Uniswap, the main decentralized exchange on Ethereum, has been suggesting that its platform is about to be upgraded to a new version in recent months. They plan to add many new features to maintain their leading DEX position. These new features include greater scalability, cheaper fees, and direct competition with centralized exchanges.

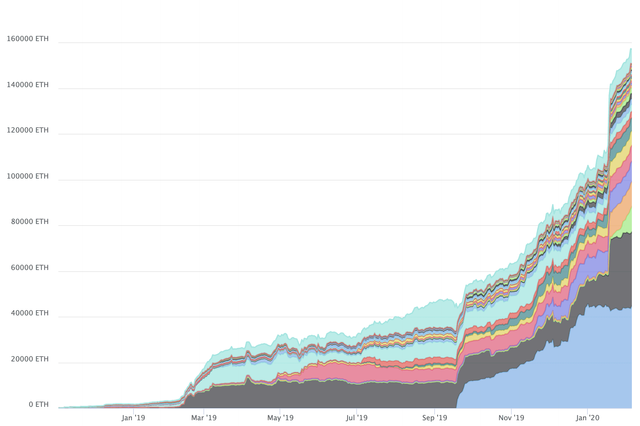

Uniswap has been an important part of DeFi since it was launched at Ethereum's Devcon4 annual developer conference in 2018. It allows anyone to trade ERC20 tokens and Ethereum in a completely decentralized manner without KYC. Initially, Uniswap V1 was a simple automated market maker agreement in which users could deposit funds into a liquidity pool and collect transaction fees from those using the platform. For example, someone can put 1 Ethereum and 1000 USDT into the liquidity pool, and then every time someone uses Ethereum and USDT to trade, he can get a small portion of the handling fee. This is innovative in the field of decentralized exchanges, and has quickly gained widespread attention. However, the technology is still in its infancy and is more like a proof of concept than the final product.

UniSwap V1 liquidity graph

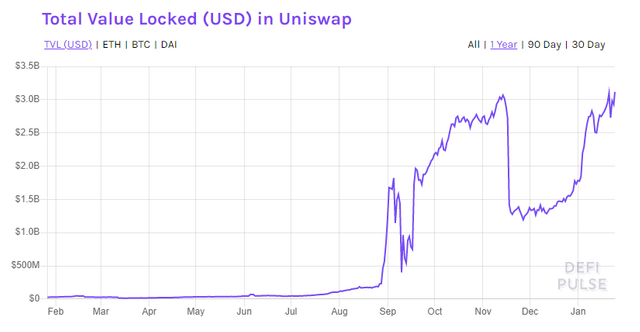

In March 2020, Uniswap V2 was released. It has made many important improvements on top of its previous version. The main improvements include: using Oracle to improve price accuracy to help DEX better resist manipulation; providing lightning swaps, which is very useful for traders who want to use DeFi for arbitrage. In addition to these two points, Uniswap V2 has also made some small improvements to improve efficiency and safety. One of the most important improvements is the start of the implementation of the Decentralized Autonomous Organization (DAO). DAO paved the way for the release of its token, UNI, which will be officially available for trading on exchanges from September 2020. The token pushed Uniswap to lock up more than $3 billion in platform funds, making it one of the largest projects in DeFi.

Although Uniswap appears to be a mature and complete project and has begun to profit from its UNI tokens, in fact, the project is far from complete. The Ethereum network has brought them many major problems. For example, during Ethereum congestion, the handling fee is extremely high, sometimes as high as $100 or more. This makes Uniswap almost impossible to use for any transaction other than large transactions. In addition, competitors like Sushiswap copied Uniswap's code and created their own exchange, which caused Uniswap to lose a lot of value. This type of competitive attack is called "vampire mining" because the "cloned exchange" tries to draw liquidity from the original protocol. These "vampire mining" behaviors have caused Uniswap to charge users higher fees and bring greater volatility to the income of the liquidity pool.

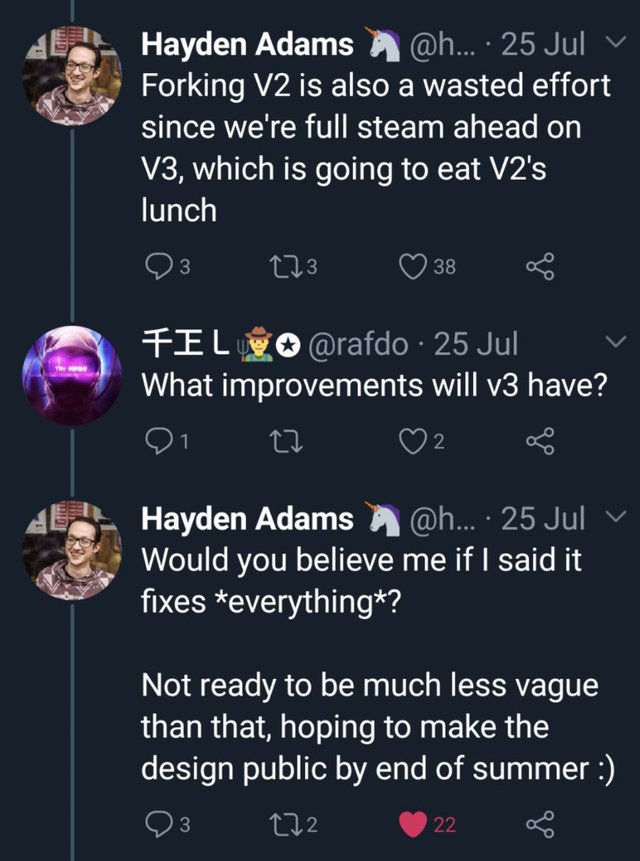

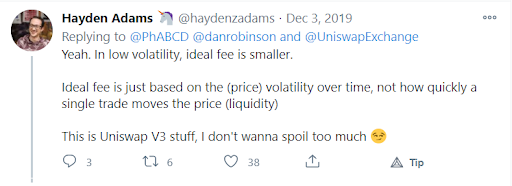

Uniswap V3 has been widely anticipated since the early summer of 2020, and its technology update should have been officially announced in the late summer. However, so far, the team has not released any specific information. However, from some warm-up texts of the Uniswap team on Twitter, we can probably learn how the agreement intends to regain its status as the first DeFi project.

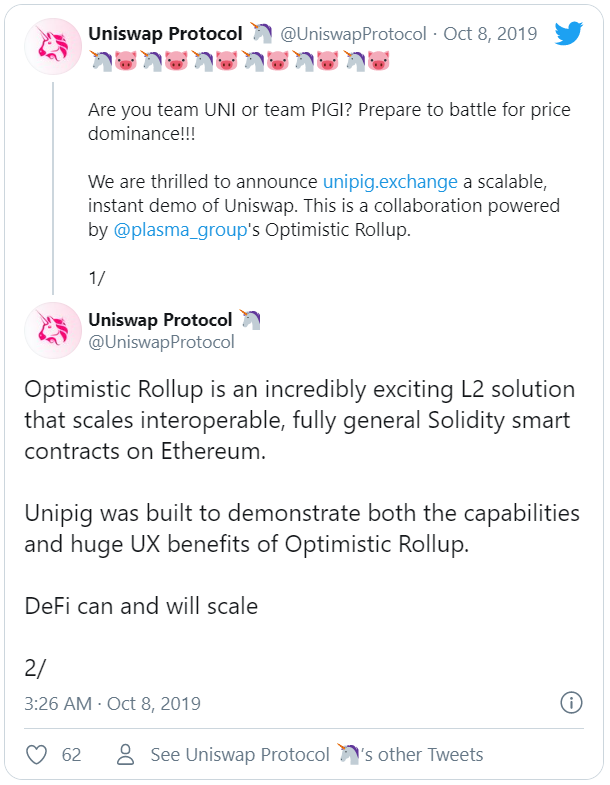

The first expected function of Uniswap V3 is to achieve faster and cheaper transactions by using Layer 2's expansion solution. In October 2019, Uniswap created a trading demo to show how Optimistic Rollups can scale up trading. Its handling fee will be as low as less than one cent, and the transaction time will be less than one minute. The demo is no longer valid, which may indicate that Uniswap is preparing to introduce it to its main platform.

Another expected feature mentioned by Uniswap founder Hayden Adams is higher efficiency, which will reduce users more expenses. This means that Uniswap V3 may compete with centralized exchanges like Binance, and have lower fees than them.

All these improvements will make V3 very technically complex, Hayden Adams believes that this will make the fork more difficult, which is beneficial to Uniswap. Because more liquidity will remain on its platform instead of being transferred to other "cloning platforms".

Currently, anyone is guessing the release date of Uniswap V3. Everyone has a lot of speculation, but there is no specific date or time range. The only reliable news about the release date is that Hayden Adams wanted to release a new version before the end of the summer of 2020, but this release window has been completely missed. At present, the release of V3 is very likely to follow a cycle similar to V2, which means that Blogpost and testnet versions will be released before the mainnet. This means that once the testnet version is released, the mainnet will be updated within a month or two. Therefore, the most likely release time should be sometime in the first half of 2021, because Uniswap should have been fully prepared last summer, after all, Hayden Adams had almost announced the news at that time.

For DeFi, the potential to have fast, cheap and decentralized options to trade any ERC20 token will be huge. After all, looking at it now, the only people who can actually use the decentralized exchange are high-value traders, because only they can not care about the $100 fee. When the fee is as low as a few cents per transaction, tens of millions of users will flood into DeFi and join the DeFi financial revolution.

Another benefit of opening up DeFi is that the total locked value (TVL) in Uniswap will be greater. This means that more people will put their money into the liquidity pool and get income. As the value of Uniswap increases, the tokens that effectively control these funds will also become more valuable. Therefore, the economy and governance of UNI tokens will follow. In theory, token holders can vote for a portion of the fees charged by the Uniswap exchange, thereby increasing the value of tokens and providing dividends to token holders.

For other smart contract platforms, this also means that more projects will return or continue to use Ethereum, thereby reducing their use cases. Because currently switching networks to EOS, the biggest motivation for Tron or NEO is that these networks will provide cheap and fast transactions that Ethereum cannot currently do. However, if Uniswap achieves this, the need to use other platforms will be greatly reduced. The funds flowing into other smart contract platforms will return to Ethereum and will further consolidate Ethereum's status as the king of smart contracts.

Therefore, although Uniswap V3 has not yet been officially released, the Ethereum and Uniswap communities are very eager for its release. It will provide cheaper transactions, faster confirmation times, and become a viable alternative to exchanges like Binance and Coinbase. Through these upgrades, Uniswap is expected to become the forefront of DeFi and become a pioneer in this field in the next few years.

This post has received a 24.95 % upvote from @boomerang.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has received a 24.95 % upvote from @boomerang.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post was resteemed by @steemvote and received a 14.87% Upvote. Send 0.5 SBD or STEEM to @steemvote

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit