It cannot be denied that the development speed of cryptocurrency far exceeds that of today's traditional financial market, but the crypto market is still "despised" by traditional financial circles for its high volatility in price trends. The industry is trying to stabilize through USDT, USDC, PAX and DAI. Currency to solve this problem. Recently, the decentralized stablecoin protocol FEI raised 639,000 ETH in three days, making it the largest algorithmic stablecoin project at present. As expected, stablecoins have triggered different reactions from innovators and regulators in the crypto industry.

In this context, this article will introduce in detail what a stablecoin is, how it works, and its value proposition in the crypto ecosystem.

How should stablecoins be defined? In essence, a stable currency is a cryptocurrency with "anchored" properties. The goal is to anchor an asset under the chain and maintain the same value with it. In order to maintain price stability, stablecoins can be mortgaged by off-chain assets (i.e. mortgage stablecoins), or a certain algorithm can be used to adjust the supply-demand relationship at a certain point in time (i.e. algorithmic stablecoins).

1. Types of stablecoins

There are three main types of stablecoins: legal currency-based stablecoins, cryptocurrency-based stablecoins, and unsecured stablecoins (algorithmic stablecoins). The following will specifically introduce the basic principles of each type of stablecoin and how it works in the crypto ecosystem.

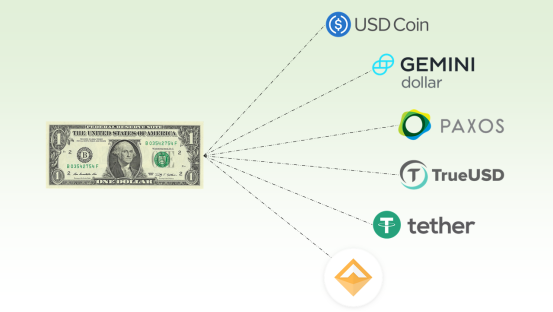

1. Stable currency based on fiat currency

As the name implies, stablecoins based on fiat currencies are linked to specific fiat currencies, which in most cases are US dollars. Ideally, stablecoins support endorsements at a ratio of 1:1, and the number of stablecoins in circulation can be balanced with the reserves held by the issuing entity at any time.

Take Tether (USDT) as an example. Its design is to anchor the U.S. dollar 1:1, which means that the Tether Foundation's cash reserves are equivalent to the amount of USDT in circulation. However, according to the latest data, the reserve support for each USDT is US$0.74 instead of US$1.

In view of the nature of centralization, most stablecoins based on fiat currencies are used in centralized exchanges, and the leading exchanges have launched stablecoin trading pairs for most of the encrypted assets on the platform.

2. Stable currency based on cryptocurrency

Cryptocurrency-based stablecoins use cryptocurrency as collateral, not legal currency as collateral. So how does this provide stability or value preservation?

Just like the U.S. dollar, which is known for its stability, some crypto assets, such as Bitcoin and Ethereum, have gained a "stable" status. In fact, most crypto-collateralized stablecoins are anchored by these two digital assets.

For example, the most popular crypto-supported stablecoin DAI launched by MakerDAO. Due to the volatility of cryptocurrency prices, DAI's collateral ratio is much higher. For example, minting (triggering supply) 1 DAI requires a deposit ratio of 1.5:1, which is basically an overcollateralization.

When the mortgage lending ratio is lower than the collateral liquidation ratio, liquidation will be triggered. In the case of DAI, the ratio should always exceed 150% (1.5:1). The liquidation is executed by the basic smart contract, which is automatically executed according to pre-coded conditions.

With the popularity of decentralized finance (DeFi), DAI stablecoin has become the favorite of Ethereum blockchain users. While users use their own ETH as collateral, they will mint DAI stablecoins to perform other profitable operations.

3. Unsecured stable currency (algorithmic stable currency)

Algorithmic stablecoins are largely theoretical, because most of the innovations are still in the early stages. This type of stable currency borrows the basic principles of Seigniorage Shares, which was first proposed by Robert Sams in 2014. Basically, they do not have any asset backing, and mainly rely on smart contracts to maintain stability and ensure value.

In this case, the quantitative easing policy includes when the value is higher than the linked target, the supply of new algorithm stable coins, when the value is lower than the linked target, burn part of the currency in circulation. In this way, the value of the underlying encrypted assets will remain stable.

Algorithmic stablecoin niche areas also include Basis, Ampleforth, Celo and Terra.

Second, the new impetus of the crypto market

Stablecoins are gradually occupying the crypto market, and more trading volume is supplied to exchanges every day. According to data from Coin Metrics, stablecoin trading volume increased by 316% last year, reaching $248 billion. It is worth noting that the number of addresses holding more than $100,000 in stablecoins has also soared by 201%.

In addition, the encryption field includes the Libra stable coin proposed by Facebook. This stable currency was originally backed by a basket of stable currencies, which was later renamed Diem.

3. Stable currency value proposition

As emphasized earlier, the basic design of stablecoins is to minimize the volatility associated with the crypto market. They are a key part of the crypto market infrastructure, especially in terms of maintaining a stable portfolio value.

In the future, as more and more stakeholders realize the basic value of stablecoins, cryptocurrency stablecoins may gain mainstream adoption. The following are the usage scenarios of stablecoins in the crypto ecosystem and financial markets.

1. Volatility hedging

Stablecoins act as a store of value to hedge against fluctuations in the crypto market. Unlike Bitcoin and other encrypted assets, stablecoins can preserve the value of investment portfolios even in the event of extreme market volatility.

Take the miner's BTC payment as an example, but it needs to be in U.S. dollars. Miners buy mining equipment by holding stablecoins instead of BTC, because BTC will be affected by fluctuations in the crypto market. In this way, miners are protected from any price changes that may reduce the value of the committed fund portfolio.

2. Profit

Given the nature of stablecoins, stablecoins can make profits in the encrypted market. They provide market makers and investors with a simple method of calculating profits.

Ideally, stablecoins can achieve profits in the crypto market through value preservation. Without these digital assets, most of the profits obtained in cryptocurrency transactions will not be realized or will eventually be erased.

3. Medium of Transaction

Like currencies, stablecoins act as a medium of exchange in active crypto markets and daily transactions. They can be used to purchase digital assets on exchanges or supporting infrastructure peer-to-peer markets.

Trade and retail are also using them for daily transactions, including the purchase of goods. In the crypto industry, stablecoins are gradually becoming the payment standard for providing services along with other forms of trade.

4. Cut transaction costs

Transaction costs may eat up most of the profits. Then, stablecoins will solve this shortcoming through cheaper transaction costs than other crypto assets. Exchange currencies like Gemini Dollar (GUSD) and Binance Dollar (BUSD) have much lower fees when trading cryptocurrency pairs. This type of currency is some of the first initiatives launched by crypto exchanges to increase the adoption rate and convenience of cryptocurrency transactions.

5. Remittance

Although stablecoins were originally designed for the digital ecosystem, stablecoins have begun to be used in traditional financial markets. It is now possible to use stable currency to remit money, and this process takes less time than normal remittance channels. In addition, the stability of these digital assets also ensures that both parties in the transaction achieve the best value.

Fourth, stable currency income

When it comes to making money, everyone likes to get a rate of return (interest). Stablecoins provide a variety of opportunities for crypto market participants to obtain higher yields through traditional financial tools, such as the farming income of the emerging DeFi niche. Participants provide liquidity with high yield incentives. The rate of return for less risky crypto market activities can be between 20-30%, and may be higher in a bull market. Stablecoins provide the perfect means to interact with the ecosystem.

1. Trading/Leverage

Stablecoins provide opportunities for trading in the encrypted market, where the upside potential may have substantial returns. Digital assets can be used to buy crypto assets such as Bitcoin or Ethereum. The prices of these two assets have increased several times in the past year.

In addition, stablecoins provide opportunities for leverage when trading; on some exchanges, leverage can be as high as 100 times. This means that the profit will be a hundred times the initial capital transaction.

Another emerging trading niche where stablecoins earn revenue is crypto derivatives, which include products such as perpetual contracts and futures. The crypto derivatives market has been especially developed in the past year and has now become a basic part of the entire market.

2. Borrowing

There is no difference between the crypto ecosystem and traditional finance, which may be the reason why some people call it the "financial future". Stablecoins can generate income through borrowing in this emerging market.

Just like traditional financial lending, cryptocurrency can realize lending. In fact, financial services have found a home in centralized finance (CeFi) and decentralized finance (DeFi). The latter is especially known for providing high deposit rates with decentralized agreements.

3. Liquidity mining

Last year, the rapid rise of DeFi as an encryption technology reached its peak when the liquidity mining was launched in the summer.

Liquid mining itself is highly profitable, but it also comes with high risks. As early as the summer of 2020, the AMM pool provided liquidity providers with thousands of percent returns. Although this craze seems to have died out, some pools still offer APY as high as 400%.

Stablecoins are a means of obtaining these DeFi protocols and can also be used to provide liquidity. Some AMM pools are composed of allowing users to deposit stablecoins as tokens to provide liquidity.

Although liquid mining is an emerging market, encryption technology does have a huge impact on traditional finance. Some people believe that the digital asset economy will eventually exceed the trading volume of today's financial markets, which will mean that most financial activities will be transferred to the chain, and stablecoins may assume a role similar to the US dollar in this ecosystem.

to sum up

The rapid growth of stablecoins in the past 12 months is irrefutable, and of course it will never be just a flash in the pan. The current algorithmic stablecoin projects are still in the experimental stage, and cannot achieve price stability, and will even amplify market fluctuations. The huge fluctuations after the FEI went live have also confirmed this. Of course, legal currency and cryptocurrency-based stablecoins are also not perfect solutions, and there are many development difficulties, but stablecoins, as a stable supplementary part of the cryptocurrency market, still have considerable potential.

Reference materials:

TechMoths: Stablecoins and their Value Proposition in the Crypto Ecosystem Stably: The Real Risks of Moving all your Assets into Stablecoins

Congratulations! Your post has been selected as a daily Steemit truffle! It is listed on rank 20 of all contributions awarded today. You can find the TOP DAILY TRUFFLE PICKS HERE.

I upvoted your contribution because to my mind your post is at least 17 SBD worth and should receive 20 votes. It's now up to the lovely Steemit community to make this come true.

I am

TrufflePig, an Artificial Intelligence Bot that helps minnows and content curators using Machine Learning. If you are curious how I select content, you can find an explanation here!Have a nice day and sincerely yours,

TrufflePigDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit