞𝚛 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢.

𝙸𝚗 𝚜𝚞𝚖𝚖𝚊𝚛𝚢, 𝚠𝚎 𝚊𝚛𝚎 𝚍𝚒𝚜𝚌𝚞𝚜𝚜𝚒𝚗𝚐 𝚝𝚑𝚎 𝚌𝚞𝚛𝚛𝚎𝚗𝚝 𝚜𝚝𝚊𝚝𝚎 𝚘𝚏 𝚂𝙾𝙻𝚄𝚂𝙳𝚃 𝚒𝚗 𝚝𝚑𝚎 𝙼5 𝚝𝚒𝚖𝚎 𝚏𝚛𝚊𝚖𝚎, 𝚑𝚒𝚐𝚑𝚕𝚒𝚐𝚑𝚝𝚒𝚗𝚐 𝚝𝚑𝚎 𝚒𝚗𝚍𝚞𝚌𝚎𝚖𝚎𝚗𝚝 𝚕𝚎𝚟𝚎𝚕 𝚊𝚗𝚍 𝚝𝚑𝚎 𝚌𝚘𝚗𝚏𝚒𝚛𝚖𝚎𝚍 𝚕𝚘𝚠𝚎𝚜𝚝 𝚖𝚊𝚛𝚔𝚎𝚝 𝚙𝚘𝚒𝚗𝚝. 𝙾𝚞𝚛 𝚙𝚕𝚊𝚗 𝚒𝚜 𝚝𝚘 𝚜𝚎𝚕𝚕 𝚞𝚜𝚒𝚗𝚐 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸 𝚖𝚎𝚝𝚑𝚘𝚍, 𝚠𝚒𝚝𝚑 𝚝𝚑𝚎 𝚝𝚊𝚛𝚐𝚎𝚝 𝚋𝚎𝚒𝚗𝚐 𝚝𝚑𝚎 𝚖𝚊𝚒𝚗 𝚕𝚘𝚠 𝚘𝚏 𝙼5, 𝚊𝚗𝚍 𝚠𝚎 𝚊𝚛𝚎 𝚋𝚎𝚒𝚗𝚐 𝚌𝚊𝚞𝚝𝚒𝚘𝚞𝚜 𝚋𝚢 𝚠𝚊𝚒𝚝𝚒𝚗𝚐 𝚏𝚘𝚛 𝚌𝚘𝚗𝚏𝚒𝚛𝚖𝚊𝚝𝚒𝚘𝚗 𝚋𝚎𝚏𝚘𝚛𝚎 𝚖𝚊𝚔𝚒𝚗𝚐 𝚊𝚗𝚢 𝚖𝚘𝚟𝚎𝚜.

.png)

M15

𝙽𝚘𝚠, 𝚕𝚎𝚝'𝚜 𝚍𝚎𝚕𝚟𝚎 𝚒𝚗𝚝𝚘 𝚂𝙾𝙻𝚄𝚂𝙳𝚃'𝚜 𝙼15 𝚝𝚒𝚖𝚎 𝚏𝚛𝚊𝚖𝚎. 𝙲𝚞𝚛𝚛𝚎𝚗𝚝𝚕𝚢, 𝚂𝚘𝚕 𝚄𝚂𝙳𝚃 𝚒𝚜 𝚒𝚗 𝚊𝚗 𝚘𝚟𝚎𝚛𝚊𝚕𝚕 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚝𝚛𝚎𝚗𝚍 𝚘𝚗 𝚝𝚑𝚒𝚜 15-𝚖𝚒𝚗𝚞𝚝𝚎 𝚌𝚑𝚊𝚛𝚝. 𝚆𝚎'𝚛𝚎 𝚙𝚊𝚝𝚒𝚎𝚗𝚝𝚕𝚢 𝚠𝚊𝚒𝚝𝚒𝚗𝚐 𝚏𝚘𝚛 𝚊 𝚝𝚛𝚒𝚐𝚐𝚎𝚛𝚒𝚗𝚐 𝚎𝚟𝚎𝚗𝚝, 𝚌𝚊𝚕𝚕𝚎𝚍 𝚝𝚑𝚎 𝚒𝚗𝚍𝚞𝚌𝚎𝚖𝚎𝚗𝚝 𝚕𝚎𝚟𝚎𝚕, 𝚝𝚘 𝚘𝚌𝚌𝚞𝚛 𝚊𝚕𝚘𝚗𝚐 𝚠𝚒𝚝𝚑 𝚊 𝚜𝚙𝚎𝚌𝚒𝚏𝚒𝚌 𝚜𝚒𝚗𝚐𝚕𝚎 𝚌𝚊𝚗𝚍𝚕𝚎.

𝙾𝚗𝚌𝚎 𝚝𝚑𝚎 𝚘𝚛𝚍𝚎𝚛 𝚋𝚕𝚘𝚌𝚔, 𝚊 𝚜𝚒𝚐𝚗𝚒𝚏𝚒𝚌𝚊𝚗𝚝 𝚖𝚊𝚛𝚔𝚎𝚝 𝚜𝚝𝚛𝚞𝚌𝚝𝚞𝚛𝚎, 𝚒𝚜 𝚒𝚍𝚎𝚗𝚝𝚒𝚏𝚒𝚎𝚍, 𝙸'𝚟𝚎 𝚙𝚕𝚊𝚌𝚎𝚍 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸 𝚘𝚗 𝚒𝚝. 𝚆𝚎'𝚕𝚕 𝚌𝚕𝚘𝚜𝚎𝚕𝚢 𝚖𝚘𝚗𝚒𝚝𝚘𝚛 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝, 𝚜𝚎𝚎𝚔𝚒𝚗𝚐 𝚌𝚘𝚗𝚏𝚒𝚛𝚖𝚊𝚝𝚒𝚘𝚗 𝚊𝚝 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸 𝚏𝚘𝚛 𝚊 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚘𝚙𝚙𝚘𝚛𝚝𝚞𝚗𝚒𝚝𝚢. 𝙾𝚞𝚛 𝚙𝚕𝚊𝚗 𝚒𝚜 𝚝𝚘 𝚜𝚎𝚕𝚕 𝚏𝚛𝚘𝚖 𝚝𝚑𝚒𝚜 𝚙𝚘𝚒𝚗𝚝, 𝚝𝚊𝚛𝚐𝚎𝚝𝚒𝚗𝚐 𝚝𝚑𝚎 𝙼15 𝚖𝚊𝚒𝚗 𝚕𝚘𝚠. 𝙳𝚞𝚛𝚒𝚗𝚐 𝚝𝚑𝚒𝚜 𝚝𝚛𝚊𝚍𝚎, 𝚠𝚎 𝚖𝚊𝚢 𝚌𝚑𝚘𝚘𝚜𝚎 𝚝𝚘 𝚝𝚊𝚔𝚎 𝚜𝚘𝚖𝚎 𝚙𝚛𝚘𝚏𝚒𝚝 𝚖𝚒𝚍𝚠𝚊𝚢 𝚘𝚛 𝚜𝚎𝚌𝚞𝚛𝚎 𝚘𝚞𝚛 𝚒𝚗𝚟𝚎𝚜𝚝𝚖𝚎𝚗𝚝 𝚋𝚢 𝚜𝚎𝚝𝚝𝚒𝚗𝚐 𝚊 𝚜𝚝𝚘𝚙 𝚕𝚘𝚜𝚜 𝚊𝚝 𝚝𝚑𝚎 𝚎𝚗𝚝𝚛𝚢 𝚙𝚘𝚒𝚗𝚝, 𝚠𝚑𝚒𝚌𝚑 𝚒𝚜 𝚌𝚘𝚖𝚖𝚘𝚗𝚕𝚢 𝚛𝚎𝚏𝚎𝚛𝚛𝚎𝚍 𝚝𝚘 𝚊𝚜 𝚋𝚛𝚎𝚊𝚔 𝚎𝚟𝚎𝚗. 𝚃𝚑𝚒𝚜 𝚌𝚊𝚞𝚝𝚒𝚘𝚞𝚜 𝚊𝚙𝚙𝚛𝚘𝚊𝚌𝚑 𝚎𝚗𝚜𝚞𝚛𝚎𝚜 𝚠𝚎 𝚖𝚊𝚗𝚊𝚐𝚎 𝚛𝚒𝚜𝚔𝚜 𝚎𝚏𝚏𝚎𝚌𝚝𝚒𝚟𝚎𝚕𝚢 𝚍𝚞𝚛𝚒𝚗𝚐 𝚝𝚑𝚎 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚙𝚛𝚘𝚌𝚎𝚜𝚜.

.png)

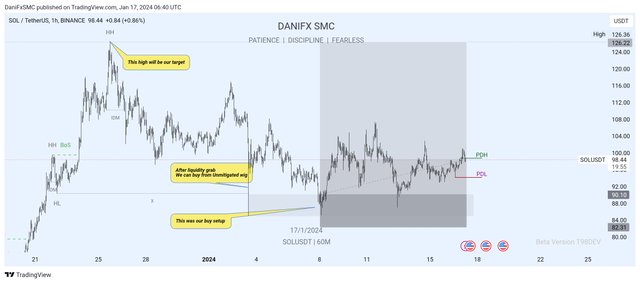

H1

𝙽𝚘𝚠, 𝚕𝚎𝚝'𝚜 𝚏𝚘𝚌𝚞𝚜 𝚘𝚗 𝚂𝙾𝙻𝚄𝚂𝙳𝚃, 𝚊 𝚌𝚛𝚢𝚙𝚝𝚘𝚌𝚞𝚛𝚛𝚎𝚗𝚌𝚢 𝚙𝚊𝚒𝚛, 𝚒𝚗 𝚝𝚑𝚎 𝙷1 𝚝𝚒𝚖𝚎 𝚏𝚛𝚊𝚖𝚎. 𝙲𝚞𝚛𝚛𝚎𝚗𝚝𝚕𝚢, 𝚂𝚘𝚕 𝚄𝚂𝙳𝚃 𝚒𝚜 𝚒𝚗 𝚊𝚗 𝚘𝚟𝚎𝚛𝚊𝚕𝚕 𝚙𝚘𝚜𝚒𝚝𝚒𝚟𝚎 𝚝𝚛𝚎𝚗𝚍 𝚊𝚜 𝚖𝚎𝚗𝚝𝚒𝚘𝚗𝚎𝚍 𝚒𝚗 𝚙𝚛𝚎𝚟𝚒𝚘𝚞𝚜 𝚊𝚗𝚊𝚕𝚢𝚜𝚎𝚜 𝚊𝚗𝚍 𝚋𝚕𝚘𝚐𝚜. 𝚆𝚎 𝚑𝚊𝚟𝚎 𝚊 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢 𝚝𝚘 𝚋𝚞𝚢 𝚠𝚑𝚎𝚗 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝 𝚍𝚒𝚜𝚙𝚕𝚊𝚢𝚜 𝚊𝚗 𝚄𝚗𝚖𝚒𝚝𝚒𝚐𝚊𝚝𝚎𝚍 𝚠𝚒𝚐, 𝚒𝚗𝚍𝚒𝚌𝚊𝚝𝚒𝚗𝚐 𝚊 𝚜𝚠𝚎𝚎𝚙 𝚘𝚏 𝚕𝚒𝚚𝚞𝚒𝚍𝚒𝚝𝚢. 𝙵𝚘𝚕𝚕𝚘𝚠𝚒𝚗𝚐 𝚝𝚑𝚒𝚜 𝚕𝚒𝚚𝚞𝚒𝚍𝚒𝚝𝚢 𝚜𝚠𝚎𝚎𝚙, 𝚠𝚎 𝚙𝚛𝚘𝚌𝚎𝚎𝚍 𝚠𝚒𝚝𝚑 𝚘𝚞𝚛 𝚋𝚞𝚢 𝚎𝚗𝚝𝚛𝚢, 𝚌𝚘𝚗𝚜𝚒𝚍𝚎𝚛𝚒𝚗𝚐 𝚝𝚑𝚎 𝚖𝚒𝚝𝚒𝚐𝚊𝚝𝚎𝚍 𝚠𝚒𝚐𝚜 𝚊𝚗𝚍 𝚘𝚞𝚛 𝚙𝚛𝚒𝚖𝚊𝚛𝚢 𝚑𝚒𝚐𝚑 𝚝𝚊𝚛𝚐𝚎𝚝.

𝙸𝚗 𝚝𝚑𝚎 𝚘𝚗𝚐𝚘𝚒𝚗𝚐 𝚖𝚊𝚛𝚔𝚎𝚝 𝚜𝚌𝚎𝚗𝚊𝚛𝚒𝚘, 𝚝𝚑𝚎 𝚙𝚛𝚒𝚌𝚎 𝚑𝚊𝚜 𝚛𝚒𝚜𝚎𝚗 𝚏𝚛𝚘𝚖 𝚝𝚑𝚎 𝚄𝚗𝚖𝚒𝚝𝚒𝚐𝚊𝚝𝚎𝚍 𝚠𝚒𝚐, 𝚊𝚕𝚒𝚐𝚗𝚒𝚗𝚐 𝚠𝚒𝚝𝚑 𝚘𝚞𝚛 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢. 𝙾𝚞𝚛 𝚐𝚘𝚊𝚕 𝚛𝚎𝚖𝚊𝚒𝚗𝚜 𝚝𝚊𝚛𝚐𝚎𝚝𝚒𝚗𝚐 𝚝𝚑𝚎 𝚖𝚊𝚒𝚗 𝚑𝚒𝚐𝚑 𝚊𝚗𝚍 𝚊𝚌𝚑𝚒𝚎𝚟𝚒𝚗𝚐 𝚘𝚞𝚛 𝚃𝚊𝚔𝚎 𝙿𝚛𝚘𝚏𝚒𝚝 (𝚃𝙿). 𝙳𝚞𝚛𝚒𝚗𝚐 𝚝𝚑𝚒𝚜 𝚙𝚛𝚘𝚌𝚎𝚜𝚜, 𝚠𝚎 𝚖𝚊𝚢 𝚜𝚎𝚌𝚞𝚛𝚎 𝚜𝚘𝚖𝚎 𝚙𝚊𝚛𝚝𝚒𝚊𝚕 𝚙𝚛𝚘𝚏𝚒𝚝𝚜 𝚋𝚎𝚏𝚘𝚛𝚎 𝚛𝚎𝚊𝚌𝚑𝚒𝚗𝚐 𝚝𝚑𝚎 𝚖𝚊𝚒𝚗 𝚃𝙿. 𝙰𝚕𝚝𝚎𝚛𝚗𝚊𝚝𝚒𝚟𝚎𝚕𝚢, 𝚠𝚎 𝚑𝚊𝚟𝚎 𝚝𝚑𝚎 𝚘𝚙𝚝𝚒𝚘𝚗 𝚝𝚘 𝚊𝚍𝚓𝚞𝚜𝚝 𝚘𝚞𝚛 𝚜𝚝𝚘𝚙 𝚕𝚘𝚜𝚜 𝚎𝚗𝚝𝚛𝚢 𝚙𝚘𝚒𝚗𝚝 𝚝𝚘 𝚖𝚊𝚗𝚊𝚐𝚎 𝚝𝚑𝚎 𝚝𝚛𝚊𝚍𝚎 𝚎𝚏𝚏𝚎𝚌𝚝𝚒𝚟𝚎𝚕𝚢. 𝚃𝚑𝚒𝚜 𝚊𝚙𝚙𝚛𝚘𝚊𝚌𝚑 𝚊𝚕𝚕𝚘𝚠𝚜 𝚞𝚜 𝚝𝚘 𝚊𝚍𝚊𝚙𝚝 𝚝𝚘 𝚝𝚑𝚎 𝚎𝚟𝚘𝚕𝚟𝚒𝚗𝚐 𝚖𝚊𝚛𝚔𝚎𝚝 𝚌𝚘𝚗𝚍𝚒𝚝𝚒𝚘𝚗𝚜 𝚠𝚑𝚒𝚕𝚎 𝚊𝚒𝚖𝚒𝚗𝚐 𝚏𝚘𝚛 𝚘𝚞𝚛 𝚜𝚎𝚝 𝚝𝚊𝚛𝚐𝚎𝚝𝚜.

.png)

H4

𝙽𝚘𝚠, 𝚝𝚞𝚛𝚗𝚒𝚗𝚐 𝚘𝚞𝚛 𝚊𝚝𝚝𝚎𝚗𝚝𝚒𝚘𝚗 𝚝𝚘 𝚝𝚑𝚎 𝙷4 𝚝𝚒𝚖𝚎 𝚏𝚛𝚊𝚖𝚎, 𝚠𝚎 𝚘𝚋𝚜𝚎𝚛𝚟𝚎 𝚊𝚗 𝚘𝚟𝚎𝚛𝚊𝚕𝚕 𝚋𝚞𝚕𝚕𝚒𝚜𝚑 𝚝𝚛𝚎𝚗𝚍 𝚒𝚗 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝. 𝙷𝚘𝚠𝚎𝚟𝚎𝚛, 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝚘𝚒𝚗𝚝 𝚘𝚏 𝙸𝚗𝚝𝚎𝚛𝚎𝚜𝚝 (𝙿𝙾𝙸) 𝚒𝚜 𝚗𝚘𝚝𝚊𝚋𝚕𝚢 𝚕𝚘𝚠. 𝚂𝚘, 𝚘𝚞𝚛 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢 𝚒𝚗𝚟𝚘𝚕𝚟𝚎𝚜 𝚠𝚊𝚒𝚝𝚒𝚗𝚐 𝚏𝚘𝚛 𝚊 𝚖𝚊𝚛𝚔𝚎𝚝 𝚜𝚑𝚒𝚏𝚝 𝚋𝚢 𝚜𝚞𝚛𝚙𝚊𝚜𝚜𝚒𝚗𝚐 𝚘𝚞𝚛 𝚙𝚛𝚎𝚟𝚒𝚘𝚞𝚜 𝚑𝚒𝚐𝚑.

𝙾𝚗𝚌𝚎 𝚠𝚎 𝚒𝚍𝚎𝚗𝚝𝚒𝚏𝚢 𝚊 𝚜𝚒𝚗𝚐𝚕𝚎 𝚌𝚊𝚗𝚍𝚕𝚎 𝚘𝚛𝚍𝚎𝚛 𝚋𝚕𝚘𝚌𝚔, 𝚖𝚊𝚛𝚔𝚎𝚍 𝚋𝚢 𝚊 𝚜𝚙𝚎𝚌𝚒𝚏𝚒𝚌 𝚣𝚘𝚗𝚎, 𝚍𝚎𝚛𝚒𝚟𝚎𝚍 𝚏𝚛𝚘𝚖 𝚝𝚑𝚒𝚜 𝚘𝚛𝚍𝚎𝚛 𝚋𝚕𝚘𝚌𝚔, 𝚠𝚎 𝚙𝚕𝚊𝚗 𝚝𝚘 𝚒𝚗𝚒𝚝𝚒𝚊𝚝𝚎 𝚊 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚎𝚗𝚝𝚛𝚢. 𝙾𝚞𝚛 𝚃𝚊𝚔𝚎 𝙿𝚛𝚘𝚏𝚒𝚝 (𝚃𝙿) 𝚠𝚒𝚕𝚕 𝚋𝚎 𝚜𝚎𝚝 𝚊𝚝 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸 𝚘𝚏 𝙷4. 𝙰𝚏𝚝𝚎𝚛 𝚘𝚋𝚝𝚊𝚒𝚗𝚒𝚗𝚐 𝚌𝚘𝚗𝚏𝚒𝚛𝚖𝚊𝚝𝚒𝚘𝚗 𝚏𝚛𝚘𝚖 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸, 𝚠𝚎 𝚠𝚒𝚕𝚕 𝚙𝚛𝚘𝚌𝚎𝚎𝚍 𝚠𝚒𝚝𝚑 𝚊 𝚋𝚞𝚢𝚒𝚗𝚐 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢, 𝚝𝚊𝚛𝚐𝚎𝚝𝚒𝚗𝚐 𝚘𝚞𝚛 𝚖𝚊𝚒𝚗 𝚑𝚒𝚐𝚑 𝚏𝚘𝚛 𝚃𝙿, 𝚠𝚑𝚒𝚌𝚑 𝚒𝚜 𝚊 𝚕𝚎𝚟𝚎𝚕 𝚎𝚜𝚝𝚊𝚋𝚕𝚒𝚜𝚑𝚎𝚍 𝚒𝚗 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝. 𝚃𝚑𝚒𝚜 𝚊𝚙𝚙𝚛𝚘𝚊𝚌𝚑 𝚒𝚗𝚟𝚘𝚕𝚟𝚎𝚜 𝚊𝚍𝚊𝚙𝚝𝚒𝚗𝚐 𝚝𝚘 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝 𝚍𝚢𝚗𝚊𝚖𝚒𝚌𝚜, 𝚊𝚕𝚕𝚘𝚠𝚒𝚗𝚐 𝚞𝚜 𝚝𝚘 𝚖𝚊𝚔𝚎 𝚒𝚗𝚏𝚘𝚛𝚖𝚎𝚍 𝚍𝚎𝚌𝚒𝚜𝚒𝚘𝚗𝚜 𝚠𝚑𝚒𝚕𝚎 𝚊𝚒𝚖𝚒𝚗𝚐 𝚏𝚘𝚛 𝚜𝚙𝚎𝚌𝚒𝚏𝚒𝚌 𝚙𝚛𝚒𝚌𝚎 𝚙𝚘𝚒𝚗𝚝𝚜.

Thank you for visiting my post

Analyzed by @danish578 Source Trading view Pairs SOL/USDT Community Steem4Bloggers Beneficiaries 25% @null Thanks For Voting My Post

.jpeg)

𝙽𝚘𝚠, 𝚠𝚎 𝚊𝚛𝚎 𝚙𝚕𝚊𝚗𝚗𝚒𝚗𝚐 𝚝𝚘 𝚝𝚊𝚔𝚎 𝚊𝚍𝚟𝚊𝚗𝚝𝚊𝚐𝚎 𝚘𝚏 𝚝𝚑𝚒𝚜 𝚜𝚒𝚝𝚞𝚊𝚝𝚒𝚘𝚗 𝚋𝚢 𝚜𝚎𝚕𝚕𝚒𝚗𝚐. 𝚃𝚘 𝚍𝚘 𝚝𝚑𝚒𝚜, 𝚠𝚎 𝚊𝚛𝚎 𝚞𝚜𝚒𝚗𝚐 𝚊 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢 𝚌𝚊𝚕𝚕𝚎𝚍 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸 (𝙿𝚘𝚒𝚗𝚝 𝚘𝚏 𝙸𝚗𝚝𝚎𝚛𝚎𝚜𝚝). 𝙾𝚞𝚛 𝚐𝚘𝚊𝚕 𝚒𝚗 𝚝𝚑𝚒𝚜 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚙𝚛𝚘𝚌𝚎𝚜𝚜 𝚒𝚜 𝚝𝚘 𝚛𝚎𝚊𝚌𝚑 𝚝𝚑𝚎 𝚕𝚘𝚠𝚎𝚜𝚝 𝚙𝚘𝚒𝚗𝚝 𝚘𝚏 𝙼5, 𝚠𝚑𝚒𝚌𝚑 𝚒𝚜 𝚊 𝚜𝚒𝚐𝚗𝚒𝚏𝚒𝚌𝚊𝚗𝚝 𝚕𝚎𝚟𝚎𝚕 𝚒𝚗 𝚝𝚑𝚎 𝚜𝚑𝚘𝚛𝚝-𝚝𝚎𝚛𝚖 𝚖𝚊𝚛𝚔𝚎𝚝 𝚊𝚗𝚊𝚕𝚢𝚜𝚒𝚜. 𝙷𝚘𝚠𝚎𝚟𝚎𝚛, 𝚋𝚎𝚏𝚘𝚛𝚎 𝚙𝚛𝚘𝚌𝚎𝚎𝚍𝚒𝚗𝚐, 𝚠𝚎 𝚊𝚛𝚎 𝚠𝚊𝚒𝚝𝚒𝚗𝚐 𝚏𝚘𝚛 𝚏𝚞𝚛𝚝𝚑𝚎𝚛 𝚌𝚘𝚗𝚏𝚒𝚛𝚖𝚊𝚝𝚒𝚘𝚗 𝚝𝚘 𝚎𝚗𝚜𝚞𝚛𝚎 𝚝𝚑𝚎 𝚌𝚘𝚗𝚍𝚒𝚝𝚒𝚘𝚗𝚜 𝚊𝚛𝚎 𝚏𝚊𝚟𝚘𝚛𝚊𝚋𝚕𝚎 𝚏𝚘𝚛 𝚘𝚞𝚛 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢.

𝙸𝚗 𝚜𝚞𝚖𝚖𝚊𝚛𝚢, 𝚠𝚎 𝚊𝚛𝚎 𝚍𝚒𝚜𝚌𝚞𝚜𝚜𝚒𝚗𝚐 𝚝𝚑𝚎 𝚌𝚞𝚛𝚛𝚎𝚗𝚝 𝚜𝚝𝚊𝚝𝚎 𝚘𝚏 𝚂𝙾𝙻𝚄𝚂𝙳𝚃 𝚒𝚗 𝚝𝚑𝚎 𝙼5 𝚝𝚒𝚖𝚎 𝚏𝚛𝚊𝚖𝚎, 𝚑𝚒𝚐𝚑𝚕𝚒𝚐𝚑𝚝𝚒𝚗𝚐 𝚝𝚑𝚎 𝚒𝚗𝚍𝚞𝚌𝚎𝚖𝚎𝚗𝚝 𝚕𝚎𝚟𝚎𝚕 𝚊𝚗𝚍 𝚝𝚑𝚎 𝚌𝚘𝚗𝚏𝚒𝚛𝚖𝚎𝚍 𝚕𝚘𝚠𝚎𝚜𝚝 𝚖𝚊𝚛𝚔𝚎𝚝 𝚙𝚘𝚒𝚗𝚝. 𝙾𝚞𝚛 𝚙𝚕𝚊𝚗 𝚒𝚜 𝚝𝚘 𝚜𝚎𝚕𝚕 𝚞𝚜𝚒𝚗𝚐 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸 𝚖𝚎𝚝𝚑𝚘𝚍, 𝚠𝚒𝚝𝚑 𝚝𝚑𝚎 𝚝𝚊𝚛𝚐𝚎𝚝 𝚋𝚎𝚒𝚗𝚐 𝚝𝚑𝚎 𝚖𝚊𝚒𝚗 𝚕𝚘𝚠 𝚘𝚏 𝙼5, 𝚊𝚗𝚍 𝚠𝚎 𝚊𝚛𝚎 𝚋𝚎𝚒𝚗𝚐 𝚌𝚊𝚞𝚝𝚒𝚘𝚞𝚜 𝚋𝚢 𝚠𝚊𝚒𝚝𝚒𝚗𝚐 𝚏𝚘𝚛 𝚌𝚘𝚗𝚏𝚒𝚛𝚖𝚊𝚝𝚒𝚘𝚗 𝚋𝚎𝚏𝚘𝚛𝚎 𝚖𝚊𝚔𝚒𝚗𝚐 𝚊𝚗𝚢 𝚖𝚘𝚟𝚎𝚜.

.png)

M15

𝙽𝚘𝚠, 𝚕𝚎𝚝'𝚜 𝚍𝚎𝚕𝚟𝚎 𝚒𝚗𝚝𝚘 𝚂𝙾𝙻𝚄𝚂𝙳𝚃'𝚜 𝙼15 𝚝𝚒𝚖𝚎 𝚏𝚛𝚊𝚖𝚎. 𝙲𝚞𝚛𝚛𝚎𝚗𝚝𝚕𝚢, 𝚂𝚘𝚕 𝚄𝚂𝙳𝚃 𝚒𝚜 𝚒𝚗 𝚊𝚗 𝚘𝚟𝚎𝚛𝚊𝚕𝚕 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚝𝚛𝚎𝚗𝚍 𝚘𝚗 𝚝𝚑𝚒𝚜 15-𝚖𝚒𝚗𝚞𝚝𝚎 𝚌𝚑𝚊𝚛𝚝. 𝚆𝚎'𝚛𝚎 𝚙𝚊𝚝𝚒𝚎𝚗𝚝𝚕𝚢 𝚠𝚊𝚒𝚝𝚒𝚗𝚐 𝚏𝚘𝚛 𝚊 𝚝𝚛𝚒𝚐𝚐𝚎𝚛𝚒𝚗𝚐 𝚎𝚟𝚎𝚗𝚝, 𝚌𝚊𝚕𝚕𝚎𝚍 𝚝𝚑𝚎 𝚒𝚗𝚍𝚞𝚌𝚎𝚖𝚎𝚗𝚝 𝚕𝚎𝚟𝚎𝚕, 𝚝𝚘 𝚘𝚌𝚌𝚞𝚛 𝚊𝚕𝚘𝚗𝚐 𝚠𝚒𝚝𝚑 𝚊 𝚜𝚙𝚎𝚌𝚒𝚏𝚒𝚌 𝚜𝚒𝚗𝚐𝚕𝚎 𝚌𝚊𝚗𝚍𝚕𝚎.

𝙾𝚗𝚌𝚎 𝚝𝚑𝚎 𝚘𝚛𝚍𝚎𝚛 𝚋𝚕𝚘𝚌𝚔, 𝚊 𝚜𝚒𝚐𝚗𝚒𝚏𝚒𝚌𝚊𝚗𝚝 𝚖𝚊𝚛𝚔𝚎𝚝 𝚜𝚝𝚛𝚞𝚌𝚝𝚞𝚛𝚎, 𝚒𝚜 𝚒𝚍𝚎𝚗𝚝𝚒𝚏𝚒𝚎𝚍, 𝙸'𝚟𝚎 𝚙𝚕𝚊𝚌𝚎𝚍 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸 𝚘𝚗 𝚒𝚝. 𝚆𝚎'𝚕𝚕 𝚌𝚕𝚘𝚜𝚎𝚕𝚢 𝚖𝚘𝚗𝚒𝚝𝚘𝚛 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝, 𝚜𝚎𝚎𝚔𝚒𝚗𝚐 𝚌𝚘𝚗𝚏𝚒𝚛𝚖𝚊𝚝𝚒𝚘𝚗 𝚊𝚝 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸 𝚏𝚘𝚛 𝚊 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚘𝚙𝚙𝚘𝚛𝚝𝚞𝚗𝚒𝚝𝚢. 𝙾𝚞𝚛 𝚙𝚕𝚊𝚗 𝚒𝚜 𝚝𝚘 𝚜𝚎𝚕𝚕 𝚏𝚛𝚘𝚖 𝚝𝚑𝚒𝚜 𝚙𝚘𝚒𝚗𝚝, 𝚝𝚊𝚛𝚐𝚎𝚝𝚒𝚗𝚐 𝚝𝚑𝚎 𝙼15 𝚖𝚊𝚒𝚗 𝚕𝚘𝚠. 𝙳𝚞𝚛𝚒𝚗𝚐 𝚝𝚑𝚒𝚜 𝚝𝚛𝚊𝚍𝚎, 𝚠𝚎 𝚖𝚊𝚢 𝚌𝚑𝚘𝚘𝚜𝚎 𝚝𝚘 𝚝𝚊𝚔𝚎 𝚜𝚘𝚖𝚎 𝚙𝚛𝚘𝚏𝚒𝚝 𝚖𝚒𝚍𝚠𝚊𝚢 𝚘𝚛 𝚜𝚎𝚌𝚞𝚛𝚎 𝚘𝚞𝚛 𝚒𝚗𝚟𝚎𝚜𝚝𝚖𝚎𝚗𝚝 𝚋𝚢 𝚜𝚎𝚝𝚝𝚒𝚗𝚐 𝚊 𝚜𝚝𝚘𝚙 𝚕𝚘𝚜𝚜 𝚊𝚝 𝚝𝚑𝚎 𝚎𝚗𝚝𝚛𝚢 𝚙𝚘𝚒𝚗𝚝, 𝚠𝚑𝚒𝚌𝚑 𝚒𝚜 𝚌𝚘𝚖𝚖𝚘𝚗𝚕𝚢 𝚛𝚎𝚏𝚎𝚛𝚛𝚎𝚍 𝚝𝚘 𝚊𝚜 𝚋𝚛𝚎𝚊𝚔 𝚎𝚟𝚎𝚗. 𝚃𝚑𝚒𝚜 𝚌𝚊𝚞𝚝𝚒𝚘𝚞𝚜 𝚊𝚙𝚙𝚛𝚘𝚊𝚌𝚑 𝚎𝚗𝚜𝚞𝚛𝚎𝚜 𝚠𝚎 𝚖𝚊𝚗𝚊𝚐𝚎 𝚛𝚒𝚜𝚔𝚜 𝚎𝚏𝚏𝚎𝚌𝚝𝚒𝚟𝚎𝚕𝚢 𝚍𝚞𝚛𝚒𝚗𝚐 𝚝𝚑𝚎 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚙𝚛𝚘𝚌𝚎𝚜𝚜.

.png)

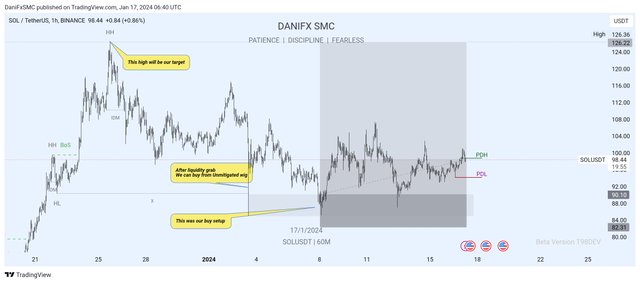

H1

𝙽𝚘𝚠, 𝚕𝚎𝚝'𝚜 𝚏𝚘𝚌𝚞𝚜 𝚘𝚗 𝚂𝙾𝙻𝚄𝚂𝙳𝚃, 𝚊 𝚌𝚛𝚢𝚙𝚝𝚘𝚌𝚞𝚛𝚛𝚎𝚗𝚌𝚢 𝚙𝚊𝚒𝚛, 𝚒𝚗 𝚝𝚑𝚎 𝙷1 𝚝𝚒𝚖𝚎 𝚏𝚛𝚊𝚖𝚎. 𝙲𝚞𝚛𝚛𝚎𝚗𝚝𝚕𝚢, 𝚂𝚘𝚕 𝚄𝚂𝙳𝚃 𝚒𝚜 𝚒𝚗 𝚊𝚗 𝚘𝚟𝚎𝚛𝚊𝚕𝚕 𝚙𝚘𝚜𝚒𝚝𝚒𝚟𝚎 𝚝𝚛𝚎𝚗𝚍 𝚊𝚜 𝚖𝚎𝚗𝚝𝚒𝚘𝚗𝚎𝚍 𝚒𝚗 𝚙𝚛𝚎𝚟𝚒𝚘𝚞𝚜 𝚊𝚗𝚊𝚕𝚢𝚜𝚎𝚜 𝚊𝚗𝚍 𝚋𝚕𝚘𝚐𝚜. 𝚆𝚎 𝚑𝚊𝚟𝚎 𝚊 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢 𝚝𝚘 𝚋𝚞𝚢 𝚠𝚑𝚎𝚗 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝 𝚍𝚒𝚜𝚙𝚕𝚊𝚢𝚜 𝚊𝚗 𝚄𝚗𝚖𝚒𝚝𝚒𝚐𝚊𝚝𝚎𝚍 𝚠𝚒𝚐, 𝚒𝚗𝚍𝚒𝚌𝚊𝚝𝚒𝚗𝚐 𝚊 𝚜𝚠𝚎𝚎𝚙 𝚘𝚏 𝚕𝚒𝚚𝚞𝚒𝚍𝚒𝚝𝚢. 𝙵𝚘𝚕𝚕𝚘𝚠𝚒𝚗𝚐 𝚝𝚑𝚒𝚜 𝚕𝚒𝚚𝚞𝚒𝚍𝚒𝚝𝚢 𝚜𝚠𝚎𝚎𝚙, 𝚠𝚎 𝚙𝚛𝚘𝚌𝚎𝚎𝚍 𝚠𝚒𝚝𝚑 𝚘𝚞𝚛 𝚋𝚞𝚢 𝚎𝚗𝚝𝚛𝚢, 𝚌𝚘𝚗𝚜𝚒𝚍𝚎𝚛𝚒𝚗𝚐 𝚝𝚑𝚎 𝚖𝚒𝚝𝚒𝚐𝚊𝚝𝚎𝚍 𝚠𝚒𝚐𝚜 𝚊𝚗𝚍 𝚘𝚞𝚛 𝚙𝚛𝚒𝚖𝚊𝚛𝚢 𝚑𝚒𝚐𝚑 𝚝𝚊𝚛𝚐𝚎𝚝.

𝙸𝚗 𝚝𝚑𝚎 𝚘𝚗𝚐𝚘𝚒𝚗𝚐 𝚖𝚊𝚛𝚔𝚎𝚝 𝚜𝚌𝚎𝚗𝚊𝚛𝚒𝚘, 𝚝𝚑𝚎 𝚙𝚛𝚒𝚌𝚎 𝚑𝚊𝚜 𝚛𝚒𝚜𝚎𝚗 𝚏𝚛𝚘𝚖 𝚝𝚑𝚎 𝚄𝚗𝚖𝚒𝚝𝚒𝚐𝚊𝚝𝚎𝚍 𝚠𝚒𝚐, 𝚊𝚕𝚒𝚐𝚗𝚒𝚗𝚐 𝚠𝚒𝚝𝚑 𝚘𝚞𝚛 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢. 𝙾𝚞𝚛 𝚐𝚘𝚊𝚕 𝚛𝚎𝚖𝚊𝚒𝚗𝚜 𝚝𝚊𝚛𝚐𝚎𝚝𝚒𝚗𝚐 𝚝𝚑𝚎 𝚖𝚊𝚒𝚗 𝚑𝚒𝚐𝚑 𝚊𝚗𝚍 𝚊𝚌𝚑𝚒𝚎𝚟𝚒𝚗𝚐 𝚘𝚞𝚛 𝚃𝚊𝚔𝚎 𝙿𝚛𝚘𝚏𝚒𝚝 (𝚃𝙿). 𝙳𝚞𝚛𝚒𝚗𝚐 𝚝𝚑𝚒𝚜 𝚙𝚛𝚘𝚌𝚎𝚜𝚜, 𝚠𝚎 𝚖𝚊𝚢 𝚜𝚎𝚌𝚞𝚛𝚎 𝚜𝚘𝚖𝚎 𝚙𝚊𝚛𝚝𝚒𝚊𝚕 𝚙𝚛𝚘𝚏𝚒𝚝𝚜 𝚋𝚎𝚏𝚘𝚛𝚎 𝚛𝚎𝚊𝚌𝚑𝚒𝚗𝚐 𝚝𝚑𝚎 𝚖𝚊𝚒𝚗 𝚃𝙿. 𝙰𝚕𝚝𝚎𝚛𝚗𝚊𝚝𝚒𝚟𝚎𝚕𝚢, 𝚠𝚎 𝚑𝚊𝚟𝚎 𝚝𝚑𝚎 𝚘𝚙𝚝𝚒𝚘𝚗 𝚝𝚘 𝚊𝚍𝚓𝚞𝚜𝚝 𝚘𝚞𝚛 𝚜𝚝𝚘𝚙 𝚕𝚘𝚜𝚜 𝚎𝚗𝚝𝚛𝚢 𝚙𝚘𝚒𝚗𝚝 𝚝𝚘 𝚖𝚊𝚗𝚊𝚐𝚎 𝚝𝚑𝚎 𝚝𝚛𝚊𝚍𝚎 𝚎𝚏𝚏𝚎𝚌𝚝𝚒𝚟𝚎𝚕𝚢. 𝚃𝚑𝚒𝚜 𝚊𝚙𝚙𝚛𝚘𝚊𝚌𝚑 𝚊𝚕𝚕𝚘𝚠𝚜 𝚞𝚜 𝚝𝚘 𝚊𝚍𝚊𝚙𝚝 𝚝𝚘 𝚝𝚑𝚎 𝚎𝚟𝚘𝚕𝚟𝚒𝚗𝚐 𝚖𝚊𝚛𝚔𝚎𝚝 𝚌𝚘𝚗𝚍𝚒𝚝𝚒𝚘𝚗𝚜 𝚠𝚑𝚒𝚕𝚎 𝚊𝚒𝚖𝚒𝚗𝚐 𝚏𝚘𝚛 𝚘𝚞𝚛 𝚜𝚎𝚝 𝚝𝚊𝚛𝚐𝚎𝚝𝚜.

.png)

H4

𝙽𝚘𝚠, 𝚝𝚞𝚛𝚗𝚒𝚗𝚐 𝚘𝚞𝚛 𝚊𝚝𝚝𝚎𝚗𝚝𝚒𝚘𝚗 𝚝𝚘 𝚝𝚑𝚎 𝙷4 𝚝𝚒𝚖𝚎 𝚏𝚛𝚊𝚖𝚎, 𝚠𝚎 𝚘𝚋𝚜𝚎𝚛𝚟𝚎 𝚊𝚗 𝚘𝚟𝚎𝚛𝚊𝚕𝚕 𝚋𝚞𝚕𝚕𝚒𝚜𝚑 𝚝𝚛𝚎𝚗𝚍 𝚒𝚗 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝. 𝙷𝚘𝚠𝚎𝚟𝚎𝚛, 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝚘𝚒𝚗𝚝 𝚘𝚏 𝙸𝚗𝚝𝚎𝚛𝚎𝚜𝚝 (𝙿𝙾𝙸) 𝚒𝚜 𝚗𝚘𝚝𝚊𝚋𝚕𝚢 𝚕𝚘𝚠. 𝚂𝚘, 𝚘𝚞𝚛 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢 𝚒𝚗𝚟𝚘𝚕𝚟𝚎𝚜 𝚠𝚊𝚒𝚝𝚒𝚗𝚐 𝚏𝚘𝚛 𝚊 𝚖𝚊𝚛𝚔𝚎𝚝 𝚜𝚑𝚒𝚏𝚝 𝚋𝚢 𝚜𝚞𝚛𝚙𝚊𝚜𝚜𝚒𝚗𝚐 𝚘𝚞𝚛 𝚙𝚛𝚎𝚟𝚒𝚘𝚞𝚜 𝚑𝚒𝚐𝚑.

𝙾𝚗𝚌𝚎 𝚠𝚎 𝚒𝚍𝚎𝚗𝚝𝚒𝚏𝚢 𝚊 𝚜𝚒𝚗𝚐𝚕𝚎 𝚌𝚊𝚗𝚍𝚕𝚎 𝚘𝚛𝚍𝚎𝚛 𝚋𝚕𝚘𝚌𝚔, 𝚖𝚊𝚛𝚔𝚎𝚍 𝚋𝚢 𝚊 𝚜𝚙𝚎𝚌𝚒𝚏𝚒𝚌 𝚣𝚘𝚗𝚎, 𝚍𝚎𝚛𝚒𝚟𝚎𝚍 𝚏𝚛𝚘𝚖 𝚝𝚑𝚒𝚜 𝚘𝚛𝚍𝚎𝚛 𝚋𝚕𝚘𝚌𝚔, 𝚠𝚎 𝚙𝚕𝚊𝚗 𝚝𝚘 𝚒𝚗𝚒𝚝𝚒𝚊𝚝𝚎 𝚊 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚎𝚗𝚝𝚛𝚢. 𝙾𝚞𝚛 𝚃𝚊𝚔𝚎 𝙿𝚛𝚘𝚏𝚒𝚝 (𝚃𝙿) 𝚠𝚒𝚕𝚕 𝚋𝚎 𝚜𝚎𝚝 𝚊𝚝 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸 𝚘𝚏 𝙷4. 𝙰𝚏𝚝𝚎𝚛 𝚘𝚋𝚝𝚊𝚒𝚗𝚒𝚗𝚐 𝚌𝚘𝚗𝚏𝚒𝚛𝚖𝚊𝚝𝚒𝚘𝚗 𝚏𝚛𝚘𝚖 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸, 𝚠𝚎 𝚠𝚒𝚕𝚕 𝚙𝚛𝚘𝚌𝚎𝚎𝚍 𝚠𝚒𝚝𝚑 𝚊 𝚋𝚞𝚢𝚒𝚗𝚐 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢, 𝚝𝚊𝚛𝚐𝚎𝚝𝚒𝚗𝚐 𝚘𝚞𝚛 𝚖𝚊𝚒𝚗 𝚑𝚒𝚐𝚑 𝚏𝚘𝚛 𝚃𝙿, 𝚠𝚑𝚒𝚌𝚑 𝚒𝚜 𝚊 𝚕𝚎𝚟𝚎𝚕 𝚎𝚜𝚝𝚊𝚋𝚕𝚒𝚜𝚑𝚎𝚍 𝚒𝚗 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝. 𝚃𝚑𝚒𝚜 𝚊𝚙𝚙𝚛𝚘𝚊𝚌𝚑 𝚒𝚗𝚟𝚘𝚕𝚟𝚎𝚜 𝚊𝚍𝚊𝚙𝚝𝚒𝚗𝚐 𝚝𝚘 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝 𝚍𝚢𝚗𝚊𝚖𝚒𝚌𝚜, 𝚊𝚕𝚕𝚘𝚠𝚒𝚗𝚐 𝚞𝚜 𝚝𝚘 𝚖𝚊𝚔𝚎 𝚒𝚗𝚏𝚘𝚛𝚖𝚎𝚍 𝚍𝚎𝚌𝚒𝚜𝚒𝚘𝚗𝚜 𝚠𝚑𝚒𝚕𝚎 𝚊𝚒𝚖𝚒𝚗𝚐 𝚏𝚘𝚛 𝚜𝚙𝚎𝚌𝚒𝚏𝚒𝚌 𝚙𝚛𝚒𝚌𝚎 𝚙𝚘𝚒𝚗𝚝𝚜.

Thank you for visiting my post

Analyzed by @danish578 Source Trading view Pairs SOL/USDT Community Steem4Bloggers Beneficiaries 25% @null Thanks For Voting My Post

.jpeg)

𝙾𝚗𝚌𝚎 𝚝𝚑𝚎 𝚘𝚛𝚍𝚎𝚛 𝚋𝚕𝚘𝚌𝚔, 𝚊 𝚜𝚒𝚐𝚗𝚒𝚏𝚒𝚌𝚊𝚗𝚝 𝚖𝚊𝚛𝚔𝚎𝚝 𝚜𝚝𝚛𝚞𝚌𝚝𝚞𝚛𝚎, 𝚒𝚜 𝚒𝚍𝚎𝚗𝚝𝚒𝚏𝚒𝚎𝚍, 𝙸'𝚟𝚎 𝚙𝚕𝚊𝚌𝚎𝚍 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸 𝚘𝚗 𝚒𝚝. 𝚆𝚎'𝚕𝚕 𝚌𝚕𝚘𝚜𝚎𝚕𝚢 𝚖𝚘𝚗𝚒𝚝𝚘𝚛 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝, 𝚜𝚎𝚎𝚔𝚒𝚗𝚐 𝚌𝚘𝚗𝚏𝚒𝚛𝚖𝚊𝚝𝚒𝚘𝚗 𝚊𝚝 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸 𝚏𝚘𝚛 𝚊 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚘𝚙𝚙𝚘𝚛𝚝𝚞𝚗𝚒𝚝𝚢. 𝙾𝚞𝚛 𝚙𝚕𝚊𝚗 𝚒𝚜 𝚝𝚘 𝚜𝚎𝚕𝚕 𝚏𝚛𝚘𝚖 𝚝𝚑𝚒𝚜 𝚙𝚘𝚒𝚗𝚝, 𝚝𝚊𝚛𝚐𝚎𝚝𝚒𝚗𝚐 𝚝𝚑𝚎 𝙼15 𝚖𝚊𝚒𝚗 𝚕𝚘𝚠. 𝙳𝚞𝚛𝚒𝚗𝚐 𝚝𝚑𝚒𝚜 𝚝𝚛𝚊𝚍𝚎, 𝚠𝚎 𝚖𝚊𝚢 𝚌𝚑𝚘𝚘𝚜𝚎 𝚝𝚘 𝚝𝚊𝚔𝚎 𝚜𝚘𝚖𝚎 𝚙𝚛𝚘𝚏𝚒𝚝 𝚖𝚒𝚍𝚠𝚊𝚢 𝚘𝚛 𝚜𝚎𝚌𝚞𝚛𝚎 𝚘𝚞𝚛 𝚒𝚗𝚟𝚎𝚜𝚝𝚖𝚎𝚗𝚝 𝚋𝚢 𝚜𝚎𝚝𝚝𝚒𝚗𝚐 𝚊 𝚜𝚝𝚘𝚙 𝚕𝚘𝚜𝚜 𝚊𝚝 𝚝𝚑𝚎 𝚎𝚗𝚝𝚛𝚢 𝚙𝚘𝚒𝚗𝚝, 𝚠𝚑𝚒𝚌𝚑 𝚒𝚜 𝚌𝚘𝚖𝚖𝚘𝚗𝚕𝚢 𝚛𝚎𝚏𝚎𝚛𝚛𝚎𝚍 𝚝𝚘 𝚊𝚜 𝚋𝚛𝚎𝚊𝚔 𝚎𝚟𝚎𝚗. 𝚃𝚑𝚒𝚜 𝚌𝚊𝚞𝚝𝚒𝚘𝚞𝚜 𝚊𝚙𝚙𝚛𝚘𝚊𝚌𝚑 𝚎𝚗𝚜𝚞𝚛𝚎𝚜 𝚠𝚎 𝚖𝚊𝚗𝚊𝚐𝚎 𝚛𝚒𝚜𝚔𝚜 𝚎𝚏𝚏𝚎𝚌𝚝𝚒𝚟𝚎𝚕𝚢 𝚍𝚞𝚛𝚒𝚗𝚐 𝚝𝚑𝚎 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚙𝚛𝚘𝚌𝚎𝚜𝚜.

.png)

H1

𝙽𝚘𝚠, 𝚕𝚎𝚝'𝚜 𝚏𝚘𝚌𝚞𝚜 𝚘𝚗 𝚂𝙾𝙻𝚄𝚂𝙳𝚃, 𝚊 𝚌𝚛𝚢𝚙𝚝𝚘𝚌𝚞𝚛𝚛𝚎𝚗𝚌𝚢 𝚙𝚊𝚒𝚛, 𝚒𝚗 𝚝𝚑𝚎 𝙷1 𝚝𝚒𝚖𝚎 𝚏𝚛𝚊𝚖𝚎. 𝙲𝚞𝚛𝚛𝚎𝚗𝚝𝚕𝚢, 𝚂𝚘𝚕 𝚄𝚂𝙳𝚃 𝚒𝚜 𝚒𝚗 𝚊𝚗 𝚘𝚟𝚎𝚛𝚊𝚕𝚕 𝚙𝚘𝚜𝚒𝚝𝚒𝚟𝚎 𝚝𝚛𝚎𝚗𝚍 𝚊𝚜 𝚖𝚎𝚗𝚝𝚒𝚘𝚗𝚎𝚍 𝚒𝚗 𝚙𝚛𝚎𝚟𝚒𝚘𝚞𝚜 𝚊𝚗𝚊𝚕𝚢𝚜𝚎𝚜 𝚊𝚗𝚍 𝚋𝚕𝚘𝚐𝚜. 𝚆𝚎 𝚑𝚊𝚟𝚎 𝚊 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢 𝚝𝚘 𝚋𝚞𝚢 𝚠𝚑𝚎𝚗 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝 𝚍𝚒𝚜𝚙𝚕𝚊𝚢𝚜 𝚊𝚗 𝚄𝚗𝚖𝚒𝚝𝚒𝚐𝚊𝚝𝚎𝚍 𝚠𝚒𝚐, 𝚒𝚗𝚍𝚒𝚌𝚊𝚝𝚒𝚗𝚐 𝚊 𝚜𝚠𝚎𝚎𝚙 𝚘𝚏 𝚕𝚒𝚚𝚞𝚒𝚍𝚒𝚝𝚢. 𝙵𝚘𝚕𝚕𝚘𝚠𝚒𝚗𝚐 𝚝𝚑𝚒𝚜 𝚕𝚒𝚚𝚞𝚒𝚍𝚒𝚝𝚢 𝚜𝚠𝚎𝚎𝚙, 𝚠𝚎 𝚙𝚛𝚘𝚌𝚎𝚎𝚍 𝚠𝚒𝚝𝚑 𝚘𝚞𝚛 𝚋𝚞𝚢 𝚎𝚗𝚝𝚛𝚢, 𝚌𝚘𝚗𝚜𝚒𝚍𝚎𝚛𝚒𝚗𝚐 𝚝𝚑𝚎 𝚖𝚒𝚝𝚒𝚐𝚊𝚝𝚎𝚍 𝚠𝚒𝚐𝚜 𝚊𝚗𝚍 𝚘𝚞𝚛 𝚙𝚛𝚒𝚖𝚊𝚛𝚢 𝚑𝚒𝚐𝚑 𝚝𝚊𝚛𝚐𝚎𝚝.

𝙸𝚗 𝚝𝚑𝚎 𝚘𝚗𝚐𝚘𝚒𝚗𝚐 𝚖𝚊𝚛𝚔𝚎𝚝 𝚜𝚌𝚎𝚗𝚊𝚛𝚒𝚘, 𝚝𝚑𝚎 𝚙𝚛𝚒𝚌𝚎 𝚑𝚊𝚜 𝚛𝚒𝚜𝚎𝚗 𝚏𝚛𝚘𝚖 𝚝𝚑𝚎 𝚄𝚗𝚖𝚒𝚝𝚒𝚐𝚊𝚝𝚎𝚍 𝚠𝚒𝚐, 𝚊𝚕𝚒𝚐𝚗𝚒𝚗𝚐 𝚠𝚒𝚝𝚑 𝚘𝚞𝚛 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢. 𝙾𝚞𝚛 𝚐𝚘𝚊𝚕 𝚛𝚎𝚖𝚊𝚒𝚗𝚜 𝚝𝚊𝚛𝚐𝚎𝚝𝚒𝚗𝚐 𝚝𝚑𝚎 𝚖𝚊𝚒𝚗 𝚑𝚒𝚐𝚑 𝚊𝚗𝚍 𝚊𝚌𝚑𝚒𝚎𝚟𝚒𝚗𝚐 𝚘𝚞𝚛 𝚃𝚊𝚔𝚎 𝙿𝚛𝚘𝚏𝚒𝚝 (𝚃𝙿). 𝙳𝚞𝚛𝚒𝚗𝚐 𝚝𝚑𝚒𝚜 𝚙𝚛𝚘𝚌𝚎𝚜𝚜, 𝚠𝚎 𝚖𝚊𝚢 𝚜𝚎𝚌𝚞𝚛𝚎 𝚜𝚘𝚖𝚎 𝚙𝚊𝚛𝚝𝚒𝚊𝚕 𝚙𝚛𝚘𝚏𝚒𝚝𝚜 𝚋𝚎𝚏𝚘𝚛𝚎 𝚛𝚎𝚊𝚌𝚑𝚒𝚗𝚐 𝚝𝚑𝚎 𝚖𝚊𝚒𝚗 𝚃𝙿. 𝙰𝚕𝚝𝚎𝚛𝚗𝚊𝚝𝚒𝚟𝚎𝚕𝚢, 𝚠𝚎 𝚑𝚊𝚟𝚎 𝚝𝚑𝚎 𝚘𝚙𝚝𝚒𝚘𝚗 𝚝𝚘 𝚊𝚍𝚓𝚞𝚜𝚝 𝚘𝚞𝚛 𝚜𝚝𝚘𝚙 𝚕𝚘𝚜𝚜 𝚎𝚗𝚝𝚛𝚢 𝚙𝚘𝚒𝚗𝚝 𝚝𝚘 𝚖𝚊𝚗𝚊𝚐𝚎 𝚝𝚑𝚎 𝚝𝚛𝚊𝚍𝚎 𝚎𝚏𝚏𝚎𝚌𝚝𝚒𝚟𝚎𝚕𝚢. 𝚃𝚑𝚒𝚜 𝚊𝚙𝚙𝚛𝚘𝚊𝚌𝚑 𝚊𝚕𝚕𝚘𝚠𝚜 𝚞𝚜 𝚝𝚘 𝚊𝚍𝚊𝚙𝚝 𝚝𝚘 𝚝𝚑𝚎 𝚎𝚟𝚘𝚕𝚟𝚒𝚗𝚐 𝚖𝚊𝚛𝚔𝚎𝚝 𝚌𝚘𝚗𝚍𝚒𝚝𝚒𝚘𝚗𝚜 𝚠𝚑𝚒𝚕𝚎 𝚊𝚒𝚖𝚒𝚗𝚐 𝚏𝚘𝚛 𝚘𝚞𝚛 𝚜𝚎𝚝 𝚝𝚊𝚛𝚐𝚎𝚝𝚜.

.png)

H4

𝙽𝚘𝚠, 𝚝𝚞𝚛𝚗𝚒𝚗𝚐 𝚘𝚞𝚛 𝚊𝚝𝚝𝚎𝚗𝚝𝚒𝚘𝚗 𝚝𝚘 𝚝𝚑𝚎 𝙷4 𝚝𝚒𝚖𝚎 𝚏𝚛𝚊𝚖𝚎, 𝚠𝚎 𝚘𝚋𝚜𝚎𝚛𝚟𝚎 𝚊𝚗 𝚘𝚟𝚎𝚛𝚊𝚕𝚕 𝚋𝚞𝚕𝚕𝚒𝚜𝚑 𝚝𝚛𝚎𝚗𝚍 𝚒𝚗 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝. 𝙷𝚘𝚠𝚎𝚟𝚎𝚛, 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝚘𝚒𝚗𝚝 𝚘𝚏 𝙸𝚗𝚝𝚎𝚛𝚎𝚜𝚝 (𝙿𝙾𝙸) 𝚒𝚜 𝚗𝚘𝚝𝚊𝚋𝚕𝚢 𝚕𝚘𝚠. 𝚂𝚘, 𝚘𝚞𝚛 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢 𝚒𝚗𝚟𝚘𝚕𝚟𝚎𝚜 𝚠𝚊𝚒𝚝𝚒𝚗𝚐 𝚏𝚘𝚛 𝚊 𝚖𝚊𝚛𝚔𝚎𝚝 𝚜𝚑𝚒𝚏𝚝 𝚋𝚢 𝚜𝚞𝚛𝚙𝚊𝚜𝚜𝚒𝚗𝚐 𝚘𝚞𝚛 𝚙𝚛𝚎𝚟𝚒𝚘𝚞𝚜 𝚑𝚒𝚐𝚑.

𝙾𝚗𝚌𝚎 𝚠𝚎 𝚒𝚍𝚎𝚗𝚝𝚒𝚏𝚢 𝚊 𝚜𝚒𝚗𝚐𝚕𝚎 𝚌𝚊𝚗𝚍𝚕𝚎 𝚘𝚛𝚍𝚎𝚛 𝚋𝚕𝚘𝚌𝚔, 𝚖𝚊𝚛𝚔𝚎𝚍 𝚋𝚢 𝚊 𝚜𝚙𝚎𝚌𝚒𝚏𝚒𝚌 𝚣𝚘𝚗𝚎, 𝚍𝚎𝚛𝚒𝚟𝚎𝚍 𝚏𝚛𝚘𝚖 𝚝𝚑𝚒𝚜 𝚘𝚛𝚍𝚎𝚛 𝚋𝚕𝚘𝚌𝚔, 𝚠𝚎 𝚙𝚕𝚊𝚗 𝚝𝚘 𝚒𝚗𝚒𝚝𝚒𝚊𝚝𝚎 𝚊 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚎𝚗𝚝𝚛𝚢. 𝙾𝚞𝚛 𝚃𝚊𝚔𝚎 𝙿𝚛𝚘𝚏𝚒𝚝 (𝚃𝙿) 𝚠𝚒𝚕𝚕 𝚋𝚎 𝚜𝚎𝚝 𝚊𝚝 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸 𝚘𝚏 𝙷4. 𝙰𝚏𝚝𝚎𝚛 𝚘𝚋𝚝𝚊𝚒𝚗𝚒𝚗𝚐 𝚌𝚘𝚗𝚏𝚒𝚛𝚖𝚊𝚝𝚒𝚘𝚗 𝚏𝚛𝚘𝚖 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸, 𝚠𝚎 𝚠𝚒𝚕𝚕 𝚙𝚛𝚘𝚌𝚎𝚎𝚍 𝚠𝚒𝚝𝚑 𝚊 𝚋𝚞𝚢𝚒𝚗𝚐 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢, 𝚝𝚊𝚛𝚐𝚎𝚝𝚒𝚗𝚐 𝚘𝚞𝚛 𝚖𝚊𝚒𝚗 𝚑𝚒𝚐𝚑 𝚏𝚘𝚛 𝚃𝙿, 𝚠𝚑𝚒𝚌𝚑 𝚒𝚜 𝚊 𝚕𝚎𝚟𝚎𝚕 𝚎𝚜𝚝𝚊𝚋𝚕𝚒𝚜𝚑𝚎𝚍 𝚒𝚗 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝. 𝚃𝚑𝚒𝚜 𝚊𝚙𝚙𝚛𝚘𝚊𝚌𝚑 𝚒𝚗𝚟𝚘𝚕𝚟𝚎𝚜 𝚊𝚍𝚊𝚙𝚝𝚒𝚗𝚐 𝚝𝚘 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝 𝚍𝚢𝚗𝚊𝚖𝚒𝚌𝚜, 𝚊𝚕𝚕𝚘𝚠𝚒𝚗𝚐 𝚞𝚜 𝚝𝚘 𝚖𝚊𝚔𝚎 𝚒𝚗𝚏𝚘𝚛𝚖𝚎𝚍 𝚍𝚎𝚌𝚒𝚜𝚒𝚘𝚗𝚜 𝚠𝚑𝚒𝚕𝚎 𝚊𝚒𝚖𝚒𝚗𝚐 𝚏𝚘𝚛 𝚜𝚙𝚎𝚌𝚒𝚏𝚒𝚌 𝚙𝚛𝚒𝚌𝚎 𝚙𝚘𝚒𝚗𝚝𝚜.

Thank you for visiting my post

Analyzed by @danish578 Source Trading view Pairs SOL/USDT Community Steem4Bloggers Beneficiaries 25% @null Thanks For Voting My Post

.jpeg)

𝙸𝚗 𝚝𝚑𝚎 𝚘𝚗𝚐𝚘𝚒𝚗𝚐 𝚖𝚊𝚛𝚔𝚎𝚝 𝚜𝚌𝚎𝚗𝚊𝚛𝚒𝚘, 𝚝𝚑𝚎 𝚙𝚛𝚒𝚌𝚎 𝚑𝚊𝚜 𝚛𝚒𝚜𝚎𝚗 𝚏𝚛𝚘𝚖 𝚝𝚑𝚎 𝚄𝚗𝚖𝚒𝚝𝚒𝚐𝚊𝚝𝚎𝚍 𝚠𝚒𝚐, 𝚊𝚕𝚒𝚐𝚗𝚒𝚗𝚐 𝚠𝚒𝚝𝚑 𝚘𝚞𝚛 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢. 𝙾𝚞𝚛 𝚐𝚘𝚊𝚕 𝚛𝚎𝚖𝚊𝚒𝚗𝚜 𝚝𝚊𝚛𝚐𝚎𝚝𝚒𝚗𝚐 𝚝𝚑𝚎 𝚖𝚊𝚒𝚗 𝚑𝚒𝚐𝚑 𝚊𝚗𝚍 𝚊𝚌𝚑𝚒𝚎𝚟𝚒𝚗𝚐 𝚘𝚞𝚛 𝚃𝚊𝚔𝚎 𝙿𝚛𝚘𝚏𝚒𝚝 (𝚃𝙿). 𝙳𝚞𝚛𝚒𝚗𝚐 𝚝𝚑𝚒𝚜 𝚙𝚛𝚘𝚌𝚎𝚜𝚜, 𝚠𝚎 𝚖𝚊𝚢 𝚜𝚎𝚌𝚞𝚛𝚎 𝚜𝚘𝚖𝚎 𝚙𝚊𝚛𝚝𝚒𝚊𝚕 𝚙𝚛𝚘𝚏𝚒𝚝𝚜 𝚋𝚎𝚏𝚘𝚛𝚎 𝚛𝚎𝚊𝚌𝚑𝚒𝚗𝚐 𝚝𝚑𝚎 𝚖𝚊𝚒𝚗 𝚃𝙿. 𝙰𝚕𝚝𝚎𝚛𝚗𝚊𝚝𝚒𝚟𝚎𝚕𝚢, 𝚠𝚎 𝚑𝚊𝚟𝚎 𝚝𝚑𝚎 𝚘𝚙𝚝𝚒𝚘𝚗 𝚝𝚘 𝚊𝚍𝚓𝚞𝚜𝚝 𝚘𝚞𝚛 𝚜𝚝𝚘𝚙 𝚕𝚘𝚜𝚜 𝚎𝚗𝚝𝚛𝚢 𝚙𝚘𝚒𝚗𝚝 𝚝𝚘 𝚖𝚊𝚗𝚊𝚐𝚎 𝚝𝚑𝚎 𝚝𝚛𝚊𝚍𝚎 𝚎𝚏𝚏𝚎𝚌𝚝𝚒𝚟𝚎𝚕𝚢. 𝚃𝚑𝚒𝚜 𝚊𝚙𝚙𝚛𝚘𝚊𝚌𝚑 𝚊𝚕𝚕𝚘𝚠𝚜 𝚞𝚜 𝚝𝚘 𝚊𝚍𝚊𝚙𝚝 𝚝𝚘 𝚝𝚑𝚎 𝚎𝚟𝚘𝚕𝚟𝚒𝚗𝚐 𝚖𝚊𝚛𝚔𝚎𝚝 𝚌𝚘𝚗𝚍𝚒𝚝𝚒𝚘𝚗𝚜 𝚠𝚑𝚒𝚕𝚎 𝚊𝚒𝚖𝚒𝚗𝚐 𝚏𝚘𝚛 𝚘𝚞𝚛 𝚜𝚎𝚝 𝚝𝚊𝚛𝚐𝚎𝚝𝚜.

.png)

H4

𝙽𝚘𝚠, 𝚝𝚞𝚛𝚗𝚒𝚗𝚐 𝚘𝚞𝚛 𝚊𝚝𝚝𝚎𝚗𝚝𝚒𝚘𝚗 𝚝𝚘 𝚝𝚑𝚎 𝙷4 𝚝𝚒𝚖𝚎 𝚏𝚛𝚊𝚖𝚎, 𝚠𝚎 𝚘𝚋𝚜𝚎𝚛𝚟𝚎 𝚊𝚗 𝚘𝚟𝚎𝚛𝚊𝚕𝚕 𝚋𝚞𝚕𝚕𝚒𝚜𝚑 𝚝𝚛𝚎𝚗𝚍 𝚒𝚗 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝. 𝙷𝚘𝚠𝚎𝚟𝚎𝚛, 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝚘𝚒𝚗𝚝 𝚘𝚏 𝙸𝚗𝚝𝚎𝚛𝚎𝚜𝚝 (𝙿𝙾𝙸) 𝚒𝚜 𝚗𝚘𝚝𝚊𝚋𝚕𝚢 𝚕𝚘𝚠. 𝚂𝚘, 𝚘𝚞𝚛 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢 𝚒𝚗𝚟𝚘𝚕𝚟𝚎𝚜 𝚠𝚊𝚒𝚝𝚒𝚗𝚐 𝚏𝚘𝚛 𝚊 𝚖𝚊𝚛𝚔𝚎𝚝 𝚜𝚑𝚒𝚏𝚝 𝚋𝚢 𝚜𝚞𝚛𝚙𝚊𝚜𝚜𝚒𝚗𝚐 𝚘𝚞𝚛 𝚙𝚛𝚎𝚟𝚒𝚘𝚞𝚜 𝚑𝚒𝚐𝚑.

𝙾𝚗𝚌𝚎 𝚠𝚎 𝚒𝚍𝚎𝚗𝚝𝚒𝚏𝚢 𝚊 𝚜𝚒𝚗𝚐𝚕𝚎 𝚌𝚊𝚗𝚍𝚕𝚎 𝚘𝚛𝚍𝚎𝚛 𝚋𝚕𝚘𝚌𝚔, 𝚖𝚊𝚛𝚔𝚎𝚍 𝚋𝚢 𝚊 𝚜𝚙𝚎𝚌𝚒𝚏𝚒𝚌 𝚣𝚘𝚗𝚎, 𝚍𝚎𝚛𝚒𝚟𝚎𝚍 𝚏𝚛𝚘𝚖 𝚝𝚑𝚒𝚜 𝚘𝚛𝚍𝚎𝚛 𝚋𝚕𝚘𝚌𝚔, 𝚠𝚎 𝚙𝚕𝚊𝚗 𝚝𝚘 𝚒𝚗𝚒𝚝𝚒𝚊𝚝𝚎 𝚊 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚎𝚗𝚝𝚛𝚢. 𝙾𝚞𝚛 𝚃𝚊𝚔𝚎 𝙿𝚛𝚘𝚏𝚒𝚝 (𝚃𝙿) 𝚠𝚒𝚕𝚕 𝚋𝚎 𝚜𝚎𝚝 𝚊𝚝 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸 𝚘𝚏 𝙷4. 𝙰𝚏𝚝𝚎𝚛 𝚘𝚋𝚝𝚊𝚒𝚗𝚒𝚗𝚐 𝚌𝚘𝚗𝚏𝚒𝚛𝚖𝚊𝚝𝚒𝚘𝚗 𝚏𝚛𝚘𝚖 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸, 𝚠𝚎 𝚠𝚒𝚕𝚕 𝚙𝚛𝚘𝚌𝚎𝚎𝚍 𝚠𝚒𝚝𝚑 𝚊 𝚋𝚞𝚢𝚒𝚗𝚐 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢, 𝚝𝚊𝚛𝚐𝚎𝚝𝚒𝚗𝚐 𝚘𝚞𝚛 𝚖𝚊𝚒𝚗 𝚑𝚒𝚐𝚑 𝚏𝚘𝚛 𝚃𝙿, 𝚠𝚑𝚒𝚌𝚑 𝚒𝚜 𝚊 𝚕𝚎𝚟𝚎𝚕 𝚎𝚜𝚝𝚊𝚋𝚕𝚒𝚜𝚑𝚎𝚍 𝚒𝚗 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝. 𝚃𝚑𝚒𝚜 𝚊𝚙𝚙𝚛𝚘𝚊𝚌𝚑 𝚒𝚗𝚟𝚘𝚕𝚟𝚎𝚜 𝚊𝚍𝚊𝚙𝚝𝚒𝚗𝚐 𝚝𝚘 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝 𝚍𝚢𝚗𝚊𝚖𝚒𝚌𝚜, 𝚊𝚕𝚕𝚘𝚠𝚒𝚗𝚐 𝚞𝚜 𝚝𝚘 𝚖𝚊𝚔𝚎 𝚒𝚗𝚏𝚘𝚛𝚖𝚎𝚍 𝚍𝚎𝚌𝚒𝚜𝚒𝚘𝚗𝚜 𝚠𝚑𝚒𝚕𝚎 𝚊𝚒𝚖𝚒𝚗𝚐 𝚏𝚘𝚛 𝚜𝚙𝚎𝚌𝚒𝚏𝚒𝚌 𝚙𝚛𝚒𝚌𝚎 𝚙𝚘𝚒𝚗𝚝𝚜.

Thank you for visiting my post

Analyzed by @danish578 Source Trading view Pairs SOL/USDT Community Steem4Bloggers Beneficiaries 25% @null Thanks For Voting My Post

.jpeg)

𝙾𝚗𝚌𝚎 𝚠𝚎 𝚒𝚍𝚎𝚗𝚝𝚒𝚏𝚢 𝚊 𝚜𝚒𝚗𝚐𝚕𝚎 𝚌𝚊𝚗𝚍𝚕𝚎 𝚘𝚛𝚍𝚎𝚛 𝚋𝚕𝚘𝚌𝚔, 𝚖𝚊𝚛𝚔𝚎𝚍 𝚋𝚢 𝚊 𝚜𝚙𝚎𝚌𝚒𝚏𝚒𝚌 𝚣𝚘𝚗𝚎, 𝚍𝚎𝚛𝚒𝚟𝚎𝚍 𝚏𝚛𝚘𝚖 𝚝𝚑𝚒𝚜 𝚘𝚛𝚍𝚎𝚛 𝚋𝚕𝚘𝚌𝚔, 𝚠𝚎 𝚙𝚕𝚊𝚗 𝚝𝚘 𝚒𝚗𝚒𝚝𝚒𝚊𝚝𝚎 𝚊 𝚜𝚎𝚕𝚕𝚒𝚗𝚐 𝚎𝚗𝚝𝚛𝚢. 𝙾𝚞𝚛 𝚃𝚊𝚔𝚎 𝙿𝚛𝚘𝚏𝚒𝚝 (𝚃𝙿) 𝚠𝚒𝚕𝚕 𝚋𝚎 𝚜𝚎𝚝 𝚊𝚝 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸 𝚘𝚏 𝙷4. 𝙰𝚏𝚝𝚎𝚛 𝚘𝚋𝚝𝚊𝚒𝚗𝚒𝚗𝚐 𝚌𝚘𝚗𝚏𝚒𝚛𝚖𝚊𝚝𝚒𝚘𝚗 𝚏𝚛𝚘𝚖 𝚝𝚑𝚎 𝙴𝚡𝚝𝚛𝚎𝚖𝚎 𝙿𝙾𝙸, 𝚠𝚎 𝚠𝚒𝚕𝚕 𝚙𝚛𝚘𝚌𝚎𝚎𝚍 𝚠𝚒𝚝𝚑 𝚊 𝚋𝚞𝚢𝚒𝚗𝚐 𝚜𝚝𝚛𝚊𝚝𝚎𝚐𝚢, 𝚝𝚊𝚛𝚐𝚎𝚝𝚒𝚗𝚐 𝚘𝚞𝚛 𝚖𝚊𝚒𝚗 𝚑𝚒𝚐𝚑 𝚏𝚘𝚛 𝚃𝙿, 𝚠𝚑𝚒𝚌𝚑 𝚒𝚜 𝚊 𝚕𝚎𝚟𝚎𝚕 𝚎𝚜𝚝𝚊𝚋𝚕𝚒𝚜𝚑𝚎𝚍 𝚒𝚗 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝. 𝚃𝚑𝚒𝚜 𝚊𝚙𝚙𝚛𝚘𝚊𝚌𝚑 𝚒𝚗𝚟𝚘𝚕𝚟𝚎𝚜 𝚊𝚍𝚊𝚙𝚝𝚒𝚗𝚐 𝚝𝚘 𝚝𝚑𝚎 𝚖𝚊𝚛𝚔𝚎𝚝 𝚍𝚢𝚗𝚊𝚖𝚒𝚌𝚜, 𝚊𝚕𝚕𝚘𝚠𝚒𝚗𝚐 𝚞𝚜 𝚝𝚘 𝚖𝚊𝚔𝚎 𝚒𝚗𝚏𝚘𝚛𝚖𝚎𝚍 𝚍𝚎𝚌𝚒𝚜𝚒𝚘𝚗𝚜 𝚠𝚑𝚒𝚕𝚎 𝚊𝚒𝚖𝚒𝚗𝚐 𝚏𝚘𝚛 𝚜𝚙𝚎𝚌𝚒𝚏𝚒𝚌 𝚙𝚛𝚒𝚌𝚎 𝚙𝚘𝚒𝚗𝚝𝚜.

Thank you for visiting my post

| Analyzed by | @danish578 |

|---|---|

| Source | Trading view |

| Pairs | SOL/USDT |

| Community | Steem4Bloggers |

| Beneficiaries | 25% @null |

| Thanks For Voting My Post |  |

.jpeg)

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit