Source: CryptoCompare

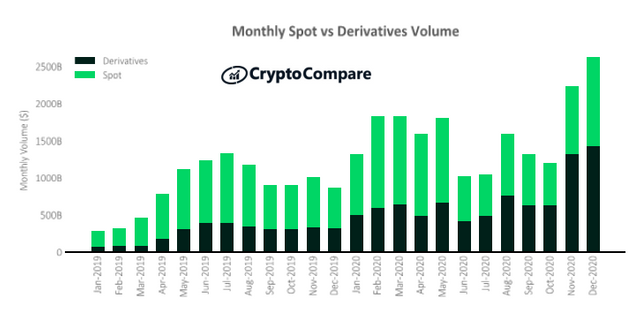

1. The volume of derivatives trading hit new monthly highs.

In December, derivatives trading volume increased 8.6%, hitting a record monthly high of US $ 1.43 trillion. At the same time, the total number of spot transactions increased by 30%, reaching $ 1.19 trillion. The derivatives market accounts for nearly 54.6% of the entire crypto market.

2. The share of the top exchange markets is constantly expanding, refreshing the highest single-day trading volume in history.

In December, trading volume on the major exchanges increased 32.2% to US $ 818.3 billion, and trading volume on other exchanges increased 23.8% to US $ 355.7 billion. The top exchange trading volume currently accounts for 69.7% of the total trading volume.

On December 17, the maximum daily trading volume of the top exchanges was $ 51.2 billion, a record high.

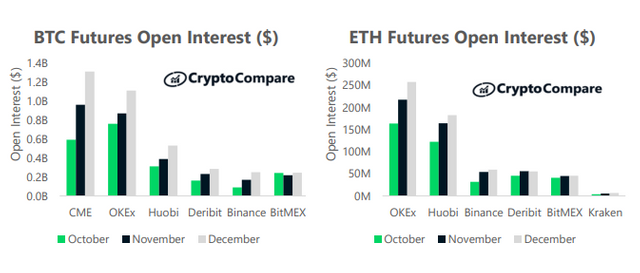

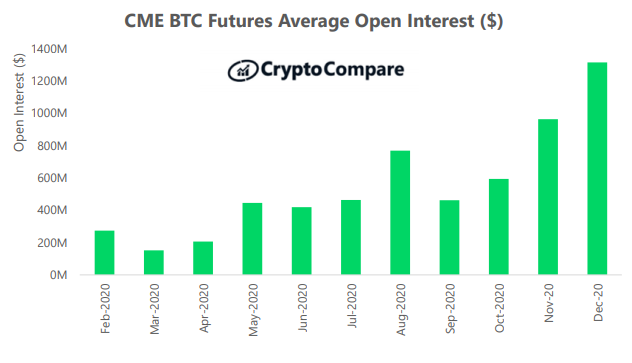

3. CME December BTC futures has the highest open interest.

CME had the highest open interest in BTC futures at USD 1.31 billion (up 37.5%), followed by OKEx at USD 1.11 billion (up 27.6%).

However, among all the futures products of various cryptocurrencies, OKEx had the highest open interest at US $ 1.8 billion (up 0.6% from November), followed by Binance (US $ 1.7 billion, down 20%) and CME. (1.3 billion US dollars, an increase of 36.5%).

02

Exchange benchmark analysis

CryptoCompare exchange benchmarks aim to assess the exchange's transparency, operational quality, regulatory status, data provision, management team, and its ability to effectively monitor illegal transactions and activities.

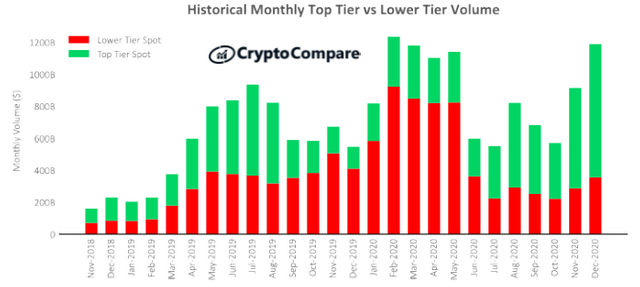

Monthly trading volume of the top exchanges and other exchanges

In December, trading volume on the major exchanges increased 32.2% to US $ 818.3 billion, and trading volume on other exchanges increased 23.8% to US $ 355.7 billion. The top exchange trading volume currently accounts for 69.7% of the total trading volume (68.29% in November).

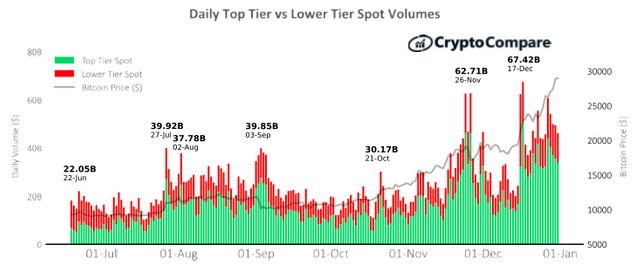

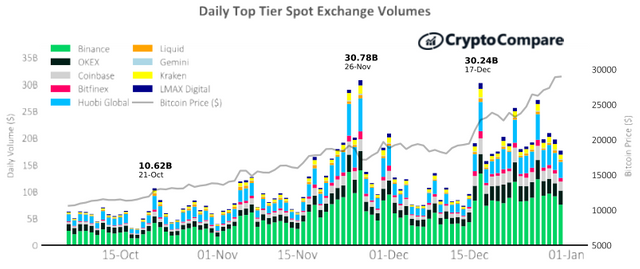

Daily spot trading volume of the top exchanges and other exchanges

As Bitcoin gradually surpassed $ 40,000, trading activity on all spot markets increased throughout December. After the Bitcoin price rose sharply, the daily trading volume on December 17 reached 67.42 billion US dollars (7.5% higher than the highest daily trading volume of 62.71 billion US dollars in November).

Despite the surge in trading volume, the daily spot trading volume did not set a new record because the trading volume on March 13, 2020 reached the upper limit of 72.5 billion US dollars.

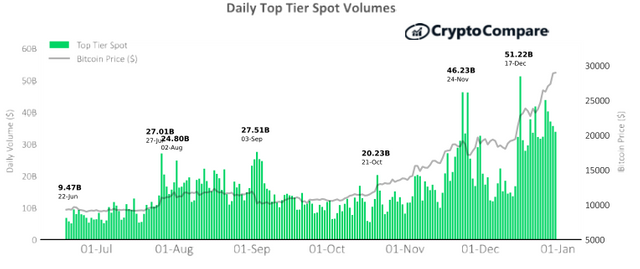

On December 17, the highest daily trading volume of the top exchanges was US $ 51.2 billion, a record high. The previous record was $ 46.2 billion in transactions on Nov. 24.

Daily spot trading volume on the top exchanges

03

Macro analysis and market segmentation

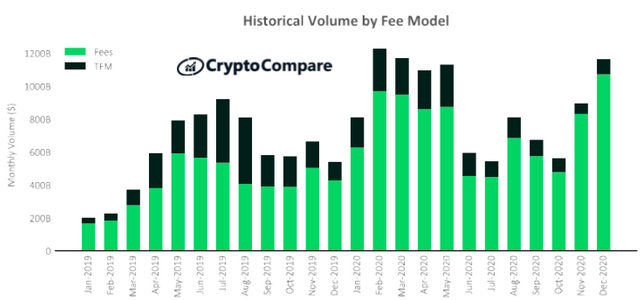

Historical transaction volume based on a cost model

In December, exchanges that charge traditional fees accounted for 92.12% of the total exchange transaction volume (92.91% in November), while exchanges using the reward transaction mining model (TFM) contributed less than 7.88%.

The total transaction volume on a fee-based exchange was US $ 1072.2 billion (an increase of 28.9% since November), while the total transaction volume of exchanges adopting the TFM model was US $ 91.7 billion (an increase of 44.5% since November).

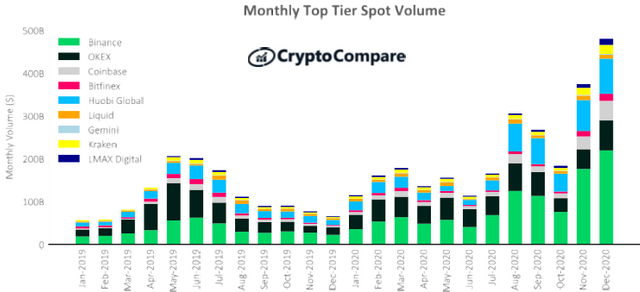

Monthly spot trading volume on the top exchanges

In December, the trading volume of the top 15 exchanges increased by an average of 32% compared to November.

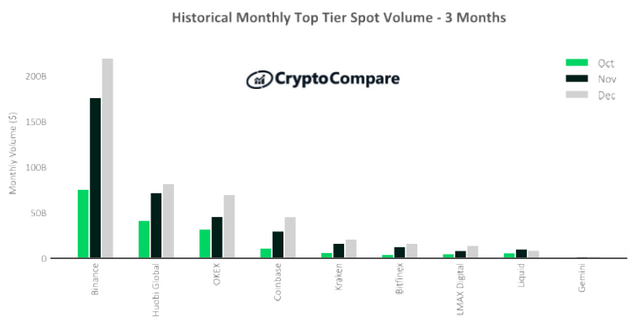

Historical monthly spot trading volume on the top exchanges in the last three months

As of December, Binance (A) was the top exchange by the largest trading volume, with a trading volume of US $ 219.6 billion (up 25%); followed by Huobi Global (BB) with a trading volume of US $ 81.9 billion (up 14%)); OKEx (BB), with a transaction volume of US $ 70 billion (an increase of 52%).

Followed by Coinbase (AA), Kraken (A) and Bitfinex (A) with USD 45.7 billion (up 53%), USD 21.1 billion (up 28%) and USD 16.6 billion (up 29%).

Daily spot trading volume on the top exchanges

Compared to other top payouts easily, Binance (A), OKEx (B) and Huobi Global (B) from terms of transaction volume are still the top ranking exchanges. Among the top 15 exchanges, they account for about 70% of the total trading volume (73% in November).

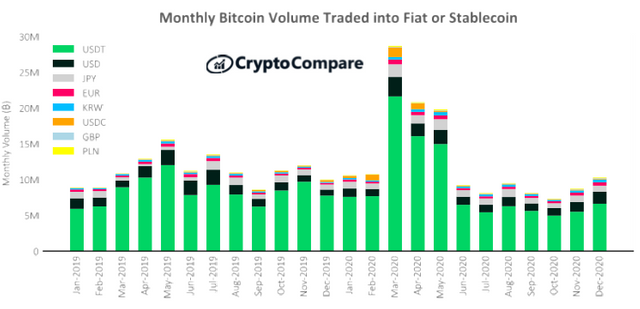

Trading volume of Bitcoin and fiat currencies

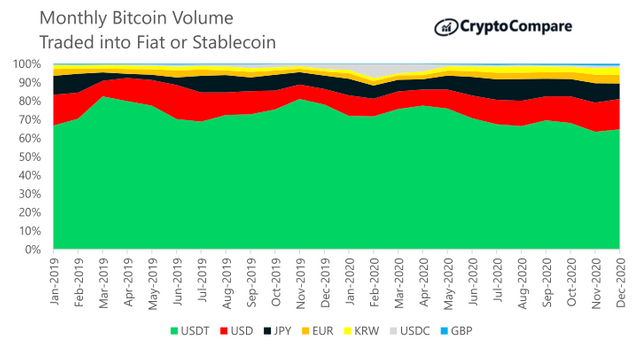

Stable monthly Bitcoin and fiat currency or currency transaction volume

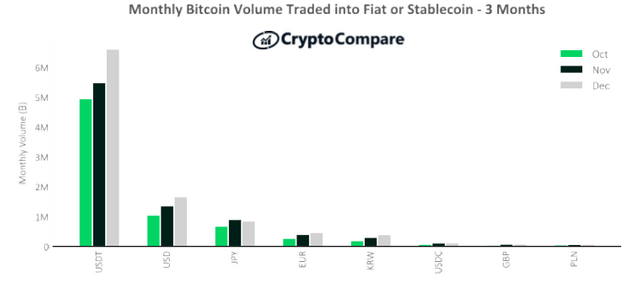

In December, the trading volume of BTC-USDT increased by 20.5%, reaching 6.62 million BTC, compared to 5.49 million BTC in November. The trading volume against the US dollar increased to 1.67 million BTC (up 22.4%); trading volume against the Japanese yen fell to 850,000 BTC (down 5.7%); trading volume against the euro increased by 16.5%; the trading volume against the Korean won increased by 30.3%.

BTC / USDC and BTC / PAX trade 120,000 BTC (up 1.8%) and 20,000 BTC (up 8.5%), respectively on the stablecoin market.

Monthly Bitcoin and Fiat Currencies or Stable Currency Trading Volume - Last March

Stable monthly Bitcoin and fiat currency or currency transaction volume

The BTC / USDT trading pair still accounts for the majority of BTC transactions, at 63.0%, and accounts for 61.8% of the total in November.

04

Derivatives

Monthly spot and derivatives trading volume

Derivatives trading volume increased 8.6% in December, reaching an all-time high of $ 1.43 trillion. At the same time, the total spot transaction volume increased 30% to US $ 1.19 trillion. The derivatives market currently accounts for around 54.6% of the entire crypto market (60% in November).

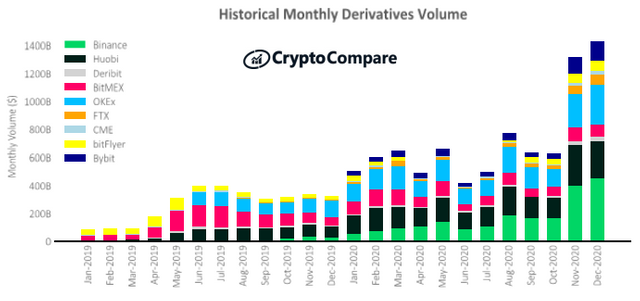

Historical monthly derivatives trading volume

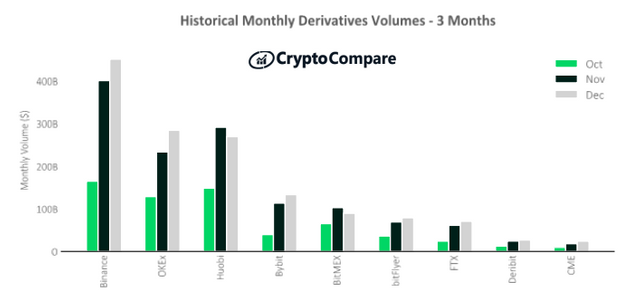

Historical monthly derivatives trading volume-past three months

Binance was the largest derivatives exchange by trading volume in December, with a monthly trading volume of US $ 451 billion (up 12.5% since November).

OKEx (up 21.8%), Huobi (down 7.6%) and Bybit (up 17.5%) followed by trading volumes of $ 284.2 billion, $ 269.3 billion and $ 133.2 billion, respectively. .

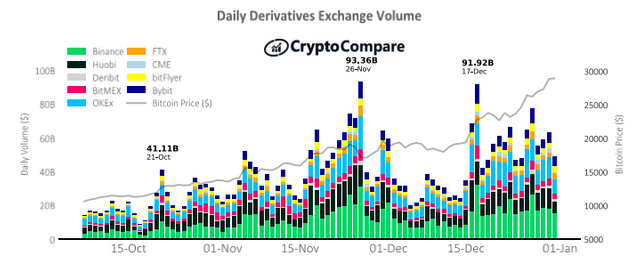

Daily trading volume of derivative exchange

On December 17, the derivatives exchange set the highest one-day trading volume in a month at US $ 91.92 billion. While the amount was enormous, it didn't break the $ 93.36 billion record set in November. Binance's top 4 exchanges, OKEx, Huobi and Bybit account for 76.8% of the day's trading volume.

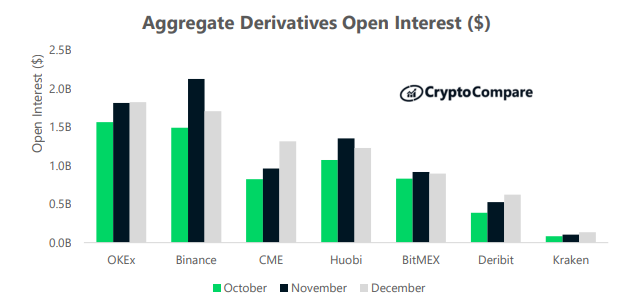

Open position

In December, OKEx had the highest amount of open interest among all derivatives, at US $ 1.8 billion (up 0.6% from November). This is followed by Binance ($ 1.7 billion, down 20%) and CME ($ 1.3 billion, up 36.5%).

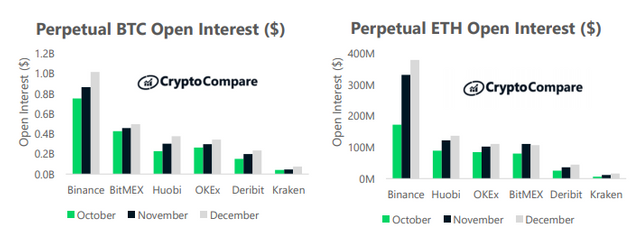

Open a derivative contract

In terms of BTC perpetual contracts, Binance had the highest amount of open interest at US $ 1.02 billion (up 17.4%), followed by BitMEX with US $ 498 million (up 8.7%). Binance also has the highest open interest in ETH perpetual contracts, with USD 379 million (up 14.4%), followed by Huobi with USD 137 million (up 11.7%).

Perpetual contract BTC (USD) ETH perpetual contract (USD)

Open interest BTC (USD) Open interest ETH (USD)

At the same time, CME, a regulated futures exchange, had the highest open interest on BTC at $ 1.31 billion (up 36.5%), followed by OKEx at $ 1.11 billion (up 27.6%). OKEx had the highest volume of open ETH contracts at $ 258 million (up 18%), followed by Huobi with $ 183 million (up 11%).

05

CME trading volume and open positions

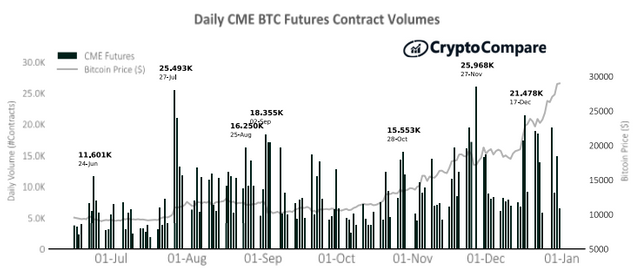

Daily trading volume of CME BTC contracts

On December 17, the trading volume for BTC futures contracts on the Chicago Mercantile Exchange (CME) reached 21,478, setting the highest one-day trading volume this month.

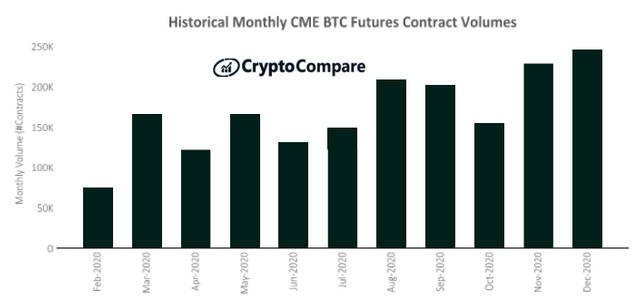

Historical monthly CME BTC contract trading volume

In terms of monthly contract volume, around 246,000 contracts were traded in December (up 7.5% since November).

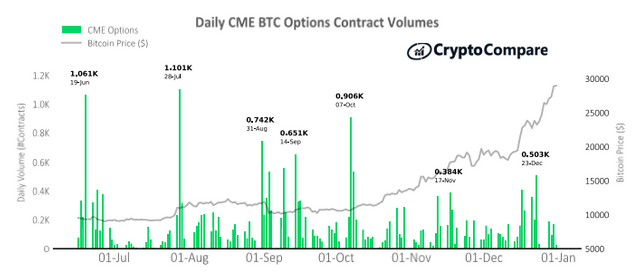

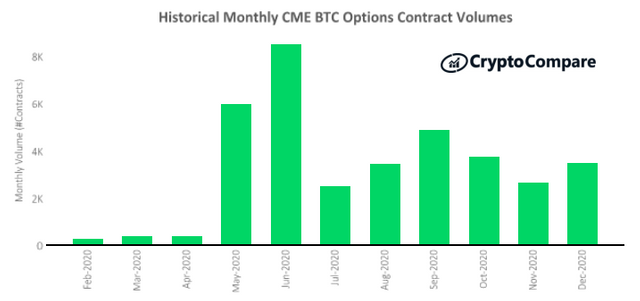

Daily CME BTC options contract volume

December The volume of Chicago Mercantile Exchange options contracts increased by 30.3%, to 3476 options trading on December 23, the volume of contracts reached the highest daily trading volume of 503.

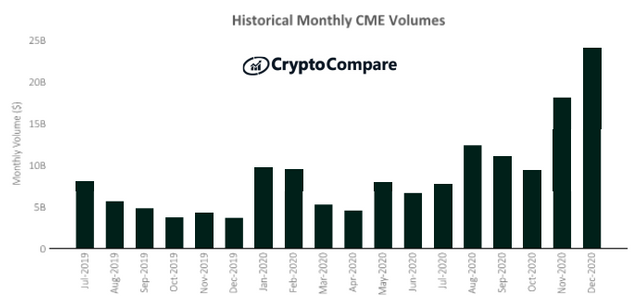

Historical monthly CME contract trading volume

In terms of total US dollar trading volume, the trading volume of CME crypto derivatives increased 32.9% in December, reaching $ 24 billion.

Historical monthly CME trading volume

In December, the CME's average open positions increased 37.5% to $ 1.31 billion.

CME BTC average open interest rate

End