Why emphasize unpublished coins? For participating users, projects that have already issued currency can easily be considered financial management behavior with a relatively certain rate of return, while projects that have not yet issued currency have a lot of room for imagination, which can create additional traction. to force users.

This article chooses Acala, Plasm, Bifrost, and Moonbeam, four non-coinable and well-known object projects, to strategize their offering to readers.

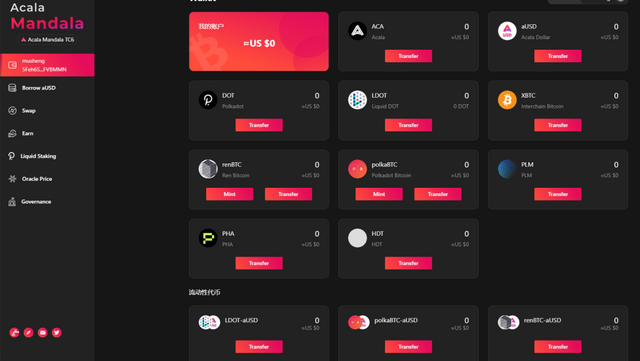

One, Acala

Acala is a well-known project in the Polkadot ecology and wants to be a decentralized financial center and stable currency platform. Acala mainly has three business parts: a cross-chain multi-asset mortgage stablecoin system, a liquidity release protocol, and a DEX trading platform. Later, Acala founded Open Oracle Gateway together with Laminar and Band, which involved the Oracle business.

Acala is also a smart contract platform. For Parachains, Polkadot is not too difficult to make himself a smart contract platform. Since Polkadot ecology just started, the business scope of many projects in Polkadot ecology is very wide, this is understandable, but it can come out depending on the specific development.

Acala's business modules are as follows:

Acala's main business is a multi-asset mortgage stable currency system similar to Maker's. Based on Polkadot's own cross-chain characteristics, Acala has created a multi-asset mortgage stable currency system across natural chains.

In the stablecoins field, centralized stablecoins currently control most of the share, but decentralized stablecoins are still a necessity in the blockchain world. The construction and operation of a decentralized stable currency system has a relatively high threshold, unlike DEX, which can be launched right away with a simple fork. Having a threshold also means that there is a ditch. Once a more mature product is in place, the late comer has to think about it if they want to enter the game.

Businesses other than stablecoins are also general and important businesses in the blockchain world. For example, DEX and oracles are very important in the blockchain world, but there are also many competing products. Acala's current liquidity release agreement plan is to only provide services for secured DOTs and KSMs, which will be able to release part of the liquidity of locked assets and increase the number of tradable assets in the Polkadot ecosystem. The released liquidity can be used as collateral in the Acala stablecoin generation system in addition to being used for transactions. On the one hand, it provides a liquidity release token usage scenario, and on the other hand, it also provides its own stablecoin creation system. Source of assets.

Regarding the slot auction, according to Parachain's data, Acala intends to use 10% of the token to rent slots for 6 years . Only 20-30% of ACA tokens earned by users participating in the offer will circulate at an early stage, and the remaining tokens will be released during the entire rental cycle. Unreleased tokens can participate in project governance. A gradual or linear release of reward tokens is an inevitable option for most projects.

The total number of Acala tokens is 100 million, and the distribution ratio is as follows:

20.25% -Tim (20,250,000 ACA)

5.00% -Ecological development (5,000,000 ACA)

11.62% -Foundation (11,620,000 ACA)

18.33% - Seed rotation (18,330,000 ACA)

10.80% -A turn (10,800,000 ACA)

34.00%-Prize (34,000,000 ACA)

10% of parachain auctions included in the prize 34%.

Acala releases Karura, a pioneering network based on Kusama. According to public information, Karura will issue 11% of the tokens to participate in the Kusama slot auction . Currently, Acala has held several rounds of warm-up activity for the slot auction, and recently connected to the Rococo v1 parachute test network.

When it comes to community building, Acala's Twitter has 57,000 followers, and the Telegram group has 17,000 members.

Second, the Plasma Network

Plasm is also a high profile project in Polkadot ecology and the first project connected to the Polkadot Parachain Rococo v1 test network. Plasm is a smart contract a rare platform that focuses on Layer 2 in the ecosystem Polkadot . Plasm is compatible with Ethereum and wants to provide better scalability for the Polkadot ecosystem. Its architecture can be understood as creating ETH2.0 in Polkadot.

Plasm has strong technical strength and has received 6 grants from the Web3 Foundation.

Plasma Module for Substrate (GitHub)

ink! Playground (GitHub)

Plasm Chain + OVM Implementation (GitHub)

ECDSA for Polkadot JS (GitHub)

Hardware ECDSA for Polkadot JS (GitHub)

ZK Rollups Pallet (GitHub)

Plasm's latest development has achieved compatibility between Plasm Network and ZK Rollups, enabling the use of Layer 2 solutions based on the Polkadot network.

Plasm's token distribution model is quite unique, Plasm has already carried out two large-scale lockup airdrops, meaning its tokens continue to be distributed to retail investors prior to the launch of the mainnet, which is relatively rare.

During the lock-up process, users will continue to pay attention to Plasm's development and bring potential users to Plasm. With the issuance and launch of tokens, it will also generate a lot of attention time and time again, which will help Plasm gain users, and the relatively large user base is essential for a smart contract platform.

Plasm locking airdrop, first round of locking over 16,000 ETH, second round of locking more than 150,000 ETH, large number of participants, and third round of air locking will be used for the Polkadot Parachain slot auction .

The total number of Plasm tokens has not been determined, and the total number of tokens will be determined after the end of the third air lock. The latest news on the number of tokens is that Plasm issued a total of 22.27 billion PLM via two airdrops and an additional 35% (for team and community) of tokens issued .

Plasm does not currently have a clear slot bidding strategy, but has designed specifications that provide different reward coefficients for different lock-up times, as follows:

The key to the bonus level is 30 x 24 days

100 days locking bonus level x 100

Unlocked for 300 days - x360 bonus level

Unlocked for a bonus level of 1000 days-x1600

Locked for a 2 year bonus level-x2000

All project parties will provide more incentives to long-term supporters, such as Plasm. From the introduction, the basic Plasm bonus rate is set according to the previous locking airdrop reward.

Plasm also released a Kusama-based advance network. According to reports, it will take 32.5% of the tokens to bid on slots in Kusama. At the same time, Plasm lock-up airdrop participants will also receive 1: 1 tokens from advancing the network.

When it comes to community building, Twitter Plasm has 33,000 followers, and the Telegram group has 13,000 members.

Three, Bifrost

Bifrost is a DeFi protocol that focuses on the business of releasing liquidity from pledged assets. Bifrost has launched its Staking ETH 2.0 liquidity release business, and will also provide a liquidity release business for slot auctions.

Much of today's public chain ecology is based on PoS and its variant consensus mechanisms, which require a large number of tokens to be mortgaged to ensure network security. With the development of DeFi, the network may experience the following two situations.

One of them is that a large number of tokens are locked through staking. In this case, the network is very secure, but it can lead to insufficient liquidity of the token and affect ecological developments. The other is the large number of tokens circulated on DeFi, and the number of tokens participating in the stakes is small. In this case, the liquidity of the token is sufficient, but network security may be affected. At the heart of both situations was the competition between Staking and DeFi for assets, and Bifrost was born to solve this problem.

Through Bifrost for staking, users can earn liquidity release tokens while earning staking profits. Liquidity release tokens can be traded and transferred, and they can participate in various DeFi activities. Liquidity tokens can be redeemed proportionally to the original assets, and they can continue to receive the staked income, which is an interest-producing asset.

Currently, Bifrost has launched its ETH 2.0 stock liquidity release business, and the development is quite good. At present, the number of ETH shares through Bifrost has exceeded 17,000, and the assets under lockdown have exceeded 28 million US dollars.

With the advancement of the Bifrost liquidity release business, Bifrost can introduce a large number of external assets to the Polkadot ecosystem (such as vETH, which is currently valued at over US $ 28 million), and become one of the external entrances to the Polkadot ecosystem. assets.

Bifrost has made it clear that it will provide liquidity release services for the Polkadot Parachain slot auction, in which DOT and KSM participating in the slot auction through Bifrost can maintain liquidity while receiving slot auction prizes. chance too long, Bifrost can perfectly solve the worries of participating in the slot auction.

Bifrost has now connected to the Rococo v1 parachain testnet and is holding air droplets from the vETH.

Bifrost has a total of 80 million tokens. According to official information, Bifrost will use 13.5% of the tokens as incentives for the slot auction to get the parachain slot usage rights for 4 years.

The distribution ratios of Bifrost tokens are as follows:

45% -Ecosystem (36,000,000BNC)

20% -Team (18,000,000 BNC)

10% -Foundation (8,000,000 BNC)

10% -reserved (8.000.000 BNC)

10% - Sales of seed rounds (8,000,000 BNC)

5% - Private Sales (4,000,000 BNC)

Among them, 45% of ecosystem specific uses are as follows:

30% - Bokapin slot auction (10,800,000 BNC)

5% - Kusama slot auction (1,800,000 BNC)

45% -vToken incentive (16,200,000 BNC)

10% - Collector Incentive (3,600,000 BNC)

10% -Slash Insurance Fund (3,600,000 BNC)

Bifrost doesn't release a lead network for Kusama, it only has one network. Bifrost will bid in advance for the slot in Kusama, and during the Kusama consensus period, the Polkadot slot auction will be conducted to realize the consensus network improvement from Kusama to Polkadot.

According to information in the white paper, Bifrost will use 2.25% of the total tokens as a prize for the Kusama parasain auction.

According to the official news, 10% of the total number of tokens ordered will be allocated after the specific announcement of the slot auction rules, and all of them will be allocated to the slot auction with probability.

When it comes to community building, Twitter Bifrost has 19,000 followers, and Telegram groups have 19,000 members. in

Fourth, the Moonlight Network

Moonbeam Network is a smart contract platform compatible with Ethereum. Moonbeam launched a test network in 2020 and has recently released a new chapter of the Alpha v6 testing network.

Moonbeam is a relatively pure project focused on building a smart contract platform. The new version of testnet already allows users to participate in governance and betting.

The number of Moonbeam tokens is 10 million, and the distribution ratio is as follows:

14% of seed sales (1,400,000 GLMR)

12% Strategic Sales (1,200,000 GLMR)

16% of public sales (1,600,000 GLMR)

15% of Parachain bond funds (1,500,000 GLMR)

Parachain Bond Reserves 0.5% (50,000 GLMR)

0,5% Treasury (50.000 GLMR)

17% Ecosystem (1,700,000 GLMR)

4.5% developer incentive (450,000 GLMR)

4.5% partners and consultants (450,000 GLMR)

1.4% of initial supporters (140,000 GLMR)

10% team (1,000,000 GLMR)

4.6% Incentives for prospective employees (460,000 GLMR)

Moonbeam reserves 15.5% of the tokens as a slot bid fee for 1-6 years, but this share of tokens cannot be used exclusively for user rewards, and can also be used to borrow DOT to participate in auction interest payments. usage strategy also Need to wait for the official announcement.

Moonbeam also issued Kusama Parachain Moonriver, Moonriver has used 60% of the tokens for slot incentives, and has also reserved 15.5% of tokens for parachain bond financing.

Currently, many well-known DeFi protocols have announced the development of products based on Moonbeam, such as Injective and Sushiswap, and Human Protocol has also announced expansion to Moonbeam.

When it comes to community building, Moonbeam's Twitter has 33,000 followers, and the Telegram group has 10,000 members.

Summary

The Polkadot slot auction is in full swing, and we may be able to usher in further progress soon. The testnet slot auction which started yesterday has also predicted something, maybe we will soon see the opening of Polkadot's ecological milestone.

Reference material:

https://medium.com/moonbeam-network/moonbeam-monthly-dispatch-february-2021-232ee92b02cf

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit