If you look back at what happened in the cryptocurrency industry in the past few months, you will find that the market is very optimistic. Narrative is important, but the data will not lie, so we decided to spend some time using data to show the growth of the cryptocurrency industry during this period.

Not much nonsense, let us quickly take a look at what has changed in the structure of the cryptocurrency market.

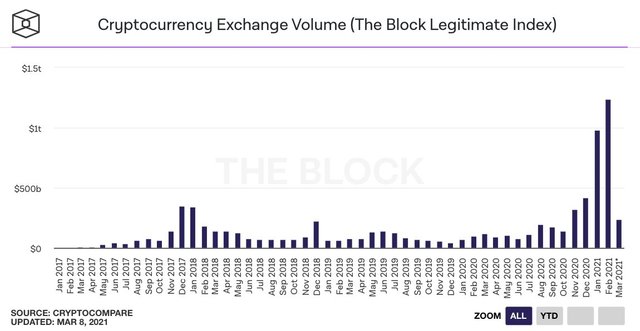

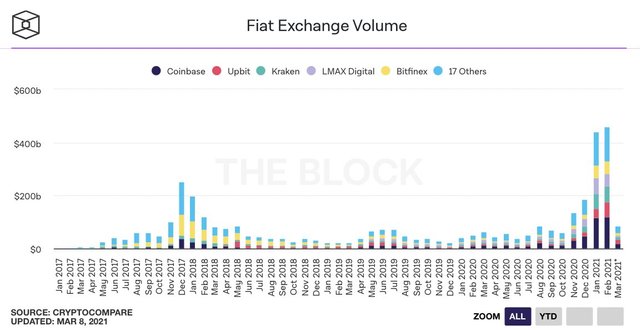

In February, the volume of cryptocurrency spot transactions reached a record high, exceeding $1 trillion, more than three times higher than the highest level in 2017. Among the cryptocurrency exchanges that support fiat currency trading, Coinbase is far ahead in terms of transaction volume, followed by Kraken, Upbit, LMAX Digital, and Bitfinex.

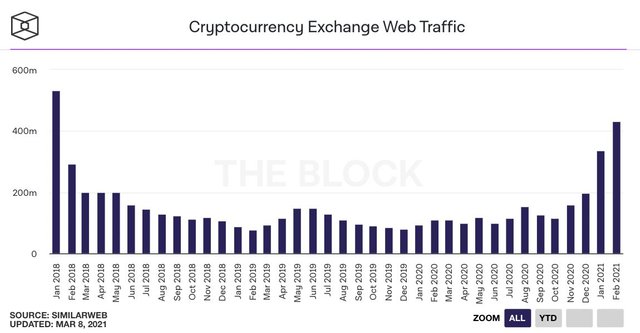

However, in February this year, the network traffic of cryptocurrency exchanges reached 432 million, of which 56% came from the two exchanges of Binance and Coinbase, which was 20% lower than in January 2018. This indicator shows that this market rebound is mainly driven by institutional capital, and there are not too many retail investors participating.

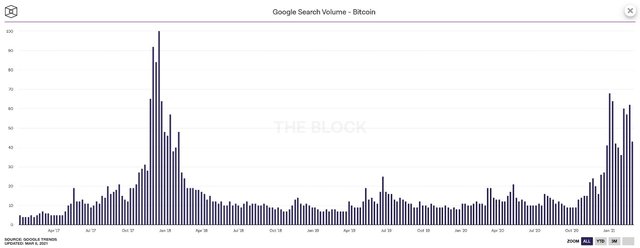

In addition, Google's Bitcoin search volume is still lower than the highest level set in 2017, but the Ethereum search volume is higher than the search volume at the historical peak in 2017.

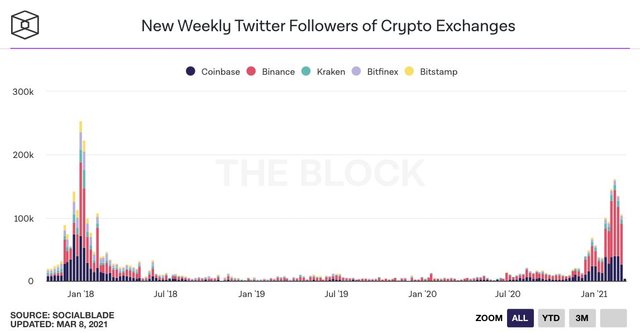

From the number of new followers on Twitter on cryptocurrency exchanges, it can also be seen that retail investors in this bull market are less involved, and the current number has not reached the level of 2017.

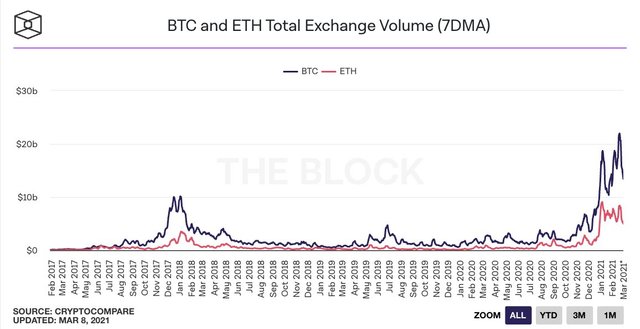

For most of the time, Bitcoin transaction volume is three times that of Ethereum, and liquidity is at least three times that.

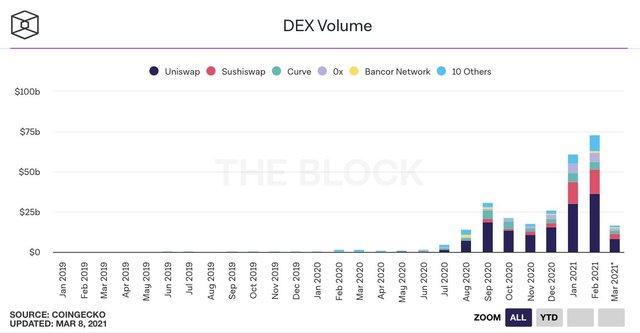

Decentralized exchanges recorded a transaction volume of $73 billion, accounting for about 7% of the total cryptocurrency spot transaction volume, of which Uniswap transaction volume accounted for the highest proportion, exceeding 50%.

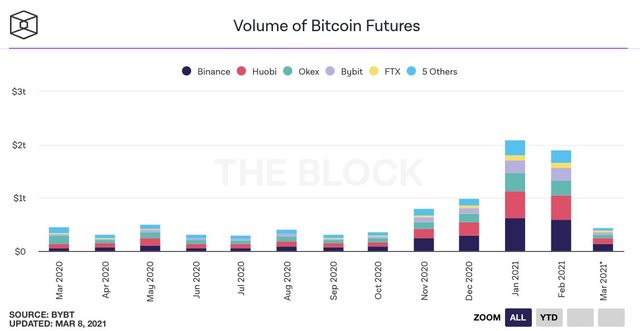

The open interest of Bitcoin futures is about 15 billion U.S. dollars, more than four times that of a year ago. Among them, the four cryptocurrency exchanges with the largest transaction volume of Bitcoin futures are: Binance, OKEx, Bybit and CME, BitMEX It has fallen behind now.

Similar to bitcoin spot trading, bitcoin futures trading volume is also much higher than the past two months, basically hovering at 2 trillion US dollars in February, which is about twice the spot trading volume.

Many people like to share the chart below. Some people think that hedge funds are shorting Bitcoin. But in fact, hedge funds are only involved in some basic transactions, such as holding long bitcoin spot, holding short CME Group bitcoin futures contracts and receiving income, nothing more. Profit margins are now lower than last month, so short positions have decreased.

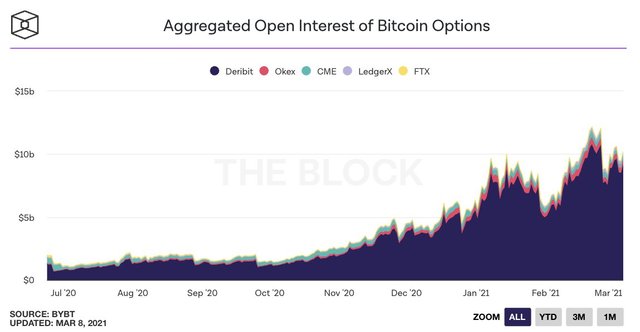

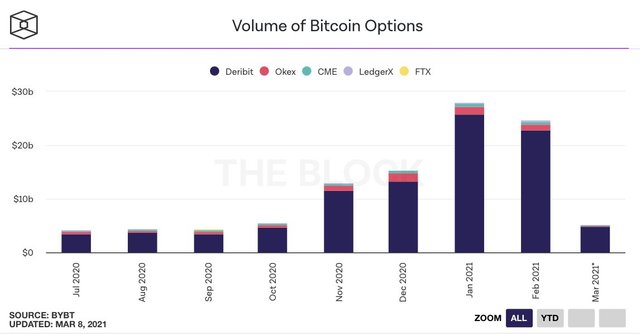

Bitcoin options have also achieved tremendous growth in the past year-so far, large options have played a significant role in Bitcoin price discovery. In terms of market share, Derbit still leads the pack, with open interest not less than twice that of futures.

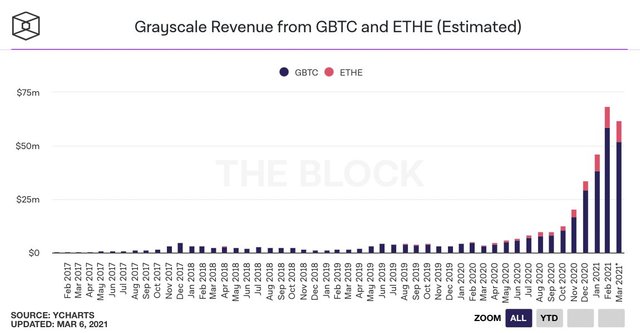

Now, Grayscale seems to have entered a "money tree" model-it can generate $70 million in revenue per month through fees alone, and because there is no redemption mechanism, this situation is unlikely to change. Grayscale now has 655,500 Bitcoin and 3.17 million Ethereum.

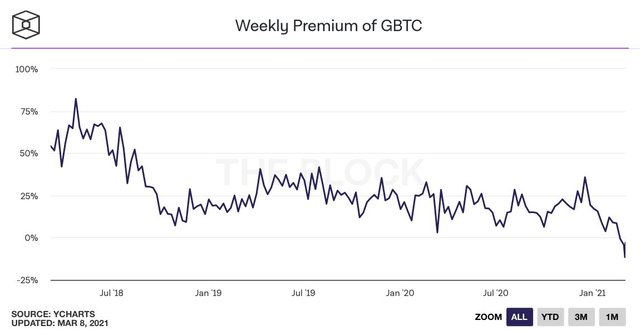

As there is no redemption mechanism, the premium of Grayscale Bitcoin Trust Fund GBTC has begun to fall in recent weeks and is now negative. This situation occurs mainly because the fund has been using hundreds of millions of dollars to reduce premiums, and now there are alternative methods of gaining risk exposure.

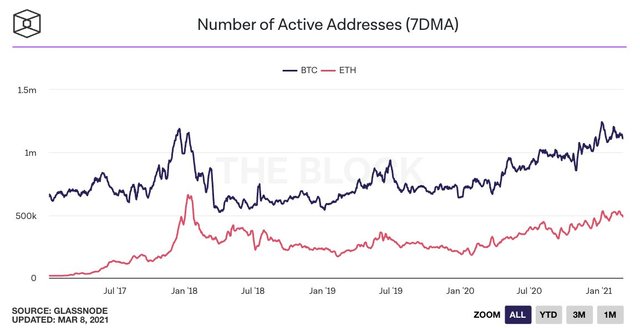

Now, let's take a look at the data on the chain. The average number of daily active addresses for Bitcoin has reached 1.1 million, and the average number of daily active addresses for Ethereum is about 500,000.

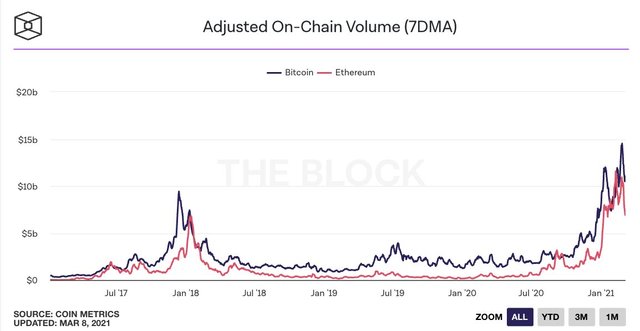

Bitcoin's daily settlement amount is about 10 billion U.S. dollars, while Ethereum is currently about 7 billion U.S. dollars.

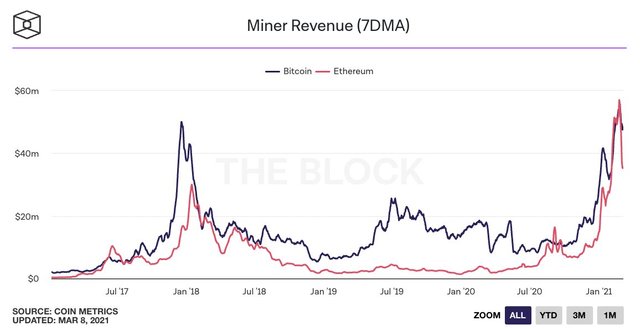

Bitcoin and Ethereum mining industries are also becoming larger and larger. In the past few weeks, Bitcoin and Ethereum miners have earned more than $50 million in daily income.

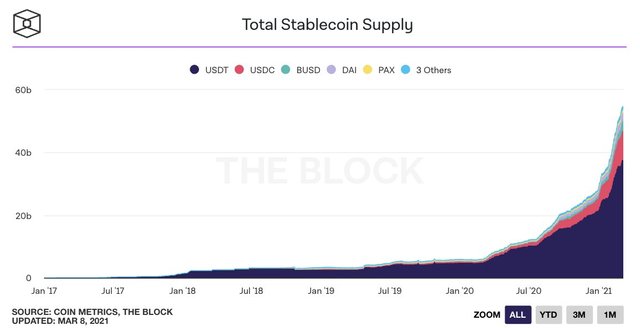

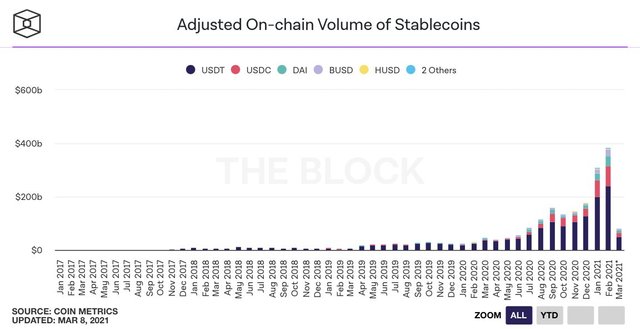

There are now more than US$50 billion worth of stablecoins. Although stablecoins are still mainly used by traders, the settlement amount of stablecoins has reached US$380 billion in the last month alone, which is the third of the total settlement amount last year. More than one part.

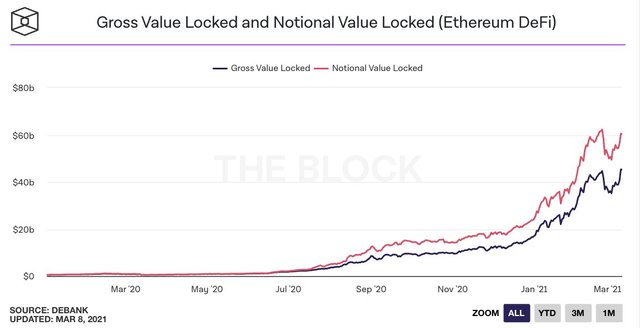

Now the total lock-up volume of DeFi has exceeded US$45 billion. Although the total lock-up volume is not an absolutely perfect indicator, it still allows us to compare different DeFi categories to see which categories have achieved product market fit. In fact, it is not surprising that the lock-up volume of the decentralized exchange DEX is about 20 billion U.S. dollars, and the lock-up volume of the loan agreement is about 17.5 billion U.S. dollars. These two categories are currently in a leading position.

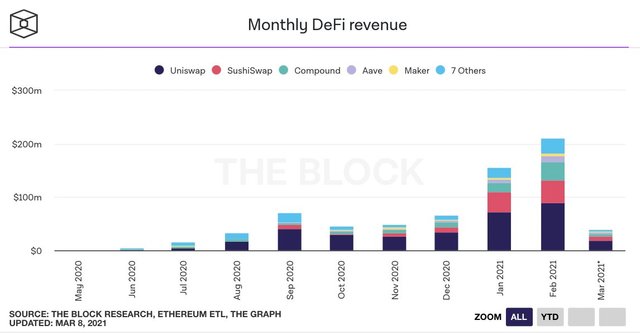

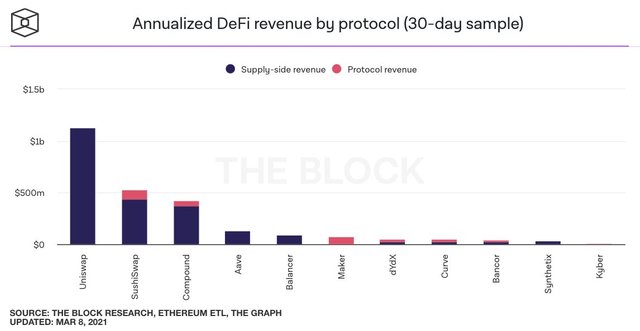

Now, the DeFi protocol generates $210 million in revenue every month, most of which is not distributed to token holders-only about 15%. Uniswap is in a leading position in terms of supplier revenue, and SushiSwap, Maker and Compound are in a leading position in terms of agreement revenue.

NFT is definitely a blockbuster this year. Two weeks ago, the weekly transaction volume of NFT projects had reached 200 million US dollars-mainly dominated by NBA Top Shot and CryptoPunks.

In terms of the number of users, because it is not limited by the scalability of Ethereum, NBA Top Shot occupies a dominant position. Last week, the number of NBA Top Shot users exceeded 350,000, followed by Axie Infinity with 8,200; CryptoPunks has a number of users. 1200.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit