What does "DCA" stand for in crypto investing?

"DCA" stands for "Dollar Cost Averaging" in crypto investment which is a strategy of investing a fixed amount of money into cryptocurrency at regular intervals. Dollar-cost averaging is the strategy that many investors are using to invest in crypto, which for example let me say I am a civil servant who cannot afford to buy 1 BTC for a single day, but I wish to have 1 BTC before the end of this year which by doing so I will then set up a specific amount of my income (salary) to be invested periodically in BTC.

DCA is seen as one of the best strategies for reducing the market of market fluctuation and volatility that is associated with crypto investments. Consistently investing in cryptocurrency weekly or monthly would help you build your crypto portfolio and save you from market fluctuations.

In what market conditions might DCA be most effective, and why?

Dollar-cost averaging is more effective in bear market conditions. A bear market is always an opportunity for investors to accumulate more crypto assets at a lower price. Also, the bear market, helps investors to maintain a steady investment plan and gives investors the chance for them not to miss opportunities in the market.

The reason why DCA is most effective during bear market conditions is because it is the condition where cryptocurrencies are more affordable to buy.

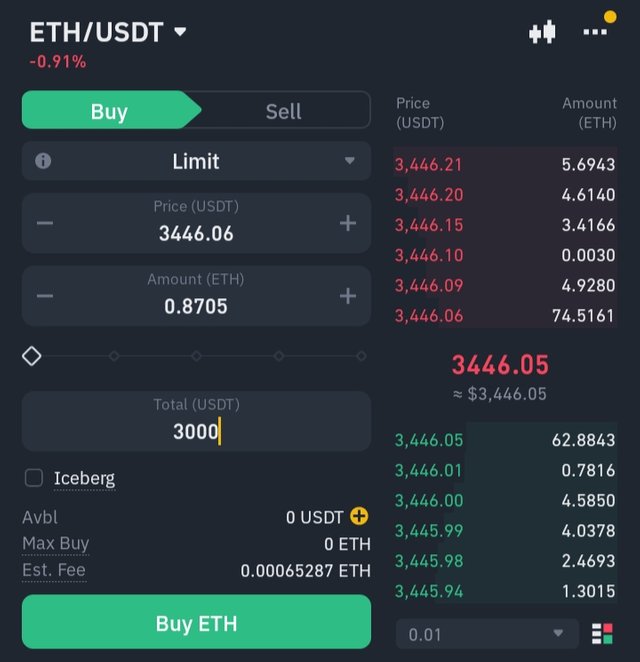

Binance

For example, let me say you have $3,000 that you want to invest into Ethereum (ETH) currently as of the time of writing this post, ETH is worth 3444.90 with $3000 you will get 0.8708 ETH.

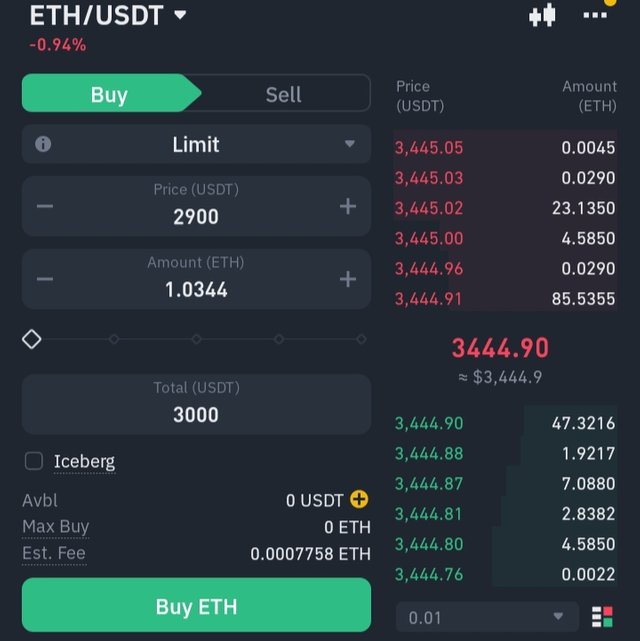

Binance

Now during the bear market, if ETH should drop down to $2900 per ETH and you invested $3000 you will get 1.0344 ETH, which is the more reason why bear market condition is the most effective for DCA.

What are the potential drawbacks or limitations of using a DCA strategy?

Whatever has advantages also has disadvantages which are DCA some of its drawbacks are as follows:

You can miss out on some opportunities. Investing monthly in DCA might make you not grow your portfolio the way you want.

The market can rise over time due to volatility in short-term investment.

It can give you a false sense of security.

I am inviting: @kuzyboy, @entity01, and @simonnwigwe

Cc:-

@waqarahmadshah

10% to @hive-109435

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit