TECHNICAL FORECAST FOR THE US DOLLAR: NEUTRAL

The DXY Index has clutched key specialized help, recommending that bulls may have somewhat more battle left at this point.

Net-short US Dollar fates situating has facilitated as the DXY Index has revitalized, yet has not moved that altogether from levels seen returning to mid-December 2020.

The IG Client Sentiment Index proposes that the Euro, the biggest part of the DXY Index, has a bearish predisposition in the close term.

US DOLLAR RATES WEEK IN REVIEW

The US Dollar (by means of the DXY Index) was having dreary week until Thursday (even as Fed Chair Jerome Powell affirmed on Capitol Hill), when it appears to be the uptick in US Treasury yields at last gushed out over to FX markets, lifting the greenback through Friday into the week by week close. The DXY Index mobilized by +0.57%, its second best week by week execution year-to-date, simply behind the second seven day stretch of January (+0.70%).

The US Dollar measure averted a huge specialized breakdown, and now apparently significant specialized harm is 'fixed,' to a degree. The appearance of the main seven day stretch of another month ought to achieve the standard uptick in unpredictability in USD-sets, thanks partially to raised occasion hazard.

US ECONOMIC CALENDAR WEEK AHEAD

The primary seven day stretch of March offers a strong financial schedule, with a worldwide concentration during the early piece of the week and a US-driven concentration to cover things off. There are a few things on the schedule that merit focusing on from the US Dollar's point of view, finishing in the March US work market report on Friday.

On Monday, the last February US Markit Manufacturing PMI and the February US ISM Manufacturing PMI will be delivered, as will the January US development spending figures.

Fed Governor Lael Brainard will be giving addresses on Monday and Tuesday.

On Wednesday, the February US ADP work change report will be delivered, as will the February US ISM Non-Manufacturing PMI. Later on Wednesday, the Fed Beige Book is expected.

On Thursday, center swings to US work markets, with the week after week US jobless cases sorts out, just as the January US production line orders report. Taken care of Chair Powell will give a discourse on Thursday, which will probably zero in on late activity in US Treasury yields.

On Friday, the February US non-ranch payrolls report just as the February US joblessness rate will be delivered. Later in the day, the US spending plan for monetary year 2022 will be unveiled.

DXY PRICE INDEX TECHNICAL ANALYSIS: DAILY CHART (FEBRUARY 2020 TO FEBRUARY 2021) (CHART 1)

The DXY Index had been sticking onto the downtrend from the March and November 2020 highs, yet was at last ready to turn higher on Thursday and Friday, breaking the intramonth downtrend all the while. Early-March will end up being a huge mental test for the US Dollar, the arrangement of lower highs and lower lows was never broken all through February. Presently, a move over the mid-February swing high of 91.06 would propose that the turn higher is acquiring authenticity.

Force is turning after the sudden meeting in costs. The DXY Index is over its every day 5-, 8-, 13-, and 21-EMA envelope, which is in neither bearish nor bullish consecutive request. Every day Slow Stochastics are driving higher from oversold region, while day by day MACD is beginning to turn higher yet underneath its sign line. More unevenness could be ahead, which was pretty much the situation all through February.

DXY PRICE INDEX TECHNICAL ANALYSIS: WEEKLY CHART (FEBRUARY 2011 TO FEBRUARY 2021) (CHART 2)

Source

The more extended term see set up in the last 50% of December 2020 remaining parts substantial: "we in this manner see the most recent advancement with faltering, especially when seen in setting of the more drawn out term specialized harm created lately; the DXY Index stays underneath its multi-year upturn, and could be chipping away at a multi-year twofold top. Insofar as the bounce back stays beneath 91.75, the DXY Index viewpoint stays bearish on a more extended term premise.

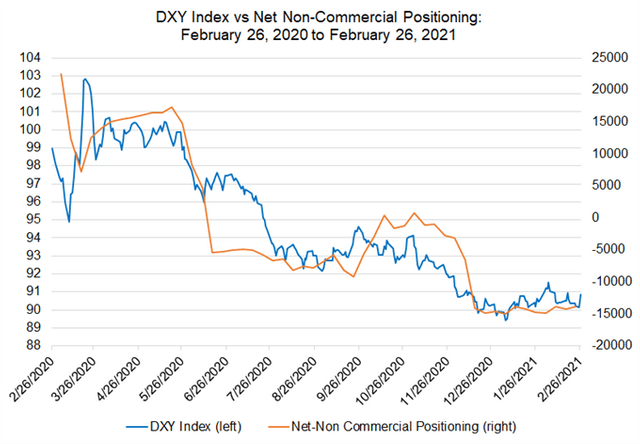

CFTC COT US DOLLAR FUTURES POSITIONING (FEBRUARY 2020 TO FEBRUARY 2021) (CHART 3)

Then, seeing situating, as per the CFTC's COT for the week finished February 23, examiners marginally diminished their net-short US Dollar positions to 13,851 agreements, down from 14,287 agreements held in the week earlier. Net-short US Dollar situating stays close to its most significant levels since March 2011, when examiners held 15,494 net-short agreements. Situating is presently the most un-net-short since the primary seven day stretch of December, when examiners held 6,486 agreements.

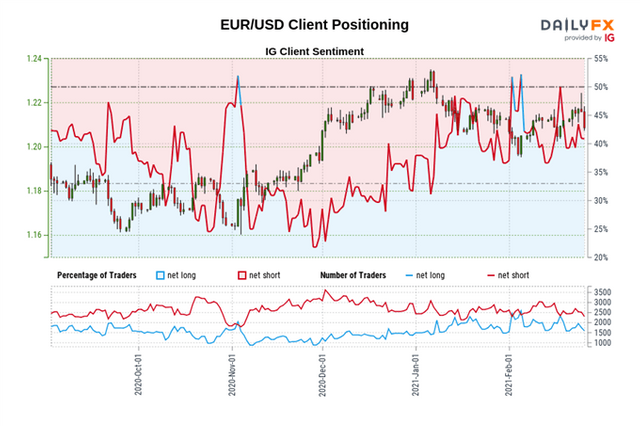

IG CLIENT SENTIMENT INDEX: EUR/USD RATE FORECAST (FEBRUARY 28, 2021) (CHART 4)

EUR/USD: Retail merchant information shows 45.61% of dealers are net-long with the proportion of brokers short to long at 1.19 to 1. The quantity of merchants net-long is 2.36% higher than yesterday and 3.00% lower from a week ago, while the quantity of brokers net-short is 24.89% lower than yesterday and 24.74% lower from a week ago.

We normally take an antagonist view to swarm assessment, and the reality dealers are net-short proposes EUR/USD costs may keep on rising.

However dealers are less net-short than yesterday and contrasted and a week ago. Ongoing changes in feeling caution that the current EUR/USD value pattern may before long opposite lower regardless of the reality merchants stay net-short.