On March 2, Cointelegraph sent an alert: Tesla Motors founder Elon Musk's wife and musician Claire Elise Boucher (Grimes) sold value on Nifty Gateway in less than 20 minutes 5.8 million USD digital artwork.

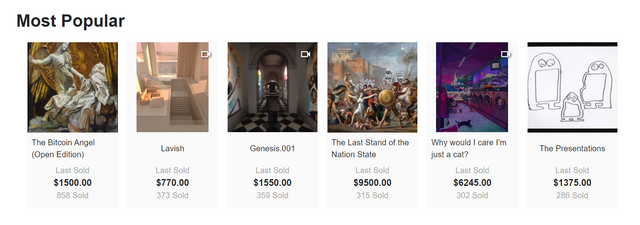

So what do these digital artworks look like? The author has intercepted parts from Nifty Gateway for readers' reference:

When you click in, you may be shocked by the exquisiteness of these paintings, and you may also have questions about "What is the difference between this and the photo? Why can this photo be sold at such a high price".

First of all, there is no physical object of this painting in reality. The painting exists on the Ethereum chain and is tokenized, that is, the collector has the sole right of the painting, and the ownership of the painting can also be transferred to others.

Secondly, the value of a painting is a thousand Hamlet. For some high-priced paintings, how many marketing promoters are behind them to increase their value, it is impossible to know that the painter also has to live. The most important thing is that this painting does have value.

Finally, standing on top of the vent, this kind of digital artwork, dubbed "NFT", is sought after by the market. Everyone hopes that the NFT they hold can make them get better returns, and any item is linked to value , Hype and incitement are inevitable.

So, how should NFT measure its value? What specific investment opportunities are there? This needs to start with understanding the concept of NFT:

In the field of blockchain, from the perspective of exchangeability, tokens can be divided into two types: homogenization and non-homogeneity.

Homogeneous tokens, namely FT (FungibleToken), use ERC20 as the basic standard, and are mutually replaceable and nearly infinitely split Tokens. However, homogenized tokens have limitations. In real life, things that are truly valuable are often irreplaceable and cannot be split indefinitely. Unique assets cannot be anchored with homogenized tokens.

The non-fungible token NFT (Non-FungibleToken) is the only and inseparable token, such as tokenized game props, tickets, artwork, etc. NFT uses ERC721 as the standard, and then the ERC1155 protocol appeared, that is, each ID represents not a single asset, but a category of assets, allowing multiple tokens to be created in batches at once.

What are the common types of NFT?

In theory, NFT has a wide range of uses, and many articles are also involved. Some possible NFT scenarios:

- Art market

- Digital collectibles, blockchain develops digital collectibles in games and collection card types such as electronic star cards

- Virtual props and characters in the game

- Domain Application

- The insurance sector uses NFT as an insurance policy

- Prediction market

- Bills in the supply chain system

- DeFi + NFT mortgage mining gameplay

- Real-world physical assets, such as NFTization of real estate assets

- Confirmation of personal information

- Software Agreement

- Tickets, admission tickets, etc.

Due to the broad definition of NFT, there is still more room for expansion or falsification in the future. It is worth mentioning that scarcity is not the most important feature of NFT. NFT is not just used for trading. As many people mistakenly think, it is ready to rise, just because the current use of NFT is more concentrated in collectibles and games. NFT assets and other fields, coupled with the DeFi boom some time ago, have led to the understanding of NFT often adding some speculative factors.

What are the mainstream NFT projects in the current market?

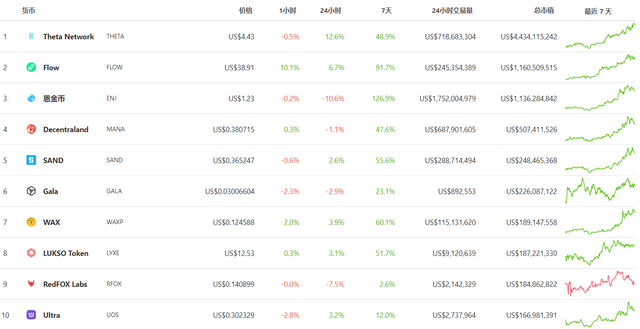

According to the information on coingecko, the current well-known NFT project is basically active on the Ethereum chain. The current 24h transaction volume of the old project THETA is as high as 700 million U.S. dollars, and the market value has also increased significantly in the near future:

According to the industry media, a more comprehensive NFT ecological portrait:

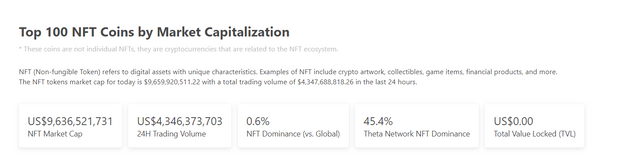

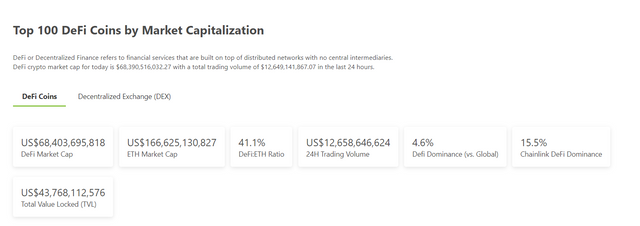

However, we also need to face up to the problem that NFT is still in the early stage of development. Compared with the current overall encryption market, the overall market value of NFT is small, and there is a big gap with the current thriving DeFi market:

However, we also need to face up to the problem that NFT is still in the early stage of development. Compared with the current overall encryption market, the overall market value of NFT is small, and there is a big gap with the current thriving DeFi market:

How to participate & get NFT?

Disassembling the NFT, you can get the most important features:

- Rely on blockchain. NFT must be issued on the blockchain.

- Need to use some kind of agreement, even if it is a self-created agreement.

- NFT has a known issuer, although there are a large number of scammers trying to deceive, but it can be compared by address

- NFT is not necessarily scarce. The issuance of NFTs can theoretically be unlimited. Of course, in current practice, there is often an upper limit set.

- NFT can carry out transaction circulation like qualitative tokens, unless the issuance contract adds restrictions.

Buying and selling NFT on the trading market is the simplest and most common way to participate in the NFT track. This kind of gameplay is equivalent to moving the collection and sale of artworks offline to online.

buy

Regarding how to purchase NFTs, there are many conventional NFT platforms like OpenSea and Rarible on Ethereum, which integrate NFTs in the ecosystem, and players can purchase various NFT assets on their application interfaces. There are also some specialized NFT markets, such as SuperRare and Nifty Gateway, which specifically target NFT encrypted artworks. In addition, the corresponding NFT assets can also be purchased through the official website of the NFT product.

Platforms like OpenSea support multiple token settlements, but mainly settle in ETH. Therefore, you also need to download wallet plugins like MetaMask. When you have your funds and wallet ready, you can buy NFT, choose a platform, connect to the wallet, and start your NFT collection journey.

The previous article also listed the current hot NFT projects, you can directly trade the tokens of the project on DEX or CEX.

Borrowing + liquidity mining

Currently there is also a NFT+DeFi gameplay. NFT holders mortgage their NFT on an NFT mortgage lending platform like NFTfi to lend cryptocurrency. The significance of this gameplay is that users can lend cryptocurrency to users who pledge NFT assets in a P2P manner, and earn interest on this basis. If the borrower defaults, users can obtain their mortgaged NFT assets. If users already hold NFT assets, they can mortgage their assets for mining on platforms like Aavegotchi to obtain platform rewards.

Index fund

NFT index funds make it easier to invest in NFTs. The most representative one is NFTX, which is a platform for generating ERC-20 tokens backed by NFT collectibles on the Ethereum blockchain. These tokens It is called a fund (Fund). And (like all ERC20) they are replaceable and composable. With NFTX, you can create and trade funds based on your favorite collectibles from DEXs like Uniswap, such as CryptoPunks, Axies, CryptoKitties, and Avastars.

The value of NFT

Regarding the value of NFT, Li Qiwei in "What is the real value of NFT? "Mentioned in the article:

The NFT must have its own value, but can it be said that the entire value of the work "Mona Lisa" has been transferred to the NFT? I don't think it is. If everyone can copy the "Mona Lisa" perfectly on their own walls, it means that most people don't really care whether they need to have a so-called "certificate of authenticity."

For collectors, owning part of the value of collections can only be said to bring them a prestige of "I own and can display my collection", and "I am unique. No one in the world can do this." a little". NFT reduced this value and became-"I have a certificate of authenticity for this work, and it is unique. No one in the world can do this."

Therefore, NFT is a unique proof of authenticity behind the collection, and it cannot represent the full value of the collection. In the process of holding NFT, users should also pay attention to the liquidity of NFT, because the value of NFT is very subjective, depends on its attractiveness to other investors, and its liquidity is poor, users need to do a long-term holding Preparation.

to sum up

NFT's current market value is small, but the industry is becoming more and more active. The landing application scenarios are mainly game props, encrypted artwork, and social tokens. The uniqueness and scarcity of NFT make it very suitable for marking the ownership of assets in the blockchain, and truly realize the connection between digital assets and real assets in the virtual world.

However, the market price of NFTs is more subjective. In the process of holding, users need to consider holding costs, circulation risks and make reasonable investments. According to their own risk preferences, select reasonable NFT investment methods and correctly participate in the NFT development bonus period.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit