There is no need to repeat the significance of using BTC in DeFi. Today, we mainly focus on the project of migrating BTC to Ethereum network, which one will have more vitality?

According to the data of Debank, the number of BTC anchor coins is 200,000, and there are more than ten well-known projects. At present, the top three are WBTC, HBTC and renBTC.

What needs special emphasis here is, why should we migrate BTC to Ethereum network? That's because BTC on Bitcoin network is very secure, but its application is very limited. You can pay, transfer money, or hold it for appreciation. When it comes to higher-level financial services, we must return to the centralized financial service system, and you must provide KYC information and give up the custody of BTC, which obviously goes against our imagination of the decentralized and unlicensed nature of the encrypted world.

Therefore, we mainly introduce ren to everyone today BTC Although it is not decentralized enough, it is working hard to achieve decentralization. By contrast, the top two are completely centralized.

Total volume (TVT): $2,314,249,385.04 Total locked volume (TVL): $503,155,728.28 Dark tone: 1,713

REN lock: 171,300,000 REN

- As of January 27, 11: 00 am EST

Sourcehttps://mainnet.renproject.io/

- What is renBTC?

RenBTC (ERC-20) is based onRenProtocol issued BTC anchor currency on Ethereum, RenBTC and real bitcoin value 1:1 anchor

Ren protocol has been launched on May 27, 2020 in renvm virtual machine. Users can deposit the native BTC into the designated renbridge gateway as collateral. Renvm issues the corresponding renbtc in the Ethereum network through smart contract. The whole release process is relatively decentralized.Renbtc has been used by 1 inchCurveSupported by the defi project. Ren agreement has issued Ren token.

according toRen (renproject.io) According to official data, the total amount of renvm as of January 31, 2021 exceeded $2.3 billion, and there were more than 3.2 million other funds to pay network participants.

2、 How does it work?

The nodes in the Ren system are called "dark nodes". Each node needs to mortgage 100000 Ren, and the nodes get the service fee reward and accept the punishment of committing crimes. Ren uses secure multi-party calculation to ensure the system security, and the private key will not be exposed, and the node itself can not know the private key.The Ren nodes of each partition must collectively bind assets no less than three times the BTC value locked in the corresponding partition to achieve anchoring.

Ren is very easy to be integrated. At present, it has been supported by curve and 1inch. Ren has formed a luxury defi alliance to support the integration of renbtc, renbch, renzec and other anchor coins cast by Ren.

Today, we mainly introduces the working mechanism of renbtc.

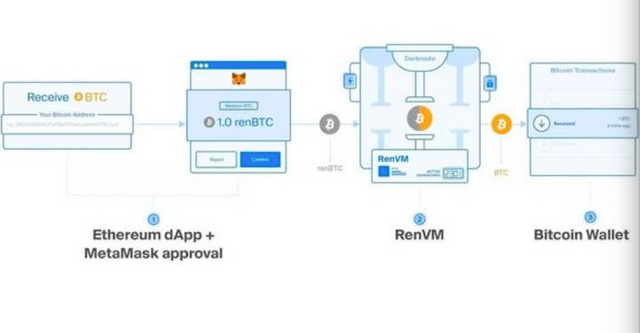

01 casting renbtc: Lock BTC into renvm, and cast renbtc on Ethereum

You just need to send the BTC to a BTC address to create a renbtc:

You want to use BTC in defi, so you find an application that integrates renvm.The user interface prompts that the application will generate a unique BTC address (that is, an address of a BTC script that can only be spent using one of renvm's ECDSA private keys).

You send 1 BTC to this address and wait for 6 blocks to confirm.After accumulating 6 block confirmations, renvm will immediately use one of its secret ECDSA private keys to generate a coinage signature.After you get this signature, you can cast 1 renbtc (renvm fee is required), and the renbtc will be sent to your specified Web 3.0 wallet.Note: these steps are usually performed automatically by the UI.

Now that you've got the 1 renbtc, you can use it in any defo app.You can use this renbtc to make loans, trade on uniswap, and do margin trading.Please note that renbtc is completely homogeneous and can be divided into any number, which is no different from renbtc cast by any other person.

02 redeem BTC from Ethereum, specify BTC address, destroy renbtc, and BTC will be returned to this address

The redemption process is as simple as the casting process. Any number of renbtc can redeem the same amount of BTC.When you are ready to redeem the BTC, you will destroy the renbtc:

You want to get your BTC back, so you find an application that integrates renvm.When the UI prompts, you provide your BTC address (the redeemed BTC will be sent to this address).This address will be used as part of an Ethereum transaction to destroy the renbtc and redeem the BTC.

You pay a small amount of gas fee for this Ethereum transaction and wait for Ethereum blockchain to confirm the transaction.When renvm sees that the renbtc has been destroyed, it will send the same amount of BTC to the BTC address you specify (renvm fee is required).

Now that BTC is back in your wallet, you need to use this BTC.

Note: all the above operations can be performed on the bitcoin / Ethereum main network.This means that all the assets cast on Ethereum via renvm are erc20 tokens that anchor an asset in a 1:1 manner; this means that if you hold a 1 renbtc (an erc20 token), you can use it to redeem a 1 BTC at any time.The supply of the original assets is directly anchored by the erc20 token cast by renvm.

3、 Important difference with wbtc

Let's first take a look at the operation process of wbtc: the eligible entities will hand over the BTC to the centralized trustee bitgo, and bitgo will deposit the BTC into the cold wallet, and cast the erc20 token (i.e., wbtc) representing BTC on the Ethereum blockchain according to the balance growth of the wallet.Sellers will sell these wbtcs in the open market.In general, bitgo stores the received BTC and casts wbtc on the Ethereum blockchain in a 1:1 manner.

RenVM is a decentralized custodian with rich functions, which is free of trust and license. The simplest way to understand RenVM is to think of it as a trust-free custodian, which can realize the cross-chain transfer of assets while holding your assets. For example, you entrust the BTC to RENNVM, and RENNVM holds the BTC and casts it as ERC20 tokens (i.e., renBTC) at Ethereum to ensure that your renBTC is always endorsed by the equivalent BTC.

Flow value exchange: renvm does not store BTC in a centralized or trusted hosting institution, but on a network composed of decentralized nodes (called "darknode").Once renvm receives the BTC, it will immediately cast erc20 token representing BTC in a ratio of 1:1 for personal and difi applications.An important nuance is that this value exchange (casting and destruction) is fluid; any number of assets can be transferred hundreds of times per minute, without relying on centralized institutions, sellers, signers, and without any friction, so as to realize the seamless transfer of cross chain digital assets (i.e., interoperability).

Composability: Another difference is that RenVM has composability (also called "DeFi Lego"). RenVM is directly integrated into DeFi application, and is not presented to end users. By using a special adapter, DeFi application can directly provide users with cross-chain function, and users do not need to worry about casting/destroying/packaging/removing packaging and other processes. Anyone (or application) can use and integrate RenVM. In this way, users can exchange BTC on decentralized exchange, lend/borrow BTC on lending platform, or pledge BTC to generate synthetic assets, and only need to use real BTC. Users don't need to see renBTC at all, or even feel the existence of Ethereum.

Decentralization, trust-free and license-free: the private key of ECDSA used in RenVM is completely private, even the same as the node itself. RenVM uses ECDSA private key to generate and sign data through a secure multi-party computing algorithm. No one can stop users from using their BTC to cast renBTC, destroy their renBTC to retrieve BTC, or use their renBTC at will.

Conclusion:

RenBTC relies on REN Project, formerly known as Republic Protocol. Therefore, it can be said that Ren is an old project, which has been developed since the upsurge in 20 17. Before doing dark pool trading, later doing cross-chain projects.

It is a challenge to determine which of WBTC, HBTC, RenBTC and the following projects will be widely used.

Some people choose custodians similar to WBTC mechanism, and may feel convenient in transactions. But the price paid is that if the terms of service are violated, the custodian can refuse any redemption; May prefer decentralized versions of token BTC such as RenBTC, because they think cryptocurrency should be completely decentralized.

Under the current situation, many people are using WBTC, but more people are looking forward to the decentralized application becoming mature and powerful.

Although RenBTC faced the challenge of centralization at the beginning, the Republic Protocol team had decentralized genes, and their RenEx dark pool was also dedicated to decentralized dark pool exchanges.

In the view of me, if it must be said that RenBTC still has risks, it is only the progress of project development-compared with centralized projects, decentralized RenBTC has ranked in the top three in the industry.

Compared with tBTC and other latecomers who have changed their patterns, it has been Turing complete and leads by one position ...