For market makers and traders who adopt DEX (based on the AMM model), impermanent losses and high slippage are inevitable pain points. The DEX that emerged after Uniswap therefore took the solution of these two major problems as the main breakthrough.

At present, most DEX try to reduce impermanence losses and reduce slippage by introducing oracles. It can be seen from the results that it has not been proven that the oracle alone can completely solve the problem-once a hacker attack occurs, or the oracle fails, the problem still exists.

Are there other ways to try?

Perpetual Protocol has devised a completely different path: eliminate the pending order side (no market maker), and only save the order-taking side (trader) to reduce impermanent losses and slippage from the root cause. At the same time, it is also trying to solve a problem that has plagued retail investors for a long time: high gas fees.

How to realize the free circulation of assets without a market maker? How to reduce gas fees? From the perspective of operating mechanism and development potential, I will take you to understand Perpetual Protocol, a DeFi derivative platform sought after by institutions such as Multicoin Capital, Three Arrows Capital, Alameda Research, and Binance .

1. What is Perpetual Protocol?

Perpetual Protocol is a decentralized perpetual contract trading platform. The main network was launched in mid-December last year (up to now, the transaction volume has exceeded 1.2 billion US dollars) . It supports the trading of BTC and ETH perpetual contracts with a maximum leverage of 12 times. It is a combination of Uniswap and BitMEX.

As we all know, Uniswap is the premier spot trading platform in the DEX market, and BitMEX is the pioneer of the perpetual contract track in the CEX market. Is Perpetual defined as a combination of Uniswap and BitMEX because the former is in a decentralized world and mainly provides perpetual contract trading services?

Obviously not. Then how should we correctly understand the "Uniswap+BitMEX=Perpetual" statement.

It is obvious that BitMEX is used to define Perpetual mainly because it is one of the few perpetual contract trading platforms in the DeFi market. It was labeled Uniswap because Perpetual designed the vAMM ( Virtualized Automated Market Maker ) model. This model is based on the AMM that has been ignited by Uniswap, and tries to solve the long- criticized impermanence loss and high slippage of AMM. Problem, and this has become its biggest bright spot.

To understand Perpetual, I have to mention vAMM.

2. vAMM ( Virtualized Automatic Market Maker )

We know that in the summer of last year, the success of Uniswap pushed AMM (automatic market maker) to a new level, and most of the subsequent DEXs also adopted a constant function of x * y = k (constant product market maker, AMM mode one Species) to exchange tokens.

Compared with AMM, the vAMM designed by Perpetual is called a virtualized automatic market maker. Although this model uses the same constant product formula as Uniswap, the two are essentially different:

1. vAMM itself does not store the real fund pool (k), the real assets are actually stored in the smart contract vault, which manages all collaterals that support vAMM;

2. vAMM is essentially equivalent to a price discovery mechanism and is not used for spot transactions;

3. In the constant product formula (x*y=k) designed by Perpetual, (at this stage) the K value is manually set and adjusted by the development team, and then set by the algorithm.

Unlike traditional AMM, which requires liquidity providers to provide liquidity for the fund pool, vAMM's liquidity comes directly from smart contract vaults outside of vAMM. The Perpetual team therefore pointed out that vAMM does not require liquidity providers to bring liquidity, and traders themselves can provide liquidity to each other.

"Since there is no need for liquidity providers in vAMM, there is no impermanence loss problem from the beginning."

In terms of reducing slippage, in the traditional AMM model, the larger the capital pool volume (the higher the K value), the smaller the slippage faced by traders. In this regard, vAMM is similar to AMM: the value of k increases, the slippage is lower. However, the K value in vAMM is virtual, which is manually set by the development team at startup, and can be adjusted through algorithms in the later stages based on transaction volume, open interest rates, financing rates and other market data.

3. Operating mechanism

The process of Perpetual is basically similar to that of a centralized derivatives exchange. The key difference is: in Perpetual transactions, the counterparty of the trader is vAMM itself; in the centralized platform, the counterparty of the transaction is the order book's pending party.

Before understanding the operating mechanism of Perpetual, let us make one point clear: the creator needs to set the number of virtual assets stored in vAMM. This part of assets is equivalent to synthetic assets, and real assets are actually stored in the smart contract vault.

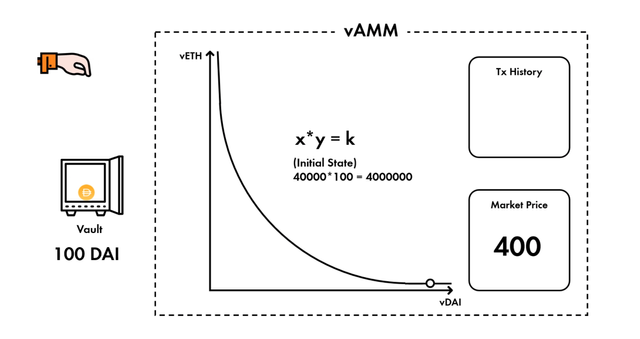

Assume that the token pair in vAMM is vETH and vDAI, and the initial asset amount is 100 vETH and 40,000 vDAI. Trader Alice chooses to go long and Bob goes short. The running process of Perpetual is as follows:

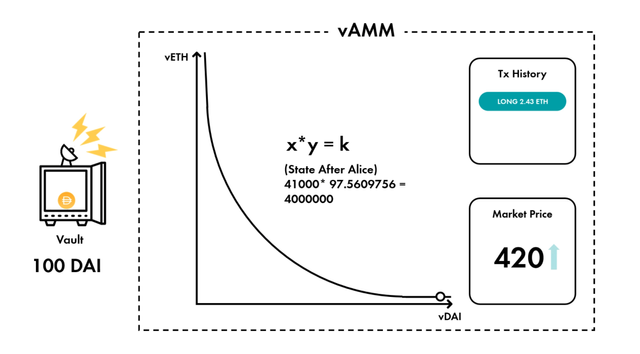

1. Longer Alice

1) Alice chooses to use 100 DAI as collateral and 10 times more ETH;

2) Alice deposits 100 DAI into the smart contract vault of the Perpetual agreement;

3) Perpetual protocol records 1000 vDAI from Alice (100 DAI with 10 times the bar), and vAMM calculates the amount of vETH received by Alice according to the constant product function (x*y=k);

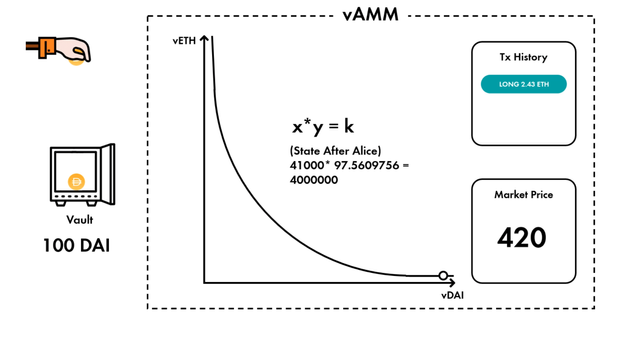

4) Perpetual protocol records that Alice now has 2.4390244 vETH, and the number in vAMM becomes 97.5609756 vETH and 41000 vDAI.

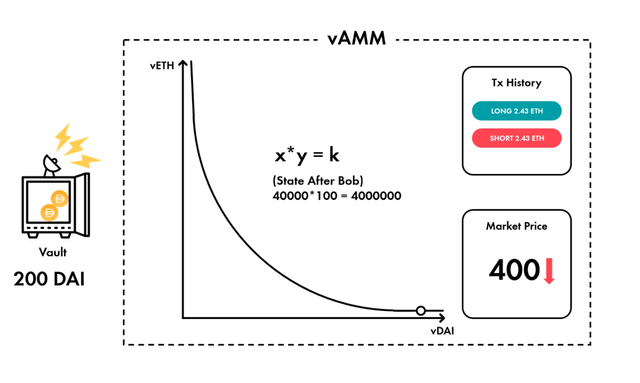

2. Short seller Bob

1) Bob then chooses to use 100 DAI as collateral and short ETH 10 times;

2) Bob also deposited 100 DAI in the same vault;

3) Perpetual protocol records -1000 vDAI from Bob into vAMM, vAMM calculates the number of negative vETH received by Bob according to the constant product function (x*y=k);

4) The Perpetual protocol records that Bob shorted 2.4390244 vETH, and the current assets in vAMM have become 100 vETH and 40,000 vDAI.

In this process, vAMM actually plays the role of "bookkeeper", and the smart contract vault is the place behind the real storage of assets. The assets stored in vAMM are synthetic assets, and real assets are in the vault.

According to the Perpetual operating mechanism, it uses the same financing interest rate formula as the FTX exchange to balance long and short positions with this interest rate. In addition, the platform provides an insurance fund (50% of the transaction costs flow to the insurance fund, and nearly 500,000 transaction fees have entered the fund) to ensure that traders who successfully place orders can get profits.

( FTX financing payment formula)

Under normal circumstances, the funds in the insurance fund will be used to repay two losses in the agreement: one is that the liquidator fails to clear the unsecured positions in a timely manner; the other is that the market is imbalanced, and vAMM needs to pay funding costs. When the assets in the fund are not enough to cover the loss, Perpetual will mint PERP tokens and sell them on the market to repay the debt.

Fourth, the value capture of PERP tokens

PERP is Perpetual's native token, which has three functions:

1. Governance

PERP holders can govern the entire agreement, and manage parameters including transaction fees, asset listings, and insurance fund management;

2. Rights

PERP holders can pledge their tokens in the staking pool and receive commission rewards and staking incentives;

3. Guarantee

In the extreme case of depletion of insurance funds, PERP holders will act as the ultimate backing. If this happens, Perpetual will mint new PERP tokens and conduct an auction, and the auction proceeds will be paid to the winning trader.

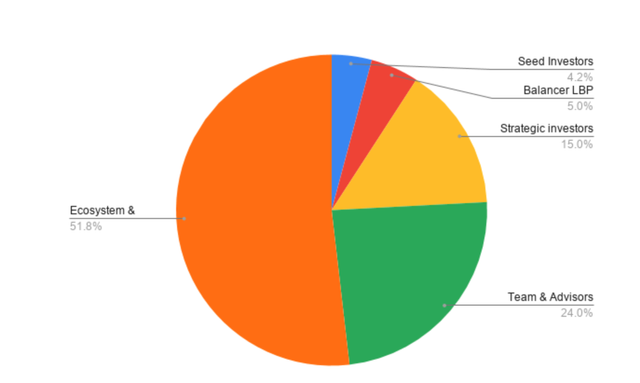

The total amount of PERP is 150 million, and the token distribution is as follows:

17.50 million PERPs: used in the Balancer LBP liquidity guiding pool ;

*Note: The liquidity guide pool is a smart pool, and its mechanism will gradually change the weight of the tokens in the pool over time.

2. 36 million PERPs: allocated to the team and advisors (tokens will be issued 6 months after the mainnet launch, and will be issued quarterly for the following 30 months);

3. 6.25 million PERPs: allocated to seed investors (Binance will invest in Perpetual in 2018);

4. 22.5 million PERPs: After the allocation to strategic investors (in the Balancer LBP liquidity guide pool) is completed (25%), seed and strategic investor tokens will be issued and will be conducted quarterly for the next 12 months once);

5. 77.75 million PERPs: used in the ecosystem and rewards to encourage traders, stakeholders and developers to establish an ecosystem.

According to Debank data, as of February 6, Perpetual agreement lock-up volume exceeded 21 million, an increase of 269% in the past month.

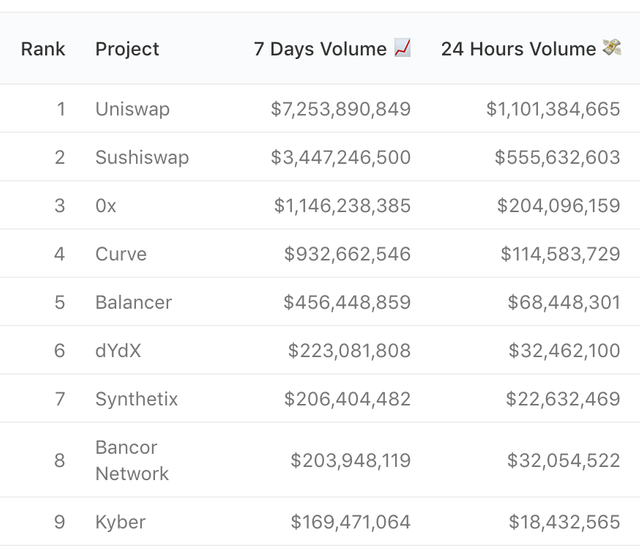

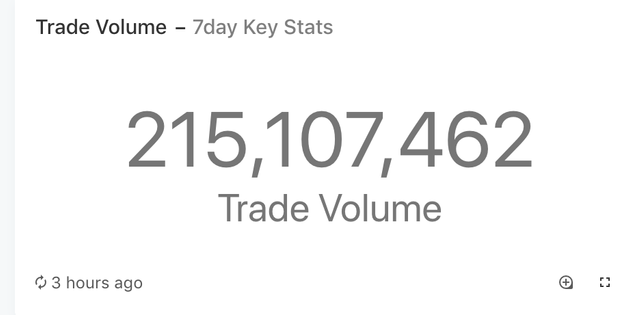

In terms of transaction volume, Perpetual's transaction volume in the past 7 days exceeded 210 million U.S. dollars, surpassing Synthetix (200 million U.S. dollars), the leading synthetic asset track project.

(DEX trading volume ranking in the past 7 days)

(Perpetual transaction volume in the past 7 days)

In terms of tokens, the current circulation of PERP reaches 21,801,250 (total 150,000,000), the price has increased by 355% in the past 30 days, to about 7.5 US dollars per piece, the market value is 165,498,864 US dollars, and the number of token holders reaches 3612.

Five, conclusion

In addition to working to reduce impermanent losses and slippage by using the vAMM model, Perpetual is also launching the xDAI sidechain (Layer2 solution) to bear Gas fees for platform traders and solve the problems that have plagued retail investors for a long time.

According to an official article published by Perpetual in mid-January, the agreement costs only $183 to execute 179,000 transactions, because the gas fee on xDai is only 1% of the Ethereum mainnet.

On the whole, Perpetual has been focusing on solving the main problems of the DeFi market. It is still in the early development stage and deserves attention.

Reference content:

1. "A Deep Dive into our Virtual AMM (vAMM)"

2. "A Brief Introduction to the Perpetual Contract Agreement"

This post was resteemed by @steemvote and received a 6.58% Upvote. Send 0.5 SBD or STEEM to @steemvote

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit