In 2020, we have seen DeFi's incredible innovation and experienced the explosive growth of the DeFi world. In particular, DeFi's level of development covering decentralized transactions, loans, options, fixed income, algorithmic stablecoins, synthetic assets, etc., has become increasingly diverse, almost following the traditional mainstream financial pattern.

And this continuous, innovative and repeatable DeFi protocol has also created a whole range of new profit possibilities for the assets of ordinary borrowers, providing liquidity to auto market makers, inserting synthetic assets, and so on.

DeFi's "Lego" attributes are naturally suited to building structured products that combine multiple protocols to achieve specific risk objectives.

What is a structured product?

A structured product is basically a combination of financial derivatives, which typically combine a series of derivatives to build a "joint product" that achieves a specific risk objective.

The advantages are obvious, because while there are many derivative tools that can play a combined advantage in trading, there are only a few experienced traders, and most people don't know how to incorporate derivatives into their overall portfolio strategy to increase risk return, this is where structured products come in:

Packing various derivative products into one product, anyone can buy it without worrying about the complexity of the structure, in a broad sense it can be understood as all financial products that are tailored to the customer.

But this also brings with it a series of problems - it's very unclear, the broker may not be able to accept payments, the investment channels are severely restricted due to geographic location, and only high-income individuals or financial institutions can use them.

What is Ribbon Finance?

Herein lies the vision of Ribbon Finance as an encrypted structured product - eliminating the investment threshold and bringing new variables to the structured product market, so that any investor with a Metamask wallet can easily participate in investing in structured products.

Because of this, Ribbon Finance chose to focus on creating encrypted structured products at DeFi, and by building new DeFi products that can be combined through DeFi cross-agreements, to help DeFi users achieve a higher risk-reward ratio.

The Ribbon currently covers four main product categories, including betting on volatility, increased returns, principal protection, and compound interest. Each category has a specific product suite to provide users with different risk recovery objectives with different services.

- Bet on volatility: Allow users to trade volatile products for various crypto assets for speculative purposes or hedging

- Increase revenue: through a combination of different rate of return tools (with revenue options), allowing users to get high-yield active and passive products

- Principal protection: an investment product to ensure that users will get their principal back on their loan, plus potential upside returns. They can be built through a combination of product and fixed income options

- Compound interest: A product that allows users to gradually and steadily accumulate their favorite assets through strategies such as automatically selling put options and reinvesting proceeds to accumulate more assets

Ribbon Finance's founder is Julian Koh, a former Coinbase software engineer. LinkedIn personal information indicates that Julian Koh worked at Coinbase from May 2019 to October 2020. In 2018, he served as a consultant for the cryptocurrency hedge fund MetaStable Capital.

How does Ribbon Finance achieve its goals?

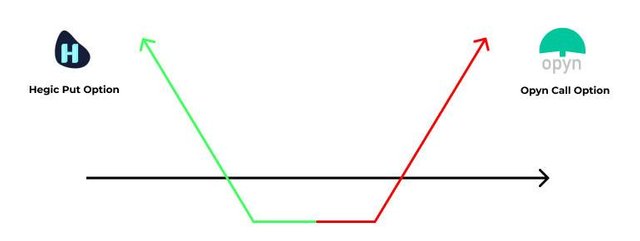

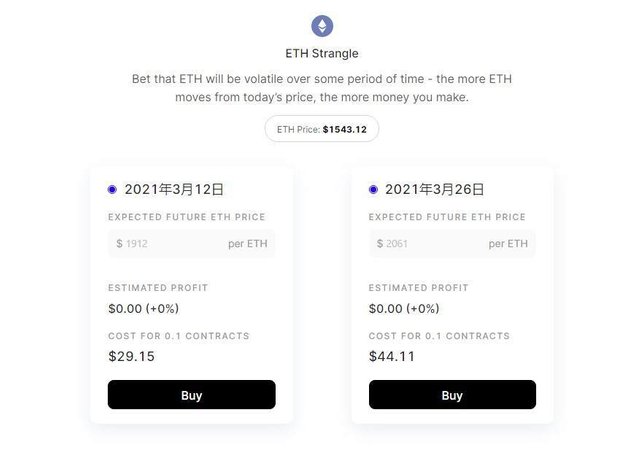

Take for example the volatility product - Strangle option. This is also the first product of the Ribbon which allows the user to bet on the volatility of ETH to make a profit by combining call options and call options with different execution prices.

To build on this combined product, the Ribbon simultaneously obtains liquidity from the two main options agreements on Ethereum, Hegic and Opyn.

First, the Ribbon will find the lowest prices for buyers and sellers of options from Hegic and Opyn, and then buy options on behalf of users and package them into smart contracts to build a portfolio of products that bet on ETH volatility.

Currently, there are two contract options for Strangle options based on the expiration date-March 12 and March 16, according to the different contract costs and return benefits.

However, the more often and the greater the fluctuation of the ETH price during the contract period, the more profit. It is also the first multi-protocol structured product to bet on volatility in Ethereum.

Three product areas of income generation, principal and compound interest protection are under development and are expected to be launched later. The official has also confirmed that there are two main directions going forward:

- Continuous integration with other on-chain option protocols to get better prices for users and create more complex products;

- Develop permanent structured products that generate revenue from ETH by selling options;

It is important to note that to date, Ribbon Finance has not issued its own tokens, and tokens with the same name appearing on the chain as BSC need to pay special attention to risks.

How big is the imagination of an encrypted structured product?

In the world of traditional finance, structured products are generally based on fixed income investment, coupled with a combination of financial derivatives. Usually financial assets that can be linked to derivatives include stocks, bonds, interest rates, foreign exchange, various indices, bulks, funds, etc. (generally like ABS, structured wealth management, structured savings, etc.) have developed rapidly in recent years and have become a powerful tool for asset management as they closely follow the needs of individual investors.

In the crypto market, there is also a long-established "structured product" model - the digital asset dual currency wealth management product. As an unsecured floating return investment product, it is characterized by "one investment, two returns".

Take the BTC standard as an example

Investors bought the 10-day "BTC-USD dual currency wealth management" product on March 1. Assuming BTC was quoted at US $ 49,200 on that day, other relevant parameters are as follows:

- Linked price: $ 49,400

- Expiration date: March 11th

- Investment amount: 1 BTC

- Yield: 3%

On the expiration date March 11, there will be two possible settlement methods:

- If the settlement price of BTC is lower than the set price of 49,400 US dollars, settlement will be made in BTC. Total settlement = (1 + yield) * purchase amount = (1 + 3%) * 1 = 1.03 BTC.

- If the settlement price of BTC is higher than or equal to the pegged price of 49,400 US dollars, settlement will be made in USD. Number of settlements = (1 + yield) * pegged price = (1 + 3%) * 49400 = 508825USD.

Take the USD standard as an example

Investors bought the 11-day product "USD-BTC dual currency wealth management" on March 1. Assuming BTC was quoted at US $ 49,200 on that day, other relevant parameters are as follows:

- Related price: US $ 49,000

- Expiration date: March 11th

- Total investment: US $ 49,200

- Yield: 3%

On the expiration date March 11, there will also be two possible settlement methods:

- If the USD-BTC settlement price is lower than or equal to the set price of 49,000 USD, the investor will settle in BTC. Settlement amount = pegged purchase quantity / price * (1 + 3%) = 49200 / 19,000 * (1+ 3%)) = 1.0408 BTC.

- If the USD-BTC settlement price is higher than the related price of 19,000 USD, the investor will settle in USD. Number of settlements = (1 + yield) * associated price = (1 + 3%) * 49000 = 50470USD.

In short, even though the BTC-USD settlement price will change on the expiration date, the investor will always get a definite 3% return. The only uncertainty is the type of funds being returned (BTC or USD).

I believe everyone has found that the hedging and risk hedging characteristics of similar options above are more suitable for building diversified structured financial products than "fixed income + derivatives" in traditional finance.

In the crypto world, with the help of smart contracts, liquidity can be obtained from various on-chain derivative agreements (including option products such as Hegic), and can be combined freely and efficiently to achieve certain specific risk objectives. time, 100% transparency is maintained at all times.

Especially when different DeFi track protocols are combined like Lego - when various DeFi financial instruments (options, fixed income, future, etc.) are combined, driven by automated algorithms, the value of the entire blockchain network will be faster. The way it flows, and an evolution based on various financial innovations will occur such as chemical reactions, thus providing users with more robust structured products to increase profits or reduce risks.

This is where the enchantment and imagination of encrypted structured products resides.