- Demand side: the time value of block space

Because there is an upper limit on the block size, it is necessary to compete for system resources if you participate without permission. For anyone who initiates a chain transaction, the charging paradigm is the most critical core user experience.

As the most popular platform for storing and executing intelligent contracts, Ethereum has experienced rapid development in practical application. DeFi "Lego bricks of money" has spawned products and services that can be interlocked without permission, and greatly promoted the innovation of new financial mechanism.

Nowadays, Ethereum users participate in the block space market through repeated first price auctions. This is a simple form of auction, in which users submit bids to include their transactions in the next block, and the bids are paid to miners in the form of transaction fees. The user can select the bid by the "Gas price" of the transaction (expressed as gwei/Gas[1gwei = 1e-9 ETH]).

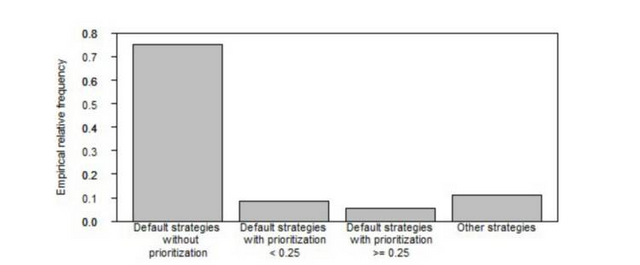

The empirical observation on the selection method of mining pool transaction shows that more than 75% of mining pools follow the default strategy and have no priority. That is to say, only transactions with descending costs need to be included, without prioritizing any specific address:

Source: Ethereum Gas Price Statistics

The market structure is simple: users want to minimize the fees paid to miners to enjoy a smooth experience, while miners want to maximize their income because they are profit-making entities.

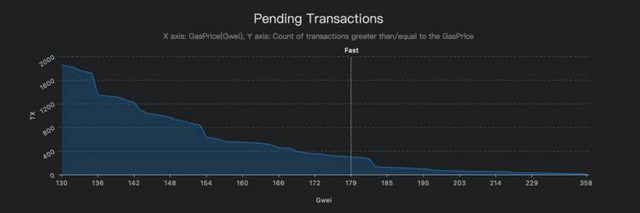

Undoubtedly, the fees paid by users will always abide by the relationship between supply and demand: the block space produced per second is a scarce asset, so users who want the next block to include their transactions immediately will always pay more than those who are willing to wait. It can be seen from the shape of pending transaction queue in the following figure:

Pending transaction queue, source: GasNow

Block space is the closest thing between cryptocurrency and "digital real estate". Block space has the intrinsic value of "real estate", in which economic activities take place.

For miners, due to the uncertainty of token price, network difficulty and cost, the time value of future block space is low.

For users, due to the uncertainty of their profitability and transaction utility, the time value of future block space is low.

- Demand side: congestion and cost

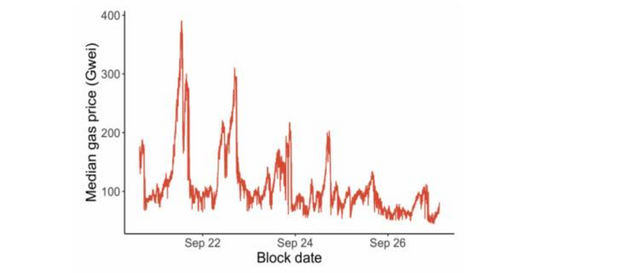

The time value of block space is directly converted into the amount of fees paid by users. In this charging paradigm, it is a difficult problem to estimate the "correct" Gas price, which can be clearly seen from the fluctuation of Gas price in a single block.

The median price of Gas fluctuated from 100 Gwei to 400 Gwei in a week.

Source: corelab

Recall the three elements of successful market design mentioned by Roth: market depth, security and no congestion.

Obviously, when the transaction is congested, the Gas price usually rises too high for ordinary users. Where is the bottleneck?

This unpredictability stems from the fact that users cannot negotiate the appropriate fees to be included in the next 1, 5 or 10 blocks. Nowadays, most users bid in a "one-off" way: they broadcast one transaction at a time, and then wait for the miners to be included in the block. By allowing users to express their cost preferences within a certain range, constant factors can be improved, such as usage Expense upgrade algorithm.

The initial version of a new technology is always rough. Over the years, various working versions have appeared to solve the congestion problem in Ethereum. The market design of block space involves balancing the interests of many factions in the ecosystem. At present, three possible paths have been discussed:

1.Short-term: block expansion. A stopgap measure may damage security.

2.Medium term: change the auction mechanism. Community consensus is needed.

3.Long term. Scalability solutions. Rollups and ETH 2.0.

People may try to increase the size of a single block, so that it can accommodate more transactions (i.e., if the demand remains unchanged, increase the supply). This change will only temporarily alleviate the pain caused by the high cost, because the new demand will fill up quickly, thus increasing the cost again. In addition, with the increase of block size, blockchain node software tends to be more resource-intensive. Therefore, in order to maintain the decentralized property of the system, this method should be avoided.

Another way is to reorganize the bidding process. Nowadays, the charging mechanism in all blockchain has realized "general first price auction". EIP-1559 of Ethereum proposes to change the mechanism to fixed-price sales without system congestion, so that users can easily choose the "best" bid for their inclusion preference (contrary to the current situation).

The variant of EIP-1559 has been deployed in Near, Celo and Filecoin. The EIP-1559 proposal is planned to be activated in Ethereum in July 2021, which will be the largest change in the charging market mechanism in the history of public chain.

EIP-1559 is also one of the most controversial topics in Ethereum. EIP-1559 has become a "trade war" between users and block space producers, as more than 60% of mining pools have expressed opposition to the proposal. Although it is difficult to quantify the exact impact of miners' fee income at present, the mining industry generally believes that the Gas price needs to rise sharply to make up for this difference. A Jian, who criticized the proposal in China's Ethereum community, said that the EIP-1559 proposal "will lead to the loss of miners' loyalty". Although Poolin, a coin-printing mining pool, has not announced any formal position, its founder believes that this will not actually have much impact on the income of mining industry, but it is "extremely insulting".

However, not all miners feel the same way. The founder of fishpond F2Pool is an active user of DeFi products, and agrees with this proposal. Even Wu Jihan, the central figure in the Bitcoin block expansion war, expressed his support for this change. In the final analysis, in the unstructured open ecosystem rooted all over the world, human coordination is still the biggest challenge.

In the long run, the correct solution is to allow horizontal expansion of the supply layer without materially affecting the trust requirements of L1 public chain system. After all, users want low cost, and low cost is not a problem of economic mechanism design, but a basic problem of blockchain scalability. It is worth noting that scalability will allow more demand to enter the system, which will offset the benefit of reducing the average cost per transaction. The main method here is the so-called layer 2 L2 solution, such as Optimal and ZK Rollups.