With the advent of 2021, the rise in the price of Bitcoin has triggered the usual comments that have plagued digital cash projects for a decade-it is nothing but a "bubble" driven by market manipulation and euphoria.

But for those who have spent many years studying this phenomenon, the graph is the latest sign of another reality, that is, the real money invention Bitcoin trumps government money in natural free market competition. Contrary to the way you might discuss Bitcoin elsewhere, the assertion of this article is that there is ample evidence that the software creates a real economy, and that this economy is slowly building up. Global currency order.

Indeed, in the coming year, one of the biggest criticisms of Bitcoin seems to be that the price of Bitcoin is irrational and speculative, and its data will be more accurately described as cyclical and predictable data that proves to be inaccurate. of. If this possibility seems surprising at first glance, we only need to review the history of Bitcoin to check this statement. After the market frenzy of 2017, skeptics and believers diverged on a single issue: how do we view the value of an asset ranging from zero to $20,000? Both groups made different assumptions, and as the market cooled, their conclusions on why prices fell again were also different. For the mainstream, the answer is the simplest model. The rapid increase in new crypto assets and the increase in trading venues (with some doubtful legal status) have once again exacerbated a market that is over-driven by inexperienced investors.

Bitcoin enthusiasts are skeptical of this conclusion. After all, there is a new currency technology worth looking forward to, and its economy has just been born for more than a decade. They asked different questions-despite the attention of investors and the media, how can prices fall again? Why is its 2017 chart so similar to the "bubble" that appeared in 2013? Why did the price decline in 2019 and 2020 stop at much higher levels than a few years ago? In order to answer these questions, a new hypothesis emerged: what if the Bitcoin price "bubble" is a product of its programming?

Bitcoin is not the price of Bitcoin

Understandably, the idea that Bitcoin may be the cause rather than the consequence of its price hikes and depressions may require an initial suspension of suspicion. However, for the purpose of this article, I would like to invite readers to do this as we gradually understand the basics of this concept. Let's start with an obvious point: Bitcoin has no price. In other words, from a code point of view, Bitcoin is only limited data. This data is a global market for buyers and sellers. These markets value and apply the "price" we usually quote.

From here, we can see that speculative fanaticism is the root cause of the rise in Bitcoin prices. The market is always setting the price of Bitcoin, so how will Bitcoin software affect this activity?

The answer lies in the programming of Bitcoin and how it defines the availability of Bitcoin in its economy. As established by the code written by Satoshi Nakamoto and released in 2009, Bitcoin has three characteristics that distinguish it from almost all other global economies.

1. Its fixed supply is 21 million units (divided by 21 trillion units)

2. It will slow down the introduction of these new devices into the economy according to the planned schedule (every 10 minutes)

3. It does not have a central operator, but is maintained by thousands of computers running its software.

Recently, a lot of attention has been focused on the third value proposition. Following the government's intervention in the COVID-19 pandemic and the intervention of the market, mainstream people began to become interested in alternatives that protect value from policy influences. However, to focus on the third quality is to focus on only part of the story. After all, unless investors are convinced that they are buying any assets at a favorable price, they will not buy any assets.

So why do Wall Street investors look at Bitcoin again? In short, they are betting on the long-term impact of the first two properties of Bitcoin software on its asset prices. Investors like Michael Saylor and Elon Musk are reviewing Bitcoin's price history and are seeing a pattern. They bet that the Bitcoin market will be turbulent, yes, but they also bet that the Bitcoin market will be upward and cyclical. In other words, Bitcoin prices create conditions of relative stability, allowing them (and any investors) to plan for the future.

The story told by the chart

Above we have determined the technical characteristics of Bitcoin, that is, it is a software technology, which both skeptics and critics agree with.

This brings us to the next assertion: Bitcoin's asset price is affected by its code parameters, which is the source of its extreme market volatility.

I want to point out to the critics that this is where our hypothesis enters a certain kind of speculation, even though the following argument takes into account nearly 12 years of observation. As mentioned earlier, believers and critics agree that the Bitcoin market is defined by two stages of growth, the first stage is 2013 (when the price exceeds $1200), and the second stage is 2017 (the price exceeds 20,000 U.S. dollars). The assumption adopted by critics (consciously or unconsciously) is that these events are quite random as this year's GameStop, euphoric events GME+3.2% and AMC fanaticism.

They pessimistically believe that as the price of Bitcoin increases, media attention increases, new investors become irrational, and old buyers take the opportunity to cash out. What has been less discussed is a reasonable counter-proposal to this proposition. That is, in each case, how does the price of Bitcoin rebound again to create the above conditions? Why not just return to zero? Of course euphoria can be ruled out. As Bloomberg admits, the price of Bitcoin has recently rebounded to an all-time high for the third time in history, and "no one is talking about it." One possible answer is that the constraints in the Bitcoin code provide the necessary catalyst for restarting the Bitcoin economy.

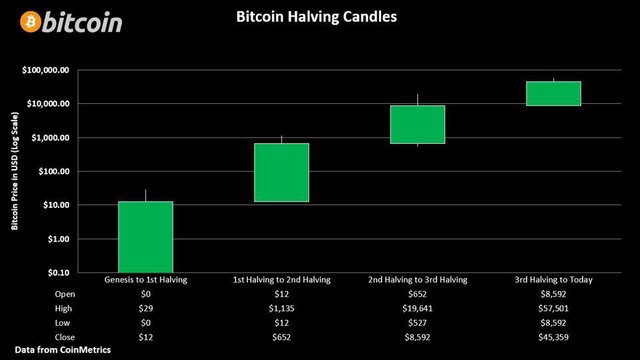

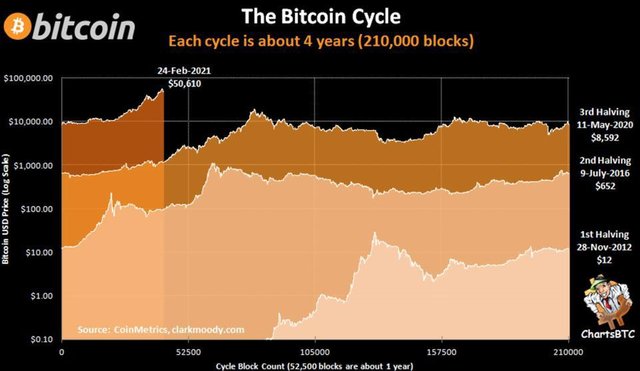

Bitcoin's performance in each of the four "halving cycles".

By reducing the supply of new bitcoins produced at a four-year pace, the software seems to set the conditions for a four-year cycle of rise and fall. From this perspective, Bitcoin price may not be random at all, but a function of known parameters, which can be understood as a pattern of stimulus generation. The price rises to a new all-time high every four years, and then drops to near but never below the price set at the top of the previous four-year cycle. From there, prices steadily rise until supply decreases, at which point changes in supply will cause the cycle to repeat. If this pattern continues, we will enter a period in which Bitcoin will soon hit an all-time high for the third time, set a price level, and then proceed to another four-year cycle of predictable performance.

Bitcoin price in each "halving cycle"

Proof hypothesis

You might say that this sounds interesting, but it is still based on future events. This reaction is understandable. I personally think that Bitcoin is a bubble (or it will be replaced by better technology), so I did not buy Bitcoin until 2018, and then I paid a fine (to spend more dollars to buy Bitcoin in the future).

In this case, the observer finds himself in the middle of two conflicting assumptions. One defines the Bitcoin phenomenon only through the perspective of external events, and then continues to present a version of reality that is inconsistent with the 12-year data (it will become zero). Another quota is based on Bitcoin's unique quality and observable data. They believe that with the rise of the Bitcoin economy, the price of its assets will rise, and the true value of the Bitcoin system (and its assets) will be orders of magnitude higher than current levels. We should also note that these two views cannot coexist. One must be proven to be correct, and the other must be proven to be wrong, because they are opposed to each other.

I believe that in the next few months, we will see the price of Bitcoin rise to new highs. So how do ordinary people get Bitcoin?

ZB exchange offers a variety of Bitcoin trading pairs. First, you need to register for an account. Registration is quick and straightforward. However, you need to verify your identity before participating in the transaction. As the world's leading blockchain digital asset trading platform,(ZB) has created a rich and diverse product matrix, advanced transaction system and matching technology, complete fund storage technology, and smooth and silky transaction experience for users. One-stop trading platform that can meet the various trading needs of different users.

It is a relatively complete virtual currency trading channel, with many large accounts, and its business covers over-the-counter trading, currency trading, and contract trading. This type of channel is selected for trading with high reputation, good credit endorsement and brand influence. , You can be assured of buying Bitcoin. Today’s ZB (ZB), one of the reasons why it is highly regarded by more people, is that it is extremely safe, and the criminal account is strictly seized. In the past 7 years, ZB has not had any fund security incidents, and the level of transaction security is in the industry. Among the best. Choose such channels that have a high reputation, good credit endorsement and brand influence to buy and sell, and you can buy Bitcoin with confidence. ZB also has the function to facilitate the purchase of coins, which is more suitable for novices to operate.