On March 10, digital cash Group (DCG), the parent company of Grayscale, the world's largest encrypted asset management company, announced that it would purchase Grayscale Bitcoin Trust (GBTC) shares worth up to US$ 250 million. DCG plans to use cash on hand to fund this purchase transaction according to the provisions of Article 10b-18 of the Securities and Exchange Law of 1934 and the judgment of the management.

Affected by this news, Bitcoin rose rapidly and exceeded $56,000, reaching a new high in March, with an increase of more than 3% in the day and a market value of $1,030 billion.

It is worth noting that this share purchase authorization does not stipulate that DCG should purchase any specific number of shares in any period, so it can expand, modify or suspend the purchase at any time. The actual time, amount and value of stock purchase will depend entirely on many factors, including available cash level, price and current market conditions. Information on stock purchase will be provided in the periodic report of GBTC submitted to the US Securities and Exchange Commission (SEC) in 10-K and 10-Q format under the applicable rules of the Securities and Exchange Law.

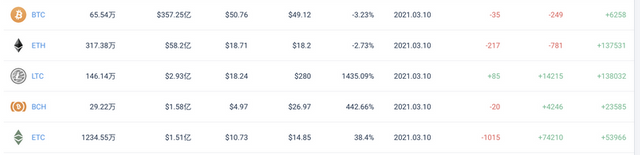

The timing of DCG's public announcement to buy GBTC comes at a time when GBTC has a large premium recently. As of press time, GBTC still has a negative premium level of 3.23%. This phenomenon is unusual in the history of GBTC. GBTC and other trusts under Grayscale have had huge positive premium levels for a long time in the past. However, despite the recent sharp rebound in the market and the return of bitcoin price to over $55,000, the negative premium of GBTC has not been alleviated. In addition, Grayscale GBTC has not increased its BTC for several days.

Grayscale Trust's cryptocurrency holdings are $42.247 billion now

Data source: Tokenview

About cryptocurrentcy Groups:

Founded by CEO Barry Silbert in 2015, DCG is the most active investor in the blockchain field. Its mission is to accelerate the development of a better financial system through the diffusion of digital assets and blockchain technology. DCG currently supports more than 175 companies related to blockchain in more than 35 countries/regions. DCG also directly invests in digital cash and other digital assets. In addition to the investment portfolio, DCG is also the parent company of Genesis (the major brokerage company of global digital assets), Grayscale Investments (the largest asset management company in digital cash), CoinDesk (financial media, data and information company), Foundry (bitcoin mining and mortgage business company) and Luno (cryptocurrency platform).