In a new report on market conditions, Santiment, a cryptanalysis company, said that holders of Bitcoin and major e-currencies appear to be bracing for a rebound.

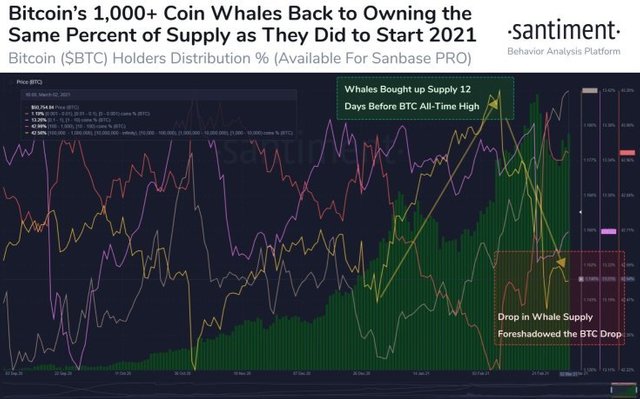

Santiment said that individuals holding 1,000 or more bitcoins dominate the BTC market and have a larger share of the BTC market, suggesting that the whales may be on the verge of a strong upside reversal.

The largest Bitcoin holder (1,000 + BTC) currently holds 42.56% of the total supply. Previously, it had 43.29% (54-week high) as of February 8, pushing its record high in February. "A return rate of more than 43% would suggest that the whales are looking for a new round of momentum for a rebound."

Whales also eat most of the ether supply, reports Santimont.

"Etalum's top ten non-exchange whale addresses are now the venues with the largest total supply of ETH tokens (16.86 million) since July 2016." On March 1, 103 million tokens were added to this address. This is the highest one day increase in 6 weeks! "

Although the whales appear to be preparing the first and second top crypto assets to make a path to new heights, Santimonte's data shows Polygon (Majiqi) (formerly Majiqi), blockchain game coin Enjin (ENJ), blockchain governance token Theta TheUEL (TFUEL) and Xinfeng (XDC) ) has performed better than all other crypto assets, especially BTC.

"As we continued to see Bitcoin trying to break another $ 50,000 (it happened briefly yesterday), the volatility of Bitcoin has continued, so most Altcoins won first place. Crypto assets." Several projects such as Majiqi, ENJ, TFUEL and XDCE are the main foundation. "

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit