Credit drives the world

For hundreds of years, the credit market has been one of the main driving factors for economic development. As early as 1780 BC, farmers in Mesopotamia used their farms as collateral to borrow money to obtain cash flow until the next harvest (this is the earliest "Yield Farmer").

-Source: Livescience-

Today, credit has become an indispensable part of the healthy development of finance. We need credit to achieve long-term goals and build long-term businesses. Imagine that if you want to build a factory, you will not only need to spend a lot of time, labor and capital, but also wait a long time to realize profitability.

For small businesses, commercial loans are particularly important because they cannot issue bonds or sell stocks on the open market. Nike founder Phil Knight emphasized the importance of credit lines to Nike in the early days in his memoir "Shoe Dog". In order to meet market demand, Nike needs funds to cope with the continuous supply of orders from suppliers. As Knight said, "Almost every day, what I think about is fluidity, what I say is fluidity, and what I pray for is fluidity."

If entrepreneurs cannot easily obtain and borrow funds, innovation will be hindered.

Unfortunately, in the DeFi industry, we still lack liquidity...

A piece of Lego missing from DeFi

-DeFi's lending boom failed to create a real credit market-

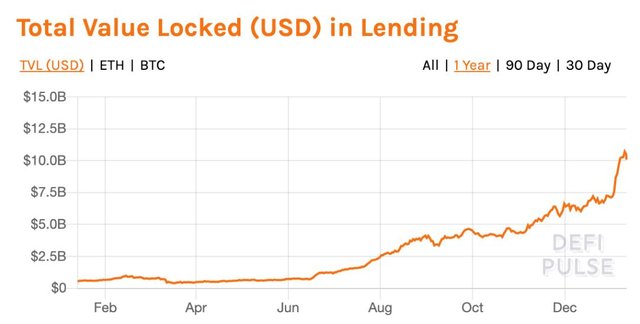

In the past few years, lending has been the hottest in the DeFi industry. In DeFi, a nearly $25 billion market, borrowing accounts for half of the country. Lending agreements such as Aave and Compound allow users to earn income by pledged cryptographic assets or borrow other assets.

However, as we all know, there is a problem with the current DeFi "lending agreement". They require all loans to be over-collateralized, that is, users' pledge amount must exceed their loan amount (the pledge rate is usually over 120%). In this mode, Compound and Aave can ensure their solvency, because once the user's pledge rate falls below the minimum pledge rate stipulated in the agreement, an automatic liquidation mechanism will be triggered.

Although these agreements represent major advances in the DeFi industry, they are not enough to form an effective credit market.

As Compound’s Jake Chervinsky said, these agreements are clearly designed to avoid relying on long-term commitments. Although this method can make these agreements solvency and become an effective source of leverage, it also prevents them from introducing the basic characteristics of the credit market, such as trust and reputation.

The inefficiency of this type of agreement is obvious-borrowing $100 by pledge of $150 is only suitable for a few cases (this is why in the traditional financial industry, over-collateralized loans are not common).

However, this is the status quo of DeFi lending, because the introduction of trust in an anonymous ecosystem will bring great challenges . In the traditional financial industry, both credit scoring and lender evaluation require identity authentication-this is difficult to achieve in an anonymous ecosystem like DeFi.

How the DeFi credit market has grown to the order of billions of dollars

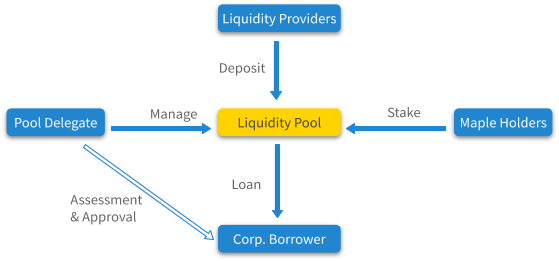

-How the decentralized credit market works (Source: Maple Finance)-

Let's take a look at the two major lending needs in the DeFi industry.

Cryptocurrency miners need credit to pay for the purchase and electricity costs of mining machines. Trading funds and market makers need credit to leverage investment portfolios and replenish liquidity.

These two needs represent the multi-billion-dollar lending market in the cryptocurrency industry. With the decentralized credit line based on Ethereum, the lending agreement can operate more efficiently, expand the scale of operations, and achieve rapid growth.

Participants in DeFi lending have healthy balance sheets, low leverage investment portfolios, experienced asset managers, good reputations, and positive cash flow. In short, they are the most popular lenders for DeFi loan agreements .

However, DeFi cannot meet their needs. As mentioned above, the existing DeFi lending agreement is inefficient for lenders, and it is not a viable option for large companies that really seek credit (rather than leverage).

As a result, a large number of miners and traders have poured into centralized lending agreements. Genesis’s lending business is experiencing explosive growth, with its lending volume increasing by $5 billion in the third quarter. BlockFi is also growing at an alarming rate.

The cryptocurrency industry obviously has a great demand for credit. According to data from the centralized lending agreement, the lending market is currently worth billions of dollars, and this is just the beginning.

So, when will it be the turn of decentralized credit?

Why does decentralized credit swallow centralized credit?

On-chain credit is significantly improved compared to centralized credit.

The decentralized credit market has greatly increased the number of lenders and created a more competitive market. Through an open architecture, anyone in the world can become a lender, as long as they are willing to take risks. Just like anyone can become a liquidity provider on Uniswap, anyone can provide their funds to verified lenders and earn income from them.

The on-chain credit market has also greatly improved capital efficiency, because borrowers can directly access the capital market without going through a "gatekeeper." In other words, they enter the pool of funds through open agreements, rather than through intermediaries to obtain funds, thereby reducing loan interest rates. Finally, borrowers can lend to multiple loan pools, creating quotation pressure for price discovery.

Although the credit market has always been opaque and dominated by institutions, decentralized credit allows both borrowers and lenders to enter the lending market in a completely transparent and equal manner.

The on-chain credit market based on Ethereum has auditable loans and liquidity reserves, enough to convince liquidity providers that their funds will be as safe as stored in a centralized lending agreement. In addition, the programmability of decentralized protocols opens up design space for incentive compatibility and helps create a more efficient credit market.

For example, Maple requires entities that perform credit evaluation to pledge MPL tokens to avoid the risk of default, to ensure consistent incentives between all parties, and to protect lenders.

Given the high demand for credit by users and the huge number of potential lenders, the decentralized credit market can easily exceed the $25 billion DeFi lock-up amount.

Boost DeFi

At Maple, we decided to create an on-chain credit market because we believe that DeFi is an innovative industry that needs to develop credit business.

Thanks to our previous experience in commercial lending and the traditional financial industry, we are well aware of the importance of the credit market for innovation. Since the day we entered this circle and began to explore how to better promote growth, we have decided to focus on improving capital flow and directing capital to where it can create the most value.

Despite the explosive growth of DeFi, without a well-functioning credit market, it will not be able to realize its full potential. If the efficiency of the lending market in the cryptocurrency ecosystem is improved, more funds can be borrowed per unit of deposit, thereby promoting the development of the entire DeFi ecosystem.

The introduction of decentralized credit can also allow honest participants to benefit from their good reputation in DeFi, thereby reducing their borrowing costs. Finally, for those companies that are blocked by over-collateralized loans and cannot reinvest all their funds into their business, credit will do a lot.

DeFi grows

Creating an efficient credit market for professional borrowers can provide liquidity providers with a more sustainable source of income.

Although "DeFidegen" likes to arbitrage between different DeFi agreements, it is difficult for long-term lenders to earn higher returns. Compared with liquid mining, providing loans to high-quality cryptocurrency native entities such as funds, market makers, and miners is a more sustainable source of income.

At present, there are more and more DeFi products designed for long-term investors. Just like the passive DeFi token investment provided by DeFi index funds, decentralized corporate debt pools are indeed a big step forward for the vast majority of investors looking for a once-and-for-all solution.

The increasingly mature DeFi is no longer the "casino" that makes quick money in 2020. In the future, more institutions will begin to use native cryptocurrency products. Therefore, it is not difficult to imagine that in the short term, the main participants in the decentralized credit market will be cryptocurrency native companies. However, its potential influence and scope of application are far beyond this.

Just as Bitcoin has become a corporate reserve asset, DeFi components such as decentralized credit markets will also enter the traditional financial industry. It is only a matter of time. Another billion-dollar market is about to be born.