The future is here, even if "312" once again surprises the black swan, please believe that Bitcoin is no longer the Bitcoin it used to be.

2020 is a special year; and March 2020 is the "Black March" that can be recorded in the annals of history. Even the stock god Warren Buffett "exclaimed for a long time." In a sense, March 2020 is a very important watershed in the global economic and financial changes, and in the context of the global financial system being almost "out of control", Bitcoin has led DeFi to emerge suddenly, triggering a "center" The financial system competes with decentralization and decentralization, and deconstruction and reconstruction.

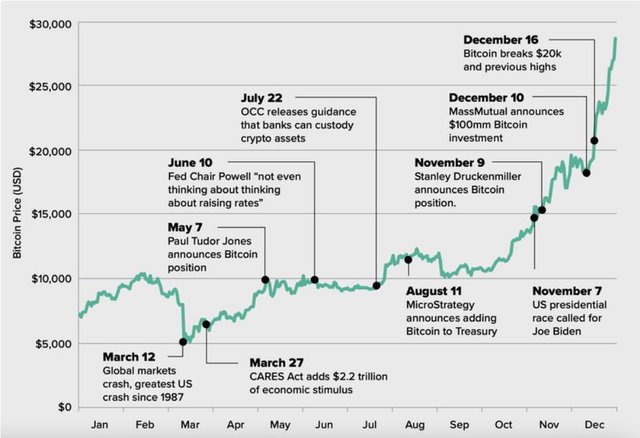

March 12 is the most representative day in the "Black March". On this day last year, the Dow closed down 9.99%, the largest one-day drop since October 1987. The Dow, Nasdaq, and S&P 500 all fell into a technical bear market; Bitcoin plummeted 38.81% from around $8,000. It fell to a minimum of 3858 US dollars the next day.

In a blink of an eye, the "312" of 2021 is coming, and in this short year, the crypto world has undergone major changes. Will history spiral up in "rhyme"? Do coin holders need to be wary of black swan risks again? Are the fundamentals of crypto finance different? This article will review and sort out the important changes in the crypto market in the past year, reveal the underlying reasons for its development and rise, and try to answer these three questions.

Bitcoin under macro changes

Bitcoin under macro changes

In 2020, the global financial market has staged many "live long-lived": In early February 2020, the new crown epidemic broke out on a global scale. On March 2, the Federal Reserve cut interest rates by 50 basis points, and then the world ushered in a wave of "interest rate cuts" by central banks; 3 On the 6th, OPEC and Russia collapsed on cooperation on production cuts. Saudi Arabia launched an oil price war. Coupled with the impact of the epidemic, international crude oil futures prices plummeted to negative values. For a while, “barrels are more expensive than oil”; US stocks fell 4 times in two weeks Buffett couldn’t help but sigh, “I lived to be 89 years old, and I have never seen this kind of scene.” Affected by the plunge in the U.S. stock market, dozens of countries around the world issued restrictions on short selling...

In the meantime, Bitcoin has staged a reversal. Bitcoin first experienced a "312 plunge" and the price was cut in two days. On March 23, the Federal Reserve once again launched a wide range of unlimited quantitative easing measures on the basis of the earlier US$700 billion bond purchase plan. Subsequently, Bitcoin and global assets began to gradually stabilize and rebound, and even hit new highs one after another. The figure below shows the trend of Bitcoin's price increase in 2020 and the major events related to it. Readers can clearly see the relationship between Bitcoin price and "message surface" in the graph.

Grayscale fourth quarter financial report data

Grayscale fourth quarter financial report data

Entering the new year, the world economy seems to be stuck in the haze of 2020. Although the vaccine has been gradually promoted, the virus strains continue to mutate, the new crown epidemic still has no signs of being completely contained, and the recovery of the world economy will still take some time. On March 7, 2021, the U.S. Senate passed an amendment to the US$1.9 trillion New Crown Relief Act, and a round of flooding will soon follow. Fed Chairman Powell also recently issued a "stand-by" statement: The Fed will not raise interest rates until the 2% inflation target is achieved and full employment is restored.

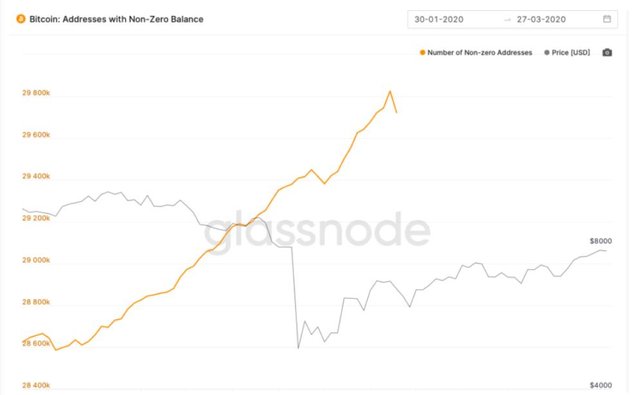

The stock market has ceased to be a barometer of the economy, but a barometer of liquidity since the moment the Fed released the flood. Looking at the global financial assets, there are all bubbles. Under such floods, we will undoubtedly usher in the rise of all kinds of new assets. According to data from the crypto research platform Glassnode in April 2020, in the context of unprecedented inflation and loose global monetary policy, the number of new investors entering the Bitcoin market has increased in a parabolic manner. Based on this inference, Bitcoin's performance under the flood of US$1.9 trillion in 2021 is still worth looking forward to.

Glassnode data

Dialing the timeline back to January 3, 2009, Satoshi Nakamoto wrote in the Bitcoin genesis block: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks (January 3, 2009) , The Chancellor of the Exchequer is on the verge of implementing the second round of emergency bank assistance)”.

On March 7, 2021, the U.S. Senate passed the $1.9 trillion new crown rescue bill amendment, and the House of Representatives vote will be held this week. Thomas Jefferson, one of the three founders of the United States, once said: "In every country that issues banknotes, banknotes can be abused, once, now, and forever." The macro financial system is getting deeper and deeper. Against the backdrop of the quagmire, deflationary assets such as Bitcoin are becoming more and more popular. Perhaps when many asset bubbles burst, Bitcoin may become a safe haven.

Bitcoin and gold race

Bitcoin and gold race

Bitcoin was called "digital gold" a long time ago, but at that time it was difficult to compare BTC and gold. Before August 2020, the correlation between Bitcoin's trend and gold was relatively strong, but after that, Bitcoin and gold seemed to have started a race.

BTC is making great strides up, while gold is falling all the way. After the price of gold broke through US$2,000 in August 2020, it started a negative decline all the way. The price of gold currently remains at around US$1700. In August 2020, BTC reached a high of US$12,448, and then continued to rise sharply after a brief adjustment. BTC has once again stood above US$50,000 and its market value has exceeded one trillion US dollars.

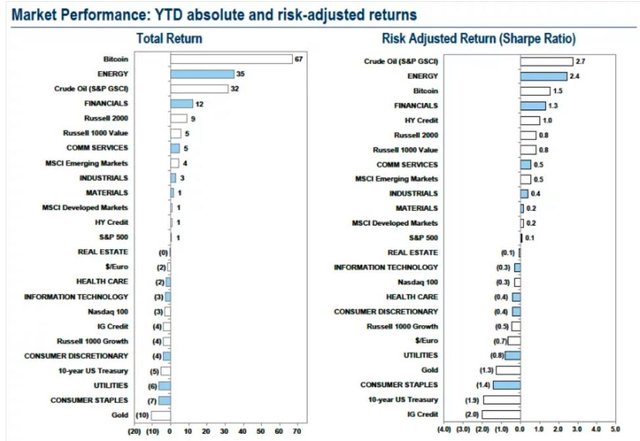

Goldman Sachs (Goldman Sachs) latest report shows that as of March 4, 2021, Bitcoin's return rate this year is about 70%, which is about twice the rate of return of the energy industry, which is closely followed by 35%. In addition, the report chart shows that so far this year, Bitcoin has outperformed all major traditional asset classes.

Goldman Sachs report data

Goldman Sachs report data

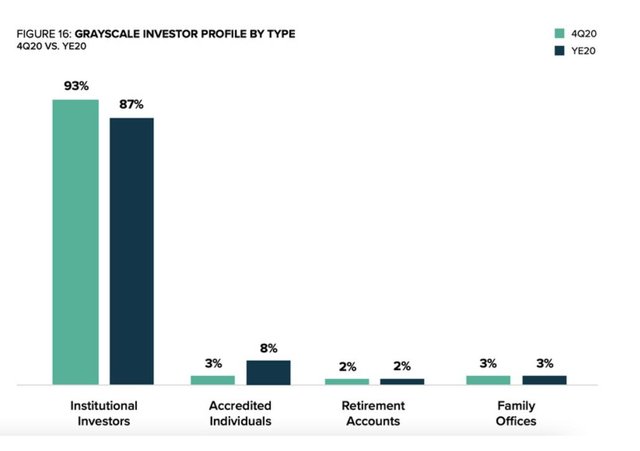

The divergence of gold and Bitcoin is the key to the fact that institutional investors begin to reduce their holdings of gold and increase their holdings of Bitcoin. Grayscale's assets under management at the beginning of the year were US$2 billion, and by the end of 2020 it was US$20.2 billion. The buyers of Grayscale Trust products are mainly encrypted asset lending companies, hedge funds, mutual funds, private wealth companies, consulting companies, family offices, etc.

Grayscale fourth quarter financial report data

Grayscale fourth quarter financial report data

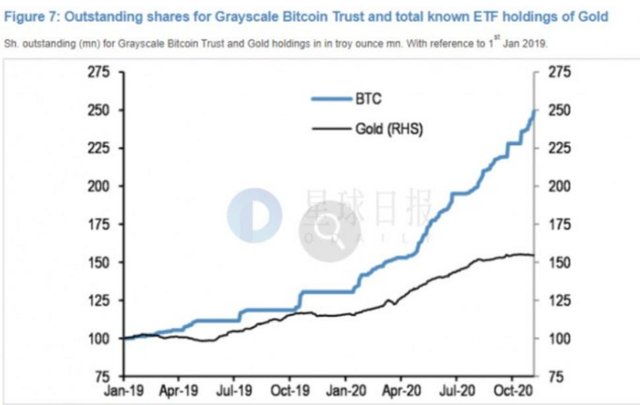

On November 9, 2020, JPMorgan Chase pointed out in a report that Bitcoin is eroding market demand for gold ETFs. Institutional investors, such as family offices, regard Bitcoin as a digital alternative to gold, and their demand for Grayscale's Bitcoin trust exceeds the total demand for all gold ETFs.

JP Morgan Chase report data

JP Morgan Chase report data

Bloomberg released the March report "Bloomberg Encryption Outlook". In the report, Bloomberg believes that in 2020, the volatility of Bitcoin will continue to decline, while the volatility of most other assets will increase. When we enter 2021, we don't see anything that can stop Bitcoin from replacing the "conservative" gold. It may only be a matter of time before Bitcoin replaces gold. The picture below shows the comparison between the volatility of the Gold-Bitcoin Index and the S&P 500 Index:

Bloomberg Intelligence data

Bloomberg Intelligence data

Bloomberg Intelligence analysis shows that the 260-day volatility rate of the Gold-Bitcoin 75/25 Index has reached the lowest level, and it is 20% lower than the same risk measure of the S&P 500 index. A similar situation was also seen in early 2016. Appeared. Generally speaking, the 260-day correlation between Bitcoin and the stock market is usually negative, but it reached 0.34 at the beginning of March, which is the highest value so far. With the Fed's monetary quantitative easing policy to promote GDP growth, it is expected that the Gold-Bitcoin Index index prices will receive more lasting support.

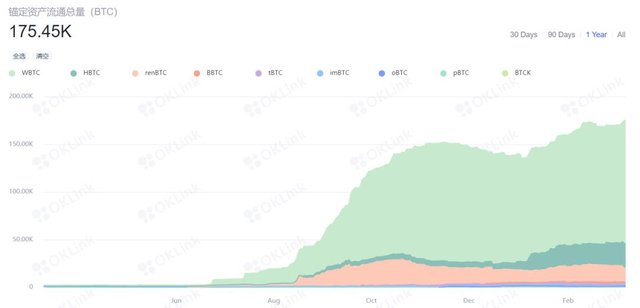

Will Bitcoin eventually replace gold? Gold has existed for thousands of years, and its historical status has indeed been unshakable in traditional society. However, human society is undergoing a major Internet migration, and mankind is entering the digital age. Many of our lifestyles have actually begun to migrate to the Internet. New technologies such as artificial intelligence, Internet of Things, cloud computing, and blockchain are developing rapidly and are rapidly reshaping society. In this process, big data has become a new means of production for mankind, and decentralized collaboration is changing the original production relations and methods of mankind. Bitcoin, as a native asset in the digital age, is naturally more suitable for value storage than gold. In the development process of decentralized finance (DeFi), BTC naturally acts as a value reserve. The following figure shows the change of BTC lock volume in DeFi:

Oklink data

Oklink data

In the development process of DeFi, BTC is closely connected with it. As the blockchain technology matures, BTC will also be applied to more scenarios to strengthen its value storage function. With the increasing volatility of BTC, it will be recognized by more institutions and even countries. Grayscale pointed out in the fourth quarter report of 2020: The latest guidance from the U.S. Currency Supervision Agency OCC indicates that Bank of America may consider incorporating digital currency into its settlement infrastructure. In 2021, we may see the beginning of digital currency integration into the national bank infrastructure.

The rise of DeFi impacts the original financial system

The rise of DeFi impacts the original financial system

Blockchain technology is most closely related to the financial sector. Bitshare in 2014, MakerDAO in 2017, etc. are all early DeFi explorers; however, the development of DeFi is indeed slow before 2020. Until 2020, DeFi will usher in a big explosion.

In further detail, until March 2020, DeFi was not favored by the mainstream encryption market; at that time, Bitcoin's halving every four years was the focus of more people's attention. However, after the "312" plummet, the global financial market and economic fundamentals "derailed", the market has huge concerns about the financial sector, financial innovation has become a new outlet, and DeFi has ushered in a rare period of development opportunities.

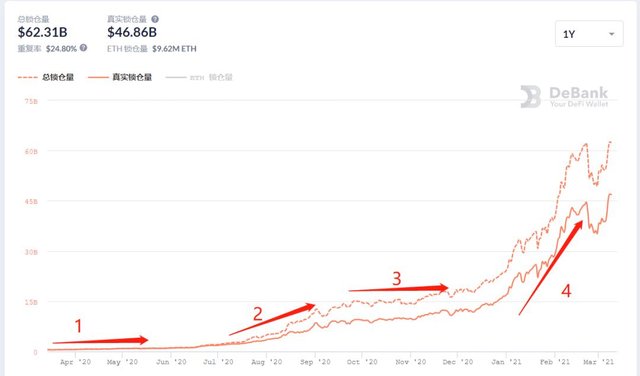

We believe that after the “312” plunge in 2020, the development of DeFi can be roughly divided into four periods:

DeBank data

DeBank data

- DeFi adjustment period (approximately March-April). The collapse of the crypto market broke the original pace of DeFi development. At this stage, some DeFi leaders entered an adjustment period and basically returned to the pre-pump. The representative is LINK, the leader of the oracle machine.

- DeFi innovative growth period (mainly from May to August). Numerous financial innovations have emerged in the DeFi field, which has promoted the rapid growth of DeFi. In mid-April, the decentralized lending leader Compound launched the governance token COMP. Both lenders and borrowers can obtain governance tokens by providing lending assets and borrowing assets. This innovation greatly stimulates the enthusiasm for market participation and introduces a large amount of idle funds for DeFi. During the same period, Uniswap, a decentralized trading platform, has suddenly emerged. Its "constant product" model allows users to exchange tokens directly in the exchange pool, changing the previous order book transaction mode, lowering the market-making threshold, and providing funds in Compound. Further provides application scenarios (transactions and earning market-making fees, etc.). Subsequently, the wealth management platform Yearn.finance was born. It uses smart contracts to develop machine gun pools and other functions, allowing users to further maximize profits with idle funds. These three leading players initially set up a DeFi infrastructure template, and then more projects were expanded and developed on this basis, and the DeFi ecosystem was prosperous.

- DeFi de-bubble period (approximately September-November). Before DeFi, there were also many financial models such as mining coins, transaction mining, etc., but most of them, after a brief boom, due to the arbitrage of a large number of speculators, the currency price entered a death spiral. The same is true for DeFi at this stage, and most of the DeFi leaders have plummeted. It is worth mentioning that the amount of DeFi locked positions has not been greatly reduced at this stage. In addition, the DeFi leaders have begun to bottom out and prices have stabilized.

- DeFi outbreak period (from December). After the substantial growth of DeFi driven by financial innovation, on the one hand, there is indeed a need for adjustment, and more importantly, it is limited by the bottleneck of the blockchain technology. The most criticized one is that the Gas fee is too high, and the speed of the advancement of Ethereum 2.0 Relatively slow. However, in December 2020, the Layer 2 solution became a life-saving straw for DeFi. For example, Loopring, one of the leaders in Layer 2, became another Google cooperation project after Chainlink and Hashgraph, and became the first zkRollup application case recommended by Google. Loopring is based on zkRollup's decentralized transaction protocol. Under the premise of ensuring security, throughput has increased by 1,000 times, while costs have been reduced by several hundred times. The progress of this type of technical solution has brought great confidence to the market. Subsequently, Synthetix, Sushi and other projects have announced their entry into Layer 2, and the DeFi+Rollup solution has become a market hope and a hot spot. At the same time, the expansion of public chains Cardano, Near, Solona, and the cross-chain leader Polkadot have also made efforts to rekindle market hopes. DeFi began to march towards CeFi from the two dimensions of financial innovation and technological innovation, and continued to conquer cities and land.

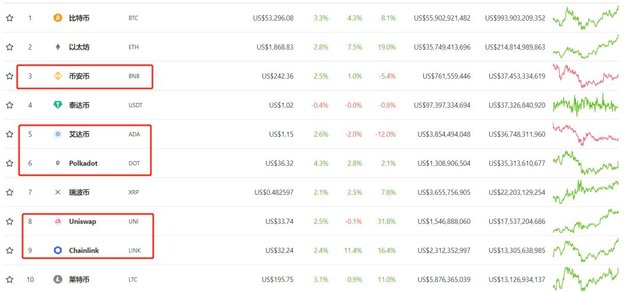

The picture above shows the top ten currencies in the current crypto market. Among the top ten currencies, UNI and LINK are DeFi leaders; ADA and Polkadot are high-performance expansion and cross-chain leaders; platform public chains such as BSC can be classified as Ethereum side chains, which are mainly benefited from taking over Ethereum Square overflow value. This also shows the important characteristics of this bull market from the side: DeFi's financial innovation and technological innovation such as capacity expansion are undoubtedly the main focus of funds and the recognized development direction.

Before 2020, DeFi is not enough; after 2020, DeFi has already hit the original financial system. In this process, the development of DeFi has also aroused the attention and worries of the government and regulatory agencies.

On December 17, 2020, the CFTC released an introductory book on the cryptocurrency industry. In its article, it stated that DeFi and cryptocurrency governance have become one of the themes of the CFTC in the field of digital assets. Heath Tarbert, chairman of the US CFTC, once bluntly stated that US regulation lags behind the development of cryptocurrency and blockchain.

On the evening of January 4, 2021, the United States’ largest banking regulator, the Office of the Comptroller of the Currency (OCC) of the U.S. Department of the Treasury, announced on its official website that U.S. banks are allowed to use public blockchains and U.S. dollar stablecoins as the settlement infrastructure in the U.S. financial system .

In January 2021, the Financial Crimes Enforcement Agency (FinCEN), an agency of the U.S. Department of the Treasury, proposed to require banks and money service companies to record transactions in private cryptocurrency wallets. Since DeFi applications mainly rely on wallets as an entry point, FinCEN's move may be aimed at beginning to try to supervise DeFi and so on.

The US tax season is approaching. Most Americans believe that the IRS does not provide taxpayers with sufficient guidance to let them know how to report their crypto income, especially reports on DeFi innovations. On March 9, 2021, the U.S. Internal Revenue Service (IRS) launched an anti-tax fraud operation called "Operation Hidden Treasure", dedicated to tracking unreported cryptocurrency transactions to pursue potential tax evasion. Responsibility.

For regulators, DeFi has developed too fast, which has greatly changed the original regulatory paradigm. In the DeFi field, many concepts still lack clear definitions, such as how to define the attributes of their token assets, and how to collect taxes on pledge income. If these definitions are still lacking, then there are natural problems with supervision and tax collection. In addition, the high degree of decentralization and global circulation of encrypted assets have further increased the difficulty of supervision.

In essence, the development of DeFi was born under the crisis of the global financial system facing collapse. The development of DeFi is the result of the mutual promotion of financial innovation and technological innovation. This is an important development direction in the digital age, and it is a financial force that no country can ignore and stop. However, how DeFi should be used by the government and how it should be supervised is an urgent issue that government regulators need to face directly, and it is also the beginning of DeFi's reshaping of the traditional financial system.

Outlook

Outlook

Due to the new crown epidemic, in more than a year, people began to accept and adapt to the no-touch or less-touch lifestyle. Although this caused a lot of inconvenience, it became a catalyst for the digitalization process and greatly improved the digitalization. The speed of the process. For example, in China, even elderly people who don’t know how to use smartphones have to learn how to use smartphones to scan codes to register. It can be said that the epidemic has caused the originally parallel traditional lifestyle and digital life to try to merge.

Although the global economy has suffered a severe setback, industries such as artificial intelligence, 5G, Internet of Things, and blockchain have developed rapidly. The fourth industrial revolution, which uses data as an important means of production, has risen rapidly, and the great migration of mankind to the Internet has never been so mighty. Grayscale pointed out in the report "The Great Transfer of Wealth Promotes BTC to Become a Mainstream Investment Target": The digital age has arrived. In the next 25 years, 68 trillion US dollars of wealth will be transferred to the younger generation who tend to invest in digital currencies. Coin is a huge opportunity.

The future is here, even if "312" once again surprises the black swan, please believe that Bitcoin is no longer the Bitcoin it used to be.