2020 is an extraordinary year. In the context of the raging epidemic, we have witnessed the sharp turbulence of the stock market and the digital currency market, as well as the rapid update and iteration of the blockchain field. With turbulence, the entire blockchain world has undergone earth-shaking changes in one year. As an industry observer, IOSG Ventures has gained not only successful investment portfolios, but also growth and thinking on the entire industry, investment logic and post-investment value creation. Next, we will look back on 2020 in a slightly different way, and hope that in the third decade of the 21st century that has come, we will continue to create long-term value to build an investment moat and do the hard and right things instead of Just follow.

Unity of knowledge and action

Time machine theory takes you to the past and witness the future

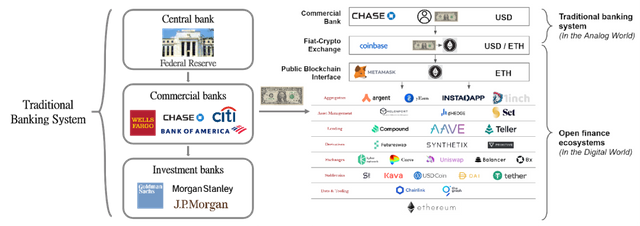

The history of human currency is as long as the history of civilization. Compared with the progress of the Internet, the progress of the entire financial industry is still slow. The world financial crisis in 2008 deepened the potential risks of the world's monetary and financial systems. It is in this context that Satoshi Nakamoto created Bitcoin. In the past two decades, the Internet has swallowed the entire world rapidly, but in the last five years we have seen a trend. Blockchain is swallowing the financial world. The open network running on the Ethereum world computer has begun to give birth to different subdivision directions. Centralized financial applications (hereinafter referred to as DeFi).

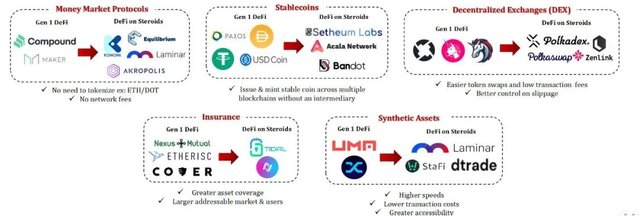

In the past 20 years, the process of civilianization of financial innovation has been slow. In the past year, we have seen many innovative agreements emerge from DeFi's low threshold cost, license-free, and regulatory advantages. Traditional financial development has evolved over a hundred years of industry theories, and in the world of cryptocurrency, with infrastructure and The enrichment of the protocol layer began to be practiced. In the law of time machine investment, the traditional financial infrastructure is complete and solid. We have seen the evolution of the DeFi protocol from the emergence of the base currency Dai to the value captured by the middleware protocol, and then to the user portal to output value; at the same time, it is developing in the DeFi industry. From the beginning of the loan agreement, to the synthetic asset agreement, to the derivatives leverage agreement, the forecast market agreement and the insurance agreement, a series of basic tools required for the construction of traditional financial systems such as leverage, margin, accounting unit, transaction infrastructure Infrastructure, loans, and issuance have emerged in the DeFi world one after another. This evolution is so similar to the development of traditional finance.

Source: IOSG Ventures

Source: IOSG Ventures

DeFi has achieved amazing explosive growth in the past year. We believe that the middleware of the open financial stack in the encrypted network acts as a native token that maintains the security of the underlying network and the value of the top-level user application interface, and it is the entire ecosystem. The important role of value added. Among them, the stablecoin protocol and the decentralized transaction and aggregation protocol play the role of decentralized value transmission. On this basis, there are various financial primitives (primitive). At the same time, as the marginal cost of communication decreases, DeFi aggregation effects and network effects will also appear, which also helps us to deploy high-quality DeFi projects with more development prospects in advance. DeFi delivers value rapidly in the world of Web3.0. How to maximize efficiency and capture value for fat protocol thin applications is the field and direction of our research.

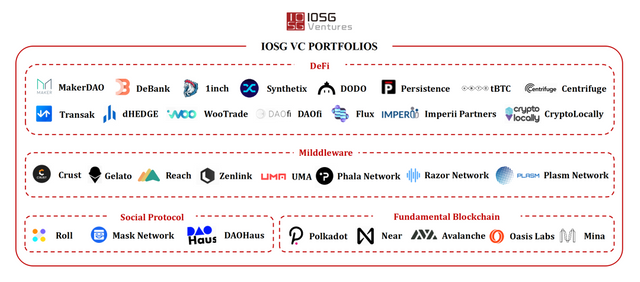

IOSG Ventures 2020 portfolio

In the crypto world in 2020, we have experienced the black swan incident, felt the craze of the DeFi wave, and welcomed the rise of DAO. After the start and precipitation of the past three years, blockchain has become the most cutting-edge platform and opportunity for open finance. DeFi has found the easiest and most grounded application scenario for blockchain. DAO was born in the blockchain, but it is not limited to the blockchain. The explosive growth of new DAO and DeFi projects, and the decentralized governance of their organizations, has attracted more and more attention and participation. In addition to increasing investment in blockchain infrastructure projects, from 2018, 2019 to 2020, the overall layout of IOSG on DeFi follows from the underlying infrastructure (such as MakerDAO, which issues stable currency DAI) to the middle layer protocol (such as: synthesis Asset agreement UMA, Synthetix) and then to the top aggregator, flow entrance (such as: 1inch, Matcha, dHedge).

IOSG Ventures 2020 portfolio

IOSG Ventures 2020 portfolio

1inch (DEX aggregator )

1inch is a DEX aggregator. It builds DEX liquidity and pricing by aggregating upstream users and lower-level liquidity agreements, and gathers users through network effects and price advantages. One of the reasons why IOSG invested in 1inch is that the liquidity transactions in the DeFi field are too fragmented and there are many protocols, and the market urgently needs the emergence of transaction aggregators; the second reason is that it provides a deeper liquidity pool for different DEXs, and Able to get the best price in various schemes.

Facts have proved that the DeFi dark horse 1inch has been recognized by the market: the current daily trading volume of 1inch is 389M, and the average daily active users in the past seven days has exceeded 3000, and the community is also extremely active. In 2021, we will see 1inch and other resource integration platforms take on an important part of the DeFi ecological infrastructure, and help the DeFi industry reach more user groups through the "one-stop" service model. We believe that 1inch as a DEX aggregator is becoming the most important solution to the problems of DEX liquidity splitting.

UMA (middleware )

UMA provides Oracle and smart contract templates for DApps, allowing anyone to create synthetic assets that can track the price of any value subject. We started researching UMA in 2019 and started contacting the UMA team, and participated in investment in early 2020. We are convinced that UMA will become one of the most successful protocols in the Web 3.0 middleware stack, and their greatest value will burst in the future to provide the basic framework and basic business logic for many top-level applications.

At present, UMA has made progress in cooperation with many community projects in the near future, including Yam, BadgerDAO, etc., and the user community has increased by 9664. And this is just the beginning. We look forward to seeing even greater success in UMA in the future.

NEAR (Open Web )

Scalability is a problem that the blockchain needs to solve urgently, and NEAR is a highly scalable basic protocol that supports running DApps quickly enough on mobile devices. The use of sharding technology makes it more friendly to developers and users, allowing the number of nodes in the blockchain and the network to scale linearly, with the goal of reaching 100,000 TPS. NEAR leads technological innovation by building infrastructure. Among the projects that can compete with Ethereum, NEAR is the most powerful competitor. As the Ethereum 2.0 roadmap further delays shard development, NEAR has become the current leader in shard development. The core of IOSG Ventures' investment is to help visionary teams like NEAR to develop and release creativity, and work with them to build a more usable and good platform.

NEAR's progress in the past year is obvious to all. The Ethereum cross-chain Rainbow Bridge, which was officially released in December last year, is currently running between NEAR and the Ethereum main network, and several DeFi projects are undergoing private testing. As of the writing, the market value of NEAR has reached US$947.8M, and the daily transaction volume on the chain has reached between 10k~30k. Its community has also grown very rapidly. Instant communication (Wechat, Discord & Telegram) has as many as 50k global community members. NEAR's capacity expansion and low fees have greatly reduced the threshold for use. Therefore, more and more Ethereum projects have begun to consider migrating to the NEAR platform. We will witness more projects migrate to the NEAR platform in the near future.

Polkadot (Web3.0 )

In the next few years, we believe that more and more developers will choose to build applications on the blockchain optimized for specific scenarios. Substrate greatly reduces the technical cost of the team that goes this route, and Polkadot makes these different chains interoperable and composable in the ecosystem. This will make it possible for a new generation of applications, and these applications cannot exist on a single smart contract platform. Therefore, we invested heavily in Polkadot and Polkadot in the early stage. It is Polkadot's ultimate mission to interconnect all chains and jointly build a fair and open cross-chain underlying system.

In addition to the amazing market performance after the listing, Polkadot can be said to be the deepest community outside of Ethereum, and it also has the strongest attraction for developers. At the moment when Parachain has not been launched, we are pleased to see a large number of teams building core DeFi infrastructure based on Polkadot, including DEX, lending, synthetic assets, equity derivatives, privacy, etc. In addition, what impressed us was that some community-driven work created developer tools, educational materials, and hackathons. This means that the most valuable thing about Polkadot today is not the Polkadot blockchain itself, but the prosperous ecology it quietly gathered. Once the main network is opened, many entities in the ecology may be able to maximize ecological synergy and complete a new leap forward at the fastest speed.

Synthetix (synthetic assets )

The reason we are optimistic about synthetic assets is that synthetic assets can promote DeFi lock-up volume and increase liquidity by absorbing traditional capital. Synthetix's synthetic assets are composable in DeFi, and the user community in the Synthetix ecosystem is also composable, which will bring rapid user growth. We have seen the Synthetix ecosystem continue to expand, and more community projects and users on partner platforms have begun to use the Synthetix platform, which has increased the number of weekly active users on the Synthetix platform by more than three times during the year.

At present, it can be seen that the highest single-day transaction volume has increased from 16.7M to 186M, an increase of 1013% year-on-year, and the number of highly active users has increased from 3136 to 7777, an increase of 148% year-on-year. As more teams and developers enter the synthetic asset track, the types of assets that can be tokenized will continue to grow. Compared with borrowing, synthetic assets is still a small-scale track, and we expect this track to grow even more surprisingly in the future.

Long-term value

Create long-term value, never forget the original intention, research first

The main track of investment in 2020 & investment logic

Thinking and deciding investment, IOSG's achievements in investment stem from continuous thinking and summarization of the industry. From our Portfolio, we can see that the track we will focus on in 2020 not only covers DeFi, Web 3.0, Synthetix synthetic assets, but also includes the Layer 2 and Polkadot ecosystems that have been discussed in various communities recently. The following will explain in detail the track we are concerned about and the specific reasons, as well as our investment logic.

Web 3.0

Investment target: Polkadot, NEAR

As early as 2017, IOSG began laying out the Layer 1 track, cross-chain protocol platforms Polkadot and Cosmos, sharding leader NEAR and many other Web 3.0 and Open Web projects. In 2019, based on past and latest research, we drew a Web 3.0 technology stack map and published a Web 3.0 research report , from its lowest-level infrastructure to Layer 1 to middleware, and middleware on and on the chain. Next, to the application layer, Open Finance is divided into the application layer. In the past two years, the industry is gradually evolving along our technology stack map. In the Web 3.0 era, users will have more control over their identity and data, and users will share data portrait rights with BAT. High replacement costs, strong network effects, and user experience are the barriers of Internet giants. They will not be subverted in the short term, but users' pursuit of the right to control identity and data will eventually start a prairie fire.

The Ethereum ecosystem is the core infrastructure that supports the development prospects of Web 3.0, and IOSG also participates in the network operation as a verification node of Ethereum 2.0. At the same time, IOSG is one of the core strategic investors in public chain projects such as Polkadot and NEAR in Asia. It also actively invests in emerging underlying agreements such as Avalanche, Mina, and Oasis. On the other hand, through a safe and efficient Layer 2 solution, Web 3.0 applications in different scenarios will have more options for the deployment of transactions, communications, and incentive mechanisms when Layer 1 resources are limited.

Starting from the investment theory of fat protocols and thin applications, we believe that with the rise of the entire DeFi open finance, middleware protocols and DeFi applications will emerge, and usher in a window of opportunity for the rapid development of the underlying infrastructure and upper-level innovative applications.

DeFi

Investment target: KAVA, MakerDAO, Kyber, 1inch, UMA, DDEX, dHedge, tBTC

2020 is more like a DeFi carnival, experiencing explosive growth and absorbing nearly $50 billion in new liquidity throughout the year. IOSG also took DeFi as its investment focus this year, and carried out multiple strategic layouts, and the final project performance in the market was very good. Regarding the overall picture of the DeFi project, we once made a " DeFi Project Panorama " on the IOSG public account , so I won't repeat it. Here we focus on the two important tracks of synthetic assets and AMM.

Synthetic assets

Source: IOSG Ventures

Source: IOSG Ventures

"Synths" is a mirror image simulation of the target asset, and the price is anchored. Holding a synthetic asset does not mean holding the mirror asset but gaining its price risk exposure. The head of the track: Synthetix and UMA and their ecosystem, there are also some emerging projects, such as Synlev, Mirror and Deus.

As the main tone of blockchain financialization in 2020 is set, synthetic assets provide DeFi with a channel to use traditional financial assets and more diverse and complex trading strategies. As long as the system and oracle can support and integrate, synthetic assets can simulate and track gold, stocks, bonds, various traditional or encrypted indexes, and theoretically can trade everything including pop culture market, Meme market, and personal Token market. and many more. Synthetic assets release greater liquidity than native cryptocurrency assets. We predict that 2021 will be a year for synthetic assets to shine.

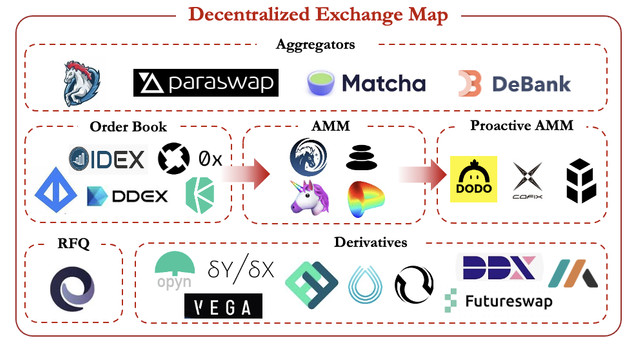

AMM

Source: IOSG Ventures

Source: IOSG Ventures

Any market may not have enough organic liquidity to support active transactions. Market makers are essentially agents who alleviate this problem by facilitating transactions that do not occur in these markets. Many market makers in traditional CEX are professional teams or institutions. AMM (Automated Market Maker) is equivalent to truly decentralizing their role. AMM replaces order matching with a mathematical formula such as an algorithm and a bonding curve. AMM plays the role of the new token issuance market, and is also the most popular solution for the listing of new agreements and the promotion of long-tail token transactions. Due to the permissionless feature of the AMM protocol and the simplicity of launching new tokens, this feature will exist as a long-term unique advantage of the AMM protocol, which is why we invest in 1inch, 0x and DODO.

In 2021 we will see the emergence of new DeFi products, and the underlying protocol of these products is the financial infrastructure established on Ethereum in 2020. In 2019, the development of liquidity supply is mature. In 2020, the liquidity incentive mechanism will produce liquidity mining and other innovative mechanisms. We have noticed that encrypted assets are beginning to be packaged into more and more complex forms, and new Dapp products have added more functions. We have seen that some Dapps can provide contracts, futures, forwards and options. The high degree of composability of Ethereum itself will make Dapp easier to iterate. In addition, the influx of new developers and the development of Layer 2, derivatives will continue to evolve, and will bring DeFi closer to the performance of traditional finance. DeFi products can be programmed and will eventually surpass traditional finance. Therefore, the development of DeFi has a promising future.

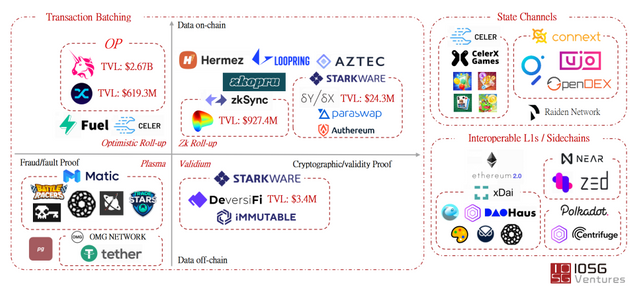

Layer 2

The expansion of Ethereum has always been a challenge. As early as three years ago, the Ethereum community realized the importance of scalability and introduced the first-generation expansion plan Plasma and state channels. However, after the rapid growth of DeFi applications and users, the community really realized and felt the throughput The bottleneck of volume restricts the development of DeFi ecology. Layer 2 technology provides a secondary framework based on the existing underlying blockchain to solve its potential scalability problems. More and more DeFi projects have begun to think about which set of Ethereum expansion solutions to choose to reduce transaction costs on the chain for users, while also taking into account the composability and security of DeFi. The design of Rollups solves the data availability problems faced by other solutions such as side chains, state channels, and plasma.

The founder of Ethereum, Vitalik, began to call on the community to use the "Rollup" solution as the leading solution to promote the expansion of Ethereum Layer 2. At the same time, other expansion solutions will also be promoted simultaneously to enrich the ecological diversity. The initial Optimistic Rollup solution may be implemented faster. It improves the lack of data availability of Plasma, but its security is not entirely based on cryptography. From a long-term perspective, ZK Rollup is a more complete set of solutions, through zero-knowledge proof technology to ensure that expansion will not reduce security, but early engineering implementation requires larger resources. Therefore, we are firmly optimistic about the long-term value of ZK Rollup to the Ethereum ecosystem. Eventually, a diversity expansion ecosystem with ZK Rollup as the mainstay and supplemented by other solutions may be formed.

The future key directions of the Layer 2 field: Layer 2 security and composability; product interface and user experience; liquidity solutions across different Layer 2 (such as Hop Protocol and Connext, etc.); education to attract new users. We expect that by the second half of 2021, some large DeFi projects will gradually be transferred to some Rollup expansion chains to take advantage of its high throughput and enjoy lower gas costs. It is foreseeable that in the future there will be indicators similar to TVL (total lock-up volume) to measure the value capture of Layer 2.

Polkadot Eco

Polkadot and Kusama have achieved a very high degree of overall code progress this year. They are one of the few directions that can still become the focus of the market outside the Ethereum world after the DeFi fire. As a heterogeneous sharded multi-chain network, Substrate's open source development framework is used to bridge homologous protocols, allowing end users to more easily access the entire heterogeneous blockchain ecosystem. In addition, Polkadot's parachain auction this year is also a fairer governance activity. How Polkadot is compatible with the Ethereum world's DeFi and transactions, we have also seen a lot of development teams working on this. We believe that only a sufficiently rich and powerful ecological project can interact well within Polkadot's decentralized system, in order to realize the true potential of the system. Therefore, we look forward to discovering more ecologically original projects focusing on specific professional fields to help the long-term ecological construction.

Ethereum industry ecology VS Polkadot industry ecology

Ethereum industry ecology VS Polkadot industry ecology

Similar to the development model of Ethereum in 2017/18, there are already a large number of projects built on Polkadot. The number of developers and projects based on Substrate has increased rapidly. The support of the Web3 Foundation has also established a solid foundation for developers to adopt the Polkadot ecosystem. Foundation.

In 2021, we will also see more projects dedicated to tools, services and integration. Their emergence will boost the growth of Polkadot and accelerate integration with other blockchain ecosystems. These infrastructure projects are essential to enhance the value of the Polkadot ecosystem and help Polkadot to value-link with other blockchains.

Today we have seen the application of EVM compatible smart contracts and asset bridges between Bitcoin, Ethereum and Polkadot. We can foresee that in the future, oracles, on-chain data query services and API management tools will be the first to be built on Polkadot and promoted as user-oriented applications.

Because of the launch of cross-chain bridge facilities and card slot auctions, Polkadot's DeFi ecosystem will flourish in the next few months. Based on the reality that the existing DOT+KSM market value is close to 25 billion U.S. dollars, we must see that 10%-20% of the DOT+KSM market value will be used as locked position card slot funds, which will generate huge derivative value.

At present, in the DeFi innovation based on Substrate and cross-chain gateways, projects like Mangata have built Ethereum bridges to solve the problem of miners running away. Acala and Equilibrium are also providing stable currency and currency market protocol support for the Polkadot ecosystem. There is a privacy chain environment like Phala that provides the basis for confidentiality.

In the earliest days of DeFi in the Polkadot ecosystem, based on the card slot auction logic, we can predict that liquid bets will explode as core value. At present, several DeFi projects are studying to provide mobile betting solutions similar to Stafi and Acala. In the coming months, we will see a large number of projects replicated on polkadot with the Lego nature of DeFi. Once the basic Lego system is established, developers will flock to develop innovative financial products.

Whether it is migration or direct development, I hope to see more synthetic token projects, business-oriented projects (similar to Centrifuge) and DEXes / AMM on Polkadot.

At present, DeFi assets locked in the Ethereum ecosystem will become the norm. Polkadot will attract many DeFi protocol migrations through card slot auctions, low-cost replication contracts and scalability in the short term, but in the longer term, we believe that Polkadot’s true value lies in With the ability to handle decentralized applications and data services, Polkadot’s system has threatened Ethereum 2.0 in terms of development progress and ecological richness. If DAPP breaks out again within 2-3 years, it will most likely be in Polkadot Support within the ecology. Therefore, projects related to games, application development, data services, and native smart contracts (!ink) are also worth preparing for long-term deployment.

As the parachain auction draws to a close, more and more projects seek the support of DOT whales, funds and communities to raise funds, and obtain parachain slots by staking DOT. The price of each parachain is highly controversial, ranging from 200,000 DOT per year to 1.6 million DOT per year. Most mature projects are well prepared for the integration of parachains and the auction process. This will be an exciting time for the Polkadot ecosystem and promote developers' development work on Polkadot.

TLDR: IOSG investment keywords

Investment is both a science and an art. In addition to testing people's knowledge, professionalism and judgment, it also tests people's disposition, aesthetics and values. IOSG's investment logic and strategy are based on the long-term guiding ideology. Key words include:

Unity of knowledge and action : Under normal circumstances, based on in-depth research, it is not difficult to initially judge the intrinsic value of a project. The difficult thing is to dare to place a heavy bet on your own judgment and stick to your own in different market sentiments and environments. judgment. Therefore, investment needs to be faithful to oneself and achieve the unity of knowledge and action. IOSG has been focusing on betting DeFi since 2017, and has built a multiple investment portfolio. 1inch+Synthetix has evolved from an obscure grassroots development team to the mainstream DeFi arena, Matcha(0X)+UMA (cooperating with the Yam/Badger community) They are all micro-innovations of well-known teams again. In this process, we have witnessed the growth of the team.

Long-termism : Long-termism requires us to stick to our original intentions, not to be troubled by current fluctuations and profit and loss, but to see the opportunities and changes in the long-term future 10 or even decades; it requires us to become long-term thinking strategists and not to prove to the outside world What, but to work hard to do our best; it requires us to continue to create value as the foundation of our lives and make choices that fit our own values between short-term profit and long-term value. In the cryptocurrency industry, we adhere to the long-term principle, choose excellent projects to walk with the team, become friends of time, and accompany the team and projects to grow together. Regardless of whether it is Polkadot or NEAR, we support it at the earliest stage. At Polkadot, we pursued two consecutive rounds of investment and then strongly supported the developer hackathon. In terms of post-investment management at NEAR, we helped them to hold meetup founder communities in four cities across the country. Yes, these teams have one characteristic. They are all believers in long-termism.

Persist in doing the right thing, not afraid of loneliness and hardship: the future blockchain ecology requires serious and professional mature investors to build. They walked step by step to today, silently, but tirelessly preaching for the encryption field, allowing more users and funds to enter this field, for everyone involved, and for this era. In-depth industry research is essentially contributing to the industry and the times. The screening of massive data and information, the communication of many projects in the industry, and the exploration of industry maps are complicated and difficult, but they must be done by someone. In this noisy capital market, only a minority who maintains independent thinking and establishes a mature decision-making process and investment system can it be possible in the complex investment world without being disturbed by market fluctuations and emotions. Find the main contradiction and become the winner of long-term excess returns.

IOSG firmly optimistic about the direction in 2021

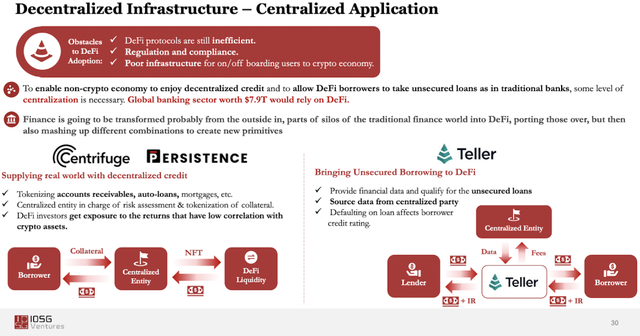

Integration of CeFi and DeFi

Financial development is gradual, and DeFi will eventually cover various financial tools and applications. However, due to regulatory restrictions, encrypted assets cannot be fully used as a means of payment. For users outside the circle who want to participate in digital asset transactions, DeFi's infrastructure is not yet complete. Therefore, we predict that the short-to-medium-term development rhythm is still the DeFi+CeFi hybrid collaboration model. In the traditional financial world, the first application case of DeFi will cooperate with the financial sector to provide services to developing regions where traditional businesses are insufficient. Because in these areas, DeFi can fill the gap created by traditional financial business restrictions.

The unmet financial needs of the world mean a market opportunity of US$5.2 trillion. Centrifuge and Persistence invested by IOSG are leaders in targeting these profitable opportunities. The main goal of this type of DeFi is to allow global users to participate in the decentralized economy and be able to make instant profits. Centrifuge, Persistence, and Goldfinch connect financial technology companies. They gather capital from DeFi and issue loans to people in need. In the long run, this is one of the directions that excites us the most, because it demonstrates the power of technology and freely flowing capital that can create tangible value for ordinary people.

Large-scale application of lightning loans

Because on-chain applications are composable, Lightning Loan is probably a DeFi product. Lightning loans are decentralized financial products that allow people with programming backgrounds the opportunity to become giant whales and can trade millions of dollars in assets in a block.

We predict that more talents will enter this field due to the high remuneration of flash loans to further develop flash loans. In addition to motivating geek developers, lightning loans have also turned DeFi into an extremely efficient market, with various arbitrage opportunities constantly emerging.

Unsecured credit loan / insufficient mortgage loan start

In order to ensure the security of the decentralized system, the DeFi loan agreement requires over-collateralization. When over-collateralization can be performed anonymously in DeFi, the smooth operation of the system is guaranteed. This is the same as traditional finance, but it also has the disadvantage of low capital efficiency.

Now, there is an agreement to access intermediaries, let them endorse, and make insufficient loans to borrowers with insufficient credit (such as our investment in AAVE). In this way, the risk can be passed on to the middle party instead of the entire system. However, due to the lack of trust between the borrower and the lender, this model is difficult to expand.

Insufficient mortgage loans that do not require an intermediary's endorsement are a big step in the development of DeFi, so we believe that one of the development priorities in 2021 is insufficient mortgage loans, and we predict that there will be more agreements similar to custodial wallets to borrow money People manage assets.

LP liquid pledged tokens can be used as collateral for lending platforms

The AMM protocol provides users with a good opportunity to passively use assets and earn income. Liquidity providers are critical to the success of many AMM agreements. In these agreements, greater liquidity under certain conditions means greater transaction volume. The reason is composed of two parts. First, deeper liquidity means better pricing, so that more orders are sent to a specific AMM. Second, more TVL means that the arbitrage robot responsible for the price efficiency of the AMM agreement can generate more transaction volume. Locking a large amount of liquidity in the AMM protocol provides an opportunity to build DeFi Lego on top of this layer.

We expect that more LP token use cases will emerge in the next few months to unlock funds from the AMM pool (for example, allowing LP tokens to become collateral for currency markets or synthetic asset agreements).

Ecological opportunities under the combination of ETH2.0 and Roll up

In the first phase of the Ethereum 2.0 beacon chain launched at the end of 2020, the Proof of Stake (PoS) consensus mechanism was enabled and the PoW workload proof consensus mechanism used by the Ethereum 1.0 chain was upgraded. Judging from the fact that the number of active pledgers of ETH2.0 is far ahead, the initial launch of the beacon chain has successfully attracted the attention of the market. However, there has always been a dispute between ETH2.0 and ETH1.0. At present, the Ethereum network is very congested, and the average cost of each transaction is more than $10, which almost isolates retail and long-tail asset transactions. Therefore, the introduction of the Layer 2 solution can be described as an arrow. But there is also such a saying: ETH 1.0 is the earth we live on now, ETH 2.0 is the Mars that many people hope to move to in the future, maybe ETH 2.0 is the ultimate solution for the long-term future, but we must survive before we have the future.

The ultimate goal of both ETH2.0 and other solutions in Layer 1 is to get rid of the low TPS restriction. The initial launch of the beacon chain made a good start for ETH2.0; the PoS consensus continues to operate stably, and more potential pledgers and individual nodes will join Ethereum 2.0; the adjustment of the Ethereum 2.0 roadmap relieves the current potential Pledgers are prohibitive of liquidity risks. We believe that the launch of ETH2.0 is not only beneficial to the long-term development of ETH, but also beneficial to the development of its DeFi ecosystem, bringing certain expectations for the scalability of Ethereum in the future.

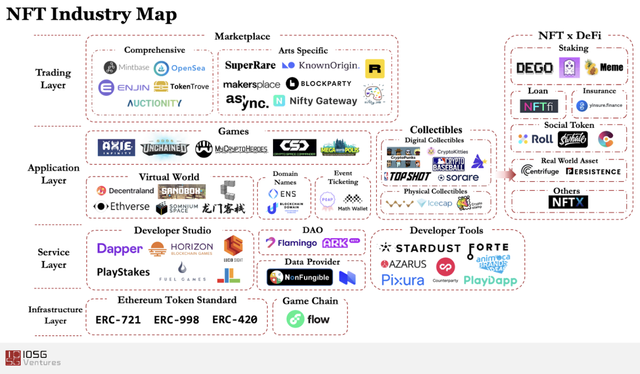

Rising NFT and game industry

In the past two years, we have witnessed the growth of the NFT field. From the underlying token protocol and public chain to development platforms, applications, and trading platforms, the NFT's territory has now covered multiple levels. We are optimistic about the breakthrough development of projects based on the combination of NFT and DeFi this year. There is nothing new under the sun. As early as a few years ago, there were many attempts in the industry to integrate NFT into blockchain games to provide permanent preservation and value support for virtual assets in the game. However, the timing was not fully ripe at that time, so NFT did not get explosive growth. We believe that the current time is relatively mature, which is mainly reflected in the following aspects: 1) The community’s enthusiastic participation in DeFi has formed a high tolerance for participation, and there is great enthusiasm for emerging NFT-type projects. And high participation ability also greatly shortens the education cycle for new users; 2) The industry gradually matures and forms a more practical customer acquisition strategy. For example, the success or failure of NFT-based games depends more on the attractiveness of the game itself; 3) The infrastructure including the underlying protocol, the second-tier network, and the second-tier trading market has been gradually improved to remove technical and liquidity barriers for the large-scale use of NFT-based games, social and entertainment applications.

In our investment, we will also focus on the deployment of infrastructure supporting the liquidity of NFT, applications such as high-quality games using NFT, and applications based on NFT in a wider range of finance, credit investigation and warrants. People combine NFT with games and collectibles because it can carry one of the unique values. But we believe that scarcity is only the surface layer of NFT. We dig deep into the deep attributes of NFT, and pay particular attention to new NFTs such as DeFi and social token. At present, the scale of NFT transactions has exceeded 180 million U.S. dollars. It can be predicted that with the blessing of DeFi attributes, the volume of NFT will exceed 1 billion U.S. dollars in the near future.

Broken financial derivatives

In 2020, the decentralized exchange (DEX) has basically completed the spot market layout. From the first quarter of 2021, we will see a deeper impact of DEX on derivatives trading. In recent years, several projects have begun to build infrastructure for the extension from spot products to derivatives, and it is expected that benefits will be realized in the near future. Derivatives are also a promising development direction for DeFi. One of the important differences between DeFi and traditional finance is capital efficiency. At present, capital efficiency is not high and requires so many additional collaterals to ensure good behavior rather than to promote more synthetic assets or derivatives. From the perspective of DeFi, no loan is unsecured. But it is possible to find a way to reasonably represent and tokenize cash flow outside of unproductive collateral. The key direction of community governance and derivatives: the role of delegation mechanism in community governance; derivatives and synthetic assets; lowering the threshold of collateral.

In 2021 we will see the emergence of new DeFi products, and the underlying protocol of these products is the financial infrastructure established on Ethereum in 2020. In 2019, the liquidity supply is mature. In 2020, the liquidity incentive mechanism will produce liquidity mining and other innovative mechanisms. We have noticed that encrypted assets are beginning to be packaged into more and more complex forms, and new Dapp products have added more functions. Based on this development logic, we can predict that complex derivatives products will shine in the future.

We have seen that some Dapps can provide contracts, futures, forwards and options. The high degree of composability of Ethereum itself will make Dapp easier to iterate. In addition, with the influx of new developers and the development of Layer 2, derivatives will continue to evolve and will bring DeFi closer to the performance of traditional finance. DeFi products can be programmed and will eventually surpass traditional finance. Therefore, how does the super-composability of Ethereum accelerate the launch of new derivatives platforms? In the future, with the enrichment of DeFi "Lego blocks", we can create new asset types and discover from basic assets by creating new derivatives platforms More value.

Tiered loan agreements and fixed rate products

Currently, one of the biggest problems in the DeFi field is that interest rates are very unstable. The lender's APY (Annual Percentage Yield) can vary from 1% to 20% within a certain period of time, which is a big problem for large institutions and individual investors seeking stable and predictable returns. Based on the demand for yield sensitivity and market price volatility, graded bonds are the main solution in the market. Graded loans are one of the new DeFi areas that have received attention from the end of 2020. Saffron and Barnbridge are the leading projects in this area. By introducing fixed-income derivatives, these projects enable conservative investors to hedge against fluctuations in yield, allowing investors to achieve different levels of risk and return on the same asset.

The above-mentioned structured products occupy an important position in traditional finance and are one of the most used financial products. As the DeFi system matures, we expect structured products and hierarchical lending platforms to be widely used among investors. Due to the composability of DeFi projects, Saffron and Barnbridge are likely to be integrated into existing DeFi blue chip projects, such as Aave, Uniswap and Compound, and provide investors with additional hedging options.

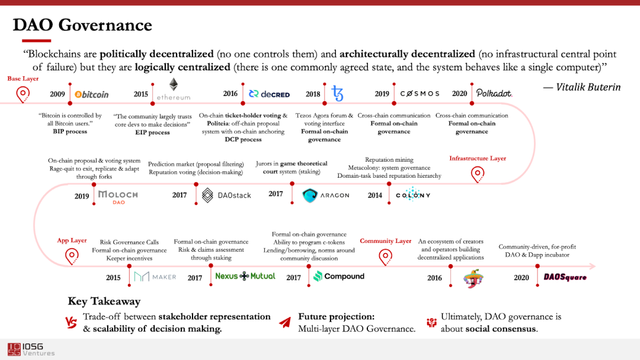

People-oriented decentralized governance

In 2020, liquidity mining has become an innovative incentive mechanism for the agreement to distribute tokens to core users, and product innovations such as Aave's "Flash Loan" and "Credit Loan" are emerging. With the development of the DeFi protocol, more and more cores with governance value have been produced. Taking Maker and Compound as early representatives, we have seen more and more DeFi projects start decentralized governance from the second half of 2020 to the present. The project uses open source code programs to make decisions, and the organization's financial records are stored on the blockchain. Decentralized autonomous organizations and governance methods are undoubtedly a huge challenge to many traditional hierarchical systems and exclusive organizational structures in the world today. It uses "group wisdom" to make better collective decisions, which is superior to traditional governance models in terms of governance democratization. DAO can maximize the participation of stakeholders in the decision-making process (decentralization), and achieve transparency in governance. Without decentralization, DeFi tools may not be revolutionary. Only by decentralization, DeFi platforms and projects can achieve revolutionary results.

As of the writing, the value locked in the global DeFi market is about $54.31B (DeFipulse.com), and the total assets managed by DAO (Asset under management) are as high as $991.8M (deepdao.io). Decentralized governance creates a trustless, borderless, transparent, accessible, interoperable, and composable organization. As DAO manages more and more DeFi assets, and more and more community members participate in the governance of DeFi projects, it is foreseeable that more DeFi products will interact with DAO in the future, and more management rules will be imposed. Write it into the smart contract public code. We believe that decentralized governance will become the basic element pursued by DeFi, and more DeFi protocols will be managed through DAO in the future.

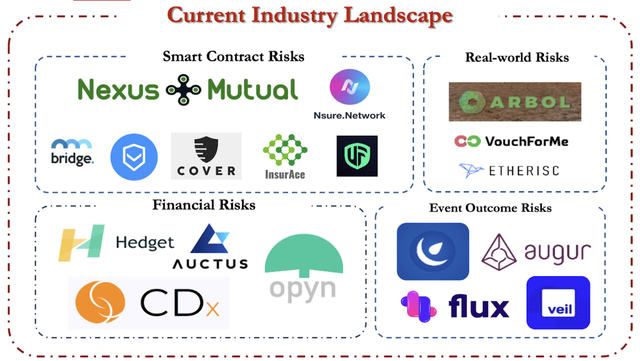

Insurance market on the rise

Since mid-2020, the DeFi insurance market has gradually become more popular, and a large number of innovative projects have emerged. Following in the footsteps of Nexus Mutual, other insurance projects, such as Nsure, Haka, Union, and InsurAce, have made rapid progress in development. We expect that more projects will be launched in the next two years, and industry-leading projects of sufficient scale will emerge. The risk categories underwritten by insurance projects continue to expand, from smart contract insurance to products that include market risk, event risk, real world risk and other risk categories. For example, investors purchase market risk insurance based on derivatives to reduce the impact of price fluctuations. In addition, the real-world risk insurance chain has also made great progress . We see that insurance projects related to aviation and agricultural risks are ready to go online. It is expected that in the next two years, as more projects are developed and launched, more risk categories can be insured to meet the various needs of users.

With the expansion of the DeFi ecosystem, the increase of users and the skyrocketing amount of funds in the ecosystem, the demand for insurance will increase explosively in 2020, and the number of insurance users will continue to rise (for example, Nexus Mutual's insurance volume has increased by a thousand times during the year). We expect that in the next two years - with the gradual growth and maturity of the DeFi ecosystem - insurance users will continue to rise, and the proportion of DeFi users who purchase insurance will also increase.

Although the DeFi insurance industry still has many risks and challenges, such as the low effective leverage/fund utilization rate, the insurance supply exceeds demand. The ecology of independent insurers is lacking, and the barriers to entry for insurance users are high. The insurance project itself is under attack, the reinsurance business ecosystem is missing, and so on. But we believe that insurance is an indispensable link in the blockchain, and large assets need an extra layer of external protection. We believe that with the joint efforts of the developer team, the community and investors, these problems will be solved in the future.

Algorithmic stablecoins and algorithmic synthetic assets

The integration and impact of traditional finance and blockchain finance, and sovereign supervision will inevitably subject centralized stablecoins to more restrictions, thereby pushing the encrypted economy to decentralized stablecoins. At the same time, the stable currency cross-border payment business continues to grow. Using stable currency or any encrypted asset to make cross-border payments is more convenient and effective than traditional methods. The decentralization and censorship resistance of algorithmic stablecoins makes it almost certain to enter the mainstream choice in the long run. In the past year, the soaring market of ESD, BASIS, FRAX and other algorithmic stablecoins led by AMPL has reshuffled the trading list, which has made the industry look at algorithmic stablecoins with admiration. Because there is no need for collateral in the early stage and there is no underlying value support, the speculative component of the capital game involved in the transaction is relatively strong. After the bubble subsides, the algorithmic stablecoin will gradually move towards stability and maintain an equilibrium state. The partial mortgage algorithmic stablecoin represented by FRAX is more like an interesting social experiment, with a view to between price stability, capital utilization and anti-censorship , To find the Schelling point that should belong to it.

Huge SaaS data service provider market

From 2019 to 2020, the number of Ethereum addresses has increased from 84 million to 131 million, an increase of 56%. For data requirements, many companies have actually started to test the waters. Nansen will have more than 50 million Ethereum addresses and Activities are marked, and data analysis is performed, and the data analysis is only delayed by 4 minutes. In addition, after the DeBank that we deployed this year sorted out the latest projects for the entire DeFi ecosystem and counted all the on-chain data, the community began to use DeBank defined lock-up volume (TVL), user scale, and transaction volume data, as important for the DeFi ecosystem Trend indicators. Another important team, Scout chose another product form to provide users with a tool that can dig deeper into Ethereum data. And in order to further lower the threshold of the tool, Scout provides a graphical interface. The prospects of DeFi are still infinitely broad, and Nansen, which focuses on on-chain analysis, will continue to provide professional and reliable data support for deep users.

The DeFi market has $54.31 billion in locked TVL, with a market value of more than $70 billion, and the market value of Ethereum is $21.1 billion (as of press time). With Aave and Synthetix, Uniswap ranks among the top 20 in total market value. We have reason to believe that DeFi’s The prospects are still infinitely broad, and the data platform focused on and on-chain analysis will continue to provide professional and reliable data support for deep users, which will further highlight the value.

Innovation of social protocol tokens

The emergence and rise of social tokens has brought a kaleidoscope of dawn to the value input of social media. A variety of token distribution models help issuers and holders to obtain a certain short-term and long-term value capture. We believe that the future of social protocols can lie in the creation of a complete social capital market. Anyone can exchange and issue tokens at any time and for any reason. However, once the issued tokens are sufficiently dispersed and circulated, there will be formal transactions in the field. So. This will enable our community, third parties, and almost any network participant to easily exchange social currency between each other. This can already be reflected in the fork exchanges of Roll and Uniswap V2.

The Roll social base layer plays the role of a community aggregator, taking personal and community tokens into the arms. Cherry is a classic example. It is a social token with a large position in the Roll platform and an influencer. By issuing Cherry, founders can effectively create their own economic market and win $Cherry by encouraging users to participate in interaction and sharing. Users with $Cherry can exchange for CherryBlossom, and use it in exchange for a series of Perks, such as watching Cherry exclusive content, interacting with Cherry, and planning for Cherry's upcoming activities. However, the core point of Cherry is not only to gain advantages on the surface, but also to fundamentally safeguard the rights and interests of both consumers and artists, helping other artists earn money through Cherry and directly provide consumers with valuable content. . The good news is that this case is only the tip of the iceberg of personal token capabilities: different artists can develop different models, create different mechanisms and opportunities, and the diversified development direction is what should excite us.

IOSG is full of expectations for the emergence of social protocol tokens. In the past year, the Roll social token has been added to our Portfolio, giving us the first step in this industry. In the short two years of its establishment, Roll has become the most popular token issuance tool in the industry and has evolved into the focus of social agreement to issue tokens. In the new year, we will pay more attention to and explore promising models, protocols, and tools in the industry, and explore valuable opportunities in the social token market.

User-friendly agreement for long tail

Although DeFi's asset scale is growing rapidly, we need to calmly observe that the actual number of users of each DeFi protocol has slowed down. For some infrastructure protocols, the number of users can be said to have stagnated. We think this is because participating in DeFi has become more and more like a capital-intensive industry. Transaction fees are only friendly to giant whales, but for early adopters who are new to DeFi with a trial mentality, as well as huge long-tail users in the future. The threshold is extremely high.

Although we also expect Layer 2 rollups, side chains and other public chains to try to migrate the existing Layer 1 DeFi ecosystem, we also recognize that such ecosystem migration will be slow and challenging. In the future, we will pay great attention to the application layer and infrastructure projects that can revitalize the existing Layer 1 DeFi ecosystem and make it easier and low-cost for long-tail users to access and use DeFi.

Investment value transfer

IOSG post-investment empowerment

IOSG Ventures is a research and community-driven investment organization. The team makes investment decisions through thinking about various areas of the blockchain and extensive research. By outputting research reports, it helped the entire team recognize the missing parts of the current market and also gained opportunities for frequent reflection. As a responsible investment institution, IOSG not only provides financial support for investment projects, but also provides assistance in community building, resource docking, brand promotion, and ecological expansion. This is something that is meaningful to both parties. Because in this cycle, the capital can better understand what the project is doing, see the market trend of the industry, and find that it can make more contributions to the progress of the industry and society. It is extremely happy to truly participate in the ecology of the project, witness the development of the project from 0 to 1, provide constructive improvement suggestions for its products, and participate deeply in the wave of industry change.

IOSG Ventures Research Report

From the beginning of 2020 to the end of the year, the IOSG WeChat official account (ID: IOSGVC) has output a total of more than 80 WeeklyBrief articles, rich in dry goods, covering industry insights, news trends, fund status, etc. At the same time, Medium (ID: IOSG Ventures) is the main output platform for English content, and many articles with unique viewpoints are output in the form of Newsletter, from discussing the underlying logic of technology AMM to exploring the popular product SushiSwap in the market and so on. Industry research is the foundation of IOSG. We have always maintained a rigorous attitude and awe of the industry and the market, so the output reports will always be well-known in the industry. IOSG will continue to output high-quality content in the new year to gain more industry recognition and customer support, and jointly promote the development of the blockchain industry.

IOSG Ventures community project cooperation

The IOSG Ventures team is located in China, the United States, Europe and Singapore. To help the project grow, team members actively participate in relevant communities and organizations, provide support for the project through efficient communication and collaboration, establish a huge social network, and help invest in the portfolio Grow and complete brand building, and increase the influence and community scale of its products.

IOSG Ventures joins related well-known organizations in the industry, such as the Enterprise Ethereum Alliance (EEA), Chicago DeFi Alliance (Chicago DeFi Alliance, CDA), etc. , to formulate entrepreneurial growth plans for Portfolio and help them go further. At the same time, IOSG is also the main participant and promoter of DeFi Summit, a well-known DeFi event, and is also a formal member of Metacartel DAO. We firmly believe in the power of the community and insist on our responsibility as an investment institution to help start-ups grow. We hope to provide not only financial help, but also community and resource support. We often maintain close contact with project founders, teams, developers, exchanges, academic research institutions, other venture capital funds, media and Internet opinion leaders, etc., to help projects such as NEAR and Oasis establish cooperation to improve the ease of their products. Usability and development efficiency, and help build the community; at the same time, we are also encouraging more developers to participate in the entire industry, sponsoring seminars and hackathons jointly organized by Cosmos, top universities and the developer community.

In the future, we can continue to do things for Portfolio, including but not limited to: injecting funds into the project, supporting the establishment of communities and commercial procurement; contacting industry experts for counseling, so as to carry out project incubation; introducing more strategic partners and industry experts; Contact other companies in the Portfolio for business cooperation and technology development to achieve tactical coordination; participate in pledge to ensure the smooth progress of the token economy; participate in community governance and propose high-quality governance proposals; play a role as a node validator, etc.

IOSG Ventures Event Conference

Activities are an excellent way to help project exposure and obtain resources. In the past year, the most eye-catching activity of IOSG Ventures was our 7th Old Friends Reunion IOSG DeFi Summit . On October 26, 2020, Old Friends Reunion came to a successful conclusion in 1933 Laochangfang, Shanghai. IOSG Ventures joined hands with imToken, DeBank and Aave to create an unprecedented feast of ideas exchange.

More than 1,000 people participated in the event, bringing together well-known blockchain developers, investors, and community builders at home and abroad. The event invited more than 60 heavyweight guests, including Ethereum co-founder Vitalik Buterin, co-founder of NEAR Illia Polosukhin, Stani Kulechov, founder and CEO of Aave, Matt, co-founder of tBTC/Keep, Emin Gün Sirer, founder of Avalanche, and Dawn Song, founder of Oasis Labs.

"IOSG Old Friends Club" has become a well-known gathering in the industry, where many founders, developers, and investors exchange ideas, insights, discuss market conditions, project incubation, and cooperation. We also hope that IOSG can make Old Friends Club a top industry event in China and abroad. It can not only promote project incubation and community growth, but also bring endless momentum to the industry. In the new year, IOSG will continue to do a good job in the output of our research content, support the project community management, organize activities, strengthen the portfolio brand building, and do a good job in the empowerment of the next invested and future projects. ready.

However, the differences between Chinese and Western languages and cultures often result in unsatisfactory information and communication. The rapid update of the blockchain industry brings new opportunities, and it also forces the industry to have an increasing demand for people who understand Chinese and Western cultures, are proficient in language communication, and are full of exploration in the encrypted world. In 2021, we will soon launch the "Spring Recruitment" plan to find excellent ambassadors for our Portfolio and build a bridge between China and the West for the project. If you are interested, please contact us!

Write at the end

Message from IOSG

The future of blockchain and cryptocurrency is never lack of sparks. Discover it, accompany it, and help it. When the time is right, it will light up the entire sky.

— IOSG Ventures Team

At present, the blockchain and cryptocurrency industries are still in the early stages of barbaric growth, so there is no shortage of short-term wealth creation opportunities and myths. Arbitrage opportunities generated by information asymmetry and speculative opportunities chasing hot spots are all over the industry. But we believe that such short-term quick money opportunities may cause investors to neglect to discover opportunities that have real long-term value, and thus lose the possibility of continuous positive evolution. As Hillhouse Capital Zhang Lei said, "There are some things that cannot be done, then they will not be done from the beginning."

In the past year, the one word we said the most was rejection, because we didn't want to make a certain choice or decision ourselves, just because others did the same. We will ask ourselves, is this a choice that makes us feel safe, or is it a choice that we are forced to make in a hurry under the noise? Of course, we also believe that short-term non-consensus will definitely become consensus. On the journey of building long-term consensus, which founders we have met who are looking for true love to the community and creating products, start and grow together with them, and stick to the cryptopunk Web3 .0 The original intention of the world.

For many funds, building a portfolio and in-depth research at the beginning of a bear market is a challenge. We are fortunate to build a core investment research team. Through each of our project discussion meetings and industry research insights on each subdivided track, we will start from the founders and developers to build products and communities together, and continue to explore a maverick crypto investment paradigm. We also look forward to the emergence of more and more professional and respected crypto funds in the oriental market in the future, and we will continue to work hard for this expectation.

reference source: https://www.iosg.vc/ https://iosgvc.medium.com/