Now to get a clearer understanding of an exchange order book let's bring it home to better grasp it more.

Let's say one wants to buy something in a local supermarket for instance a thin milk and we have different super market around that are selling it at different prices, let's say super market A sells it for $1 and super market B sells for $1.1 and supermarket C sells it for $1.2 and we ourselves who wants to go and buy this milk already has a price range we are willing to buy it ifnot we won't let's say before going what we plan on buying milk it's between $0.8-1 anything more than that we are not buying and on getting to know how much all this people are selling we will no doubt buy from the place that sells at $1 since it's between the range of what we are willing to buy.

Now in a similar manner an exchange order simply is a place that has a list of buyers and sellers present at the market at that time and what the sellers in the market are willing to part with their asset and how much the buyers wants to buy, it shows the prices the buyers in the exchange wants to buy and the different prices sellers are willing to sell their asset to prospective buyers.

We are kind of in recession now, many world economy is suffering from recession so the prices of goods are all spiked up so when will go to the market today something we bought at $50 today by tomorrow it will get to $70 just like we see in the crypto market though the crypto market is much more violatile than any market and a coin that's $69k now could easily fall to $12k and could easily spike to $250k anything is possible it's filled with many possibilities and more risky than any market and in an order book we trade one crypto pair against another unlike whilst going to buy something in a supermarket where we make use of cash or credit cards.

Crypto asset are traded in pairs we can trade BTC/ETH or ETH/STEEM etc so we trade crypto in pairs or trade one crypto asset with a usd pegged coin like Usdt or BUSD or USDC.

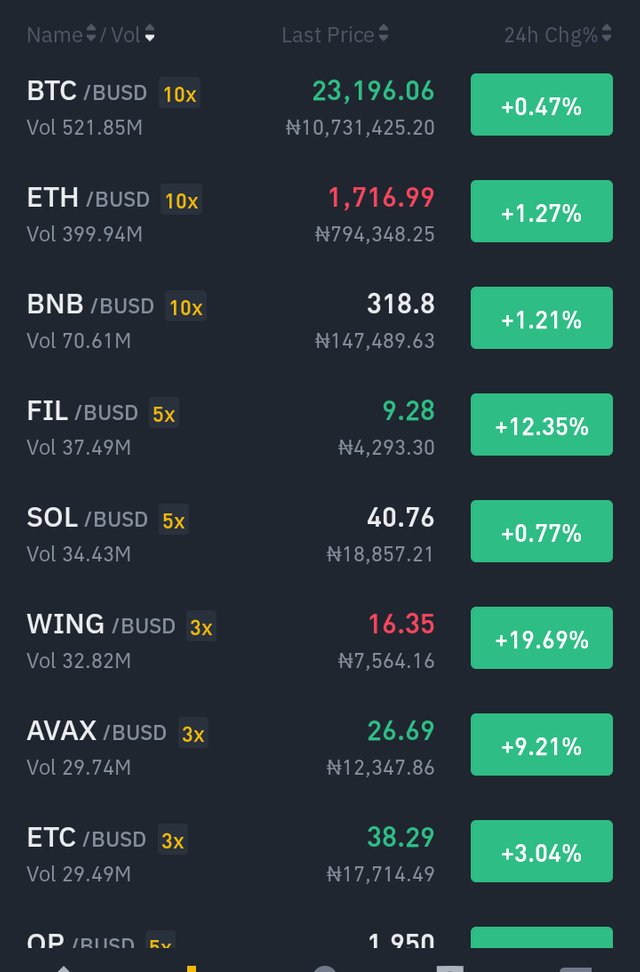

The arrangements in the pic shows how crypto are being traded in pairs, BUSD/FIL, BUSD/SOL, BUSD/BNB etc.

Now when we talk about pair what do we understand by that.

Pairs

Well the idea it's pretty simple it all depends on what we want to buy and what we have, as we know when we talk about pair we are talking about two things they are usually more than one so let's say we have Usdt and we believe Btc will soon appreciate in price and we use our Usdt to buy Btc that usually creates a trading pair of Usdt/BTC or we have ethereum and we believe that the price of steem will appreciate over the price of ethereum we can sell our ethereum to steem which creates a pair of ETH/STEEM, so it's basically the pairing of the asset we are buying with the one we are selling to buy it or vice versa.

Usually in trading we usually based on buying or selling decisions based on fundamentals for the long term or on the technicals, the technicals especially for short term trading and scalping that's when we hear of support and resistance, as most traders often buy an asset when it's in an area of support or demand zone as it's expected to rise from there, let's say btc is at a support level and in an area of high demand we use our Usdt and buy into btc at that area with hope of price appreciation now we would be trading btc/Usdt pair.

The resistance level or the supply zone level is usually a level where the asset is believed to reach and start coming down, let's say BNB reach a particular resistance level and we feel it will start coming down we sell into a stable coin like usdc by so doing a pair of USDC/BNB has been made.

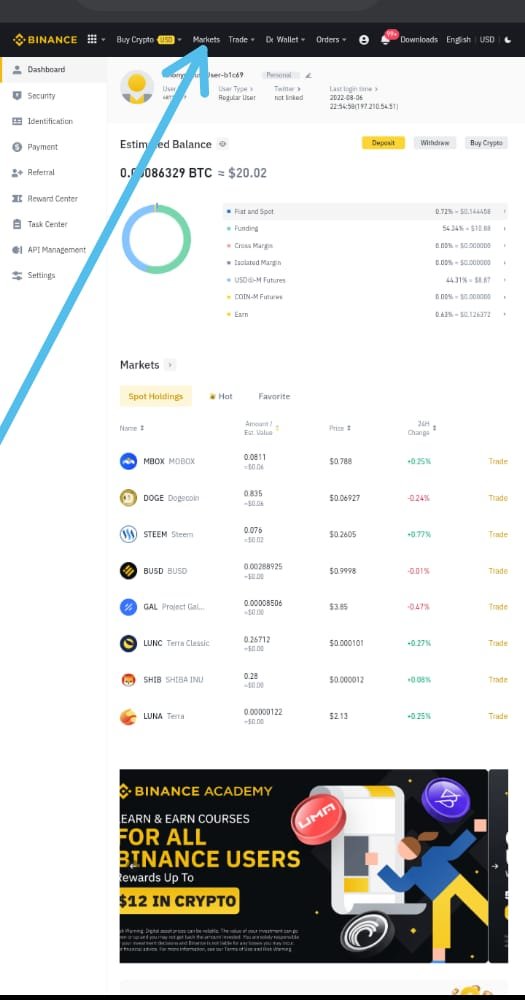

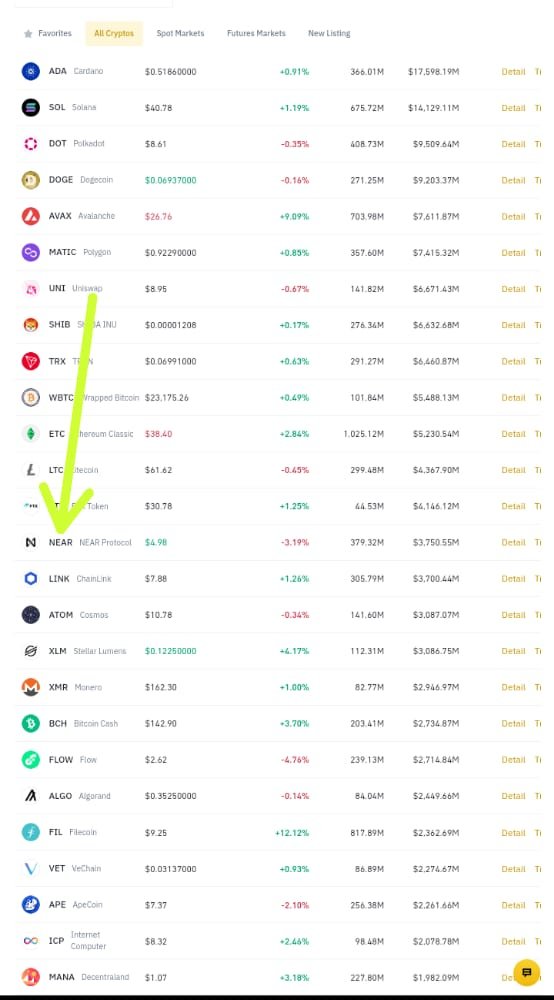

To locate and order book on a binance exchange is quite easy, for starters we open our binance now when we open our binance then we go to top bar in the area we see market as the arrow in the pic is pointing to then we click market and all the possible pairs in the market will open.

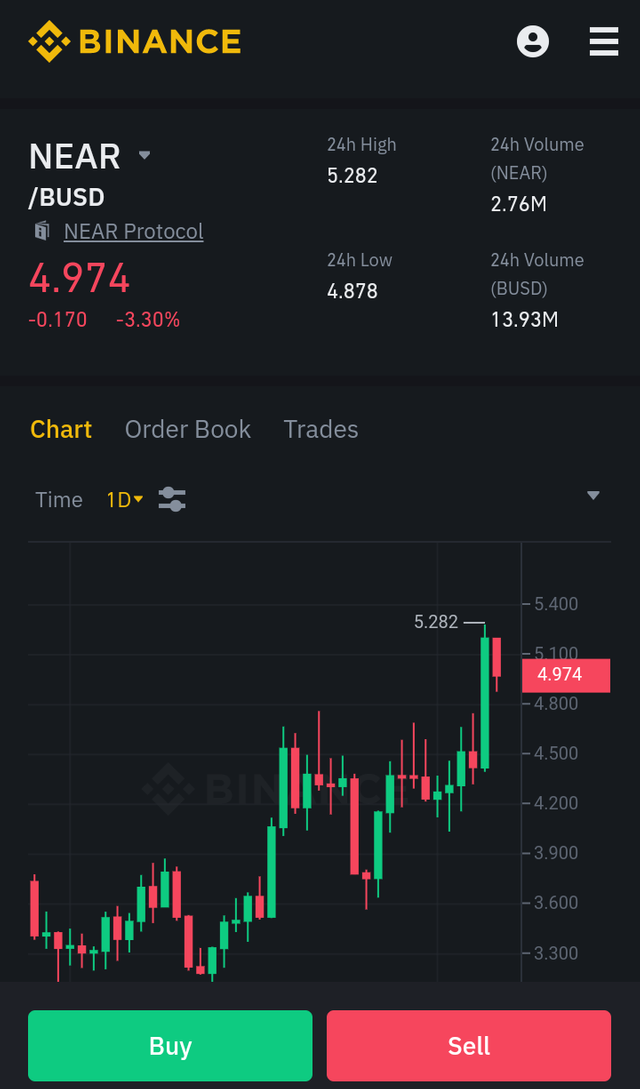

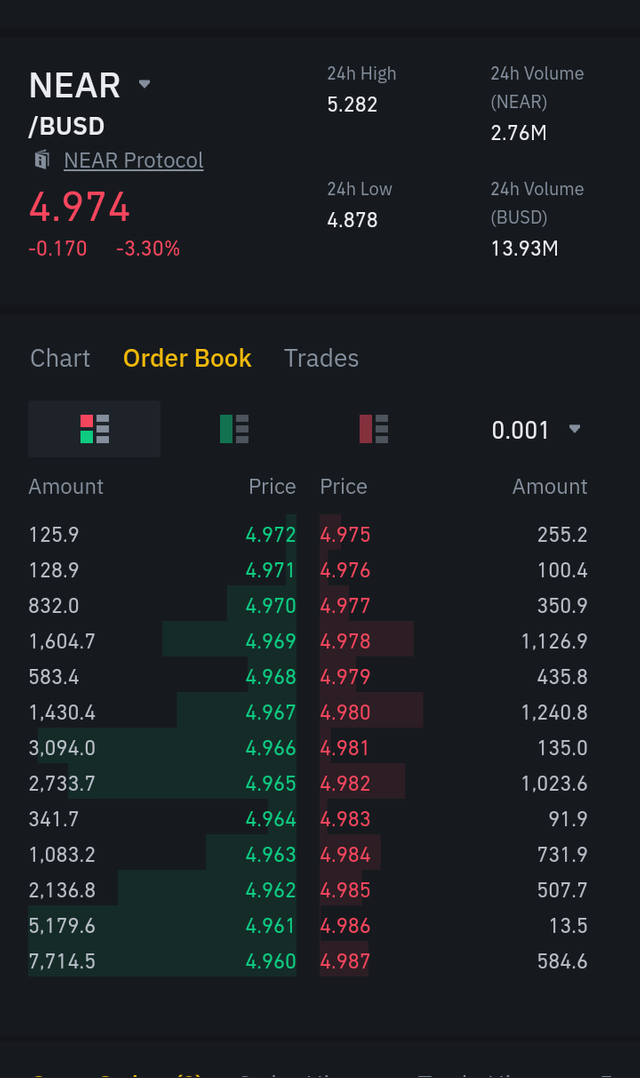

We will now be taken to the page where we could see the near/busd pair and we will be given 3 options like chart, order book and trades and in our case since we are especially concerned about the order book we will do justice and click on order book and here it is the order book opens.

On the order book as we can see the green area is the area of buyers present in the market whilst the red is where sellers are and the different prices they are willing to sell and the different prices buyers are willing to buy, so this is what an order book looks like.

Well the order book is very vital to us and the information it provides us helps us to know what to do in the market whether we are buying or selling, as the pic shows us we can see the 24 hour volume and we can see it's 24 hour high and low and the current price of the commodity.

Another interesting feature of the order block is it helps us to also know or get a picture of the time frame that various orders comes into the market, all the selling history and the time it took place all the buying records to when it happens it keeps track of this even to the least seconds and help us to know what's happening to an asset at the time whether buying or selling and shows the total money inflow in the market at a given time, I mean all this information combine prove a useful tool for one looking to invest in an asset or to trade it as the case may be.

Indeed the order book it's one interesting feature of an exchange that will no doubt like because of the useful information it provides us, let's simply break down the benefits in easy form.

1). An order book helps us to know all the open orders on a particular crypto asset at a given time

2).It helps us to know about the total volume flowing in to the market

3).Seeing the different buy orders and sell orders and their prices help us to create an accurate and realistic price range we are willing to buy or sell an asset

4).The order book also helps u in getting to know the spread in prices of the best buy or sell of an asset

5). We can also use the market order feature to enter the market immediately when we don't want to sit around in the sideline for long

6). It also useful tool to add in technical analysis, as knowing the total amount flowing into the market will help us know how liquid an asset is.

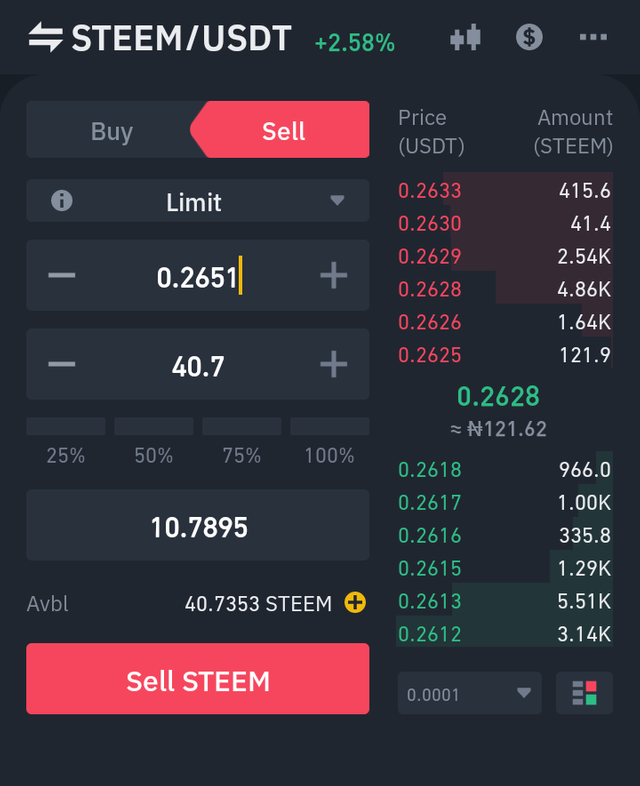

Limit order:This is the kind of order we usually do place in the order for when price reach a particular level, we set the order down and wait for price to reach that level then it gets activated.

In this limit order to better understand let's say steem is valued at $0.2628 and we want to sell but doesn't want to sell at the value that steem is currently been priced so we set it a bit higher than that let's say $0.2651, now when price gets there our order will be triggered.

Market Order:This is the kind of we place in the order book when we don't want to wait around any longer we simply want to get in on what's happening in the market without further delay, in this case we don't place a waiting order but instead we enter a market order and it will ensure we enter the market at once. The market order ensures we buy or sell at the current market price immediately.

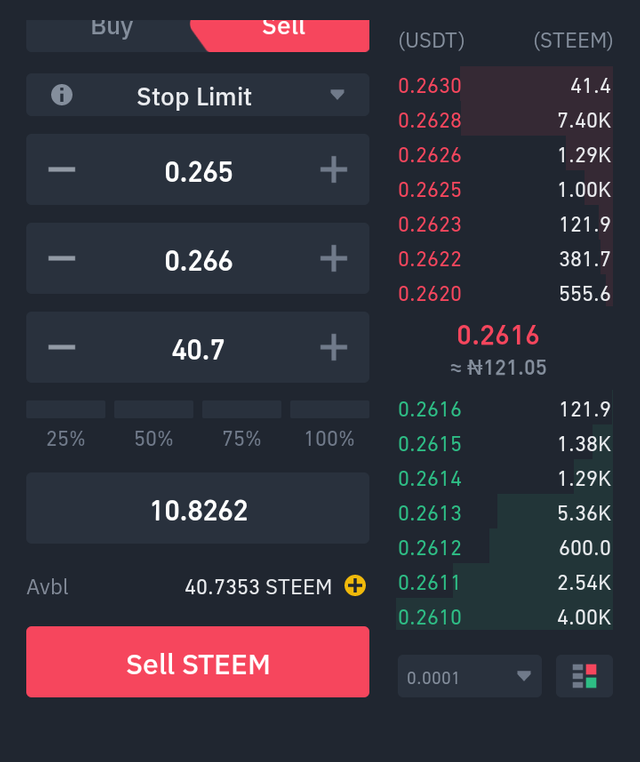

Stoplimit Order:

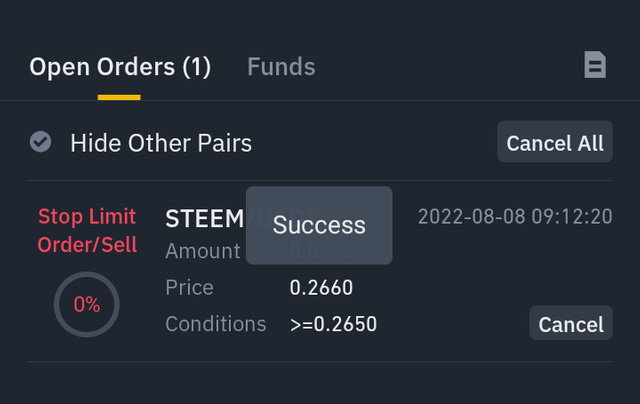

The stop limit order is more like a limit order but different in a way, yes in this order it's placed with expectancy of the market reaching a particular price. In the stop limit order let's say we want to sell steem at $0.266 we will put a stop price at $0.265 now what happens is this when the price of steem gets to the stop price of $0.265 our limit order to sell at $0.266 will automatically be placed.

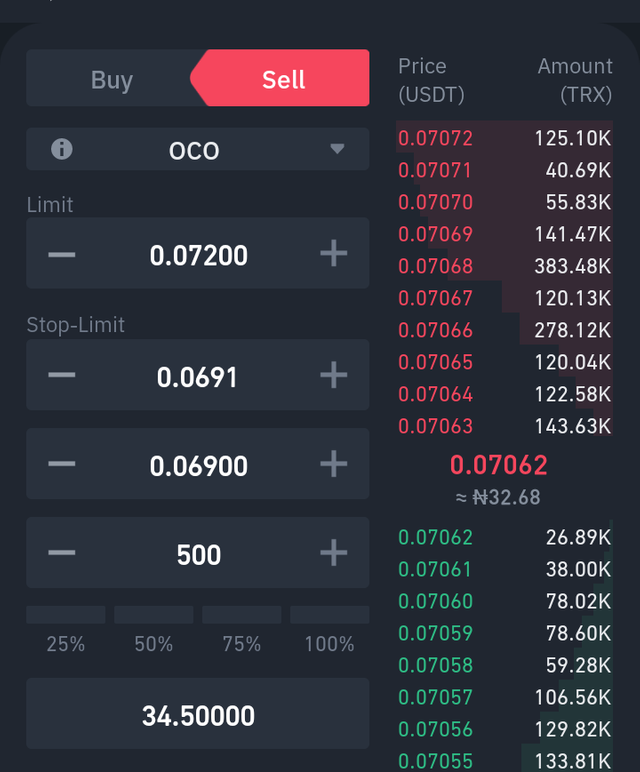

Oco order:

This order is known as the one cancels the other type of order. Let's say we want to sell trx at $0.07200 if the price were to reach that level we will sell our trx but we also put another other incase the market reverses at limit order of $0.06900 with a stop at $0.06910 so that if the price start calling and get to our stop order of $0.6910 then a limit order of $0.06900 will be placed and in an even this happens the initial order to sell at $0.07200 will be invalid but if the price first get to $0.07200 then the limit order of $0.06900 will be cancelled, hence the name one cancels the other.

It's important we make use of our order book to gain useful knowledge about how much an asset is bring priced and valued by buyers and sellers and know the volume being traded which helps us in making wise trading choice.

Every image used were screenshot from binance