In the institutional-led Bitcoin bull market, the Bitcoin options market continues to grow. With the expiration of the Chicago Mercantile Exchange (CME) Bitcoin futures contract on Friday, it may cause dramatic price fluctuations.

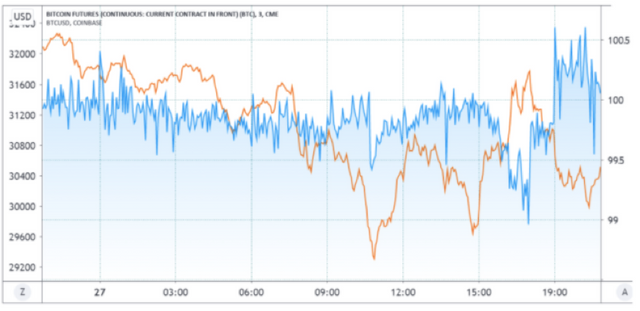

According to TradingView data, the trading price of CME Group Bitcoin futures contracts is 1% premium to the spot Bitcoin market, indicating that few institutions are willing to short the asset.

Bitstamp Bitcoin price

CME Bitcoin price

CME is a traditional futures exchange, and the futures premium on the platform shows that traditional institutions are particularly optimistic about Bitcoin.

Futures premium measures the premium of longer-term futures contracts relative to the current spot (regular market) level. When the indicator turns negative, this situation is called a spot premium, indicating bearish sentiment.

In addition, as long as the holder has sufficient margin, the futures contract can be postponed to a certain date in the future.

CME futures premium

The above data levels indicate that the CME Bitcoin futures premium fell sharply later in the day. As Bitcoin tested the resistance level of $31800, CME's selling pressure continued, resulting in a short spread.

CME Futures Premium vs. Coinbase BTC USD

The expiration of options rarely has a direct impact on spot prices. However, when open positions are concentrated on out-of-the-money (OTM) call and put options (which is the case with Bitcoin), market makers may hedge the underlying asset, which can lead to greater price fluctuations.

Swiss data provider Laevitas pointed out that there are currently more than 52,600 call option contracts and 29,800 put option contracts that are OTM.

Quantitative analyst Samneet Chepal said: “If Bitcoin quickly jumps to record highs in the next few days, market makers are expected to actively hedge their out-of-the-money short call options exposure, which may increase overall market volatility.”

Image source: TradingView

Hello @douglasyukanov Send minimum 0.5 steem to @double-voter to get 100% upvote from our 110k+ curation trial.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit