In the DeFi market that pursues maximum capital efficiency, the revenue aggregation track has always been the darling of investors and VCs.

Since YFI spread throughout the market last summer, until the beginning of the year, Badger Dao and Alpha Homora's lock-up volume surged. Aggregators designed to improve capital utilization have become a popular investment tool in the market.

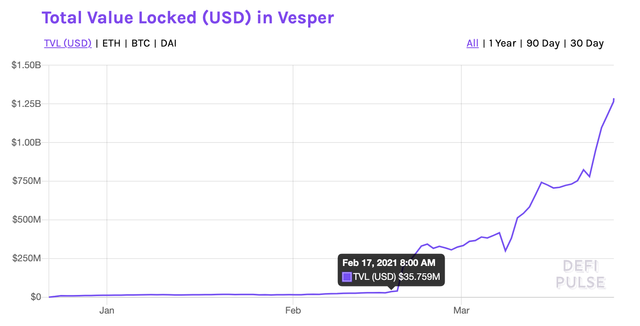

Recently, Vesper Finance (VSP) has continued to increase the amount of locked positions and currency prices, which seems to further confirm the market’s preference for revenue aggregation agreements . Defipulse data shows that since its official launch on February 17, Vesper's lock-up volume has risen by more than 2500% in less than 40 days, breaking through $1 billion, and ranking tenth; its native token VSP has risen by 29 times during the same period (and Compared with the opening price of $2.50 on the Sushiswap platform) , it reached the highest level since its issuance.

(Since its official launch on February 17, Vesper Finance's lock-up volume performance )

Compared with the narratives of Badger Dao (introducing Bitcoin into DeFi) and Alpha Homora (leverage mining), what story does Vesper tell? Is its rapid rise just because it provides revenue aggregation functions? From the perspective of operating mechanism and token economics, will take you quickly to understand the booming Vesper Finance.

1. What is Vesper Finance?

According to the official definition, Vesper Finance is a DeFi platform focused on ease of use, designed to provide users with a simple and easy-to-use experience and lower the investment threshold for entering the DeFi world.

Simply understand, Vesper Finance is an income aggregator, which is characterized by simplifying the way users invest. This is mainly manifested in the fact that Vesper has designed two pools of "radical" and "conservative" to facilitate investors to invest according to their own risk appetite; at the same time, its application interface also provides users with 8 language choices including Chinese, English and Japanese, which reduces Investment complexity.

Vesper Finance was incubated by blockchain infrastructure company Bloq, whose founder was early Bitcoin developer Jeff Garzik. In December last year, Vesper officially started testing, and over 700 users invested $25 million in the pool within 2 months.

As of February 15, two days before Vesper was officially launched, the official team announced that it had completed 2.5 million US dollars in financing. Investors included 8 companies including A195 Capital, CMT Digital, Kenetic Capital, Digital Strategies, and HCM Capital (founded by the parent company of Foxconn Group). Institutions, as well as individual investors such as Robert Leshner (founder of Compound), Ryan Selkis (founder of Messari) and Meltem Demirors (chief strategy officer of CoinShares).

2. Operation mechanism

Is reducing investment complexity the fundamental reason for Vesper's success in attracting capital and users? The answer may be hidden in the operating mechanism.

Vesper’s core product is “Grow Pools”. We already know that its design is “conservative” and “radical” strategy pools. The former supports a higher mortgage rate, and liquidity only flows into MakerDAO, Aave, Compound, etc. Audited agreements; the latter ("aggressive" pool) allows users to increase revenue with a lower mortgage rate and maximized capital efficiency, most of which interact with new agreements or unaudited agreements (such as Harvest).

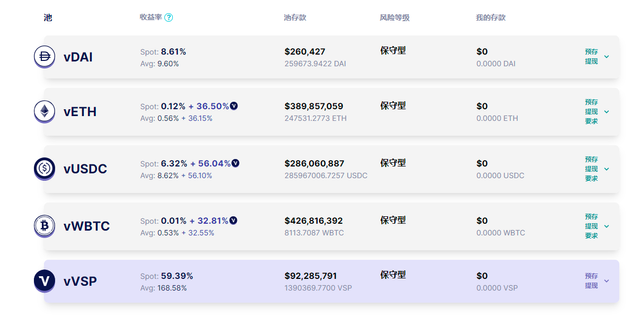

In contrast, if the market fluctuates sharply, the "radical" pool is more likely to trigger liquidation, but the returns are also higher. Vesper currently only launches a "conservative" strategy pool, involving currencies including DAI, ETH, USDC, WBTC and VSP.

(Vesper "conservative" strategy pool)

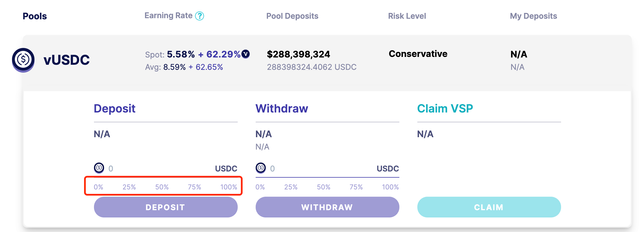

When users use Vesper, they can choose a strategy pool based on the rate of return, and of course, they can also invest their assets in multiple pools. Thereafter, Vesper will deploy the aggregated liquidity to DeFi protocols such as Aave and Compound to generate revenue.

(Users can choose to put some assets into the pool)

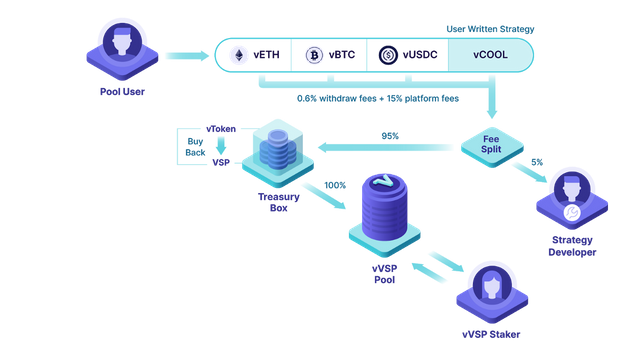

When a user decides to withdraw funds, Vesper will charge two parts: 0.6% withdrawal fee and 15% platform fee. 95% of these fees are used to repurchase VSP, and the remaining 5% are allocated to strategy developers.

for example:

• A strategy pool with a total withdrawal volume of US$50 million and a cumulative return of US$5 million will translate into a fee of US$1.05 million;

(The 0.6% withdrawal fee is US$300,000, and the 15% platform fee is US$750,000. The two incurred a total cost of US$1.05 million)

• The $1.05 million will be sent to Treasury Box, and then VSP will be repurchased on the open market;

• Of the US$1.05 million, 95% will be allocated to vVSP pool participants (US$997,500) (that is, the repurchased VSP will be put into the vVSP pool again to increase the holder’s income) ;

• The remaining 5% is allocated to the strategy developer who designed the pool ($52,500).

The Vesper operating mechanism combines VSP holders and policy pool users.

All the fees generated by the Vesper platform will be sent to the treasury (also known as the Treasury Box) for the repurchase of VSP in the open market. This not only encourages users to use the product for a long time, but also provides upward momentum for the token's performance in the secondary market and promotes currency holding People hold assets for a long time.

In general, VSP tokens have become the engine that drives the operation of Vesper, and this may be an important reason for its lock-up volume and token price soaring.

3. VSP tokens

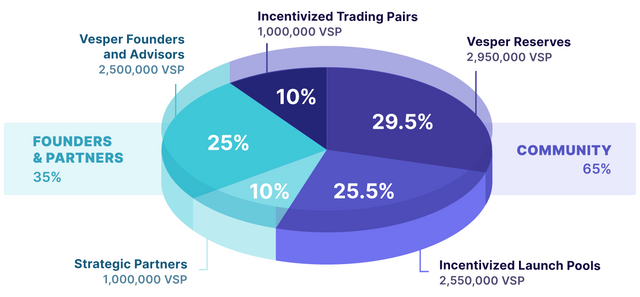

The total number of VSP tokens is 10 million, of which 65% (6.5 million) are allocated to the community, and the remaining 35% (3.5 million) are allocated to the Vesper team, consultants and strategic partners.

Specifically:

• Launch pool (2.55 million VSPs)

Participants of the test version will allocate 450,000 VSPs and airdrop when VSP tokens are released (the final airdrop is 300,000 VSPs);

2.1 million pieces will be allocated in the next 12 months, with a larger share in the first three months;

• Reserve (2.95 million VSP)

Reserve funds are used for community building and incentives;

• Liquidity provider (1 million VSP)

Used to incentivize liquidity providers on Uniswap, SushiSwap and Loopring platforms;

• Team and consultants (2.5 million VSPs)

208333 tokens will be released when they go online;

2,291,667 tokens will be released linearly within 11 months after the platform is officially launched;

• Strategic partner (1 million VSP)

83,333 tokens will be released upon launch;

916,667 tokens will be released linearly within 11 months after the official launch of the platform.

It is estimated that one year after Vesper goes live, the circulation of VSP tokens will account for 70% to 80% of the total supply. According to the official, the community can vote to change the VSP supply.

According to official Vesper data, the current price of a single VSP is US$74.71, the circulating volume is 2,174,159 (21% of the total supply), and the market value exceeds US$160 million. The number of tokens repurchased and put into the vVSP pool in the past 24 hours is 508 Pieces.

Fourth, the conclusion

On the whole, Vesper learns from Sushiswap and uses the repurchase of native tokens to incentivize users and token holders to build a community. According to the official Twitter, the Vesper team plans to achieve complete communityization after the platform has been running for 6 months or a year.

In terms of product design, in addition to the Grow Pool mentioned above, Vesper also plans to launch Earn Pool, allowing users to deposit one token to obtain another token. This is a unique revenue strategy that is not common in the current DeFi market.

This post was resteemed by @steemvote and received a 2.31% Upvote. Send 0.5 SBD or STEEM to @steemvote

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit