BlockSwap is a decentralized protocol that provides staking asset liquidity for ETH 2 (or other PoS chains). It liberates users from the complex staking process and motivates both Stake nodes and Stakers with the corresponding Token (dual Token) design. (Users participating in staking, the same below), while providing liquidity to staking assets, it also creates more income possibilities.

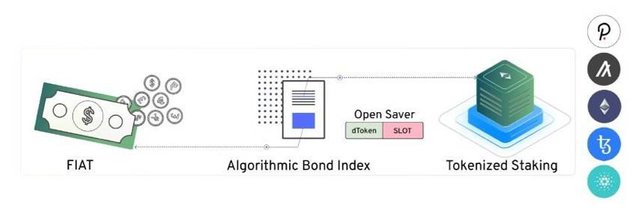

Specifically, BlockSwap Network (BSN) solves the liquidity problem of staking assets by creating an automated liquidity layer for the PoS chain-this liquidity layer is designed and constructed through the liquidity redemption of tokens while staking the basic assets PoS bond market, and provide users with fixed income products.

In this way, under the premise that the security of the PoS chain is guaranteed, the user's staking shares are given liquidity in the form of tokens for use in all DeFi protocols, and fixed-income products also lay the foundation for the establishment of more DeFi financial services.

And it can access almost all the functions of traditional fixed-income market products through a simple developer-oriented API model, which is open, transparent and convenient.

In a nutshell, BSN grants liquidity to the pledged Staking assets in the form of equity through the issuance of corresponding Tokens (dual token design), and converts them into infrastructure with the nature of fixed-income products for subsequent possible coverage Richer chain financial services for billions of users provide support.

BlockSwap's dual token architecture

In order to realize the above vision, BlockSwap Network (BSN) has designed a fully automated and non-tamperable smart contract system based on the interdependent dual Token architecture (dToken/SLOT).

In the BlockSwap Network (BSN), the Stake node on the chain is called StakeHouse. It is a special AMM with DeFi liquidity for pledged PoS assets and fully autonomous on the chain. It enables Stakers in the PoS network to have good cash flow.

Each StakeHouse holds a SLOT (perpetual bond token). SLOT serves as the income certificate for StakeHouse to obtain continuous cash flow incentives, ensuring that Stake operations on the chain can be processed in a timely manner by Stake House and protecting Stakers from slashing risk. Risk).

At the same time, Stakers will also receive non-slashable dTokens at a ratio of 1:1 based on their staking shares on the chain, so as to ensure that Stakers continue to receive staking rewards.

Moreover, the dual Token architecture (dToken/SLOT) design greatly reduces the time cost and energy consumption of the staking process through intuitive revenue vouchers, and there are two significant advantages:

- It enables Stakers to obtain the liquidity of their staking assets and obtain additional income through one-click operations. For example, a user pledges PoS tokens to a smart contract to obtain the corresponding dToken (equivalent to a "bond"). dToken can be circulated in the market to solve liquidity problems, and regardless of the number, even small staking needs can be met. Satisfy. Good cash flow visibility-this is the primary reason why many people withdraw from Staking and withdraw funds;

- Even without banking infrastructure and expertise, BSN allows DeFi or Fintech applications to provide on-demand savings deposit services to any user, just by using BSN's API;

In short, BlockSwap solves the contradiction between the security required by the network and the liquidity of its tokens by distributing dual tokens to staking participants. In addition to the benefits of staking, users can also obtain staking equity tokens. Financial operations such as transactions.

BlockSwap's fixed income products

As BlockSwap's first fixed-income product, Open Saver is a USD-denominated savings depository. Any DeFi user can create and deposit money into a corresponding blockchain USD account, and earn interest directly from the pledge income of PoS assets .

Open Saver is similar to the currency market, but the difference is that its interest rate is fixed, with an average yield of 5-7%. It is fully supported by the algorithmic PoS bond index, providing DeFi users with a stable savings rate of various encrypted assets.

In Open Saver, savings deposits are anti-confiscation, full mortgage, permanent USD interest, and can be redeemed at any time. DeFi users do not need to know or worry about encrypted assets or their prices. They can use the Internet and mobile applications to pay Create a USD deposit account within minutes.

With Open Saver, everything from DeFi protocols, wallets to flexible Fintech/non-encrypted applications can be seamlessly connected immediately.

At the same time, for dToken and SLOT holders, Open Saver will help their tokens find an initial market in the Saver pool and have the opportunity to enjoy passive income:

StakeHouse (SLOT holder)

- Is a bond maker;

- Provide liquidity to the savings pool to activate the market;

- At most 70% of the SLOT held is used for LP in the savings market;

- Provide SLOT for Mintbase;

Stakers (dToken holders)

- Provide liquidity for bonds and share the fees earned by LP;

- Do savings LP to get BSNT subsidy;

- Charge LP fees when users withdraw their savings;

- Use dToken to trade USDC/T/DAI;

In short, Open Saver does not require financial infrastructure, and no person or institution can forcibly close it. It is a trust-free chain savings protocol that is open to everyone for their use. It guarantees that Internet users who do not have the services of banking institutions can also obtain corresponding US dollar deposit accounts and make savings.

And according to the official website information, Open Saver will have a savings market based on Saver USD and ETH2 in the initial stage, and more assets will be added as it develops.

BlockSwap is about to launch community incentives

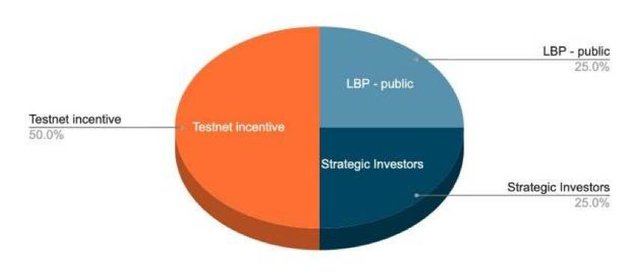

500 million BSN tokens (10% of the total supply) will be used as an incentive measure to be distributed within 4 months during the testnet stage, which mainly involves three directions.

Community network incentive plan-50%, 250 million pieces

BlockSwap will launch a community network incentive plan, and distribute about 250 million dBSN (Testnet Token) before the BSN mainnet goes live for the 5-month distribution arrangement of Uniswap LP, test products/feedback, community activities, etc. The goal is to cultivate A basic user group, and through the "ETH2 Testnet" exercises to improve the user experience of Collab Staking and savings.

During this period, users will be able to use dBSN (Testnet Token) to access and use all demo products, and accumulate incentive rewards through participation. In addition, there will be more incentives for the community to promote the BlockSwap protocol and a wider audience. Its products.

dBSN (Testnet Token) can exchange BSN 1:1 after the mainnet launch in August. During this period, anyone can use BSN products by holding dBSN (including those available on uniswap and other exchanges) , Users can also use dBSN for LP shares or governance-related incentives to get more dBSN.

LBP issuance-25%, 125 million pieces (no lock-up period)

Blockswap will launch the liquidity issuance of LBP, the specific time will be announced in the near future, and the corresponding Uniswap pool will be created after LBP for token trading.

Strategic investors-25%, 125 million pieces (1 month lock-up period after the end of LBP)

Strategic investor allocation will be completed before LBP, and trading will be opened on Uniswap after the end of LBP;

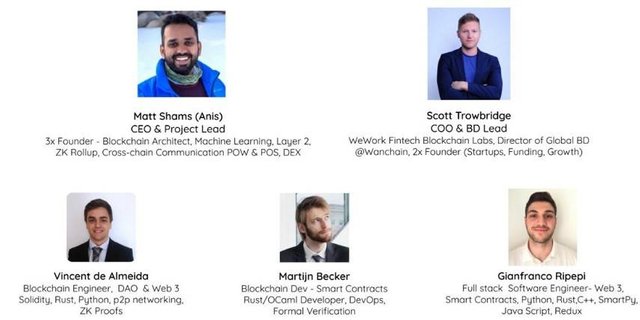

BlockSwap's team members include many experienced veterans from various fields such as distributed computing, financial transactions, blockchain consensus design, and cross-chain.