DeFi has developed rapidly in 2020, asset prices have risen explosively, and it has been recognized and supported by many public figures.

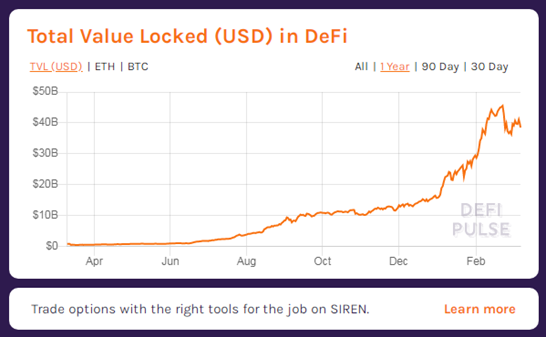

As a highly scalable global ecosystem, once DeFi proves its usefulness, exponential growth can be achieved. According to data from the DeFi Pulse website, on January 1, 2020, TVL reached 700 million US dollars, but it began to skyrocket in June 2020, reaching 1.9 billion on July 1, reaching 4 billion on August 1, and in 2020 It exceeded 8 billion U.S. dollars on September 1, 2015. Up to now, TVL has reached 38.51 billion U.S. dollars.

What will happen to the development of DeFi in 2021?

DeFi developed from the Ethereum ecosystem and has reached a bottleneck period, and it is difficult to continue to develop in the current Ethereum paradigm. With more and more users pouring into the platform, the average transaction fee has soared from US$1 in October last year to US$22 now, a surge of 2100%. High transaction fees have a greater impact on the DeFi protocol, and ETH 2.0 promises lower fees to achieve the higher scalability required by future financial products. The future trend of ETH 2.0 will definitely have an important impact on the development of DeFi.

DEX (Decentralized Exchange) is a cryptocurrency exchange within the DeFi ecosystem that allows direct peer-to-peer transactions without intermediaries. By using decentralized smart contracts encoded on the public blockchain, users can always retain their private keys, thereby eliminating counterparty risks inherent in centralized transactions.

The total trading volume of DEX such as Uniswap, Sushiswap, Curve, Balancer, etc. exceeded 61 billion US dollars in January this year. In the first six months of July 2020, the combined monthly trading volume of DEX was only 4.9 billion US dollars, an amazing increase of more than 1,100%. This has attracted the attention of centralized crypto exchanges such as Coinbase, Kraken, and Gemini, and expressed that they must actively embrace DeFi to achieve business growth. By integrating the DeFi protocol, it is possible to maintain market share by providing users with the most advanced products and actively shaping the way users interact with them.

Everything has its fragile side, and DeFi smart contracts will inevitably be attacked by hackers. Hacking incidents occurred throughout 2020 and early 2021, causing tens of millions of dollars in financial losses. For example, in October 2020, the DeFi project Harvest.Finance was attacked by hackers, and 24 million US dollars were stolen, which caused a sensation in the currency circle.

Hackers attacked flash loans, borrowing large amounts of unsecured ETH and withdrawing funds from exchanges through complex arbitrage opportunities between stablecoins. For this reason, smart contracts must be reviewed as part of the loan strategy of third-party companies such as Nexus Mutual before they can take effect and become a recognized specification for the DeFi platform. At the same time, users need to be familiar with the basic knowledge of the DeFi development process and community-led initiatives to ensure a complete audit of the contract.

In addition, many DeFi agreements exist in the gray area of regulation, and they promote the exchange of potential unregistered securities and the flow of funds under the guise of decentralization. As more and more traditional financial institutions begin to accept the benefits of cryptocurrency, it is imperative to conduct industry supervision. This is not only a huge challenge, but an important opportunity to bridge the gap between decentralized finance and traditional finance.

According to data from the crypto market analysis company Messari, as of July 2020, the total capital of all DeFi applications is only 1.5% of the total crypto market. With the iterative technology, more convenient applications and more standardized supervision, it is believed that DeFi will continue to increase its share in the encryption market, and there is still a lot of room for growth. In 2021, DeFi has a lot to do.