Although UNI currently ranks eighth on the list of crypto assets with a market value of over 15 billion U.S. dollars, in the early days of DeFi’s “zero to one” growth, the oracle Chainlink has always been regarded as the facade of the DeFi market, after all, as a chain An important bridge between online applications and the real world, oracle products represented by Chainlink are one of the most important infrastructures for applications on the chain. Today, LINK still maintains the 11th place in the market value list of all encrypted assets with a market value of over ten billion U.S. dollars, and is still in the leading position among hundreds of DeFi projects, which also proves the importance of the oracle.

However, for Chainlink, doubts about its "centralization" have long existed in the market, and rising stars such as Nest and other oracles that adopt fully decentralized solutions have encountered some bottlenecks in performance, so now the market is stuck We have reached a dilemma where we question Chainlink but cannot find a better solution, and Razor Network is trying to change this status quo.

What is Razor Network?

Razor Network is a decentralized oracle project that currently runs on the Ethereum network, but it does not target applications on the Ethereum mainnet. Instead, it will cooperate with multiple L1 and L2 blockchains to improve A fully decentralized oracle is provided on the platform. Hope to connect smart contracts with data in a fast and safe way. At present, the testnet of the flagship product decentralized oracle network has been launched, and at the same time the official also released a testnet browser for browsing testnet information.

Razor uses a sliding computer mechanism to prevent attacks such as invalid sources and (bribery) signals that may occur on the oracle. This mechanism can iteratively resolve disputes over the results of the oracle, and will ensure a steady improvement in system security. The project focuses on providing the maximum security allowed by game theory without sacrificing speed. Because of this, Razor has found a balance between efficiency and security, and its completely decentralized setting also avoids The bottleneck problem that the centralized oracle may encounter.

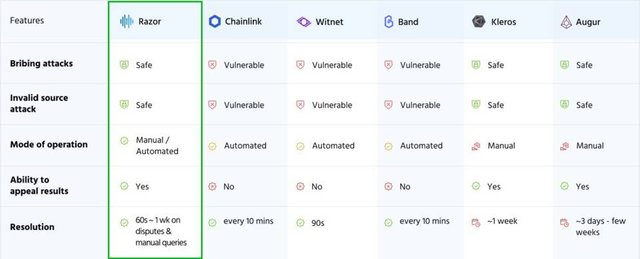

The Razor team’s attention is not limited to oracle products such as ChainLink, Tellor, Band, and DIA. The core functions of Kleros and Augur are not oracles but projects that include oracle functions in the solution are also regarded as indirect competitors by Razor. However, compared with the above competing products, Razor's balance of decentralization, safety and performance has allowed it to find the possibility of "overtaking in corners".

Horizontal comparison between Razor and some mainstream oracle products

Horizontal comparison between Razor and some mainstream oracle products

As a member of the Decentralized Oracle Association, Razor has reached cooperation with a series of projects such as Skale, Matic, MatraDAO, Meter, XDC, OpenDeFi, Conflux, Sentinel, DaFi and Persistence, and is on the road to realize the standardization of oracle integration. A solid first step has been taken.

Investment and financing information

Razor completed the seed round and private equity round of financing between September and November 2020, and the total amount of the two rounds of financing reached 3.7 million US dollars. Participating institutions include NGC Ventures, Alameda Research, Borderless Capital, IOSG, ZMT Capital, Origin Capital, Bixin Ventures, Spark Digital Capital, Kosmos Ventures, One Block Capital, BTC12 Capital, TRG Capital, 11-11dg Ventures, Genblock Capital, Bitblock Capital and Consensus Capital.

At the same time, the project has also been favored by several angel investors such as Mariano Conti, former smart contract leader of MakerDAO, former researcher of Metamask, Vincent Eli, PhD in decision theory, and Persistence CEO Tushar.

In addition, Razor has completed the public offering through the Liquidity Bootstrapping Pool (LBP) on the Balancer on February 4-6 this year.

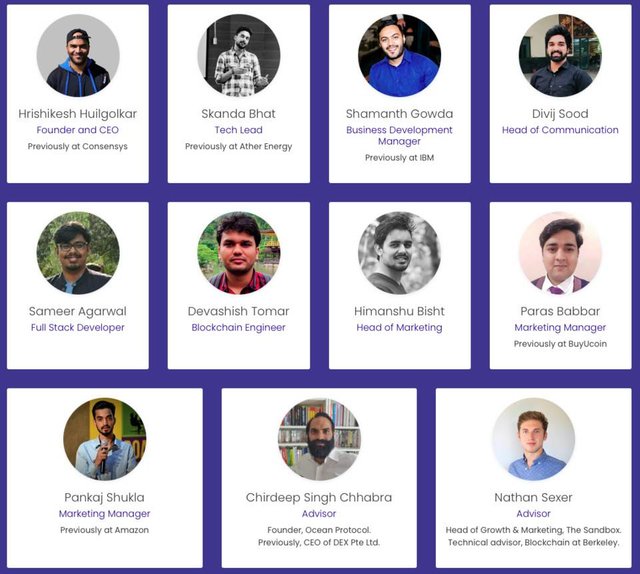

Core member

Founder and CEO Hrishikesh started to understand Bitcoin and Ethereum as early as the end of 2015. Before that, he worked in various positions such as data scientist and product manager. He decided to become a blockchain developer in 2016. He has worked in blockchain development for many companies including ConsenSys, and has made open source contributions to projects such as Ethereum and Raiden networks. Other members of the team also have rich experience in the blockchain industry, and some core members have also worked for Internet giants such as Amazon and IBM.

Native token RAZOR

Razor launched the native token RAZOR, with a total issuance of 1 billion RAZOR. As an oracle machine that adopts the proof-of-stake PoS mechanism, the pledger needs to lock the RAZOR token to participate in the Razor network. The system will reward users who continue to provide accurate data through token incentives, and will punish those users who do evil in the system.

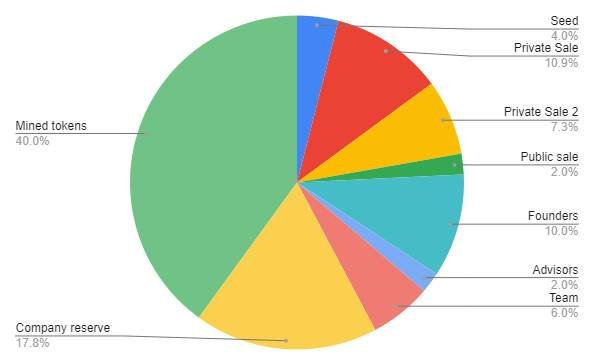

RAZOR’s distribution plan is as follows:

- 4% of the seed round sales, priced at $0.00625, fully locked, 33% unlocked every 6 months starting from June 2021;

- 10.9% of the first round of private sale, priced at US$0.015, initially unlocked 10%, the remaining part will be locked for 6 months, and 22.5% will be unlocked every 3 months thereafter;

- The second round of private sale is 7.3%, priced at $0.025, initially unlocked 10%, the remaining part is locked for 3 months, and 22.5% is unlocked every 3 months thereafter;

- The team reserves 18%, of which the founder allocates 10%, the team allocates 6%, and the consultant allocates 2%;

- The company reserves 17.8% for a series of operating costs of the company in the future. This part of the tokens will be locked for 3 years;

- Public sale 2%, the public sale was completed through the LBP distribution on Balancer in early February this year;

- 40% reserved for mining.

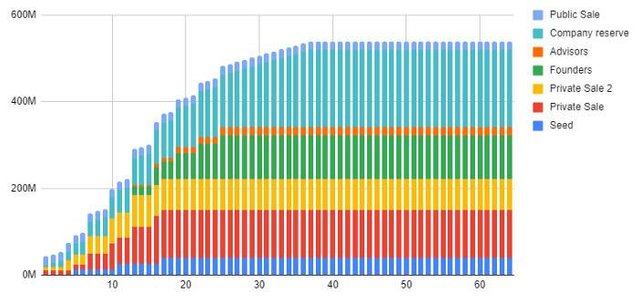

Taken together, the token release trajectory of the initially allocated RAZOR is as follows:

summary

As stated by Razor founder and CEO Hrishikesh Huilgolkar, the market performance has proven the value and prospects of DeFi, and centralized oracles will not be able to match the development of DeFi in the future. Therefore, building a fully decentralized oracle is a rigid demand for the market. , And what Razor needs to do is to continuously face challenges and solve problems, and create a "safer" and "more efficient" oracle network on the basis of ensuring complete decentralization.

@tipu curate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted 👌 (Mana: 0/3) Promote your post with @tipU :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit