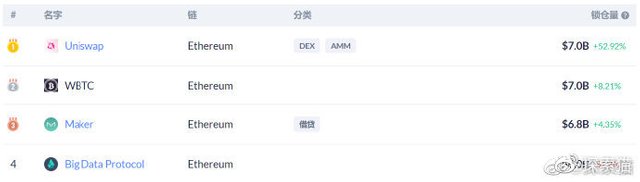

UNI's lock-up volume has reached 7 billion U.S. dollars, ranking first.

I have always believed that UNI is the king of DEFI last year on 8th, 9th, and 10th, and the market value will definitely enter the TOP5. Now that this goal is close at hand. The current market value of 17.7 billion U.S. dollars in circulation, maybe the climax of this bull market will enter a market value of 100 billion U.S. dollars. V3 is about to be launched, which is a great benefit and will far surpass other DEXs. In addition, I guess UNI will launch the second round of mining along with V3, which will increase the lock-up amount to tens of billions of dollars.

According to Cointelegraph, due to market speculation that Uniswap is about to launch V3, the price of Uniswap's governance token, UNI, soared by nearly 50% within a week, becoming the eighth largest crypto asset with a market value of $17.7 billion. In addition, according to Messari data, UNI is currently the second largest Ethereum-based asset, with a market value second only to Tether, and nearly 50% higher than the market value of Chainlink. The current price of UNI is at the first line of US$34. At the same time, UNI entered the top 10 crypto assets by market value on March 5, becoming the first DeFi DApp native token to enter the top ten crypto assets. Historical data shows that within 24 hours, the market value of UNI increased from US$8.8 billion on March 4 to US$14.7 billion.

For the entire ecology, what is more important is the growth rate of the number of users, which requires more people who have never played DEX before to play. The overall market value of UNI will increase greatly, and it may soon enter within TOP5 or even TOP4. From a larger perspective, from the perspective of God, this is the beginning of the large-scale popularization of decentralized applications, and the market value of a single DAPP has entered the era of hundreds of billions of dollars.

Last year, the global capital market plummeted at 9.4, which also caused the currency market to plummet, and the popular DEFI suddenly cooled down. At that time, some people said that the UNI currency issue was the last carnival of DEFI last year. I wrote an article to oppose this view. Looking back now, after the first round of UNI mining ended on 11.19, a batch of new DEFI projects, including BASIS CASH, etc., were stimulated. At the end of the year, the algorithmic stable currency reached its craziest period. It can be seen that for many things, don't judge the general trend because of a momentary downturn and trough. The most feared is the "expert's mouth."

Many people (including Twitter) analyze the value of the project and take the Market Cap / TVL Ratio as an example. In fact, I analyze it now: just look at the value growth rate of the circulating market value lock-up ratio. The most suitable project is the newly born project, but not Suitable for projects that have grown up. The circulating market value of UNI is $17.7 billion, and the circulating market value lock-up ratio is 3.78; CRV is 0.16; Badger is now 0.26. But UNI may have a stronger growth rate than the latter two.

The key to the growth rate is to see the growth rate of daily activity and user volume, and the essence is to see whether DAPP is actually being used. From December last year to January this year, Badger locked the position at 700 million US dollars, but the unit price was only 7 US dollars, and the market value was extremely low, indicating that the number of users is relatively large, but they have nowhere to vent. Wait until DIGG mining starts. , Coupled with the improvement of the general environment, the price of BADGER has soared. And now that it has passed the early stage of violent skyrocketing, the number of users may be rising, but the growth rate of users is declining, and the inflow of funds is decreasing.

Therefore, just looking at the growth rate of the market value of the circulating market value lock-up ratio analysis value, the most suitable project is the newly born project, but it is not suitable for the project that has grown up. Therefore, for a project, whether it is early or later, the user growth rate is the best indicator for judging the value of the project.

NFT is very hot recently. Don't chase the rise and fall of everything that is very hot. But the good news is that the stimulus technology is moving towards real applications. For example, it is estimated that e-commerce of NFT digital products will also explode in the future, similar to blind box music, continuous comic works, novels, videos, etc., so that authors can truly get their due return through genuine authenticity. .

Every NFT fever seems to lead to a new round of DEFI outbreak. Binance first listed NFT tokens, but ANT rose. In October last year, the NFT was hot. At that time, DEGO Twitter reached 40,000 followers, but as a result, a new DEFI project was launched and the algorithmic stablecoin was pushed to the climax of the end of the year.

The downturn in the past 20 days has also made NFT hot. After this time, it should be an explosion of DEFI based on L2. In the past 30 days, UNISWAP users have increased by 22%, which in itself is also a sign that demand is increasing. A major technological breakthrough is urgently needed.

The indicators for judging the value of the project should be comprehensively looked at: user growth rate, user volume, user daily activity, monthly activity (retained monthly activity after March), lock-up amount, circulating market value lock-up ratio, total issuance, current price FDV. The most valuable indicator is still to look at the "user growth rate" and monthly inventory after March.

Badger DAO sold $21 million in DAO treasury assets to four major investors, namely Polychain Capital, Parafi Capital, Blockchain Capital and Whale Wallet 0xB1. The sale is part of a broader "funding diversification through strategic partnership" plan.

In addition, according to news on March 9, the decentralized stablecoin project Fei Labs has raised $19 million from Framework Ventures, Coinbase Ventures, and AngelList founder Naval Ravikant. The upcoming Fei Protocol will mint stablecoins by directly selling stablecoins to users.

Fei announced the TRIBE governance token distribution plan. According to the distribution plan, the community, team, and investors accounted for 80%, 15%, and 5% of the token distribution respectively. The vast majority of TRIBE will be controlled by DAO. Genesis groups will have the opportunity to participate in the initial DEX issuance. The total initial supply of TRIBE is 1 billion.

In mid-to-late March, algorithmic stablecoins will come out of the hole collectively, and the hibernation is over.

Last year, DeFi received very little VC investment, but this year VC’s investment in DeFi projects is very large and scaled. The FEI has not yet started, and it is close to the Badger financing scale that has been online for several months, which is equivalent to 1,900 in the angel investment stage. Ten thousand dollars. Overseas VC investment in the blockchain field is very active this year, and there is no similar enthusiasm in China, but in fact, domestic capital and project parties are developing overseas. This is due to factors such as domestic laws and regulations.

Some mortgage-based stablecoins have become the consensus of the industry. Pure algorithmic stablecoins need more time to explore. In addition, perhaps purely algorithmic stablecoins will develop into an independent emerging cryptocurrency, which may not necessarily aim at anchoring major countries' fiat currencies.

High-quality DeFi projects are completely different from the previous promotion methods of blockchain projects. The last thing you need is a big V platform, media announcements, and advertisements. Especially pure community projects are self-driven, self-growth, and self-explosion. In the past, project traffic came from the media, but now the media uses reports on high-quality projects to obtain traffic.

UNI skyrocketed the most because of L2. This is because of the high-frequency demand for trading, but I think:

UNISWAP is the king of DEFI, but it is not the master of blockchain 3.0. Blockchain 3.0 not only includes DAPP applications, but also WEB3. Only WEB3 will be the master of blockchain 3.0. It is the entrance to many top DEFIs, including The entrance of UNIswap, many people still dare not imagine this, but it will appear soon in the future.

The highest level of decentralized social products is the establishment of a decentralized social network based on Ethereum. The most valuable assets are all on this continent. With the large-scale launch of L2, there are two major mobile operating systems (Android and IOS) in analogy, Ethereum will become more monopolized, and other public chain infrastructures will become increasingly nonexistent. Necessary.