- Overview of blockspace Market

Blockspace is the commodity that drives the heart of all cryptocurrency networks.In the block space market, miners are producers, mine pools are auction houses, and users are bidders.The impact of the blockspace market is so widespread that it touches almost every aspect of the cryptocurrency ecosystem.

Every time a user starts a transaction, the transaction will be broadcast point-to-point in each node's memory pool.Each transaction carries a fee.The cost represents the willingness to buy the block space so that it can be processed and included in the block.

There are many "proposed blocks" in this "Schrodinger state" all the time, between unacknowledged and confirmed, competing to find the first hash output that meets the difficulty goal.Each block has the potential to become the next.By contributing billions of calculations per second, miners have the upper hand in the encounter with probability waves, earning money from filling in the ledger history.

Because the block size has an upper limit, the number of transactions that can be passed at a given time is limited, thus giving the block space an implicit time value.If the transaction is not confirmed for a long time, it may be affected by the market fluctuation, or the arbitrage robot may rush to complete the transaction.The fees paid by users for the purchase of block space reflect their willingness to bid for their space and time.The blockspace market is where miners and users connect.

On the surface, the blockspace market looks complicated and chaotic due to the lack of central coordination.It relies on detailed rules, procedures and the integration of supply and demand to adjust itself.How do we know: is the current market design optimized to ensure success?

Alvin E. Roth, the Nobel Laureate in economics, is regarded as a pioneer in the field of market design.In his pioneering work "who gets what - and why", he pointed out that to make the market work normally, the market needs to do at least three things:

1.Market depth: enough potential buyers and sellers to interact.In the blockspace market, block rewards encourage suppliers to provide hash rate.On the other hand, as more and more people use the Internet for transactions, the demand for block space is also increasing.

2.Security: market participants must be able to confidently disclose or use confidential information they may hold.Due to the transparent nature of transactions on the chain, users who submit sealed bids may not always get the results they want.In addition, transactions require a high degree of settlement assurance.In other words, there should be enough hash rate to make reorganizing historical blocks expensive.

3.No congestion: transactions should be passed or cancelled in a timely manner.If the market cannot effectively cope with the congestion caused by transaction volume, participants may not be able to include their transactions in the block without too much delay.As can be seen from the recent popularity of Ethereum DAPP, gas prices have skyrocketed due to network congestion.

In the history of bitcoin and Ethereum, how to optimize the design of the block space market structure often causes a lot of heated debates.In the following, we will demonstrate the structure of Ethereum blockspace market from the perspective of supply side (miners) and demand side (users).We have reviewed whether the current block space market design can provide depth, ease congestion, or can participate safely and simply.Next, let's talk about popular proposals to optimize the market structure and how the blockspace market will develop in the future.

- Supply side: mining structure of Ethereum

The ultimate goal of the entire mining industry is to act as a decentralized and transparent clearing house for a single commodity (block space).

This task is by no means easy.In a global distributed system operating 24 / 7, without authoritative coordinator, miners need to invest a lot of hardware and power costs to generate an amazing number of calculations to ensure network security, so as to provide powerful block space for anonymous auction Settlement guarantee.

Despite widespread concern about the over concentration of hash rates, mining is not a concerted effort.The price fluctuation of the block space market has different impacts on each component.Every miner is seriously affected by geographical location, machine type, temperature, machine maintenance and mining strategy.

Bitcoin and Ethereum mining have different market forms.Bitcoin and a lot of work prove that pow token has almost completely migrated to the era of ASIC mining.On the other hand, although Ethereum ranks the second in terms of token market value, but Almost no ASIC mining。Although there are frequent rumors that ASIC miner manufacturers will launch Ethereum, it is estimated that about 80-90% of the current Ethereum mining industry's hash rate is dominated by GPU graphics processors.

In terms of structure, what is the difference between the block space supplier market mainly composed of GPUs and the market mainly composed of ASIC mining machines?

Every story of every GPU mining starts with NVIDIA and AMD.These two big factories either sell independent graphics cards directly, or wholesale GPU chips and memory to low-end graphics card manufacturers.These manufacturers remove features that are not related to mining, so they are called "mining graphics cards.".There are many white label custom mining video card brands.

The number of customized video card miner manufacturers in the market is significantly more than that of ASIC mining machine manufacturers.Therefore, the hash rate composition of Ethereum is more diversified than that of typical ASIC networks.This also brings challenges to distributors' monopoly channels.Miners have more choices because they don't have to wait for ASIC miners such as bitland and Shenma to solve their supply chain problems.This means that initial supply is usually not as often hit by supply bottlenecks as ASIC miners using advanced back-end processes.

In addition, GPU miners are not bound to any specific network.The miners engaged in speculative mining almost only use GPU mining machines.In addition, retail GPU cards are also valuable in other areas of computing, such as games, data centers, and AI work.In general, GPU miners' hardware has higher option value.

Structure determines properties.Hardware composition determines the average capital expenditure and energy consumption of the industry.These two factors are crucial to the calculation of mining costs and have ripple effects on the rest of the mining ecosystem: from manufacturing, distribution, hosting facilities, gas cost volatility, preference for EIP proposals, to the defining characteristics of its mining market cycle.

- Supply side: Ethereum mining market cycle

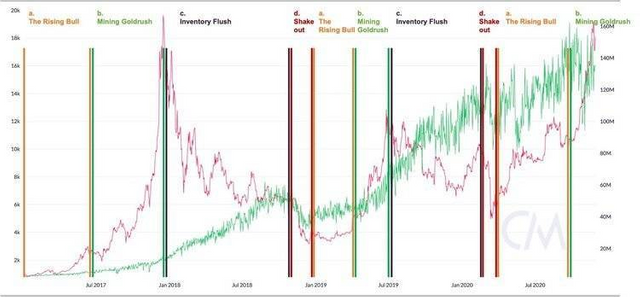

According to the relative change rate between bitcoin price and network hash rate, we introduce four basic stages of mining market cycle

Source: the alchemy of hashpower, Pt II

Due to the inherent lack of liquidity in the hardware market, the change of network hash rate often lags behind the price change.Hardware response time depends on a variety of external factors, such as manufacturer's supply chain bottlenecks, foundry inventory, plant capacity, and even transportation logistics.

These delays are particularly important this year as the market is racing into the "mad cow" market.Miners and investors scrambled to order new machines.Manufacturers, on the other hand, are just beginning to recover from supply chain disruptions during the outbreak of the new crown shortage Is forcing all semiconductor businesses: mining, automobiles, consumer electronics, etc. to line up for wafer distribution.

In addition, NVIDIA recently announce, they will artificially destroy the mining performance of ethash algorithm on the latest graphics card to prevent miners from buying out all the GPU inventory.This means that unless token prices or fees start to skyrocket, when the backlog of mining machines finally goes online, the two stages of "inventory flush" and "shuffle out the shakeout" may become a nightmare for many miners.

In the Ethereum blockchain, mining revenue mainly comes from three sources:

1.Coinbase reward (2 eth + uncle block reward for each block dug)

2.Transaction fee

3.Miner extractable value (MeV)

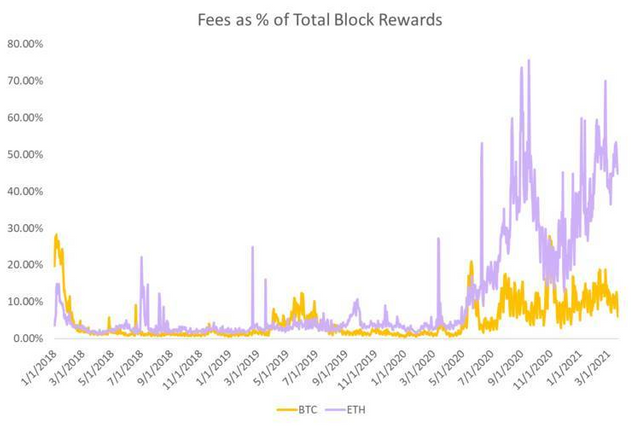

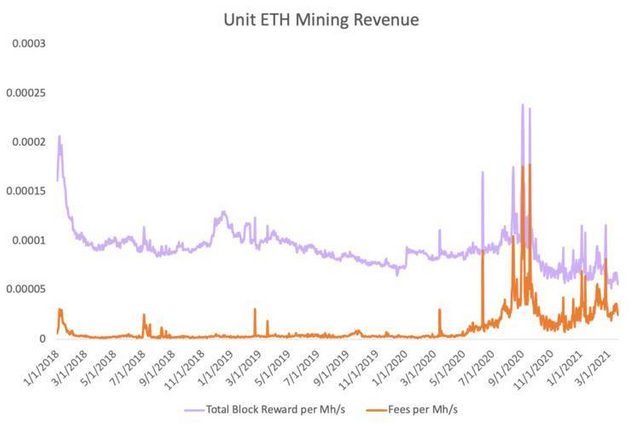

The transaction cost of Ethereum accounts for a much higher percentage of all block rewards than bitcoin.This means that Ethereum miners pay attention not only to token prices, but also to gas prices.Even if the ETH price remains stable, the increase of transaction costs is enough to encourage miners to increase the hash rate.

Source: coin metrics

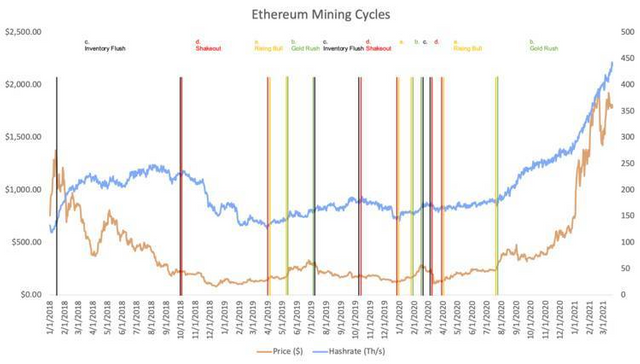

In addition, as mentioned in the previous sections, due to the flexibility of option value and distribution of GPU, compared with ASIC network, it is easier to expand or reduce the hash rate.Therefore, the mining market cycle of Ethereum is often shorter:

Source: coin metrics

Short cycle means that competition will accelerate rapidly when mining income is high, and option value of hardware means that hash rate is easier to disassemble when mining income is low.Unit profitability (block rewards per MH / s) can fluctuate dramatically, making it difficult to predict returns:

Source: coin metrics

The significant increase of token price and transaction cost attracted more miners to mine.But unlike most commodity markets, more producers do not mean an increase in the supply of block space.

The supply of block space depends on block size and average block time.This means that the increase of hash rate will not reduce the network transaction cost, but will increase the network security budget.As more and more miners join the competition, reorganizing historical blocks becomes more expensive, thus improving the security of the network.