Assalamualaikum Steemian |

|---|

With the prayers of my well-wishers I'm doing great and so do I wish for you all, beautiful people. Today, I'll write on the topic "Crypto trading" organized by @khursheedanwar Here is my view about the concerned topic.

What benefits you can get from crypto trading? |

|---|

People use to buy goods and commodity with other goods in Ancient time which was replaced by the gold. After gold, fiat currency was introduced and it was used as a source to buy things with. In 2010, Bitcoin was used to buy something with. The unluckiest man was Laszlo Hanyecz who bought just 2 family pizza with 10,000 Bitcoins worth $30. At that time, the price of one Bitcoin was few cents but today its price is ranging in 55,000 to 60,000, now just calculate and imagine his net worth now. Compare it with gold. When crypto came first, Bitcoin price was $0.0008 in 2009. Gold was $1100 per pound. Today, gold is trading around $2000-24000 and Bitcoin is around $55,000-60,000.

Several benefits are listed below

- decentralization

- High returns

- Market 24/7 open

- Easy accessibility

- Diversification

- Secure transactions

- Limited supply

- Transactions are faster

Share your recent crypto trading experience in form of profit or loss? |

|---|

My last month profitable trades are as follows:

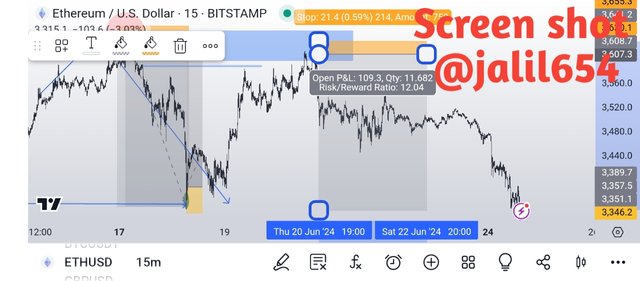

Trade 01

I found that Eth/USD pair was creating Lower Low(LL) and Higher Low(HL) on 15 minutes timeframe. When I was done with the structure mapping, I saw that there wasn't any unmitigated order block. I waited for the pair to touch it's extreme point(Lower high) or Supply Zone. The pair reached there and I take a Short or Sell entry there targeting the the price lower low with stop loss the price lower high. When a apply the short position tool, I was surprised as it was giving me a 1:20 Risk/ Rewards Ratio. I catched the move and didn't miss the opportunity and entered in the trade which was successful executed and the target was achieved.

Trade 02, An encounter Trade

The Second trade was an encounter trade which means that it's against the market structure. Such trades are highly risky as we enter in a market that is opposite and against the market structure. But I take the trade as the last candle sweeped the previous lower low. You can see in the picture, the green oval shape, it's where the previous low was sweeped.

It's a strong signal and a sign of trend reversal but still I keep the stop loss just below the previous low and for safer side, I still targeted the order block in the lower lows entreme point. This target was also accomplished with 1:5 risk/rewards ratio.

Trade 03

This time, I was bullish about the market as the pair had sweeped the lower low so my thought was that the trend may change. But When the lower high order bloc was touched and I switched to lower time frame(1 minute), I saw a ChoCh(Change of Character) on lower time frame which indicates that the market will now again fall. I take a Sell entry and it finally it was achieved with 1:12 risk/reward ratio.

Few days back, Bitcoin/usdt pair was creating lower lows and lower highs on 15 minutes timeframe. When Bitcoin reached it's extreme point(lower high), I took a short entry. The trade was going well but it just reversed just above the target area and hit my target. The whole market structure changed as change of character happened there and new higher high and higher lows were seen.

The pair is making lower lows and lower highs on 1hour timeframe. It's current price is on decision POI(blue rectangle/order block). We may see a slight downward reaction from here but the market will go up again towards the Yellow rectangle(order flow) from there the price will drop and we can take a short entry there.

I'm not a financial advisor, do your own research. DYOR

In the end, I want to say that many people will be agree with me while few may not, this is what the difference of opinion is and that is what leads the world forward.

Thanks for being here!

inviting @tommyl33 @beemengine and @ripon0630 to take part in the contest.

Regards,

@jalil654