A tweet offer of $ 2.5 million, this must be crazy! Therefore, some rational outsiders will question the rationality and prospects of NFTs. But what is the logic behind the NFT?

Some thought it was too late to buy Flow, and some thought the NFT would be short-lived. These issues are worth discussing, which helps us understand what the logic behind NFTs is. Therefore, the reason for paying attention to Flow is not only about discussing FLOW buying and selling investment opportunities, we also pay attention to the logic of Flow in the hope that it can clarify the logic behind NFT.

1. Is it too late to buy FLOW?

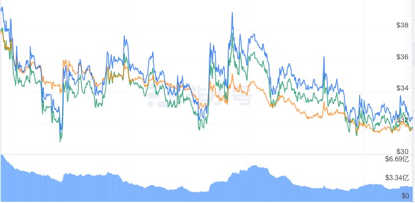

FLOW has increased more than 300 times since currency listing for one and a half months; if calculated according to the private placement price, it has exceeded three thousand times. But the situation is undergoing minor changes - in the past week, the decline was 12%; after hitting a high on March 4, it was hard to break an all-time high, even after my friend Jane entered the market for $ 30. I was worried about the little leek.

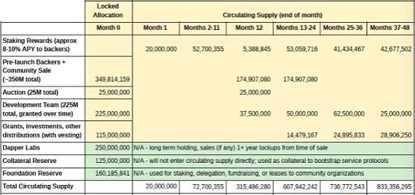

Yes, he didn't lose money; but what about a hundredfold currency? Is it too late to buy FLOW now? We will discuss the circulation of the Flow token. In 2021, FLOW tokens will be listed on the KraKen exchange. There will be a total of 1.25 billion FLOW in the genesis block; 20 million Flow tokens will be allocated as an additional reward to pledge verifier node operators within 30 days of launch to ensure that there is sufficient in the early stages Circulation of an estimated token supply of around 30 million in the half year following launch. In other words, the number of tokens in circulation today is very large. Compared to the total number of tokens, the number of tokens on the market is only a small plate.

Hence, the pressure will come from releasing liquidity in the next few months. Although the current market value of FLOW tokens is not very high, this is mainly due to the fact that most of the FLOWs are in a locked position. unlocking, there may be a bigger selling pressure at that point. Additionally, Flow's public offering had over 10,000 people, which was three times more than Coinlist's previous public offering. The reason is that the maximum number of participants in the FLOW public offering is 10,000, so the chips are relatively spread out, and the real throw of pressure has not been reflected. With the superposition of these two parts, we cannot ignore the concern that it is too late to invest in FLOW.

However, from a long-term investment perspective, what I appreciate more is the long-term development capability of the Public Chain Flow project (this section will be detailed in the third section) and the ability to capture the value of the FLOW token.

The analysis of the FLOW token economy model should be based on the "vertical sharding + special division of labor" scheme adopted in the technology. Different transactions in the chain are assigned to different nodes, similar to operating a pipeline. The general principle of division of labor flows is: First, the transaction link of each transaction in the chain is unloaded, divided into two types of links, deterministic (objectivity) and non-determinism (subjectivity), and then divided into transaction collection, consensus, execution, and verification. . Four sub-links are assigned to the appropriate four nodes. Nodes are divided according to two dimensions, one is the requirements of different nodes on different links, and the other is a characteristic of the resources and capabilities of the nodes themselves. Different nodes are assigned tasks on different links.,

Collect nodes: Increase DApp network connection and data availability, and report information to consensus nodes;

Consensus node: Determine whether the transaction exists and the order in which it is on the blockchain;

Execution node: executes the calculations related to each transaction, and does not participate in the consensus;

Verification nodes: Oversee and hold accountability for execution nodes.

Then, from the perspective of using its tokens to pay for calculation and verification services (i.e. transaction fees), transaction media, node guaranteed margins, secondary token mortgage assets, and participation in governance, the ability to capture Flow Token value is worth looking forward to.

analyze the combination of the technical division of labor and the rewards of the Flow node. Fixed payoff comes from inflation of the additional issuance of Flow tokens. In the early stages of development, the payment for transaction costs is less, so the node will be given a higher fixed fee, namely higher inflation, for example, inflation in the first year was 3.75% of the initial issuance. With more and more users in the future, after the transaction costs increase, the rewards will still decrease, and inflation will approach zero indefinitely.

In this token economy model based on technical division of labor, if Flow cannot rapidly increase user volume and transaction volume, resulting in less transaction fees in return for nodes, then Flow will maintain a higher rate for the benefit of the node inflation rate. This is the biggest difficulty! This is also the biggest risk in observing the value of investment Flow in the long run.

But is this something to worry about? Given the popular status of the Flow public chain and its ecology across the NFT field, this would be the most valuable investment vision target in the NFT field, except for short-lived NFTs.

2. Is the NFT short-lived?

"Either you have an NFT; or you don't have anything;

The creator may have devoted more time and passion to pursuing the NFT ... It feels like you've bought a particular stock, but unlike a stock, an NFT won't pay you dividends, nor will it attach any other rights;

NFTs are also very different from real works of art. The NFT itself lacks an aesthetic feeling. The NFT represents only something, nothing more ... "

This is Seth Godin's autographed article, "NFT is a terrible trap, why?", He gives a serious warning at the end of the article: "NFT's trap is to make creators obsessed with creating it. Nowadays buyers will fall into sunk costs, thinking NFT prices will be. continues to rise, and then sinks to No escape. In this way, creators and buyers will fall into the cycle, and we have to pay enormous fees for unregulated systems that consume a lot of precious energy, but otherwise make some numbers Rare Nothing is good except tokens. "

What is short-lived NFT logic? understand the emotions of pessimists in many ways. The main reasons stem from the sudden wealth effect of the predecessors and the conflict between the followers' inability to understand the future. The conflict is even bigger than the early BTC and ICO era. NBA early-time TopShot players made $ 9 million with $ 600, and the rate of return was as high as 15,000 times. It only took a few months of the investment cycle. Correspondingly, tens of thousands of times Bitcoin's earnings will take years.

Therefore, most objective critics believe that the popularity of NFTs since last year is more like a wealth effect than a value discovery. This can be compared to the 2017 ICO boom - they think NFTs have room for imagination, but still need to solve one To solve problems in applications, improve infrastructure, and calm down from hype hype, accumulate technology, build ecology, and build consensus, so NFT can embark on a healthy path to future development.

If you are a player in the NFT circle, would you be willing to remind yourself: Actually, the NFT will come like this.

To clarify the logic of the NFT, the story begins with Dieter Shirley and his team hiding out in a workshop cottage in Vancouver and spending three months developing the ERC-721. This happened at the end of 2017. ERC-721 is an Ethereum token standard that can realize "scarcity verification" of digital artwork. Based on this, the CryptoKitties project has received an enthusiastic response from the market, and the enthusiasm of many enthusiasts of the "cloud cat" has almost caused the Ethereum network to collapse. This leads to FLOW, the main character of this article, and the story behind the entire NFT ecosystem.

The project innovation lies in the combination of scarcity and cryptocurrencies; Rare crypto cats may be worth thousands of dollars. In 2018, a cat named "Dragon" was even sold for a sky-high price of US $ 170,000.

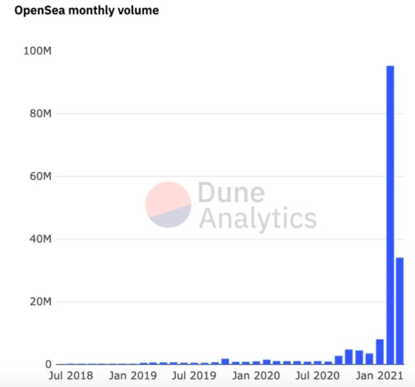

Poor network congestion and transaction fees limited the early development of the NFT. OpenSea entered the NFT market in early 2018 to try to change this situation, but its performance in the last two years has been unsatisfactory; until recently, he also decided to join the Flow ecosystem.

OpenSea is a comprehensive marketplace where everything from encrypted artwork to domain names, virtual goods, cards to game assets can be traded on.

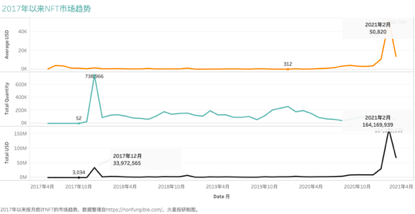

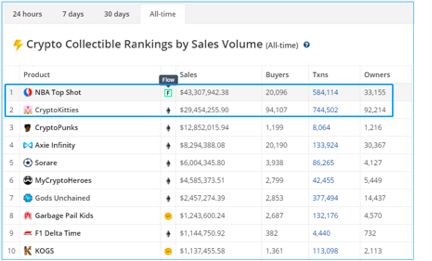

As can be seen from the image above, the NFT market has been quiet for a long time after the popularity of crypto cats in 2017, and is slowly growing, having only seen a significant increase since last December.

It's important to clarify what an NFT is and what it can do. Fungible means replaceable, and non-fungible means not homogeneous. NFT is a generic term for non-homogeneous tokens, and because each NFT is unique, it is also called an indivisible token. This kind of recognition is still too general, and we still can't understand it intuitively.

At present, the life and work of most people are related to the Internet, especially the younger generation of Internet natives, who need media of value and storage of the digital age, such as Bitcoin, and also need collections of the digital age. This is an NFT. The foundation of survival. In the course of blockchain technology iterations and the evolution of the encryption economy, NFTs have become unstoppable. Despite the short-term hype and major fluctuations, there are also many disruptive projects fishing in troubled waters, and there are efficiency constraints brought about by the capabilities of the underlying public chain ...

3. What can Flow bring to the NFT?

analyzed NFT market data and found that the total volume of NFT transactions this year reached 236 million US dollars, or about 3.8 times the total volume of transactions last year, however the number of NFT transactions this year is around 320,000, which is much lower than the same period in previous years. To some extent, the significant increase in the unit price of NFT transactions reflects a key driver for NFT prosperity and development - an increase in general market consensus on the value of NFTs; but the more pessimistic logic behind it is that network congestion and high transaction costs limit NFT Space for long-term development.

There is no doubt that the first thing that got in the way of NFT development was Ethereum bottlenecks. What the Flow public chain can bring to the NFT, this is the biggest hope. Flow uses the idea of vertical sharding + custom division of labor to improve performance:

(1) First, by cutting each transaction vertically, i.e. unlinking and processing transactions, transactions are split into two types of deterministic and non-deterministic links. Then create a more detailed division of the various types and links, such as transaction collection, consensus, execution, verification, and other subdivision processes.

(2) Second, nodes are classified according to two dimensions, one is the requirements of different nodes in different transaction links, and the other is the characteristics of the resources and capabilities of the nodes themselves.

(3) Finally, different links and tasks are allocated to different nodes, and each link handles the task best. For example, nodes with high computing power and strong computing power can process and execute compute tasks, ensuring the speed and scale of transaction processing; nodes with strong collection and sorting capabilities are responsible for processing collection transactions and improve node efficiency; verification nodes ensure the correctness of transaction processing; more consensus nodes ensure network decentralization.

Overall, the idea and principle of FLOW is to separate the two main tasks that will be handled by the blockchain, the most resource-consuming computation process and the most time-consuming consensus process, and to allocate tasks according to their nature and capabilities. from the node itself.

Roham Gharegozlou, CEO of Dapper Labs, has publicly stated that implementing Flow will truly impact the lives of millions, tens of millions, and even billions of people. The last project developed by the Dapper Labs team was cryptokitties, which caused a bottleneck on Ethereum. So far, their NBA Top Shot based on Flow has broken cryptokitties records and has become the market's best non-patent technology and most digitally sold product.

What is NBA Top Shot? What does this have to do with the NBA? This is actually a Flow-based blockchain collection game co-created by the NBA, NBPA, and Dapper Labs. It is committed to turning the good moments of NBA games into a digital collection forever; NBA Top Shot has achieved official IP authorization cooperation with NBA, So that collectors can get the spotlight of real NBA stars through gamification, and can trade them in the market on the platform. In less than 2 months, the transaction value of NBA TOP Shot has exceeded US $ 300 million. This transaction was used to purchase NBA "exciting video clips". Due to the popularity of NBA Top Shot, after Compound liquidity mining exploded the DeFi concept in 2020, the investment community believes that the NFT concept sector is the most important sector in 2021.

NBA Top Shot is just a small part of the wider Flow ecosystem. This ecosystem includes dozens of companies, migrating from the Fortune 500 to some of the most well-known startups on the Ethereum pathway, including the already established NFT trading platform OpenSea.

In particular, Polygon plans to become the first Layer 2 solution aggregator on the Ethereum chain to build a modular, universal and flexible expansion framework for Ethereum to build and interconnect protocols and blockchain network frameworks compatible with Ethereum.

However, currently the most active NFT market is the Flow Ecological NBA Top Sort project, CryptoKitties, and the magnitude of the clue is clear. In addition, once OpenSea has integrated the Flow public chain, users can directly trade NFTs on the Flow chain in OpenSea, which further strengthens the current market activity of the Flow ecosystem.

Development of Layer 2 based on the Ethereum chain will have some impact on Flow, but it is not enough to pose a threat; and the real threat to Flow's ecological competitiveness will be in the Ethereum 2.0 era. Therefore, Flow will have enough time to improve its own ecology, and more investment value and investment opportunities in the NFT ecology will emerge in the process, which has attracted the attention of professional investment institutions. The latest news is that Grayscale has just registered 4 trust fund products, including GRAYSCALE Numeraire TRUST (NMR), Reserve (RSR), Graph (GRT), Flow (FLOW). Investment Research focuses on blockchain investment and financing opportunities, the investment logic of an encrypted economy and post-investment value creation, but I do not recommend projects,

To the question in your title, my Magic 8-Ball says:

Hi! I'm a bot, and this answer was posted automatically. Check this post out for more information.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit