Despite competing with each other, the development of Sushiswap and Uniswap is actually mutually beneficial, and both are working together to make the DEX cake bigger. This article compares Sushiswap and Uniswap from five chain indicators to help us better understand these two heavyweight AMM products.

in Uniswap Among the many fork projects, SushiSwap stand out. I believe no one would have expected the current development of SushiSwap in September.

Despite competing with each other, the development of SushiSwap and Uniswap is actually mutually beneficial, and both are working together to make the DEX cake bigger. This article compares SushiSwap and Uniswap from five on-chain indicators to help us better understand these two heavyweight AMM products.

Although at the beginning SushiSwap was just a typical example of Uniswap's various food-naming fork projects, SushiSwap not only survived, but its development and innovation in the AMM model also exceeded everyone's expectations. Now SushiSwap can be used in many levels. I started to compete with Uniswap.

At present, these two AMMs have differentiated into two completely different products. SushiSwap has been continuously releasing new features, such as Bentobox. The core developers of Uniswap have been focusing on building Uniswap V3. The development prospects of Uniswap V3 are still difficult to estimate, but it is certain that the competition between the two agreements is heating up.

This article has an in-depth study of the on-chain indicators of SushiSwap and Uniswap, and compares how these two AMM protocols mirror each other in the DEX protocol king competition.

Transaction volume comparison: Uniswap wins

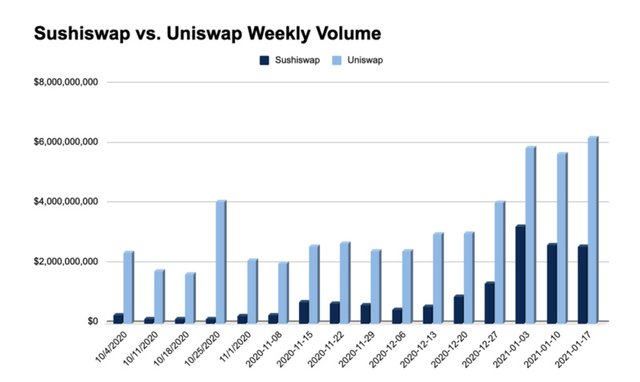

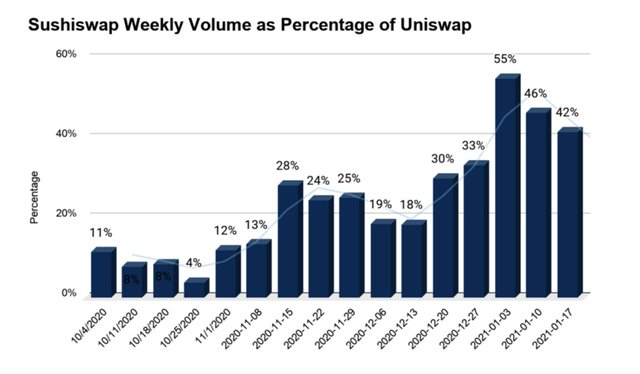

To measure the success of any decentralized exchange, one of the most basic indicators is naturally trading volume. After all, the core purpose of a decentralized exchange is to facilitate the exchange of tokens between participants. Although Uniswap still dominates the transaction volume of the entire DEX field, it is difficult to ignore the transaction volume of SushiSwap.

In the past three weeks, Uniswap's average weekly trading volume was close to 6 billion U.S. dollars, while SushiSwap processed 2.8 billion U.S. dollars in transaction volume-a considerable number for an agreement that has only existed for a few months .

Just one month ago, in December, the average transaction volume processed by SushiSwap was 25% of Uniswap's weekly transaction volume. Now, the average processing volume of the agreement has reached 48% of Uniswap's transaction volume.

Data source: Dune Analytics

Data source: Dune Analytics

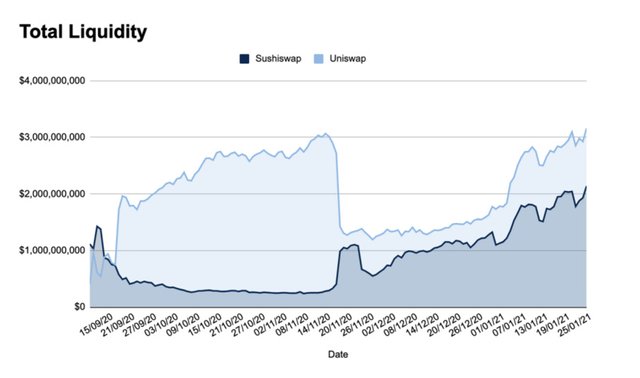

Agreement total liquidity comparison: Uniswap wins

In addition to the transaction volume, the total value of locked positions in the DeFi agreement, or the total liquidity available in the agreement, is also a key indicator of the success of the DEX.

SushiSwap started to gain its own trading volume through a novel "vampire attack" operation. In the early days of SushiSwap, this kind of gameplay harmed its reputation, after all, its opponent was DeFi's darling Uniswap.

The temptation of token incentives makes it difficult for people to resist. The strategy of "forking + adding tokens" adopted by SushiSwap shows the power of token incentives. But Uniswap also fought back. Within a few weeks after SushiSwap went live, Uniswap also adopted a currency issuance strategy. Of course, this event is not over yet.

Uniswap goes a step further than SushiSwap. It allocates 15% of the tokens to previous users retrospectively. Those who used Uniswap before have earned thousands of dollars in return. Just like Compound Like the market-making mining fever, Uniswap's retrospective distribution method has also become a standard configuration in the DeFI industry. This method will be adopted when tokens are launched, whether it is new or old protocols.

After Uniswap issued the coin, the board flipped instantly.

After SushiSwap absorbed a large amount of liquidity in August, liquidity providers have returned to Uniswap to share a piece of the pie, participate in liquidity mining after Uniswap tokens went online, and obtain UNI tokens.

After a few months, the situation gradually stabilized. Both Uniswap and SushiSwap now have billions of dollars in liquidity. However, there is also a key difference.

After the liquidity incentive measures ended in November 2020, Uniswap's current liquidity pool of US$3 billion is now completely unsubsidized by token incentives. At the same time, SushiSwap continues to vigorously reward LPs (liquidity providers) and further distribute SUSHI token rewards.

Data source: Token Terminal

It should be noted here that although Uniswap's market maker (LP) does not directly receive UNI token incentives, many projects are using Uniswap as their main trading venue and incentivize their communities to provide liquidity to their respective Uniswap pools Sex.

In any case, the high liquidity and the lack of native UNI incentive mechanisms coexist, marking that Uniswap has reached the product and market fit. Uniswap continues to be the premier trading platform for traders and token projects, dominating the entire market. However, SushiSwap also surpassed the US$2 billion milestone in total liquidity, which is hard to ignore.

SushiSwap now has a large market depth, and key DeFi projects, especially Yearn Ecosystem chooses to use SushiSwap as its main source of liquidity.

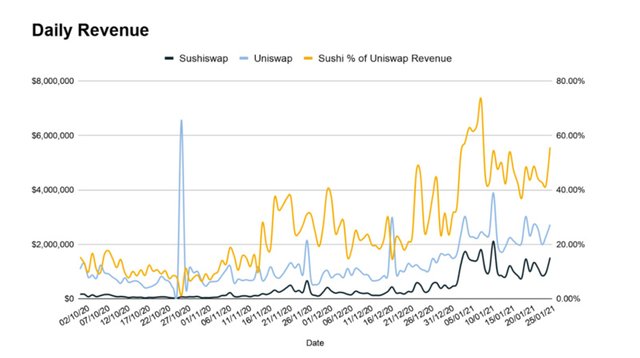

Revenue comparison: Uniswap wins

Uniswap and SushiSwap compete fiercely in terms of transaction volume and depth of liquidity, and revenue has become another key indicator that needs attention. The income mentioned here refers to the cash flow brought to LP (market maker) from user transaction fees. It is worth noting that the feature of these two agreements is that a 0.3% transaction fee is charged for any transaction pair.

Throughout the entire DeFi field, Uniswap is like a king. The agreement is a money printing machine. In January 2021, Uniswap generated an average of more than US$2.3 million in revenue per day for LPs-much higher than any other agreement in the field.

Which competitor is closer to it? Yes, you guessed it. It is SushiSwap. Although SushiSwap's AMM only accounts for half of Uniswap's daily income, it still brings an average of 7-figure income to SushiSwap's LPs, and generates an average of approximately US$1.2 million in daily income.

Similar to transaction volume data, from a revenue perspective, SushiSwap is also growing. Earlier this month, the agreement soared, and the daily revenue generated was about 64% of Uniswap's during the same period. At the same time, the average revenue in the past 7 days was about 46% of Uniswap's daily revenue. Although in comparison, SushiSwap is still significantly lower than Uniswap.

Data source: Token Terminal

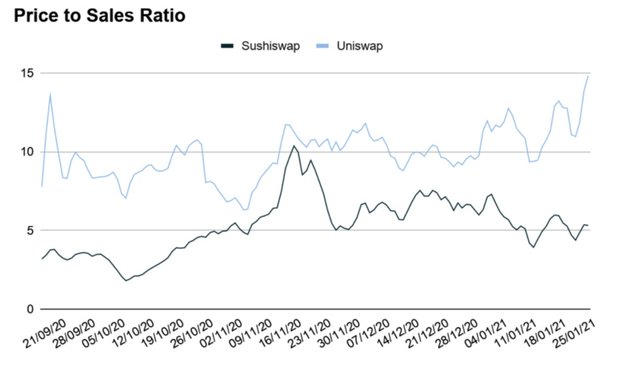

P/S comparison: SushiSwap wins

The ratio of market price to revenue (market-to-sales ratio, P/S) has gradually become a common indicator of DeFi agreements. The P/S value compares the price of the token with the income of the corresponding DeFi agreement. It is an index for evaluating the market price of the agreement based on the transaction fee income of the agreement.

This means that a token with a lower P/S ratio may have a fairer valuation than a similar agreement with a higher P/S value, or the market may have lower expectations of token growth (and vice versa).

According to Token Terminal data, SushiSwap has remained stable with a P/S ratio of about 5, while Uniswap has recently touched about 15 due to the sharp price increase in the past few weeks.

Data source: Token Terminal

In view of this, from the current cash flow generated by Uniswap, compared to SushiSwap, the current market valuation of Uniswap is too high. But this does not mean that Uniswap is overvalued, or that SushiSwap is undervalued. As mentioned earlier, there are many subtle differences behind this valuation metric, depending on how the reader wants to interpret the data.

Token design of two types of agreements

I want to talk more about the token mechanism of these two protocols.

UNI tokens are currently a non-productive governance token, which means that they do not represent any economic rights to the cash cow of Uniswap. On the other hand, SUSHI holders do have rights to the cash flow of the agreement, making it a productive asset.

With this in mind, Uniswap V2 introduced an optional protocol fee ratio parameter. You can choose to reduce the fee ratio transferred to LP from 0.3% to 0.25%s, and the remaining 0.05% will go through decentralized governance Process to assign.

SushiSwap adopts this model, but it is not vague about the intention of charging the agreement like Uniswap (and closed by default), but allows SUSHI holders to directly obtain the cash of the agreement by collateralizing tokens flow.

In the past 30 days, SushiSwap has allocated 5.3 million USD in mortgage income to token mortgagers, which is an annualized rate of return of approximately 8%. If Uniswap implements the same model, calculated based on 30-day income data, the agreement will double the income of UNI mortgagers, which is $11 million this month.

Based on this calculation, if Uniswap also adopts the SushiSwap model, the annual income of UNI mortgagers can reach 132 million US dollars, with an annualized rate of return of 3.1%.

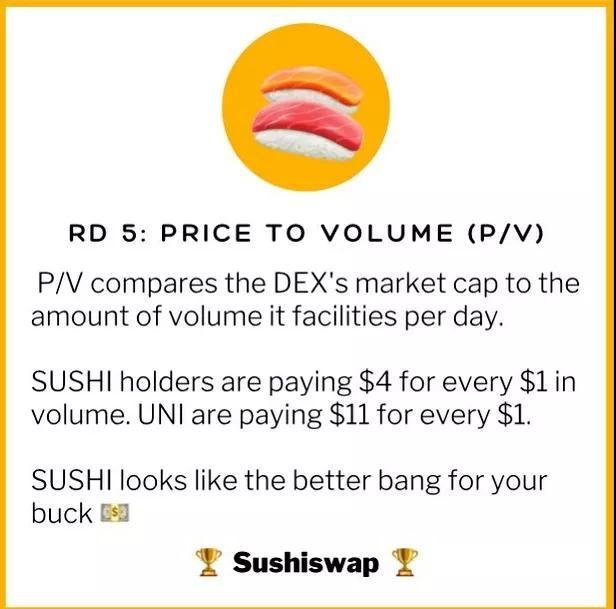

Price-volume ratio (P/V value): SushiSwap wins

The price-to-volume ratio (P/V) is a newer and unique valuation index for DEX, which has similar characteristics to the P/S ratio.

The P/S market-sales ratio indicator will be valued based on the costs incurred by the liquidity agreement. When studying agreements with different fee rates, the amount of fees may vary, making comparison difficult. The P/V ratio ignores these differences and measures how the market values the agreement based on the transaction volume of the DeFi agreement.

To put it simply, the current market’s P/V value for SushiSwap is 4, which means that for every US$1 in SushiSwap’s daily trading volume, the market is valued at US$4; for Uniswap, the ratio is even higher, at 11. This means that the price corresponding to every $1 of transaction volume processed is about $11.

To put it simply, the current market’s P/V value for SushiSwap is 4, which means that for every US$1 in SushiSwap’s daily trading volume, the market is valued at US$4; for Uniswap, the ratio is even higher, at 11. This means that the price corresponding to every $1 of transaction volume processed is about $11.

Data source: Token Terminal

Similar to the P/S ratio, the market may give Uniswap a higher valuation, which manifests itself as a higher P/V value because their growth expectations for the agreement will be higher relative to SushiSwap. Also considering that SushiSwap is still a relatively new agreement, the market's growth expectations for this agreement may be lower because it has not clearly defined its moat, while Uniswap has.

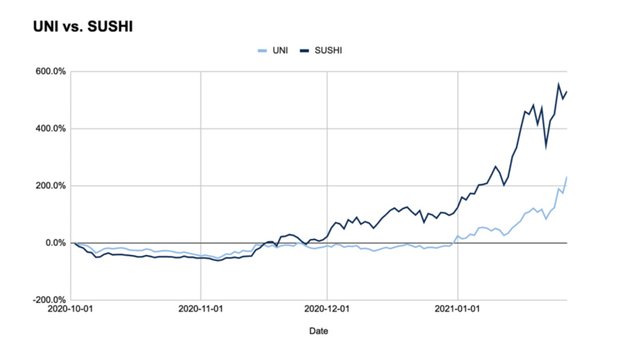

Price performance: SushiSwap wins

Okay, let's get to the topic. Ultimately, fundamentals and valuation indicators can only get you so far, and the market is the ultimate judge. So, how do these agreements perform?

In recent weeks, both of these tokens have seen a massive rise, so whether you hold SUSHI or UNI, you may be very happy now. But along the way, the sun was not always shining and the flowers were everywhere. Uniswap and SushiSwap (and the entire DeFi market) had a difficult time at the end of the third quarter and the beginning of the fourth quarter.

During this period of time, in the DeFi bear market, UNI was better able to hold its ground than its fork project, because UNI’s lowest trough in Q4 was a -53% decline, and SUSHI holders felt it More pain, down -61%. Fortunately, these two projects have rebounded greatly since then.

Looking at it today, since the fourth quarter of 2020, Uniswap's growth rate has soared to 232%, while SushiSwap broke out again with a 530% growth rate after everyone thought it was dead.

Data: CoinGecko

It must be recognized that Uniswap is an asset with a higher market value, which means that more funds must naturally flow in to drive the rise. For reference, the circulating market value of Sushi at the bottom is only US$48 million, while the circulating market value of Uniswap at the bottom is still over US$500 million.

summary

Although Uniswap still dominates, the development of SushiSwap and its competitiveness in the market in recent months have fully demonstrated that the product market fit is also improving. The final result of today's battle? A draw.

Uniswap wins in basic indicators such as transaction volume, liquidity and income, because it is the main liquidity and trading venue in DeFi. On the other hand, because of its more attractive economic design and smaller market capitalization, SushiSwap wins in valuation indicators such as P/S, P/V and price performance.

If anything is certain, the coming year of these two agreements will be exciting. It looks like competition will still be fierce.

Both SushiSwap and Uniswap plan to release major versions. Uniswap will bring V3, and SushiSwap also formulated an ambitious roadmap earlier this year.

Who is the winner? I think only time will know.

wow great post about the difference of the uniswap and sushiswap but time by time they will be fluctuating all the time but it may be possible that one can win the domain.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit